-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Banks Still Prominent in Measuring Risk

EXECUTIVE SUMMARY

EUROPE

EU: Monetary policymakers have underestimated how changes in inflation have left long-term marks on households’ expectations, leaving them surprised when their measures prove ineffective, a senior advisor to the German government and expert on behavioral economics told MNI, adding that central bankers’ decisions are also measurably influenced by their lifetime memories.

- Ulrike Malmendier said she was surprised by the results of her own research which showed how strongly central bankers on the Federal Reserve’s Federal Open Market Committee are steered by their personal experience of inflation.

- “When you look at them making forecasts in their semi-annual policy reports to Congress, you can really trace out what inflation experiences they have made personally,” Malmendier, Professor of Economics and Finance at UC Berkeley and a member of the German Council of Economic Experts said in an interview. “Those who have lived through hyperinflation, like the famous case of German-born governor Henry Wallich, or just high inflation, like the 1970s oil price shocks, then they remain rather pessimistic going forward for quite a while. The effect is statistically significant.”

US

FED: Federal Reserve Vice Chair for Supervision Michael Barr Tuesday said he anticipates the need to strengthen rules for banks over $100 billion.

- "I anticipate the need to strengthen capital and liquidity standards for firms over a hundred billion dollars," he told lawmakers at a Senate hearing. "We of course would need to go through a notice and comment rule-making in this process."

- Barr's comments come as top officials at the FDIC and the Treasury Department also expressed support for strengthening rules and supervision of banks over USD100 billion. Vice Chair Barr on Tuesday largely blamed SVB's management for the bank's collapse, while acknowledging the lightening speed of the bank run. He stated SVB had expected USD100 billion in deposit outflow on March 10.

- “We are monitoring the financial system, monitoring the banking system, we’re looking at interest rate risk and liquidity risk across the banking system,” Barr said. “The banking system is sound and resilient. Depositors are safe. Most banks are highly effective in managing interest rate risk and liquidity risk.”

- "Financial stress has been on the rise since then in the wake of recent bank failures and turmoil," Bullard wrote in a column. "The macroprudential policy response to these events has been swift and appropriate. Regulatory authorities have used some of the tools that were developed or first utilized in response to the 2007-09 financial crisis in order to limit the damage to the macroeconomy, and they’re ready to take additional action if necessary."

- Bullard said "continued appropriate macroprudential policy can contain financial stress in the current environment, while appropriate monetary policy can continue to put downward pressure on inflation."

UK

BOE: Regulatory vigilance is key as financial market participants search for weaknesses in the banking system, Bank of England executives giving evidence to lawmakers on the Treasury Select Committee said Wednesday, adding that they were keeping a close eye on bank funding costs.

- BOE Governor Andrew Bailey, giving evidence of the failure of SVB bank, said that it was a period of "heightened tension" with markets "trying to find points of weakness" in the banking system and against this backdrop they had to be very vigilant, but that so far the UK banking system has held up well. Deputy Governor Dave Ramsden noted the extreme volatility in debt and money markets, with US Treasury implied volatility at post global financial crisis highs, and he warned market stresses could feed through to the real economy.

- Bailey on Monday left the door open to further rate hikes, highlighting the division between the Bank's monetary and financial stability roles, although as Ramsden noted the MPC does factor in the impact of financial shocks.

