-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Short End Thumbs Nose at Hawks

EXECUTIVE SUMMARY

MNI INTERVIEW: Too Soon To Say Inflation Peaked- Fed’s Wright

MNI BRIEF: Fed’s Bullard - Rates Need to Go Up To 4.5% Range

MNI INTERVIEW: BOC To Follow Through Even If Recession- Tombe

US

FED: It’s too early to say whether U.S. inflation has peaked at near 40-year highs and the Federal Reserve must keep raising interest rates in order to make monetary policy modestly restrictive, St. Louis Fed economist Mark Wright told MNI.

- “It’s still far too soon for us to be confident that inflation has peaked and we need to remain vigilant,” said Wright, a senior vice president at the regional central bank, in an interview. “The inflation situation is still very troubling – the numbers are much too high.” While the recent moderation in some price categories had been “slightly” encouraging, he noted that it was driven by volatile energy components.

- “I don’t think we can take terribly much confidence from the movements in commodity prices,” said Wright, recently research director at the Minneapolis Fed. “We need to be focused on getting those core numbers back down.”

- “Unfortunately, the inflation news we received over the summer didn’t go our way,” Bullard said in a webcast. That means rates need to be “closer to 4.5,” he said.

- Bullard told MNI’s FedSpeak podcast last month rates might need to be “higher for longer,” pushing back against market expectations for rate cuts next year.

SF Fed On Growing Importance Of Inflation Expectations On Wage Setting

- SF Fed research shows that the impact of inflation expectations on wage growth has increased from a coefficient of 0.12 (not statistically different from zero) in the pre-pandemic sample to a statistically significant 0.98, essentially a 1 to 1 pass-through, post-pandemic

- In addition, with the pandemic, wages exhibit somewhat lower persistence, from 0.63 to 0.41, as would be expected when price inflation is not stable and feeds more directly into wages.

- “The more

inflation continues to grow, the more expectations will drift, and the larger

the effect on price and wage inflation. Should this dynamic linger, one risks

the makings of an inflation-wage spiral.”

CANADA

BOC: The Bank of Canada will follow through on its commitment to keep monetary policy tight until inflation comes back to its target range even if that triggers a recession, Trevor Tombe, a University of Calgary professor doing academic research with central bank staff, told MNI.

- The exact path of higher rates depends on uncertain developments around global commodity prices and the Ukraine war, Tombe said. Canada's dual role as a major energy exporter and consumer makes the mix even more complicated, he said. For more see MNI Policy main wire at 1007ET.

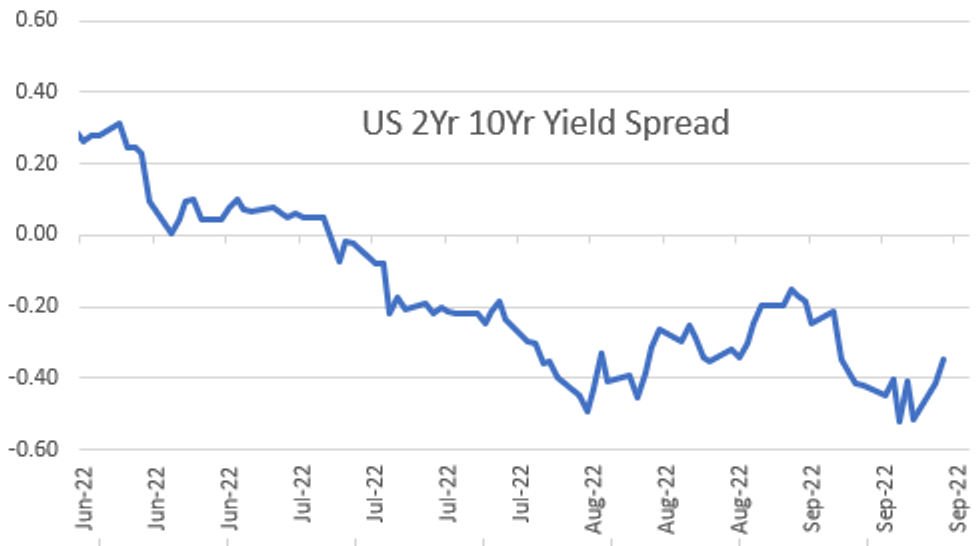

US TSYS: Bond Rout Continues, 2s10s Curve 24bp Off Last Wk Lows

Tsys quickly reversed overnight gains after the NY open, bonds extending lows through midday, yield curves bear steepened with 2s outperforming: 2s10s +9.728 at -33.191 -- back to mid September levels after the spd extended inversion to new low of -57.943 pre-FOMC.

