-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: 30Y Reopen Tailed, Curves Bear Steepen

- MNI INTERVIEW: Credit Tightening To Crimp US Small Firm Hiring

- MNI BRIEF: SF Fed’s Leduc Says Making Progress On Inflation

- MNI BRIEF: US September CPI Slightly Firmer Than Expected CPI Slightly Firmer Than Expected

- MNI US: Biden: Core Inflation Fell To Lowest Level In Two Years, Touts 'Bidenomics'

- MNI Core PCE To Pick Up, But Below CPI Equivalent

US

FED: The Federal Reserve is making progress in its fight to bring inflation back to target but there’s still a way to go before a resilient economy gets back to price stability, San Francisco Fed research director Sylvain Leduc said Thursday.

- “There’s progress that we've made but there’s still a lot left to be done. We are still way above our target, but things are moving in the right direction," he said. “It’s going to take time for inflation to come back down to 2%,” Leduc added, agreeing with the median FOMC view in the SEP that this goal won’t be reached until 2026.

- “There’s going to be some pain in the labor market that will come with that but we’re not foreseeing a recession," he said in a Q&A sponsored by the San Francisco Fed. (See MNI INTERVIEW: Labor Hording Raises Odds Of Soft Landing) The SF Fed research director said he is heartened by decline in one-year inflation expectations back to pre-pandemic levels.

US DATA: U.S. CPI rose 0.396% in September and 3.7% from a year ago, the Bureau of Labor Statistics reported Thursday, a tenth higher than markets expected, while core CPI added 0.323% and 4.1% over the month and year, respectively, in line with expectations. The three-month annualized rate for core CPI rose to 3.1% in September from 2.4% the previous month.

- The Labor Department in a separate report said 209,000 people filed for initial jobless claims in the week ending Oct 7, the same as the week before and a tad lower than the 210,000 expected. Traders drove higher pricing of the Fed's terminal policy rate to 9.5bp above current levels and priced in a slightly lower 53bp of cuts through next September. The dollar also strengthened on expectations that the Fed would keep rates restrictive for some time. (See MNI: Most of FOMC Saw One More Hike This Year -- Fed Minutes)

- Shelter accounted for over half of the headline CPI rise, increasing 0.6% in September after 0.3% the previous month. Hotel prices rebounded 3.7% in September after three straight decreases. Auto insurance added 1.3% and the medical care index rose 0.2% in the month. Used cars and trucks prices fell 2.5% in September and apparel declined 0.8%.

US: US President Joe Biden has issued a statement on today's CPI print, arguing that the, "report shows core inflation fell to its lowest level in two years."

- Biden: "Overall inflation is down by 60% from its peak at a time when unemployment has remained below 4% for 20 months in a row and the share of working-age Americans in the workforce is the highest in 20 years."

- Biden: "That's Bidenomics in action. I'll continue to fight to build an economy from the middle out and bottom up, even as Republicans in Congress make reckless threats to weaken our economy, prioritize tax cuts for the wealthy and large corporations, and push for deep cuts to programs that are essential for hardworking Americans and seniors."

- At 16:30 ET 21:30 BST, Biden will meet with CEOs, "to hear their perspectives on the economy, discuss his administration's progress implementing his historic agenda, and highlight how Bidenomics is growing the economy..."

- Bloomberg reports that invitees, including CEOs of IBM, Amex, and Catalyst Partners will discuss, "the state of the economy, implementation of the president's agenda and what additional actions the government should pursue to encourage growth."

FED: Small U.S. businesses are set to create hundreds of thousands fewer jobs as a result of tighter lending conditions following the March collapse of Silicon Valley Bank, which in the long run will make America's economy less dynamic and more concentrated, Federal Reserve Bank of Atlanta economists Salome Baslandze and Jonathan Willis told MNI.

