-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: Markets Retrace Midweek Bid, Hawks Dig In

EXECUTIVE SUMMARY

MNI BRIEF: Mester Sees Rates Peak A Little Above FOMC Median

MNI BRIEF: Fed’s Bullard: Market Turmoil Won't Deter Hikes

MNI BRIEF: Fed's Bullard: Job Market To Stay Strong Amid Hikes

MNI BRIEF: Latest Long Bond Buys Not MonPol Move - BOE Pill

MNI INTERVIEW: SNB Could Be Forced Into Intra-Meeting Hike

US

FED: Cleveland Federal Reserve President Loretta Mester said Thursday her own forecast for where the federal funds rate is in 2023 is “a little bit above” the FOMC median of 4.6% in the September SEP.

- “I think inflation will be a little more persistent than the median in the SEP,” she said during a conference hosted by the Cleveland Fed. Mester told MNI in a webcast this month that substantial further monetary tightening was needed to make Fed policy restrictive.

FED: Federal Reserve Bank of St. Louis President James Bullard said Thursday the FOMC's projected rise in the unemployment rate to 4.4% next year is just a "return to mean" for a very strong labor market.

- "The U.S. labor market is super strong," he said, noting that initial jobless claims for the latest week dipped below 200,000, bucking expectations for claims to rise as interest rates head higher. The current 3.7% unemployment rate, close to 50-year lows, shouldn't be expected to last, he said. "This is probably a good time to get inflation under control while the labor market is doing so well."

- "If you look at the dots, it does look like the committee is expecting a fair amount of additional moves this year. That has been digested by markets and does seem to be the right expectation," he added. Speaking at an event in London on Wednesday, Bullard said rates will probably need to rise to 4.5%.

- "The U.S. labor market is super strong," he said, noting that initial jobless claims for the latest week dipped below 200,000, bucking expectations for claims to rise as interest rates head higher. The current 3.7% unemployment rate, close to 50-year lows, shouldn't be expected to last, he said. "This is probably a good time to get inflation under control while the labor market is doing so well." For more see MNI Policy main wire at 1001ET.

UK

BOE: The Bank of England's decision to buy long dated gilts, unveiled Wednesday, is not a form of yield curve control or a relaunch of quantitative easing but instead a temporary move designed only to avoid contagion and dysfunction at the long-end of the gilt market, Chief Economist Huw Pill said Thursday.

- Long dated gilt prices had surged following the fiscal easing in the mini-Budget with margin calls lead to spiraling price rises before the BOE stepped in. Pill said that the "Bank is preventing a self-sustaining vicious spiral of collateral calls, forced sales and disappearing liquidity from emerging in a core segment of the financial markets" but that this was purely for financial stability reasons. For more see MNI Policy main wire at 1157ET.

EUROPE

SNB: The Swiss National Bank could be forced to announce a 25 or 50bp interest rate hike before its next scheduled meeting as major central banks continue to tighten their monetary policy, a former SNB economist told MNI in an interview, though she saw it as unlikely that the policy rate would rise much beyond 1.5%.

- The SNB will try to avoid another monetary policy decision before its next planned announcement, said Sarah Lein, senior economist at the SNB from 2008-14 and now professor of macroeconomics at the University of Basel. But, while Chairman Thomas Jordan could use communication to signal a higher or lower rate path and smooth out the period between September and December, recent experience suggests the bank may be reluctant to provide steers on its possible future policy path. For more see MNI Policy main wire at 0943ET.

US TSYS: Still Reacting to the BoE Tax Cut/Gilt Buy Program Scheme

Tsys weaker after the bell, well off late overnight lows to near middle of the session range, focus largely remained on the BoE and aftermath of last week's abrupt tax cut annc that spurred Wed's long end Gilt buy program.