US TSYS: Treasury Yields Inch Higher, Bank Risk Moderates

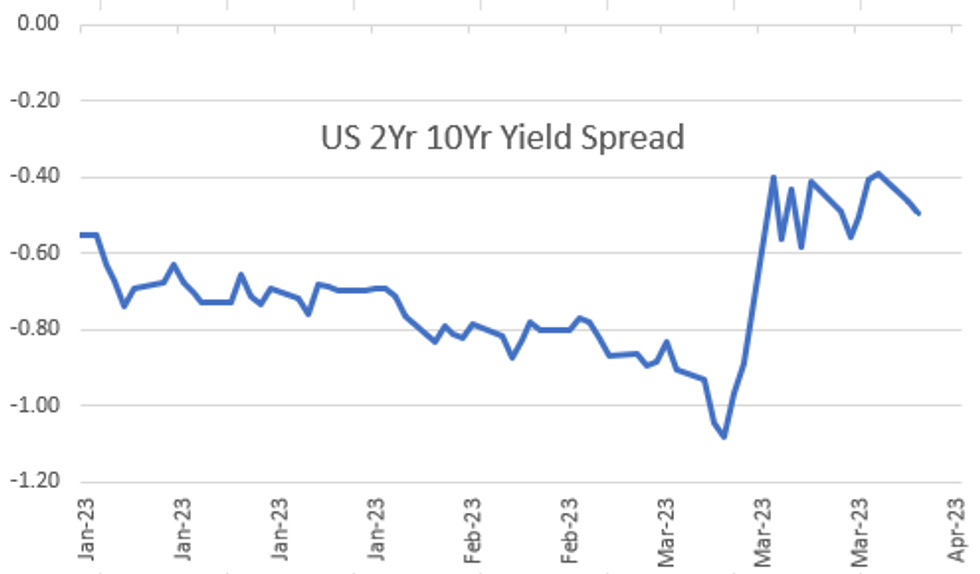

Tsy futures held modestly weaker in late trade, yield curves bear flattening (2s10s -3.019 at -49.761, well off early high of -40.451) amid ongoing focus on bank risk.

- Early support for stocks soured midday after White House Deputy Press Secretary Dalton indicated to reporters that President Biden will continue to decline to meet with House Speaker McCarthy for debt limit negotiations until House Republicans release a FY24 budget.

- A late session bounce in KBW Bank index (BKX) off midday lows (79.77) to 80.48 (+.10) helped underpin SPX Emini futures in late trade: ESM3 at 3996.0 -11.25.

- The Federal Reserve is monitoring the risks that higher interest rates pose to the balance sheets of banks after losses on a large portfolio of Treasuries helped precipitate the collapse of Silicon Valley Bank, the Fed’s vice chair of supervision Michael Barr told Congress Tuesday.

- “We are monitoring the financial system, monitoring the banking system, we’re looking at interest rate risk and liquidity risk across the banking system,” Barr said. “The banking system is sound and resilient. Depositors are safe. Most banks are highly effective in managing interest rate risk and liquidity risk.”

- Items in focus for Wednesday: Pending Home Sale; Fed speak NY Fed Supervision head Dobbeck will take moderated questions at a Bankers Assn event; US Treasury $22B 2Y FRN and $35B 7Y Note auctions.

OVERNIGHT DATA

- US FEB. RETAIL INVENTORIES RISE 0.8% M/M; EST. +0.2%

- US PRELIM FEB. WHOLESALE INVENTORIES RISE 0.2%; EST. -0.1%

- US FEB. ADV GOODS TRADE DEFICIT $91.6B; EST. -$90.0B

- US REDBOOK: MAR STORE SALES +2.9% V YR AGO MO

- US REDBOOK: STORE SALES +2.8% WK ENDED MAR 25 V YR AGO WK

- US JAN. FHFA HOME PRICE INDEX RISES 0.2% M/M; EST. -0.3%; YoY +5.3%

- US JAN. S&P CORELOGIC CS 20-CITY INDEX RISES 2.5% Y/Y

- US JAN. S&P CORELOGIC CS 20-CITY ADJUSTED INDEX FELL 0.4% M/M

- US JAN. S&P CORELOGIC CS NATIONAL INDEX RISES 3.8% Y/Y

- US MARCH RICHMOND FED FACTORY INDEX -5; EST. -10

- US MARCH CONSUMER CONFIDENCE AT 104.2; EST. 101.0; FEB REVISED TO 103.4 FROM 102.9

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 87.96 points (-0.27%) at 32344.43

- S&P E-Mini Future down 12.5 points (-0.31%) at 3994.75

- Nasdaq down 73.8 points (-0.6%) at 11695.42

- US 10-Yr yield is up 1.9 bps at 3.5488%

- US Jun 10-Yr futures are down 8/32 at 114-23.5

- EURUSD up 0.0048 (0.44%) at 1.0846

- USDJPY down 0.82 (-0.62%) at 130.75

- WTI Crude Oil (front-month) up $0.5 (0.69%) at $73.31

- Gold is up $17.37 (0.89%) at $1974.08

- EuroStoxx 50 up 3.59 points (0.09%) at 4168.21

- FTSE 100 up 12.48 points (0.17%) at 7484.25

- German DAX up 14.34 points (0.09%) at 15142.02

- French CAC 40 up 10.07 points (0.14%) at 7088.34

US TREASURY FUTURES CLOSE

- 3M10Y -2.747, -121.592 (L: -134.638 / H: -118.092)

- 2Y10Y -2.888, -49.63 (L: -50.666 / H: -40.451)