- Firms with fewer than 500 employees accounted for the majority of job growth during the pandemic and the recovery, hiring a third of the net 1.5 million people who became employed between March 2020 and March 2022. Yet they will also bear the brunt of the negative impact on job creation as a result of crimped bank lending, whereas their large counterparts can keep growing by accessing capital markets and other sources of nonbank funding, Baslandze and Willis said in an interview.

- A 1 percentage point tightening in bank credit supply is associated with an 11% decline in small businesses' net job creation rate, Baslandze and Willis and bank colleagues Camelia Minoiu and Veronika Penciakova estimated by analyzing the supply-side impact of credit contraction on small business employment at the state level. For more see MNI Policy main wire at 1459ET.

US TSYS Core CPI Gained, 30Y Bond Reopen Tailed

- Tsys have fallen back to early Monday levels Thursday, curves bear steepening in the minutes following a poorly received 30Y Bond auction re-open that tailed 3.5bp.

- Heavy volumes after the bell (TYZ3 near 2M), Dec'23 10Y futures at 107-10 (-20) still well above initial technical support of 106-14 (2.0% Lower Bollinger Band), 10Y Yield 4.6928% (+.1345) after tapping 4.7261% high after the Bond sale.

- Busy early session as Tsys gapped higher in the seconds PRIOR to the data release (TYZ3 108-16 high) just as quickly reversed/extended lows after U.S. CPI rose 0.396% in September and 3.7% from a year ago, the Bureau of Labor Statistics reported Thursday, a tenth higher than markets expected.

- Meanwhile core CPI added 0.323% and 4.1% over the month and year, respectively, in line with expectations. The three-month annualized rate for core CPI rose to 3.1% in September from 2.4% the previous month.

- Curves reversed flatter profiles - gapped steeper immediately after the $20B 30Y bond auction tailed 3.5bp (4.837% high yield vs. 4.802% WI). 3M10Y currently +12.906 at -82.121 vs. -99.763 low; 2Y10Y +5.635 at 37.134 vs. -48.359; 5Y10Y +3.154 at -37.811 vs. -45.133 low.

- Friday Data Calendar: Import/Export Prices, UofM Sentiment, Philly Fed Harker will present his 2023 economic outlook (text, Q&A) at 0900ET.