- On the open, FI mkts had scaled back decent portion of Wed's BOE buy program-tied rally w/ PM Liz Truss continued defense of the mini-budget on BBC radio, strong regional German CPI overnight adding to moves. Second round of BoE Gilt purchases underutilized: GBP1.415bln of long-dated gilts. Rejects GBP442.8mln offers. Take-up higher than Wed - but still relatively low, GB2.5B of 10B thus far.

- Still working out the kinks, PM Truss on regional BBC TV: BEST TO START TODAY ON GOVERNMENT'S FISCAL PLANS as WE"RE IN A VERY SERIOUS SITUATION.

- Little reaction to Fed speakers on the day, Bullard: "This is probably a good time to get inflation under control while the labor market is doing so well." Weekly claims lower than exp (193k vs. 215k; continuing claims 1.347M vs. 1.385M est), GDP slightly higher at 9.0% vs. 8.9% est.

- On tap Friday: Personal Income/Spending, Chicago PMI, UofM Sentiment and more Fed-speakers: Barkin, Brainard, Bowman and Williams.

- Currently, the 2-Yr yield is up 3.3bps at 4.1678%, 5-Yr is up 3.8bps at 3.9859%, 10-Yr is up 2.2bps at 3.7534%, and 30-Yr is down 0.1bps at 3.6981%.

