-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - European Leaders Meet, Ukraine High on Agenda

MNI BRIEF: Firm, Job Losses Up, But Turnaround In Sight - IWH

MNI China Daily Summary: Thursday, March 6

MNI ASIA OPEN: AHE Strength Vs. Headline Jobs Miss

- MNI INTERVIEW: US Labor Market Surpasses Pre-Pandemic Strength

- MNI Payrolls Takeaway: A Nuanced Report Highlighted By Stronger Wages But Cooling Hours

- MNI AHE Wage Growth Moves In Wrong Direction For Fed

- MNI Unemployment Rates Offer A Not Overly Surprising Hawkish Angle

US

US: The U.S. labor market has now recovered many of the workforce gaps brought on by the Covid-19 pandemic, and shortages of workers alone should be enough to slow payroll growth to around 65,000 a month, Federal Reserve Bank of Chicago economist Bart Hobijn told MNI.

- Contrary to a prevailing narrative of five million "missing jobs" and a shortfall of workers compared to pre-pandemic levels, cyclical pressures on participation are higher than in February 2020 and have boosted payrolls by more than 1.4 million relative to that time, Hobijn said.

- The labor market is now running up against the same problem it had pre-Covid -- baby boomers retiring en masse -- showing how little the pandemic has shifted long-run trends, he said. For more see MNI Policy main wire at 0923ET.

US DATA: Payrolls growth saw a relatively small miss but was combined with further downward revisions, although the private sector fared better in this latest report after months of underperforming. Both total and private payrolls are only back to or still above the 2019 average, so moderating but still growing strongly on a historical basis.

- AHE provided the clear hawkish angle to the report with a beat at 0.42% M/M and net upward revisions, with momentum moving in the wrong direction for the Fed at near 5% annualized after its recent moderation.

- It was however offset by average hours worked surprising lower, dropping back a tenth to the very bottom of the 34.3-34.6 pre-pandemic range seen through 2011-19, a way of cutting costs with an unwillingness to let workers go with skill shortages still an issue.

- The separate household employment survey was generally hawkish with the unemployment rate pushing lower - as a notable share of analysts had called for – and the underemployment falling back, boosted by a partial reversal of a sharp increase in those working part-time for economic reason.

- There is some nuance to the participation rates though. Prime-age participation has struggled to surpass its recent push to highs since 2002 and actually edged lower this month. However, 55+ participation increased 0.3pps on the month in what could be nascent signs of early retirees being tempted back to the labor force but still close to post-pandemic lows and some 1.7pps below pre-pandemic levels.

Bonds Extending Late Highs

- After briefly paring post-NFP highs at midmorning, Tsy futures continued to extend session highs into the close, curves bull flattening/unwinding some of Thu's move (3M10Y -12.886 at -136.364; 2Y10Y -3.107 at -73.910) with intermediate to long end rates outperforming (USU3 +2.05 at 128-09, 30YY 4.1997% low).

- Fast two-way trade was reported after this morning's July employment data came out slightly lower than expected at +187k vs. 200k est, June down-revised by -49,000. Average hourly earnings, on the other hand, were stronger than expected, rising 0.42% M/M (cons 0.3) after an upward revised 0.45% (initial 0.36% M/M) which was only marginally offset by a lower 0.33% in May (initial 0.36%).

- Rates continued to angle higher amid dovish comments from unscheduled Fed speakers Bostic "US JOBS NUMBERS CAME IN AS EXPECTED; I'M COMFORTABLE" and Goolsbee "SHOULD START THINKING ABOUT HOW LONG TO HOLD RATES" underscoring, if not exactly providing a bid to the rally.

- Cross-asset gains at midday: stocks near highs (ESU3 +28.0 at 4550.0; Crude firm (WTI +1.05 at 82.60), Gold firmer (+8.65 at 1942.7.

- Slow start to next week's data with the first significant release next Thursday with CPI and weekly Claims.

OVERNIGHT DATA

- US JUL NONFARM PAYROLLS +187K; PRIVATE +172K, GOVT +15K

- US PRIOR MONTHS PAYROLLS REVISED: JUN +185K; MAY +281K

- US PAYROLLS REVISIONS FOR JUNE, MAY -49K

- US JUL UNEMPLOYMENT RATE 3.5%

- The unemployment rate came in lower than expected, printing a ‘genuine’ 3.5% with 3.50% (cons 3.6) after 3.57%, although as we noted in the preview there was a healthy share of analysts looking for such a move.

- From the household survey, employment (+268k) outstripped the labor force (+152k).

- The participation rate was exactly the same at 62.58% (in line) as it remains nearly 1pp below pre-pandemic levels. Prime-age participation inched a tenth lower to 83.4% (but still 0.4pps above pre-pandemic recent highs after its recent push higher), offset by a rare push increase from the 55+ cohort in what could be seen as potentially positive for future labour supply if it’s continued.

- On a more hawkish angle, the U6 underemployment rate fell back 0.2pps to 6.7%, with those working part-time for economic reasons falling -191k after a particularly strong +452k increase in June.