OVERNIGHT DATA

- US SEP CPI 0.4%, CORE 0.3%; CPI Y/Y 3.7%, CORE Y/Y 4.1%

- US SEP ENERGY PRICES 1.5%

- US SEP OWNERS' EQUIVALENT RENT PRICES 0.6%

- US SEP CPI UNROUNDED M/M 0.396%, CORE 0.323%

- Unrounded % M/M (SA): Core: 0.323% (from 0.278%); Headline: 0.396%

- Unrounded % Y/Y (NSA): Core: 4.147% (from 4.349%); Headline: 3.7%

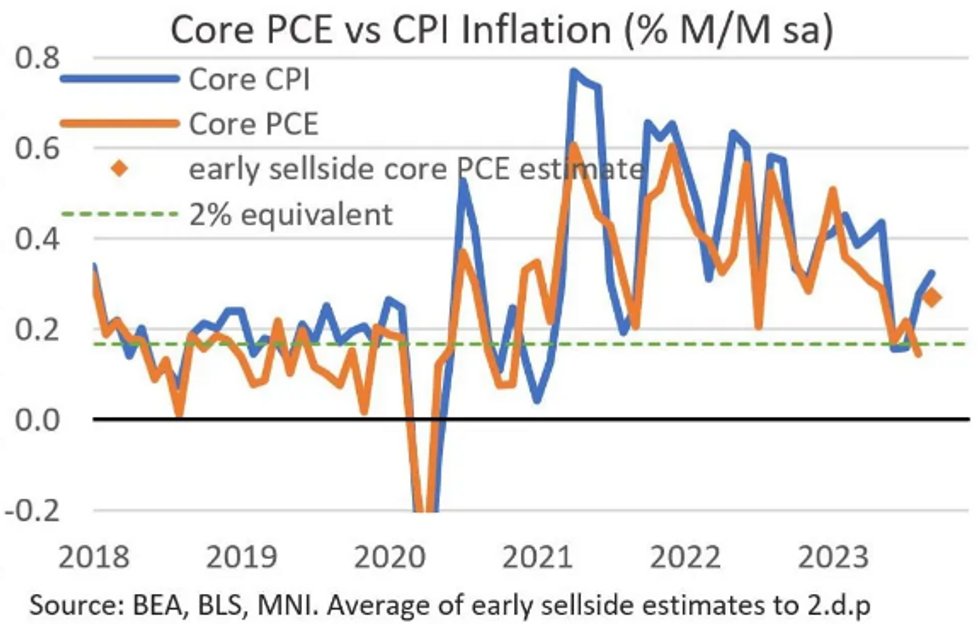

Core PCE is expected to come in below core CPI for a 2nd consecutive month in September.

- Most analysts’ estimates point to a reading between 0.2-0.3% M/M and leaning to 0.3%, for the Oct 27 core PCE release which prints just a few days before the Nov 1 FOMC decision.

- While the surprisingly strong core CPI (+0.32% M/M) has seen PCE estimates tick higher in the wake of the release, the PPI inputs to key categories were mixed (airline passenger services negative, medical categories picking up).

A few core PCE estimates post-CPI, vs August’s +0.14% M/M reading include the following - we will publish more in our US Inflation Insight out Friday:

- Wrightson ICAP’s 0.2% (unchanged from prior to CPI but higher risks of 0.3% now, than 0.1%)

- Pantheon Economics’ 0.27%

- Morgan Stanley 0.27% M/M (with core services ex-housing at +0.34% M/M vs +0.14% M/M prior “given soft financial services from PPI”).

- US JOBLESS CLAIMS +0K TO 209K IN OCT 07 WK

- US PREV JOBLESS CLAIMS REVISED TO 209K IN SEP 30 WK

- US CONTINUING CLAIMS +0.030M to 1.702M IN SEP 30 WK

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA down 196.56 points (-0.58%) at 33607.35

- S&P E-Mini Future down 32.5 points (-0.74%) at 4377

- Nasdaq down 99.3 points (-0.7%) at 13559.33

- US 10-Yr yield is up 14.1 bps at 4.699%

- US Dec 10-Yr futures are down 20.5/32 at 107-9.5

- EURUSD down 0.0089 (-0.84%) at 1.053

- USDJPY up 0.64 (0.43%) at 149.82

- WTI Crude Oil (front-month) down $0.07 (-0.08%) at $83.41

- Gold is down $5.26 (-0.28%) at $1869.02

- European bourses closing levels:

- EuroStoxx 50 down 2.57 points (-0.06%) at 4198.23

- FTSE 100 up 24.75 points (0.32%) at 7644.78

- German DAX down 34.98 points (-0.23%) at 15425.03

- French CAC 40 down 26.68 points (-0.37%) at 7104.53

US TREASURY FUTURES CLOSE

- 3M10Y +13.637, -81.39 (L: -99.763 / H: -78.681)

- 2Y10Y +5.843, -36.966 (L: -48.359 / H: -34.25)

- 2Y30Y +7.887, -21.331 (L: -36.51 / H: -18.494)

- 5Y30Y +4.551, 15.944 (L: 6.071 / H: 17.906)

- Current futures levels:

- Dec 2-Yr futures down 3.75/32 at 101-9.75 (L: 101-08.625 / H: 101-15.5)

- Dec 5-Yr futures down 12.25/32 at 104-31 (L: 104-28.75 / H: 105-20.5)

- Dec 10-Yr futures down 20.5/32 at 107-9.5 (L: 107-04 / H: 108-16)

- Dec 30-Yr futures down 1-24/32 at 111-20 (L: 111-07 / H: 114-10)

- Dec Ultra futures down 2-11/32 at 115-24 (L: 115-06 / H: 119-14)