- 2Y30Y -4.488, -28.171 (L: -30.065 / H: -16.98)

- 5Y30Y -4.911, 11.678 (L: 9.12 / H: 17.901)

- Current futures levels:

- Jun 2-Yr futures down 5/32 at 103-9.375 (L: 103-07.75 / H: 103-18.125)

- Jun 5-Yr futures down 7.25/32 at 109-13 (L: 109-07.5 / H: 109-26.5)

- Jun 10-Yr futures down 7/32 at 114-24.5 (L: 114-17 / H: 115-07.5)

- Jun 30-Yr futures down 6/32 at 130-5 (L: 129-27 / H: 130-25)

- Jun Ultra futures down 5/32 at 139-17 (L: 138-31 / H: 140-08)

US 10YR FUTURE TECHS: Short-Term Reversal Extends

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 2: 116-06+/117-01+ High Mar 27 / High Mar 24 and bull trigger

- RES 1: 115-07+ Intraday high

- PRICE: 114-21+ @ 18:34 BST Mar 28

- SUP 1: 114-17 Low Mar 28

- SUP 2: 114-03/113-26 20-day EMA / Low Mar 22

- SUP 3: 113-23+ 50-day EMA

- SUP 4: 113-08+ Low Mar 15

Treasury futures continue to pull back from last Friday’s high of 117-01+. Early signals suggest that Friday’s candle pattern - a shooting star formation - represents a possible short-term reversal signal. If correct, this suggests scope for further weakness towards the 20-day EMA, at 114-03. The average represents a key support, ahead of 113-26, the Mar 22 low. Key resistance and the bull trigger has been defined at 117-01+.

EURODOLLAR FUTURES CLOSE

- Jun 23 +0.020 at 94.820

- Sep 23 -0.065 at 95.220

- Dec 23 -0.10 at 95.510

- Mar 24 -0.110 at 95.885

- Red Pack (Jun 24-Mar 25) -0.11 to -0.06

- Green Pack (Jun 25-Mar 26) -0.05 to -0.03

- Blue Pack (Jun 26-Mar 27) -0.04 to -0.025

- Gold Pack (Jun 27-Mar 28) -0.03 to -0.01

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00229 to 4.81100% (+0.00214/wk)

- 1M +0.00642 to 4.85871% (+0.02814/wk)

- 3M +0.01972 to 5.16286% (+0.06143/wk)*/**

- 6M +0.08557 to 5.24671% (+0.25942/wk)

- 12M +0.12657 to 5.18771% (+0.35185/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.16286% on 3/28/23

- Daily Effective Fed Funds Rate: 4.83% volume: $92B

- Daily Overnight Bank Funding Rate: 4.82% volume: $268B

- Secured Overnight Financing Rate (SOFR): 4.81%, $1.365T

- Broad General Collateral Rate (BGCR): 4.79%, $521B

- Tri-Party General Collateral Rate (TGCR): 4.79%, $514B

- (rate, volume levels reflect prior session)

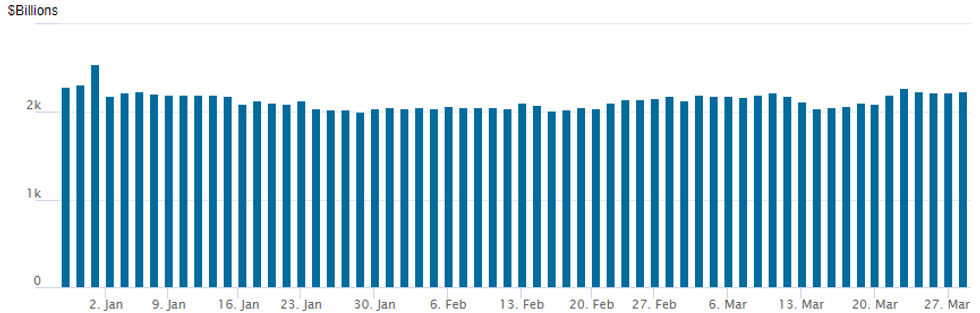

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,231.749B w/ 102 counterparties vs. the prior session's $2,.220.131B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $2.5B Hyundai 3Pt Launched Late

$13.35B to price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 03/28 $5B #Republic of Poland $2.5B +10Y +140, $2.5B 30Y +180

- 03/28 $3B #Lowe's $1B 3Y+95, $1B 10Y+160, $500M 30Y+200, $500M 40Y+210

- 03/28 $2.5B #Hyundai Capital $1.2B 3Y +175, $800M 5Y +200, $500M 7Y +225

- 03/28 $1.5B #Virginia Electric 10Y +150, 30Y +175

- 03/28 $750M #Pacific Gas & Electric 30Y +295

- 03/28 $600M #AIA Group 10Y +145

EGBs-GILTS CASH CLOSE: Bank Sentiment Remains Paramount

The German curve bear flattened for a second consecutive session Tuesday, while the UK's bear steepened.