- US JUL AVERAGE WEEKLY HOURS 34.3 HRS

- US JUL AVERAGE HOURLY EARNINGS +0.4% Vs JUN +0.4%; +4.4% YOY

- AHE stronger than expected on the month and revised higher in June

- Total AHE: M/M (SA): 0.417% in Jul from 0.448% in Jun; Y/Y (SA): 4.361% in Jul from 4.413% in Jun

- AHE Non-Supervisory:

- M/M (SA): 0.451% in Jul from 0.383% in Jun; Y/Y (SA): 4.776% in Jul from 4.722% in Jun

- The AHE data were clearly stronger than expected in July, rising 0.42% M/M (cons 0.3) after an upward revised 0.45% (initial 0.36% M/M) which was only marginally offset by a lower 0.33% in May (initial 0.36%).

- Non-supervisory meanwhile accelerated from 0.38% M/M to 0.45% M/M.

- It leaves a three-month average of 4.8% annualized for AHE and 4.9% annualized for non-supervisory, moving the wrong way for the Fed after recent moderation.

- CANADA JULY JOBS -6.4K VS FORECAST +25K, PRIOR +59.9K

- CANADA JOBLESS RATE UP 3RD MONTH, HIGHEST SINCE JAN 2022

- CANADA JOBLESS RATE 5.5% VS FORECAST 5.4%, PRIOR 5.4%

- CANADA HOURLY WAGES +5% YEAR-OVER-YEAR VS PRIOR 4.2%

- CANADA FULL-TIME JOBS +1.7K, PART-TIME -8.1K

- CANADA JOB DECLINE LED BY CONSTRUCTION -44.7K

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 106.51 points (-0.3%) at 35109.99

- S&P E-Mini Future down 15.5 points (-0.34%) at 4506

- Nasdaq down 10.6 points (-0.1%) at 13949.39

- US 10-Yr yield is down 12.1 bps at 4.054%

- US Sep 10-Yr futures are up 30/32 at 111-5.5

- EURUSD up 0.0059 (0.54%) at 1.1008

- USDJPY down 0.73 (-0.51%) at 141.85

- WTI Crude Oil (front-month) up $1.06 (1.3%) at $82.62

- Gold is up $7.21 (0.37%) at $1941.28

- EuroStoxx 50 up 28.28 points (0.66%) at 4332.91

- FTSE 100 up 35.21 points (0.47%) at 7564.37

- German DAX up 58.48 points (0.37%) at 15951.86

US TREASURY FUTURES CLOSE

- 3M10Y -12.281, -135.759 (L: -140.01 / H: -122.29)

- 2Y10Y -2.921, -73.724 (L: -78.509 / H: -68.1)

- 2Y30Y +1.077, -58.35 (L: -66.768 / H: -52.468)

- 5Y30Y +5.013, 4.754 (L: -6.992 / H: 7.928)

- Current futures levels:

- Sep 2-Yr futures up 5.75/32 at 101-21.375 (L: 101-10 / H: 101-21.875)

- Sep 5-Yr futures up 17.75/32 at 106-29.5 (L: 105-30.75 / H: 106-29.75)

- Sep 10-Yr futures up 30.5/32 at 111-6 (L: 109-24 / H: 111-06)

- Sep 30-Yr futures up 1-25/32 at 122-4 (L: 119-25 / H: 122-04)

- Sep Ultra futures up 2-01/32 at 128-5 (L: 125-28 / H: 128-05)

(U3) Bounces Solidly Off Lows

- RES 4: 113-08 High Jul 18 and a bull trigger

- RES 3: 112-31 High Jul 20

- RES 2: 112-19 50-day EMA

- RES 1: 111-21+/112-07 20-day EMA / High Jul 27

- PRICE: 111-02 @ 1230 ET Aug 4

- SUP 1: 109-24 Low Aug 04

- SUP 2: 109-14 Low Nov 8 2022 (cont)

- SUP 3: 109-10+ Low Nov 4 2022 (cont)

- SUP 4: 108-26+ Low Oct 21 2022 (cont) and a major support

This week’s bear leg in Treasuries extended to 109-24 Friday, reinforcing the bearish theme. Nonetheless, prices bounced sharply off lows, rallying into the close to pause the recent downtrend. The next key support rests at 109-14, the Nov 8 2022 low (cont). The 20-day EMA, at 111-21+, is the resistance to watch.

SOFR FUTURES CLOSE

- Sep 23 +0.015 at 94.605

- Dec 23 +0.040 at 94.660

- Mar 24 +0.070 at 94.930

- Jun 24 +0.10 at 95.295

- Red Pack (Sep 24-Jun 25) +0.125 to +0.145

- Green Pack (Sep 25-Jun 26) +0.150 to +0.160

- Blue Pack (Sep 26-Jun 27) +0.155 to +0.160

- Gold Pack (Sep 27-Jun 28) +0.150 to +0.155

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00084 to 5.31724 (-.00083/wk)

- 3M +0.00073 to 5.37058 (-0.00133/wk)

- 6M +0.00112 to 5.43419 (-0.01382/wk)

- 12M -0.00252 to 5.36235 (-0.04553/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.32% volume: $263B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.413T

