-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Bank Turmoil Influenced FOMC Decision, Minutes

EXECUTIVE SUMMARY

- MNI: FOMC Agreed Modest Rate Hike Prudent-Minutes

- MNI: FED Staff See Mild Recession Later This Year But Powell Had Hinted At Such

- MNI: Fed's Daly-Economy Could Keep Slowing Without More Hikes

- MNI: BOC WATCH: Rate Held, Pause Phrase Gone, Hike Talk Stays

- MNI: BOC Inflation Fight Not Done, Prepared To Hike Further

CPI Takeaways: Softer Housing, Non-Housing Services Supported By Volatile Items

- Housing saw the largest downside surprise in the March CPI release, with OER and primary rents easing to 0.48/0.49% M/M for the softest pace since Apr/Mar’22.

- Core services ex housing softened from 0.50% to 0.40% M/M, or a more pronounced 0.45 to 0.25% M/M when stripping out all shelter including another surprisingly strong lodging increase of 3.1%.

- Combined with airfares increasing another 4.0% after 6.4% in Feb (with a reminder that tomorrow's PPI airfares matter for PCE, the Feb release of which didn’t show any of CPI’s strength), it’s notable that two of the largest outright contributions of monthly core ex-housing inflation are from volatile categories which could struggle to maintain current strength ahead.

- Medical care service components that can be a more helpful guide for PCE healthcare were mixed meanwhile, with professional services at 0.0% after -0.3% M/M but hospital services -0.2% after +0.1% M/M.

US

FED: Federal Reserve officials debated a temporary pause to interest rate hikes last month as a banking sector crisis raged but unanimously decided inflation pressures were still sufficiently worrisome to warrant a quarter point interest rate increase, according to minutes of the March meeting released Wednesday.

- “Participants noted that recent developments in the banking sector would likely result in tighter credit conditions for households and businesses and weigh on economic activity, hiring, and inflation, though the extent of these effects was highly uncertain. Against this backdrop, all participants agreed that it was appropriate to raise the target range for the federal funds rate 25 basis points,” the minutes said.

- The report said “several” Fed officials considered whether it might be appropriate to hold rates steady but decided otherwise. In contrast, some participants said they might have considered a 50 basis point hike were it not for the banking stress.

- Officials were also unanimous in their desire to keep reducing the central bank’s balance sheet by allowing maturing bonds to roll off. For more, see MNI Policy news wire at 1200ET.

FED: There’s some attention in the FOMC minutes on the staff forecast now showing a mild recession as a base case: “Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.”

- However, we repeat the following from our review of the Fed decision: "Recession Starting To Look Like Fed’s Base Case: Powell was asked about the unemployment forecast implying a sharp rise by year-end from current levels, and he spoke briefly about non-linear effects on inflation of a recession almost as if it were the baseline scenario. And assuming the Fed’s projections for H1 of this year are similar to market expectations of strong growth, the 2023-2024 GDP forecast arithmetically implies a sharp slowdown / contraction in H2 2023."

FED: With credit tightening underway, the U.S. economy could slow enough to bring down inflation without the Federal Reserve lifting interest rates further, San Francisco Fed President Mary Daly said Wednesday.

- However, it's uncertain how much credit tightening will ultimately occur, and policymakers should also be open to raising rates further if data argue for doing so, she said.

- "Looking ahead, there are good reasons to think that policy may have to tighten more to bring inflation down. But there are also good reasons to think that the economy may continue to slow, even without additional policy adjustments," she said in remarks prepared for the Salt Lake City Chamber.

- The Fed has taken its benchmark fed funds rate from just above zero to just under 5% in a year, but inflation remains at 5%, more than double the Fed's target. For more, see MNI Policy news wire at 1200ET.

CANADA

BOC: The Bank of Canada dropped language about likely being done with interest-rate hikes while keeping a phrase about a potential increase to address inflation now seen above target longer than expected, putting it more back in line with Fed and ECB hawks and widening a divergence with investors predicting a rate cut later this year.

- Governor Tiff Macklem left the overnight rate target at 4.5% Wednesday, the second pause after eight prior hikes, a decision predicted by all economists surveyed by MNI. Most of those economists though had predicted the Bank would keep its earlier commitment to a likely extended pause with inflation slowing in recent months.