US 10Y FUTURE TECHS: (Z3) Bounce Fades as CPI Boosts Yields

- RES 4: 109-12+ 50-day EMA

- RES 3: 108-26+ High Sep 22

- RES 2: 108-14+ High Sep 29

- RES 1: 108-11 High Oct 11

- PRICE: 107-08 @ 1430 ET Oct 12

- SUP 1: 106-14 2.0% Lower Bollinger Band

- SUP 2: 106-03+/00 Low Sep 4 / Round number support

- SUP 3: 105-11 2.0% 10-dma envelope

- SUP 4: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Markets traded firmer through the 20-day EMA Wednesday, further building momentum and signalling a possible base at the early October lows. The near-term strength stalled on Thursday, however, with prices under pressure as CPI topped estimates. For bears to regain control, weakness through 106-12 would signal a fade in the short-term momentum, and open further losses. The near-term upside opens for further gains toward late September levels at 108-14+, the Sep29 high. With last week’s lows yet to be re-tested, a further stabilisation in prices could signal a near-term reversal higher.

SOFR FUTURES CLOSE

- Dec 23 -0.025 at 94.545

- Mar 24 -0.045 at 94.650

- Jun 24 -0.060 at 94.850

- Sep 24 -0.075 at 95.10

- Red Pack (Dec 24-Sep 25) -0.095 to -0.09

- Green Pack (Dec 25-Sep 26) -0.10 to -0.095

- Blue Pack (Dec 26-Sep 27) -0.105 to -0.095

- Gold Pack (Dec 27-Sep 28) -0.10 to -0.095

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00212 to 5.33450 (-0.00657/wk)

- 3M +0.00010 to 5.39387 (-0.01287/wk)

- 6M +0.00530 to 5.43994 (-0.01452/wk)

- 12M +0.01319 to 5.36920 (-0.02736/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $94B

- Daily Overnight Bank Funding Rate: 5.32% volume: $247B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.465T

- Broad General Collateral Rate (BGCR): 5.30%, $567B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $556B

- (rate, volume levels reflect prior session)

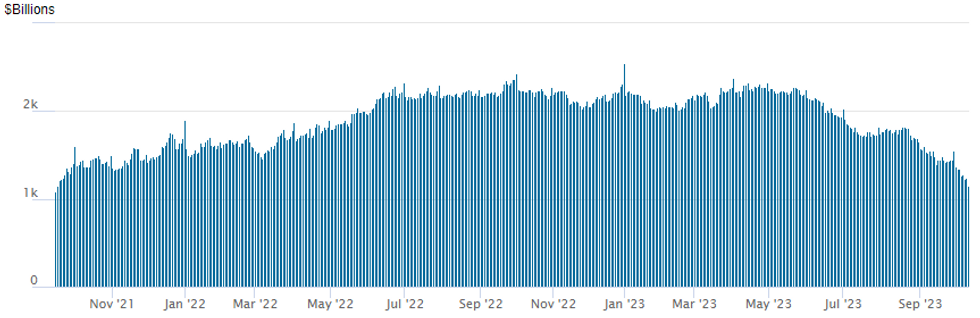

FED REVERSE REPO OPERATION - Usage Falls to New Cycle Low

NY Federal Reserve/MNI

Repo operation usage falls to the lowest since mid-September 2021 at $1,157.319B w/97 counterparties vs. $1,239.382B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $11.25B Corporate Debt Issued Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 10/12 $500M #Shinhan Formosa 5Y SOFR+108

- $11.25B Priced Wednesday, $20.75B total/week

- 10/11 $6B *KFW 2Y SOFR+21, 7Y SOFR+49

- 10/11 $3.5B *Smucker $750M 5Y +130, $1B 10Y +160, $750M 20Y +162.5, $1B 30Y +180

- 10/11 $1.25B *Nationwide BS 4NC3 +180

- 10/11 $500M *JBIC WNG 5Y SOFR+59

EGBs-GILTS CASH CLOSE: Bear Steepening On Strong US Inflation Data

EGB and Gilt yields retraced some of the drop seen earlier in the week on Thursday after stronger-than-expected US September inflation data.