- Tsy 2YY currently -.0371 at 4.3035%, 30YY +.1130 at 3.8530%. while 10YY +.0513 at 3.9758 -- up appr 235bp already this year - more than any full year since 1962!

- Tsy futures initially scaled back gains following in-line to better than expected Durable Goods data (-0.2% vs. -0.3% est; ex-trans in line at 0.2%), Cap Goods +1.3% vs. +0.2% est.

- Surge in Aug new home sales (+28.8% to .685M SAAR), coupled with rise in consumer confidence to 108.0 vs. 104.6 est. spurred renewed selling in 5s-30s. Technical selling in TYZ2 as futures drop through first support of 111-00+ (Low Sep 26) to 110-27, next key support: 110-13+ 3.0% 10-dma envelope to 110.

- Session's Fed speak didn't really cover any new ground, while the BoE lead economist Pill comments did little to calm markets as short end Gilts priced in additional 250bp in hikes by year end! GBP knocked lower in early afternoon trade to 1.0687 -.0002.

- Tsy futures extended session lows after $44B 5Y note auction (91282CFM8) tailed: 4.228% high yield vs. 4.202% WI; 2.27x bid-to-cover vs. 2.30x last month.

- The 2-Yr yield is down 3.5bps at 4.3056%, 5-Yr is up 1.5bps at 4.2064%, 10-Yr is up 3.3bps at 3.9573%, and 30-Yr is up 8.3bps at 3.8225%.

OVERNIGHT DATA

- US AUG. DURABLE GOODS ORDERS DECREASE 0.2%; EST. -0.3%

- US JUL DURABLE GDS NEW ORDERS REV TO -0.1%

- US AUG NONDEF CAP GDS ORDERS EX-AIR +1.3% V JUL +0.7%

- US JUL FHFA HPI SA -0.6% V +0.1% JUN; +13.9% Y/Y

- US REDBOOK: SEP STORE SALES +10.9% V YR AGO MO

- US REDBOOK: STORE SALES +11.0% WK ENDED SEP 24 V YR AGO WK

- US SEPT. CONSUMER CONFIDENCE AT 108.0; EST. 104.6

- Richmond Fed’s Sept. Manufacturing Survey at 0; Est. -10

- Richmond Fed: Sep Mfg Shipments Index 14 Vs Aug -8

- US AUG NEW HOME SALES +28.8% TO 0.685M SAAR

- US JUL NEW HOME SALES REVISED TO 0.532M SAAR

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 103.91 points (-0.36%) at 29153.51

- S&P E-Mini Future down 8 points (-0.22%) at 3661

- Nasdaq up 20 points (0.2%) at 10819.8

- US 10-Yr yield is up 3.5 bps at 3.9594%

- US Dec 10Y are down 16/32 at 110-27.5

- EURUSD down 0.0012 (-0.12%) at 0.9598

- USDJPY up 0.04 (0.03%) at 144.78

- WTI Crude Oil (front-month) up $2.1 (2.74%) at $78.81

- Gold is up $8.02 (0.49%) at $1630.41

- EuroStoxx 50 down 13.91 points (-0.42%) at 3328.65

- FTSE 100 down 36.36 points (-0.52%) at 6984.59

- German DAX down 88.24 points (-0.72%) at 12139.68

- French CAC 40 down 15.57 points (-0.27%) at 5753.82

US TSY FUTURES CLOSE

- 3M10Y -3.582, 62.688 (L: 42.607 / H: 65.963)

- 2Y10Y +7.681, -35.238 (L: -45.43 / H: -33.395)

- 2Y30Y +12.636, -48.727 (L: -63.685 / H: -47.549)

- 5Y30Y +7.098, -38.579 (L: -46.411 / H: -34.83)

- Current futures levels:

- Dec 2Y up 0.5/32 at 102-15.125 (L: 102-12.125 / H: 102-21.75)

- Dec 5Y down 5/32 at 106-21.75 (L: 106-17.5 / H: 107-11.5)

- Dec 10Y down 15/32 at 110-28.5 (L: 110-22 / H: 112-01.5)

- Dec 30Y down 1-21/32 at 124-27 (L: 124-15 / H: 127-07)

- Dec Ultra 30Y down 3-05/32 at 135-17 (L: 135-08 / H: 139-09)

US 10YR FUTURE TECHS: (Z2) Trend Signals Point South

- RES 4: 116-18+ 50 day EMA values

- RES 3: 115-06+ High Sep 14

- RES 2: 114-26+ 20-day EMA

- RES 1: 112-30+/114-00 High Sep 23 / 22

- PRICE: 111-07+ @ 15:57 BST Sep 27

- SUP 1: 110-22 Low Sep 27

- SUP 2: 110-13+ 3.0% 10-dma envelope

- SUP 3: 110-00 Psychological Support

- SUP 4: 109-23+ Low Nov 30 20074 (cont)

