-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed's Inflation Fight Continues

EXECUTIVE SUMMARY

- MNI BRIEF: Fed Has ‘More Work To Do’ On Inflation-Kashkari

- MNI INTERVIEW: Fed Would Pause QT, Not Hikes, On Market TurmoilFed Would Pause QT, Not Hikes, On Market Turmoil

- MNI US Payrolls Preview: Significant Two-Sided RiskMNI US Payrolls Preview: Significant Two-Sided Risk

- MNI: Inflation Must Be Tamed Even If Recession Is The Price-IMFInflation Must Be Tamed Even If Recession Is The Price-IMF

- MNI BRIEF: BOC Says Weak CAD May Mean More Rate-Hike Work

US

FED: The Federal Reserve needs to tighten monetary policy further in order to bring down inflation running near 40-year highs and showing little sign of abating, Minneapolis Fed President Neel Kashkari said Thursday.

- “We’re at a time of very high inflation, the Federal Reserve has worked very aggressively to raise interest rates to bring the economy back into balance. We have more work to do,” he said.

- Kashkari said a soft landing was more likely if supply chain pressures ease more quickly. “The big questions everybody is asking is, can we achieve a soft landing, can we cool down the inflation without triggering a recession? I hope so. We’re going to try. But we have to bring inflation down.”

- St. Louis Fed economist Mark Wright told MNI it’s too soon to say whether inflation has peaked. Kashkari echoed that view: "We’re seeing almost no evidence that underlying inflation has peaked or is trending down."

FED: Market instability will not dissuade the Fed from pressing on with its aggressive interest rate hike campaign, but the central bank is likely to to pause its balance sheet runoff sooner than it has signalled as financial volatility heightens systemic risks, former White House economist Joseph LaVorgna told MNI.

- “I don’t see the Fed going anywhere near as far as what they expect on the balance sheet and look for them to certainly stop that if not this year, next year,” LaVorgna, former head of the White House National Economic Council under President Trump, told MNI’s FedSpeak podcast.

- “A mini-pivot might mean the Fed opening up swap lines with other central banks as they’ve done before, and then possibly temporarily stopping QT until market conditions stabilize.” For more see MNI Policy main wire at 1310ET.

US DATA: Consensus sees NFP growth moderating to 260k in Sept after the 315k from August’s ‘goldilocks’ report.

- Indications of tightness from AHE and the u/e rate combined with recovery in participation will help shape the market reaction after the u/e rate ticked up two tenths and wage growth cooled moderately in Aug.

- Analyst expectations imply a reasonable chance of small beats for the u/e rate and wage growth, at least at a first glance on rounding, potentially paving way for an initial overreaction to small surprises.

CANADA

BOC: Bank of Canada Governor Tiff Macklem said Thursday the U.S. dollar's strength against his currency may need more effort with rate hikes to bring inflation back to target.

- “Normally when we raise interest rates, the exchange rate actually appreciates, and so that does part of the work for us. This time that’s not happening, so other things equal, as economists like to say, that means more to do with interest rates,” he said after a speech in Halifax, Nova Scotia. CAD weakened 0.9% at midday Thursday to CAD1.3739 and from about CAD1.25 in early June as investors bet the Fed would catch up with BOC rate hikes and sought refuge from global risk. The Bank can hike 100bp in the next two meetings, former Governor David Dodge has told MNI.

- Macklem also said “there is a path to a soft landing, but it is a narrow path," and “with inflation running at 7%, we are more concerned about the upside shocks to inflation.”

EUROPE

IMF: Global policy makers must keep the fight to bring down inflation as their top priority, with central banks acting "decisively" and governments avoiding "indiscriminate" stimulus, IMF chief Kristalina Georgieva said Thursday, adding that stance means a fourth downgrade to global forecasts and leaves many economies on the brink of recession.

- The fund's updated forecast outlook next week will cut the 2023 growth forecast from 2.9%, she said in the text of a "curtain raiser" speech for semi-annual IMF meetings.

- Countries accounting for about one-third of the world economy will experience at least two consecutive quarters of contraction this or next year," Georgieva said. "Even when growth is positive, it will feel like a recession because of shrinking real incomes and rising prices."