- The European morning session saw some modest gains (Gilts benefited from softer-than-expected manufacturing data) that faded as oil prices and equities found a footing.

- But trade was tentative ahead of US CPI data, which saw global core FI retreat sharply as the implications of unexpectedly strong core/supercore figures were digested. The selling momentum carried on through the cash close.

- German and UK curves bear steepened on the day, with Gilts underperforming Bunds.

- Periphery EGB spreads widened led by BTPs, having cheapened post-CPI and on ECB's Vasle calling for a debate to begin on shrinking the balance sheet.

- The week concludes Friday with final Sept Eurozone CPI data and Eurozone industrial production for August, along with multiple central bank speakers once again including BoE's Bailey and ECB's Lagarde.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.3bps at 3.161%, 5-Yr is up 5.7bps at 2.716%, 10-Yr is up 6.8bps at 2.786%, and 30-Yr is up 7.6bps at 2.975%.

- UK: The 2-Yr yield is up 5.3bps at 4.85%, 5-Yr is up 8.3bps at 4.471%, 10-Yr is up 9.5bps at 4.423%, and 30-Yr is up 9.6bps at 4.864%.

- Italian BTP spread up 2.6bps at 197.7bps / Spanish up 1.4bps at 111.3bps

FOREX USD Index Rises 0.7% Following Above-Estimate Inflation Data

- The slightly firmer than expected US inflation data sparked a shift higher for US treasury yields and an associated recovery for the greenback. A persistent USD bid throughout the session tilted the USD index back into positive territory on the week and those moves extended in late trade amid the weakness for global equity benchmarks.

- Equities weakness weighed substantially on the likes of AUD and NZD, which are registering losses of over 1.5% on the session as we approach the APAC crossover, with GBP closely behind, dropping 1.1% and back below the 1.2200 mark.

- EURUSD’s traded with a renewed downward bias, sinking back to 1.0530 at typing, over a big figure from the earlier session highs.

- In similar vein, USDJPY narrowed the gap once more to 150.00 with Japanese authorities reiterating that FX volatility is problematic and that currency adjustments must reflect fundamentals. USDJPY’s recovery from last Tuesday’s low at 147.43 is a bullish technical development and - for now - the uptrend remains in play. A clear break of the 150.00 handle would reinforce bullish conditions. The bull trigger is 150.16, the Oct 3 high and a break would initially open 150.40 and 151.09, both Fibonacci projections.

- Reversing much of the prior positive sentiment earlier in the week, EM currencies such as MXN and ZAR were among the worst performers amid the higher US yields and waning equities.

- Chinese CPI/PPI data will be released overnight on Friday, alongside September trade data. BOE Governor Bailey is due to speak at the Institute of International Finance Annual Membership Meeting, in Morocco. The US docket is highlighted by UMich consumer sentiment and inflation expectations.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/10/2023 | 0100/0900 | *** |  | CN | Money Supply |

| 13/10/2023 | 0100/0900 | *** |  | CN | New Loans |

| 13/10/2023 | 0100/0900 | *** |  | CN | Social Financing |

| 13/10/2023 | 0130/0930 | *** |  | CN | CPI |

| 13/10/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 13/10/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 13/10/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/10/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/10/2023 | 0800/0900 |  | UK | BoE's Bailey speaks at Institute of International Finance Annual Membership Meeting | |

| 13/10/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/10/2023 | - | *** |  | CN | Trade |

| 13/10/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 13/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/10/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 13/10/2023 | 1300/0900 |  | US | Philadelphia Fed's Pat Harker | |

| 13/10/2023 | 1300/1500 |  | EU | ECB's Lagarde participates in IMF seminar | |

| 13/10/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 13/10/2023 | 1630/1730 |  | UK | BoE's Cunliffe speaks at Institute of International Finance |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.