- "Governing Council continues to assess whether monetary policy is sufficiently restrictive to relieve price pressures and remains prepared to raise the policy rate further if needed to return inflation to the 2% target," Macklem and his Governing Council deputies said in a statement. The Governor has an 11am EST press conference. For more, see MNI Policy news wire at 1000ET.

- "The work of monetary policy- the full impact of the the policy rate increases we've undertaken so far- is not done," Macklem said in an opening statement for a press conference. Earlier he held the benchmark lending rate at 4.5%, while dropping language about a likely pause and keeping a phrase about potential further tightening.

- "If monetary policy is not restrictive enough to get us all the way back to the 2% target, we are prepared to raise the policy rate further to get there," he said. Officials discussed whether the policy rate needs to remain restrictive for longer, he said. The main upside risk is stubborn services inflation and the main downside risk is a global recession, though the upside is more important with inflation well above target, he said. "Several things still have to happen to get inflation all the way back to target."

US TSYS: Post-March FOMC Minutes Calm

- Treasury futures holding modestly higher for the most part, near the middle of a wide session range. Futures fell back to pre-CPI levels after the Tsy $32B 10Y note auction tailed 2.3bp, but gradually climbed to middle of range (TYM3 115-25.5 +13.5) in the aftermath of the March FOMC minutes release.

- Federal Reserve officials debated a temporary pause to interest rate hikes last month as a banking sector crisis raged but unanimously decided inflation pressures were still sufficiently worrisome to warrant a quarter point interest rate increase.

- Post-minutes calm, projected year end rate cuts back to approximately -50bp cumulative for December after paring the move around midday. Initial impetus from the lower than anticipated CPI (CPI 0.1%, CORE 0.4%; CPI Y/Y 5.0%, CORE Y/Y 5.6%) has since scaled back the move while less than a 25bp hike at the May meeting holding steady.

- Markets showed little reaction to several unscheduled Fed speakers this morning Richmond Fed initially stayed away from discussing policy at a annual conference on investing, reiterated "THERE IS STILL MORE TO DO TO GET CORE INFLATION DOWN ... while PAST PEAK INFLATION BUT WE STILL HAVE WAYS TO GO" at a midmorning CNBC interview.

- Meanwhile, SF Fed President Daly said the U.S. economy could slow enough to bring down inflation without the Federal Reserve lifting interest rates further.

OVERNIGHT DATA

- CPI Unrounded % M/M (SA): Headline 0.053%; Core: 0.385% (from 0.452%)

- CPI Unrounded % Y/Y (NSA): Headline 4.985%; Core: 5.59% (from 5.538%)

- US MAR CPI 0.1%, CORE 0.4%; CPI Y/Y 5.0%, CORE Y/Y 5.6%

- US MAR ENERGY PRICES -3.5%

- US MAR OWNERS' EQUIVALENT RENT PRICES 0.5%

Slight Moderation In Core Services Ex-Housing. Back near recent average for core services excl OER & primary rents: 0.4% M/M after 0.5% and 3mth av of 0.42% More pronounced for core services excl all shelter: 0.25% M/M after 0.45% and 3mth av of 0.36%

- US MBA: MARKET COMPOSITE +5.3% SA THRU APR 07 WK

- US MBA: REFIS +0.1% SA; PURCH INDEX +8% SA THRU APRIL 7 WK

- US MBA: UNADJ PURCHASE INDEX -31% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.3% VS 6.4% PREV

- MNI: BOC HOLDS 4.5% RATE, DROPS PHRASE ABOUT CONTINUED PAUSE

- BOC REMAINS PREPARED TO HIKE AGAIN TO CURB INFLATION

- BOC SEES IT TAKING LONGER TO RESTORE 2% INFLATION

- BOC SEES 2% CPI AT END OF 2024 VS PRIOR VIEW OF `IN 2024

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 5.63 points (-0.02%) at 33721.84

- S&P E-Mini Future down 9.5 points (-0.23%) at 4132.25

- Nasdaq down 59.3 points (-0.5%) at 11984.38

- US 10-Yr yield is down 1.7 bps at 3.4093%

- US Jun 10-Yr futures are up 12.5/32 at 115-24.5

- EURUSD up 0.0084 (0.77%) at 1.0996

- USDJPY down 0.53 (-0.4%) at 133.17

- WTI Crude Oil (front-month) up $1.74 (2.13%) at $83.32

- Gold is up $12.93 (0.65%) at $2016.93

- EuroStoxx 50 up 0.74 points (0.02%) at 4334.03

- FTSE 100 up 39.12 points (0.5%) at 7824.84

- German DAX up 48.43 points (0.31%) at 15703.6

- French CAC 40 up 6.66 points (0.09%) at 7396.94

US TREASURY FUTURES CLOSE

- 3M10Y -0.87, -164.478 (L: -174.54 / H: -159.538)