OVERNIGHT DATA

- US JOBLESS CLAIMS -16K TO 193K IN SEP 24 WK

- US PREV JOBLESS CLAIMS REVISED TO 209K IN SEP 17 WK

- US CONTINUING CLAIMS -0.029M to 1.347M IN SEP 17 WK

- MNI: US Q2 GDP -0.6%

- CANADIAN JULY GDP +0.1% VS -0.1% EXPECTED

- CANADA FLASH AUG GDP REMAINS UNCHANGED

- CANADA JULY YOY GROSS DOMESTIC PRODUCT +4.3%

- CANADA AVERAGE WEEKLY EARNINGS JULY YOY +2.9%

- CANADA JUL GROSS DOMESTIC PRODUCT +0.1% MOM

- CANADA JUL GOODS INDUSTRY GDP +0.5%, SERVICES -0.1%

- CANADA REVISED JUN GROSS DOMESTIC PRODUCT +0.1% MOM

MARKETS SNAPSHOT

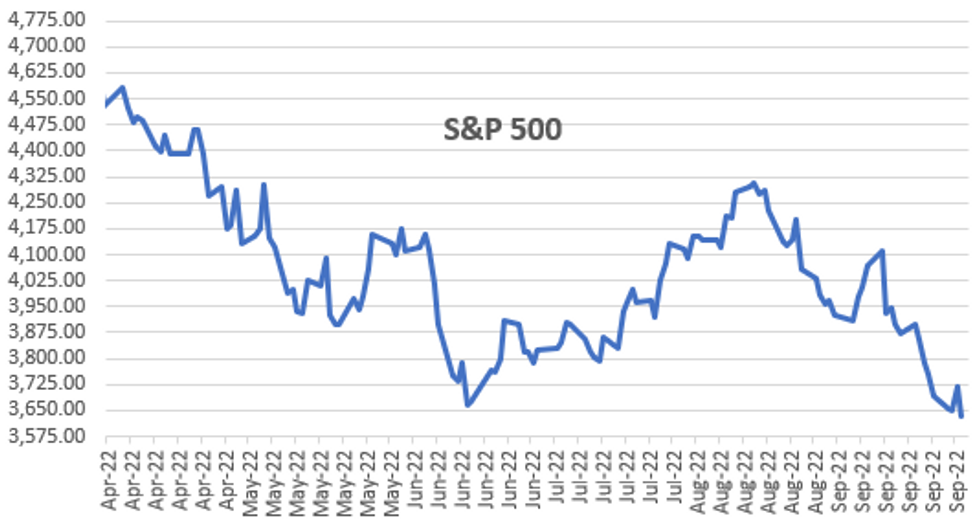

Key late session market levels:- DJIA down 521.03 points (-1.76%) at 29162.83

- S&P E-Mini Future down 90 points (-2.41%) at 3641.75

- Nasdaq down 362.5 points (-3.3%) at 10690.56

- US 10-Yr yield is up 2.2 bps at 3.7534%

- US Dec 10Y are down 14.5/32 at 112-13

- EURUSD up 0.0065 (0.67%) at 0.98

- USDJPY up 0.22 (0.15%) at 144.38

- WTI Crude Oil (front-month) down $0.63 (-0.77%) at $81.51

- Gold is down $0.27 (-0.02%) at $1659.75

- EuroStoxx 50 down 56.26 points (-1.69%) at 3279.04

- FTSE 100 down 123.8 points (-1.77%) at 6881.59

- German DAX down 207.73 points (-1.71%) at 11975.55

- French CAC 40 down 88.14 points (-1.53%) at 5676.87

US TSY FUTURES CLOSE

- 3M10Y +6.637, 42.615 (L: 34.947 / H: 50.35)

- 2Y10Y -1.265, -41.844 (L: -47.734 / H: -35.622)

- 2Y30Y -3.487, -47.284 (L: -52.831 / H: -41.761)

- 5Y30Y -3.9, -29.128 (L: -32.211 / H: -25.217)

- Current futures levels:

- Dec 2Y down 4.75/32 at 102-24.25 (L: 102-19.875 / H: 102-26.625)

- Dec 5Y down 10.75/32 at 107-23.25 (L: 107-08.25 / H: 107-29)

- Dec 10Y down 15/32 at 112-12.5 (L: 111-20.5 / H: 112-21)

- Dec 30Y down 23/32 at 126-31 (L: 125-22 / H: 127-18)

- Dec Ultra 30Y down 14/32 at 138-15 (L: 136-10 / H: 139-02)

US 10YR FUTURE TECHS: (Z2) Corrective Bounce

- RES 4: 115-06+ High Sep 14

- RES 3: 114-17 High Sep 20

- RES 2: 114-10 20-day EMA

- RES 1: 112-30+/114-00 High Sep 23 / 22

- PRICE: 112-12 @ 1500ET Sep 29

- SUP 1: 110-19 Low Sep 28

- SUP 2: 110-00 Psychological Support

- SUP 3: 109 26+ 3.0% 10-dma envelope

- SUP 4: 109-23+ Low Nov 30 20074 (cont)

Treasuries remain vulnerable despite yesterday’s climb. The latest extension of the downtrend together with this week’s move lower, has reinforced current conditions. A bearish price sequence of lower lows and lower highs and bearish moving average studies clearly highlight the market's bearish sentiment. The focus is on 109-26+ a lower moving average band value. Initial resistance is last Friday’s high of 112-30+.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.015 at 95.315

- Mar 23 -0.055 at 95.295

- Jun 23 -0.055 at 95.335

- Sep 23 -0.065 at 95.440

- Red Pack (Dec 23-Sep 24) -0.08 to -0.065

- Green Pack (Dec 24-Sep 25) -0.06 to -0.045

- Blue Pack (Dec 25-Sep 26) -0.05 to -0.045

- Gold Pack (Dec 26-Sep 27) -0.05 to -0.05

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00300 to 3.06400% (-0.00843/wk)

- 1M +0.01257 to 3.12786% (+0.03757/wk)

- 3M +0.06872 to 3.74286% (+0.11443/wk) * / **

- 6M +0.03943 to 4.20929% (+0.00800/wk)

- 12M +0.01129 to 4.78729% (-0.04757/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.74286% on 9/29/22

- Daily Effective Fed Funds Rate: 3.08% volume: $110B

- Daily Overnight Bank Funding Rate: 3.07% volume: $272B

- Secured Overnight Financing Rate (SOFR): 2.98%, $911B

- Broad General Collateral Rate (BGCR): 2.98%, $359B

- Tri-Party General Collateral Rate (TGCR): 2.98%, $338B

- (rate, volume levels reflect prior session)