- Yields jumped at the cash open, in part registering BoE Bailey's hawkish-leaning comments on February inflation data made after Monday's cash close.

- The sell-off continued through mid-morning, on risk-on sentiment as reflected in continued gains in European equities.

- The bearish move petered out over the rest of the session after equities peaked.

- There were few discernible headline drivers to the partial reversal, but it remains evident from intraday movements that banking sector risk sentiment remains the driving cross-asset force for now.

- Periphery spreads were mostly wider, but only marginally, with 10Y BTPs yet again unable to break through the 183bp mark vs Bunds.

- Wednesday brings French consumer sentiment data (following confidence readings on the strong side this morning from France and Italy), with UK money supply and mortgage data later in the session. The BoE's financial policy summary release also bears watching.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.1bps at 2.592%, 5-Yr is up 6.9bps at 2.28%, 10-Yr is up 6.3bps at 2.29%, and 30-Yr is up 6.5bps at 2.373%.

- UK: The 2-Yr yield is up 5.3bps at 3.364%, 5-Yr is up 6.6bps at 3.285%, 10-Yr is up 9bps at 3.456%, and 30-Yr is up 5.4bps at 3.861%.

- Italian BTP spread up 1.1bps at 184.8bps / Spanish up 0.1bps at 103.7bps

FOREX: Greenback Weakness Prevailing, CHF Underperforms

- With few discernible headlines surrounding banking sector risk sentiment, the greenback remained under pressure on Tuesday, falling against all G10 currencies apart from the Swiss Franc.

- The extension of weakness for the USD index (-0.42%) has now seen the entirety of Friday’s bounce reversed and narrows the gap with the March lows at 101.92.

- In line with the greenback move, EURUSD continues to trade with a bid tone and has moved steadily above the 1.08 handle today. For bulls, clearance of 1.0930 would reinstate the recent bull theme and signal scope for a climb towards 1.1033, the Feb 2 high.

- With equities on the back foot, the Japanese Yen has outperformed and USDJPY sits 0.70% lower on Tuesday. The pair briefly matched the Monday lows at 130.41 before a substantial bounce, however, the pair is gravitating back towards those lows approaching the APAC crossover. Little option interest at the Tuesday 10am cut, however interest builds later in the week to month-end: just over $4.5bln rolls off between Y130.00 - 131.00 across the Thursday/Friday cuts, which could help define the range into the end of the week.

- Further weakness, however, through 129.64 would mark a resumption of the March downleg and put prices at the lowest levels since early February. 129.12 undercuts as more notable support - the Feb 2 High.

- Swiss Franc weakness was notable throughout today’s session, making it the worst performer in G10 to partially reverse the outperformance noted at the tail-end of last week. Worth flagging yesterday's sight deposits data surged higher - the first meaningful rise in sight deposits since 2020. Though this doesn't necessarily reflect FX intervention, it likely suggests Swiss banks were users of emergency liquidity facilities made available last week - and may be working against CHF haven flows this week.

- CAD annual budget release and Australian CPI headline the overnight docket before US pending home sales on Wednesday. Focus remains on the latter part of the week where Eurozone CPI prints and US Core PCE price index data are scheduled.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/03/2023 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 29/03/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/03/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/03/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 29/03/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/03/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/03/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/03/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/03/2023 | 0930/1030 |  | UK | Bank of England FPC Report/minutes | |

| 29/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 29/03/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 29/03/2023 | 1400/1000 |  | US | US House Financial Services Hearing | |

| 29/03/2023 | 1400/1000 |  | US | Treasury Secretary Janet Yellen | |

| 29/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 29/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 29/03/2023 | 1630/1230 |  | CA | BOC Deputy Gravelle speech "The market liquidity measures we took during COVID" | |

| 29/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 29/03/2023 | 1850/1950 |  | UK | BOE Mann Panellist at NABE | |

| 29/03/2023 | 2045/2245 |  | EU | ECB Schnabel Panels NABE Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.