- 2Y10Y +4.27, -55.563 (L: -67.056 / H: -52.782)

- 2Y30Y +8.109, -32.377 (L: -44.367 / H: -29.426)

- 5Y30Y +8.626, 17.447 (L: 6.839 / H: 18.634)

- Current futures levels:

- Jun 2-Yr futures up 5.125/32 at 103-12.75 (L: 103-05.75 / H: 103-18.875)

- Jun 5-Yr futures up 11.25/32 at 110-3.75 (L: 109-22.5 / H: 110-15.75)

- Jun 10-Yr futures up 11/32 at 115-23 (L: 115-08 / H: 116-08)

- Jun 30-Yr futures down 6/32 at 132-6 (L: 131-15 / H: 133-15)

- Jun Ultra futures down 19/32 at 142-4 (L: 141-06 / H: 143-24)

US 10YR FUTURE TECHS: Fails to Hold Intraday Rally

- RES 4: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 3: 117-01+ High Mar 24 and bull trigger

- RES 2: 116-30 High Apr 5 / 6

- RES 1: 116-08 High Apr 12

- PRICE: 115-18 @ 15:39 BST Apr 12

- SUP 1: 115-03 20-day EMA

- SUP 2: 114-18 Low Apr 3

- SUP 3: 114-11+ 50-day EMA

- SUP 4: 114-07 Low Mar 29 and 30 and key support

Treasury futures rallied sharply on the CPI release, but failed to build from there, fading off the 116-08 high. This keeps prices well off last week’s 116-30 high, with the week’s lows of 115-06+ well within range. Key support sits below at 114-07, the Mar 29/30 low. Over the medium-term, however, a bullish theme remains intact and moving average studies highlight an uptrend. Resistance at 117-01+, the Mar 24 high, is a key short-term hurdle. A break of this level opens 117-14+, the Aug 29/30 2022 high (cont).

EURODOLLAR FUTURES CLOSE

- Jun 23 +0.040 at 94.725

- Sep 23 +0.070 at 95.115

- Dec 23 +0.070 at 95.475

- Mar 24 +0.085 at 95.935

- Red Pack (Jun 24-Mar 25) +0.110 to +0.135

- Green Pack (Jun 25-Mar 26) +0.065 to +0.10

- Blue Pack (Jun 26-Mar 27) steadysteady0 to +0.060

- Gold Pack (Jun 27-Mar 28) +0.005 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00143 to 4.81486% (+0.00515 total last wk)

- 1M +0.00842 to 4.94571% (+0.04542 total last wk)

- 3M +0.00972 to 5.25129% (+0.05343/wk)*/**

- 6M -0.00957 to 5.34200% (-0.06600 total last wk)

- 12M +0.04329 to 5.36643% (-0.13629 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.25129% on 4/12/23

- Daily Effective Fed Funds Rate: 4.83% volume: $108B

- Daily Overnight Bank Funding Rate: 4.82% volume: $273B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.365T

- Broad General Collateral Rate (BGCR): 4.78%, $528B

- Tri-Party General Collateral Rate (TGCR): 4.78%, $522B

- (rate, volume levels reflect prior session)

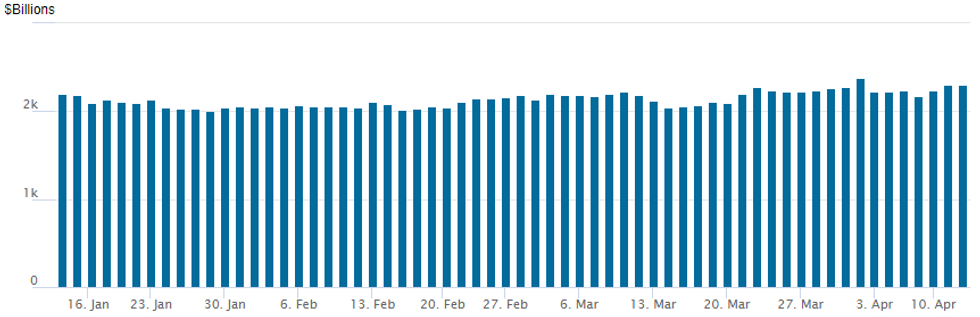

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,303.862B w/ 106 counterparties, compares to prior $2,297.208B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