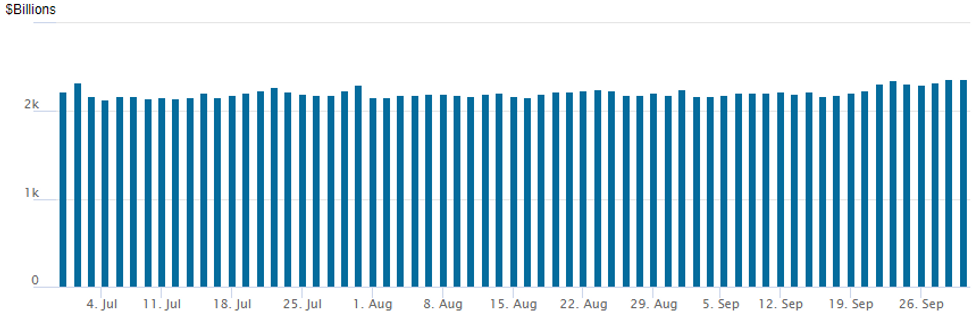

FED Reverse Repo Operation: Second Consecutive New High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of $2,371.763B w/ 103 counterparties vs. $2,366.798B record in the prior session. Surpasses last week's record high of $2,359.227B marked Thursday, September 22.

Komatsu, Kepco Priced

Market volatility keeping issuers sidelined, only two for Thursday

- Date $MM Issuer (Priced *, Launch #)

- 09/29 $800M *Kepco $500M 3.5Y +120, $300M 5.5Y +160

- 09/29 $600M *Komatsu 5Y +150

EGBs-GILTS CASH CLOSE: German Short End Outperforms Amid Broader Weakness

German bonds outperformed through the 10Y segment while the UK long end outperformed Thursday.

- High German state inflation triggered Bund losses early, which carried through to on the national September CPI release in the afternoon coming in at 10% Y/Y vs expectations of 9.5% coming into the session.

- Several ECB speakers reiterated that a 75bp hike was likely in October, though the terminal rate dipped 3bp to the lowest since Sep 23 under 2.90% and Schatz outperformed.

- Long-end Gilt yields fell sharply alongside a GBP rebound on news that the OBR could get a full fiscal forecast by end-Oct. The BoE's bond buying op saw fairly low takeup again (GBP1.5bln), while appearances by Ramsden and Pill brought little new.

- BTP spreads widened as Reuters reported the ECB saw no need to activate TPI to cap Italian yields.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.8bps at 1.818%, 5-Yr is up 1.4bps at 2.042%, 10-Yr is up 7.3bps at 2.193%, and 30-Yr is up 14.4bps at 2.161%.

- UK: The 2-Yr yield is up 10.9bps at 4.402%, 5-Yr is up 15bps at 4.442%, 10-Yr is up 13.5bps at 4.147%, and 30-Yr is up 3.6bps at 3.968%.

- Italian BTP spread up 6bps at 246.9bps / Spanish up 0.7bps at 118.7bps

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/09/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 30/09/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/09/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/09/2022 | 0630/0830 | ** |  | CH | retail sales |

| 30/09/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/09/2022 | 0645/0845 | ** |  | FR | PPI |

| 30/09/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/09/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/09/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 30/09/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/09/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/09/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/09/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 30/09/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 30/09/2022 | 1100/1300 |  | EU | ECB Elderson in Discussion at Uni Amsterdam | |

| 30/09/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/09/2022 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 1300/0900 |  | US | Fed Vice Chair Lael Brainard | |

| 30/09/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/09/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 30/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 30/09/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 30/09/2022 | 1530/1730 |  | EU | ECB Schnabel Panels La Toja Forum | |

| 30/09/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 30/09/2022 | 1630/1230 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 2015/1615 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.