- Broad General Collateral Rate (BGCR): 5.28%, $579B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $572B

- (rate, volume levels reflect prior session)

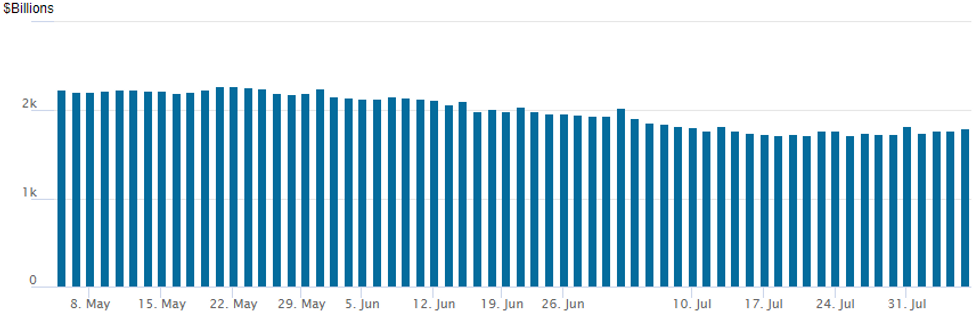

FED REVERSE REPO OPERATION

The latest operation inches up to $1,793.804B, w/102 counterparties, compared to $1,776.774B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE Issuers Remain Sidelined Post-NFP, Quarterly Earnings Blackout

- Date $MM Issuer (Priced *, Launch #)

- 08/04 No new issuance Friday, $15.05B total issued on week

- $2.25B Priced Thursday

- 08/03 $900M #Public Service E&G $500M 10Y +103, $400M 30Y +115

- 08/03 $750M #NY State Electric & Gas $350M 5Y +140, $400M 10Y +168

- 08/03 $600M #PACCAR Financial $300M 3Y +50, $300M 5Y +70

EGBs-GILTS CASH CLOSE: Soft US Jobs Growth Triggers Bull Flattening

European curves bull flattened Friday, with yields pulling back from recent extremes after US employment data was seen to be on the soft side.

- An early upside surprise in German factory orders helped extend the bearish tone of the previous two sessions (which had centred around US Treasury supply expectations), but the space rallied in the early afternoon after US nonfarm payroll growth came in below expectations.

- The standout moves were in the UK curve with yields down by high-single digits in a bull flattening move; the German curve moved accordingly but with a less pronounced yield drop.

- Commentary by BoE Pill didn't move the needle, with the Chief Economist reiterating that rates are not on a pre-set course.

- Greek spreads outperformed a broader periphery rally, with DBRS Morningstar noting that Greece is close to receiving investment grade status, while Scope Ratings' reviews the sovereign after market close today.

- Next week is a quieter one on the European calendar, with Monday's highlights including German industrial production data and another appearance by BoE's Pill.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.1bps at 3.014%, 5-Yr is down 2.3bps at 2.581%, 10-Yr is down 4.3bps at 2.562%, and 30-Yr is down 6.3bps at 2.624%.

- UK: The 2-Yr yield is down 6bps at 4.92%, 5-Yr is down 6.7bps at 4.402%, 10-Yr is down 9bps at 4.38%, and 30-Yr is down 8.6bps at 4.569%.

- Italian BTP spread down 1.9bps at 165bps / Greek down 4.7bps at 122.6bps

FOREX Greenback Snaps Winning Streak as NFP Undermines Uptrend

- The greenback snapped the winning streak Friday, with the uptrend in the USD Index undermined by the July Nonfarm Payrolls release. A poorer-than-expected headline and negative revisions plus softer hours worked countered any hawkish overtones from strong AHE and the drop in the unemployment rate. The release, compounded with the recent pullback in CPI inflation, has helped ease market-implied peak pricing at the Fed in November by ~4bps off the day's high, weighing on yields and helping support equities. That was until a late slide in US stocks, seemingly flow- rather than headline-driven ahead of the weekend, which has provided a small uplift for the USD index but with DXY still -0.6% on the day.

- The USD pullback helped prompt a corrective recovery in EUR/USD, which rallied to touch 1.1042 and clear the Wednesday high in the process. This cements the 50- and 100-dmas as key supports, which have held well this week at 1.0937 and 1.0920 respectively.

- A firmer oil price into the close has favoured oil-tied FX, putting NOK at the top of the G10 pile, although CAD underperforms notably on US linkages and its own softer jobs print. The moves in NOK come ahead of next week's July CPI report, at which markets expect the Norges Bank's favoured inflation gauge - CPI-ATE - to ease off a cycle high of 7.0%. Continued stubbornness in inflation would work against any expectations that the bank can revert to 25bps hikes at the August rate decision.

- Focus in the coming week turns to global inflation, with US, Norway and China all posting their latest CPI prints. The Banxico decision is also due, with the bank seen standing out from regional peers by keeping the overnight rate unchanged.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/08/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 07/08/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/08/2023 | 1230/0830 |  | US | Fed's Michelle Bowman, Raphael Bostic | |

| 07/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/08/2023 | 1600/1700 |  | UK | BOE Pill speaks at the MPR Live Q&A | |

| 07/08/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.