US TSYS: Liquidity Challenged Ahead Sep NFP

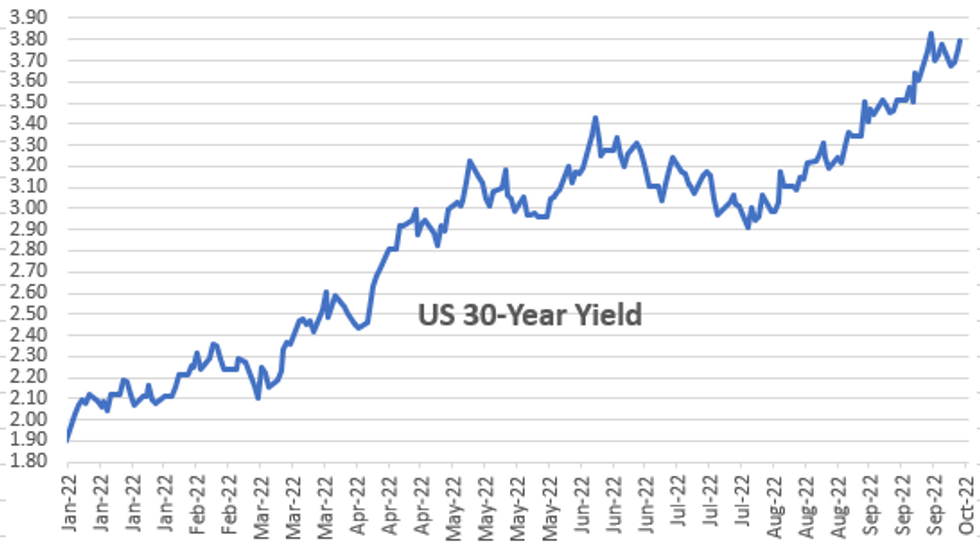

Tsy futures weaker but off midmorning lows after the close where 10YY tapped 3.8418% high, 30YY 3.8140% high, before paring move into midday, initial impetus tied to sympathy move with sell-off in EGBs, particularly longer Gilts apparently as mkt expresses dissatisfaction with poorly researched/planned buy scheme introduced last week.

- Off-sides positioning hampered by low liquidity ahead Friday's September NFP (+250k est vs. +315k prior; wide dealer range from +200k low to JPM high at +389k)

- Sell-stops triggered on the way down while couple Dec'22 10Y future block sales (over 11k total) contributed to higher yields as did hawkish tones from Fed speakers (MN Fed Kashkari: high bar to change Fed's current path of higher rates to combat inflation).

- The 2-Yr yield is up 8.7bps at 4.235%, 5-Yr is up 8bps at 4.0462%, 10-Yr is up 6.3bps at 3.8155%, and 30-Yr is up 3.6bps at 3.7896%.

OVERNIGHT DATA

- US JOBLESS CLAIMS +29K TO 219K IN OCT 01 WK

- US PREV JOBLESS CLAIMS REVISED TO 190K IN SEP 24 WK

- US CONTINUING CLAIMS +0.015M to 1.361M IN SEP 24 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 317.17 points (-1.05%) at 29955.5

- S&P E-Mini Future down 31 points (-0.82%) at 3763

- Nasdaq down 56.4 points (-0.5%) at 11092.63

- US 10-Yr yield is up 6.3 bps at 3.8155%

- US Dec 10Y are down 17/32 at 112-0

- EURUSD down 0.0087 (-0.88%) at 0.9797

- USDJPY up 0.42 (0.29%) at 145.06

- WTI Crude Oil (front-month) up $0.95 (1.08%) at $88.72

- Gold is down $1.43 (-0.08%) at $1714.82

- EuroStoxx 50 down 14.27 points (-0.41%) at 3433.45

- FTSE 100 down 55.35 points (-0.78%) at 6997.27

- German DAX down 46.4 points (-0.37%) at 12470.78

- French CAC 40 down 49.04 points (-0.82%) at 5936.42

US TSY FUTURES CLOSE

- 3M10Y +6.04, 41.864 (L: 30.641 / H: 45.782)

- 2Y10Y -2.22, -42.368 (L: -43.406 / H: -37.425)

- 2Y30Y -4.901, -44.954 (L: -47.251 / H: -37.905)

- 5Y30Y -4.411, -25.829 (L: -28.386 / H: -20.183)

- Current futures levels:

- Dec 2Y down 5.5/32 at 102-20.75 (L: 102-19.875 / H: 102-27.375)

- Dec 5Y down 13/32 at 107-14 (L: 107-12 / H: 107-29.75)

- Dec 10Y down 17/32 at 112-0 (L: 111-27 / H: 112-22.5)

- Dec 30Y down 15/32 at 126-10 (L: 125-28 / H: 127-09)

- Dec Ultra 30Y down 16/32 at 136-14 (L: 135-25 / H: 137-26)

US 10YR FUTURE TECHS:: (Z2) Weakness Holds as Oversold Condition Unwound

- RES 4: 116-11 50.0% retracement of the Aug 2 - Sep 28 bear leg

- RES 3: 115-26 50-day EMA

- RES 2: 114-31+ 38.2% retracement of the Aug 2 - Sep 28 bear leg

- RES 1: 113-30 High Oct 4

- PRICE: 111-27 @ 15:37 BST Oct 6

- SUP 1: 111-20+/110-19 Low Sep 29 / Low Sep 28

- SUP 2: 110-00 Psychological Support

- SUP 3: 109 07 3.0% 10-dma envelope

- SUP 4: 109-23+ Low Nov 30 20074 (cont)

Treasuries are holding the entirety of the Wednesday pullback, with corrective bounces short-lived and keeping the short-term condition bearish. The rally posted since the beginning of the week has allowed the oversold condition to unwind, and markets now re-target support at 111-20+, the Sep 29 low. Any recovery higher will need to again top the 20-day EMA ahead of 114-31+, a Fibonacci retracement.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.010 at 95.285