PIPELINE: $5B Walmart 5pt Jumbo Launched

- Date $MM Issuer (Priced *, Launch #)

- 04/12 $5B #Walmart 5pt jumbo: $750M 3Y +30, $750M 5Y +47, $500M 7Y +60, $1.5B 10Y +70, $1.5B 30Y +90 (same amount as the last time Walmart issued debt on Sep 6'22, $5B total, for comparison: $1.75B 3Y +35, $1B 5Y +55, $1.25B 10Y +85, $1B 30Y +100)

- 04/12 $Benchmark OMERS Finance Trust 5Y SOFR +90a

EGBs-GILTS CASH CLOSE: Bearish Intraday Reversal

European yields fully reversed a sharp intraday drop set after a soft US CPI report Thursday, with Bunds underperforming Gilts.

- Core FI was caught wrong-footed by the inflation print: 10Y Bund yields had risen by 15bp and Gilts 11bp this week going into the data, but those rises were trimmed by 8bp and 9bp respectively immediately after the release.

- Then the reversal more than reversed, with 10Y yields jumping 15bp from the lows, as the CPI data was eventually interpreted as not being a game-changer for the inflation path ahead or for Federal Reserve policy.

- The publication of an interview with ECB's Holzmann in which he eyed a 50bp May hike and a need to keep hiking beyond next month sent European yields to session highs.

- ECB hike pricing hit a post-Mar 10 high, with a peak Depo rate of 3.74% now seen in October - up 8bp on the day (and 23bp above session lows). BoE pricing was steady.

- Periphery spreads reversed most of the narrowing, with BTPs closing a couple of basis points tighter to Bunds.

- Thursday's schedule includes an MNI event with BoE's Pill, as well as UK GDP data and final Eurozone national CPI prints.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9bps at 2.796%, 5-Yr is up 7.5bps at 2.397%, 10-Yr is up 5.9bps at 2.37%, and 30-Yr is up 5.6bps at 2.445%.

- UK: The 2-Yr yield is up 3.3bps at 3.519%, 5-Yr is up 2.1bps at 3.405%, 10-Yr is up 2.8bps at 3.57%, and 30-Yr is up 3.4bps at 3.895%.

- Italian BTP spread down 1.6bps at 184.5bps / Spanish down 0.8bps at 104bps

FOREX: Greenback Extends Downtrend, USD Index Pressing Towards 2023 Lows

- Following the marginally below-estimate US inflation data, pressure remained on the US dollar on Wednesday as the DXY continues to gravitate towards last week’s lows around 101.45 and has the 2023 lows as the next obvious target. The FOMC minutes release had close to zero effect on currency markets as Wednesday’s session drew to a close.

- The Euro and Swiss franc are outperforming. USDCHF (-0.85%) has cracked support at 0.9000 handle, marking a resumption of the broader downtrend that started from the Oct 2022 high of 1.0148. The break lower signals scope for weakness towards 0.8926 and 0.8871, the Feb 16 2021 low.

- In similar vein, both EURUSD and GBPUSD are hugging session highs and remain in close proximity of the 2023 peaks of 1.1033 and 1.2525 respectively. For cable, this level marks the bull trigger to resume the next stage of the medium-term uptrend. Additionally, both SEK and NOK have gained over 1% against the greenback, retracing the entirety of yesterday’s weakness amid the firmer commodity/oil backdrop.

- With US yields retracing a solid portion of their initial move following the US data, the Japanese yen is broadly underperforming across G10, with moderate weakness against the greenback but lower on the day against a host of other currencies.

- Australian employment data headlines the overnight docket before final German CPI and UK GDP in Europe. The US session will look at PPI data for March as well as the latest jobless claims figures.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/04/2023 | 0130/1130 | *** |  | AU | Labor force survey |

| 13/04/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 13/04/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/04/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/04/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 13/04/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/04/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/04/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank, G20 Finance Ministers' Meetings | |

| 13/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/04/2023 | 1230/0830 | *** |  | US | PPI |

| 13/04/2023 | 1300/0900 |  | CA | Governor Macklem speaks at IMF | |

| 13/04/2023 | 1300/1400 |  | UK | BOE Pill Speaker at MNI Connect | |

| 13/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/04/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.