Treasuries remain soft following last week’s extension of its downtrend and this week’s move lower reinforces current conditions. A bearish price sequence of lower lows and lower highs and bearish moving average studies clearly highlight the market's current bearish sentiment. The focus is on 110-13+, a lower moving average band value. Initial resistance is Friday’s high of 112-30+.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.050 at 95.310

- Mar 23 +0.105 at 95.210

- Jun 23 +0.125 at 95.20

- Sep 23 +0.120 at 95.265

- Red Pack (Dec 23-Sep 24) +0.015 to +0.075

- Green Pack (Dec 24-Sep 25) -0.04 to +0.005

- Blue Pack (Dec 25-Sep 26) -0.08 to -0.05

- Gold Pack (Dec 26-Sep 27) -0.10 to -0.085

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00071 to 3.06400% (-0.00543/wk)

- 1M +0.00743 to 3.12057% (+0.04028/wk)

- 3M +0.00100 to 3.64186% (+0.01343/wk) * / **

- 6M -0.03772 to 4.20814% (+0.00685wk)

- 12M -0.05329 to 4.85171% (+0.01685/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.64186% on 9/27/22

- Daily Effective Fed Funds Rate: 3.08% volume: $111B

- Daily Overnight Bank Funding Rate: 3.07% volume: $288B

- Secured Overnight Financing Rate (SOFR): 2.99%, $976B

- Broad General Collateral Rate (BGCR): 2.99%, $384B

- Tri-Party General Collateral Rate (TGCR): 2.98%, $361B

- (rate, volume levels reflect prior session)

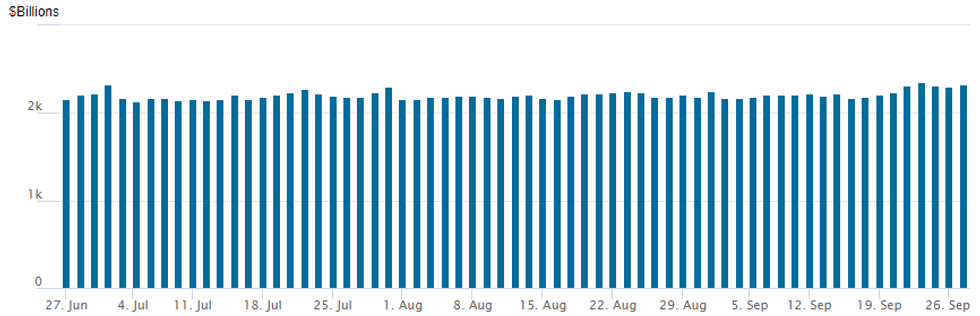

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,327.111B w/ 100 counterparties vs. $2,299.011B in the prior session.

Off last week's record high of $2,359.227B marked Thursday, September 22.

PIPELINE: $800M Atmos Energy Launched, $500M IADB Priced Earlier

- Date $MM Issuer (Priced *, Launch #)

- 09/27 $800M #Atmos Energy $300M 10Y +152, $500M 30Y +195

- 09/27 $500M *IADB 5Y SOFR+35

- 09/27 $Benchmark Komatsu Finance investor calls

- Expected to issue Wednesday:

- 09/28 $500M JBIC WNG 5Y Green SOFR+75a

- TBA: Saudi wealth fund headline points to Green bond sale debut

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/09/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 27/09/2022 | 0035/2035 |  | US | San Francisco Fed's Mary Daly | |

| 28/09/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/09/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/09/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/09/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 28/09/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/09/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/09/2022 | 0715/0915 |  | EU | ECB Lagarde at Frankfurt Forum Discussion | |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/09/2022 | 0815/0915 |  | UK | BOE Cunliffe Keynote at AFME Conference | |

| 28/09/2022 | 0900/1100 | * |  | IT | Industrial Orders |

| 28/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/09/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/09/2022 | 1235/0835 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/09/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/09/2022 | 1410/1010 |  | US | St. Louis Fed's James Bullard | |

| 28/09/2022 | 1415/1015 |  | US | Fed Chair Jerome Powell | |

| 28/09/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 28/09/2022 | 1500/1700 |  | EU | ECB Elderson Intro at Greens/EFA Event | |

| 28/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 28/09/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/09/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 28/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/09/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 28/09/2022 | 1800/1900 |  | UK | BOE Dhingra Chairs Panel at LSE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.