- Mar 23 -0.055 at 95.225

- Jun 23 -0.085 at 95.245

- Sep 23 -0.110 at 95.335

- Red Pack (Dec 23-Sep 24) -0.115 to -0.085

- Green Pack (Dec 24-Sep 25) -0.07 to -0.055

- Blue Pack (Dec 25-Sep 26) -0.055 to -0.05

- Gold Pack (Dec 26-Sep 27) -0.06 to -0.045

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00228 to 3.05871% (-0.00643/wk)

- 1M +0.10215 to 3.30029% (+0.15758/wk)

- 3M +0.04171 to 3.82571% (+0.07100/wk) * / **

- 6M +0.02386 to 4.30757% (+0.07557/wk)

- 12M +0.05971 to 4.88471% (+0.10414/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.75471% on 9/30/22

- Daily Effective Fed Funds Rate: 3.08% volume: $104B

- Daily Overnight Bank Funding Rate: 3.07% volume: $281B

- Secured Overnight Financing Rate (SOFR): 3.04%, $992B

- Broad General Collateral Rate (BGCR): 3.00%, $397B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $366B

- (rate, volume levels reflect prior session)

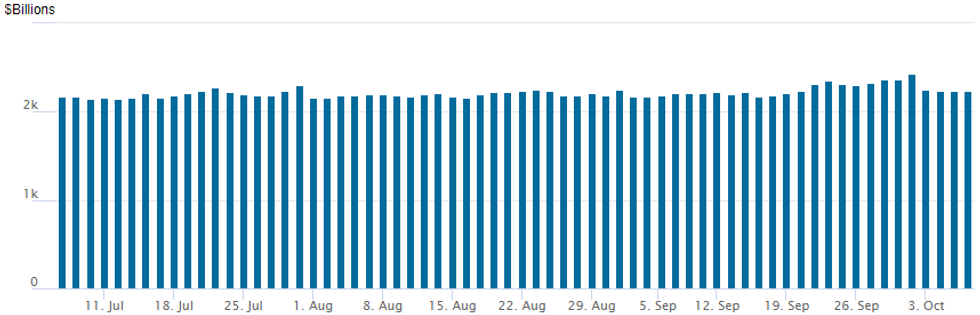

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbed to $2,232.801B w/ 101 counterparties vs. $2,230.799B in the prior session. Recent record high stands at $2,425.910B on Friday, September 30.

$4B Enel Finance 4Pt, $2.5B Turkey Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/06 $4B #Enel Finance $750M 3Y +275, $1B 5Y +325, $1.25B 10Y +400, $1B 30Y +440

- 10/06 $2.5B #Turkey 3Y Sukuk 9.758%

- 10/06 $1.75B #TD Bank 60NC5 8.125%

- 10/06 $1.25B #GM Fncl 3Y +185

- 10/06 $750M #AIB Group 4NC3 +335

FOREX: Greenback Extends Recovery, DXY Rises 0.95% Ahead Of NFP

- Renewed greenback strength gathered momentum throughout Thursday’s trading session, with the USD index (+0.85%) extending its recovery, rising through yesterday’s high and then above Fibonacci resistance at 111.86.

- The broad dollar strength has seen the Euro dip back below $0.98 and the weakness in equities has heavily weighed on the likes of AUD and NZD, both down roughly 1.5%.

- GBPUSD (-1.55%) is the poorest performer, briefly printing at 1.1114, nearly 400 pips from Wednesday’s peak. Initial firm support is seen at 1.1025, the Sep 30 low.

- Rising at a much slower pace (potentially amid lingering MOF concerns) is USDJPY, however the pair is now inching above Y145, narrowing the gap with the post intervention highs at 145.30. The primary uptrend remains intact and sights are on the bull trigger at 145.90, Sep 22 high.

- Weakness in equities is underpinning the greenback approaching the APAC crossover. The week’s early optimism for major indices has been dissipating as markets await Friday’s US employment report for further signals on the health of the US economy/Fed policy.

- Consensus sees NFP growth moderating to 260k in Sept after the 315k from August’s ‘goldilocks’ report. Canadian jobs data will be released in conjunction with the US data.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/10/2022 | 2301/0001 | ** |  | UK | IHS Markit/REC Jobs Report |

| 07/10/2022 | 0545/0745 | ** |  | CH | Unemployment |

| 07/10/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/10/2022 | 0600/0800 | ** |  | DE | Retail Sales |

| 07/10/2022 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 07/10/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 07/10/2022 | 0645/0845 | * |  | FR | Current Account |

| 07/10/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/10/2022 | 0800/1000 |  | EU | ECB Consumer Expectations Survey Results - August | |

| 07/10/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 07/10/2022 | 1025/1125 |  | UK | BOE Ramsden Speech at Securities Industry Conference | |

| 07/10/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 07/10/2022 | 1230/0830 | *** |  | US | Employment Report |

| 07/10/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 07/10/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 07/10/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.