-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Taps Sacks For White House Job

MNI US MARKETS ANALYSIS - NFP Followed by Ample Fedspeak

MNI ASIA OPEN - Barnier to Meet Fishing Chiefs as Brexit Drags On

EXECUTIVE SUMMARY:

- THANKSGIVING HOLIDAYS KEEP PRICE ACTION UNDER WRAPS

- BARNIER TO MEET EU FISHERIES MINISTERS

- RIKSBANK BOOSTS BOND BUYS

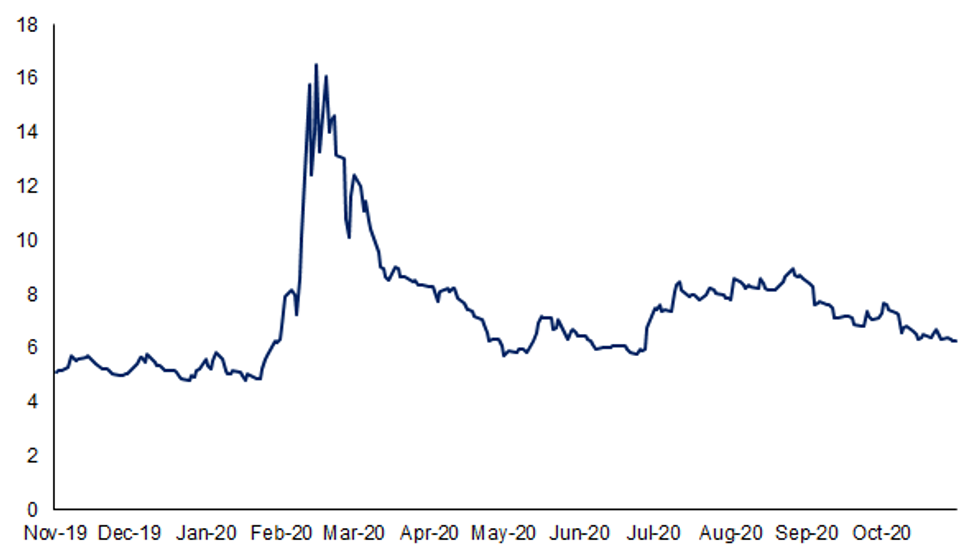

USD/JPY 3m Implied Volatility

USD/JPY 3m Implied Volatility

ASIA

China Needs Macroprudential Measures-Advisor (MNI)

- China could increase capital adequacy requirements for banks

- Property market controls could also help control leverage

- But the PBOC should refrain from tightening policy, Zhang Xiaojing says

Chinese authorities should take macroprudential measures to tackle high debt, but the People's Bank of China is expected to refrain from tightening in the near future, a senior Chinese policy advisor told MNI.

China To Gauge Risk On Struggling OBOR Partner Aid (MNI)

China will help partner countries in the One Belt, One Road initiative struggling through the fiscal fall out of the Covid-19 pandemic while keeping strict control over risks, a former senior regulation official told reporters in a forum held by The Belt and Road Financial Cooperation Research Center.

UK

Barnier Calls Emergency Meeting Of EU Fisheries Ministers: RTE

Tony Connelly at RTE tweets: "The EU's chief negotiator Michel Barnier has called an "urgent" meeting of EU fisheries ministers for tomorrow, acc to two sources"

- Comes after MNI Brief published at 1352GMT "MNI Brief: UK/EU Deal Talks Seen Drifting Well Into Next Month"

- Fisheries has been one of the three major sticking points in talks. MNI Brief above reports some Westminster mutterings that there could be some movement from the UK side on the issue. As such, a meeting of EU fisheries ministers could also be a sign of a shift in stance.

Covid Will Scar UK Economy, OBR's Bean Says (MNI)

The UK economy is likely to emerge deeply scarred from the Covid shock despite good news on vaccines, former Bank of England Deputy Governor Charles Bean told MNI, pointing to potential hits to productivity growth from corporate debt overhangs, skill shortages and a shrinking labour force.

EUROPE

Wide Agreement For ECB Policy Guide Need: Accounts (MNI)

There was 'wide agreement' amongst Governing Council members that the European Central Bank should signal a recalibration of monetary policy tools at the next meeting, according to the accounts of the October 28-29 meeting, published Thursday. However, there were cautious reminders from some members that the GC should not pre-commit itself to specific policy action.

ECB Must Ensure Favorable Finance Conditions: Lane (MNI)

The European Central Bank will ensure monetary policy continues to have a clear role ensuring the preservation of favourable financial conditions in the euro area Chief Economist Philip Lane said.

Riksbank Boosts Bond Buys As Virus Concerns Grow (MNI)

The Riksbank increased its quantitative easing programme by more than expected, boosting asset purchases to SEK700 billion from SEK500 billion and extending the programme by six months to the end of December 2021 as a second Covid wave prompted it to cut growth forecasts.

FOREX: Modest Defensive Trade in Holiday-Thinned Markets

Currency markets were understandably a touch quieter than average on Thursday, with the Thanksgiving holidays stateside keeping newsflow and price action thin. JPY modestly outperformed as those still trading took a slightly defensive stance, with CHF rising in tandem. Recent ranges, however, were respected, providing few new technical signals.

In Sweden, the Riksbank opted to expand their QE programme by more than expected, adding an additional SEK 200bln of purchases. SEK was sold in response, prompting a 0.4% rally in EUR/SEK - although the majority of the move has since retraced.

JPY, CHF were strongest, GBP, NOK and SEK the weakest.

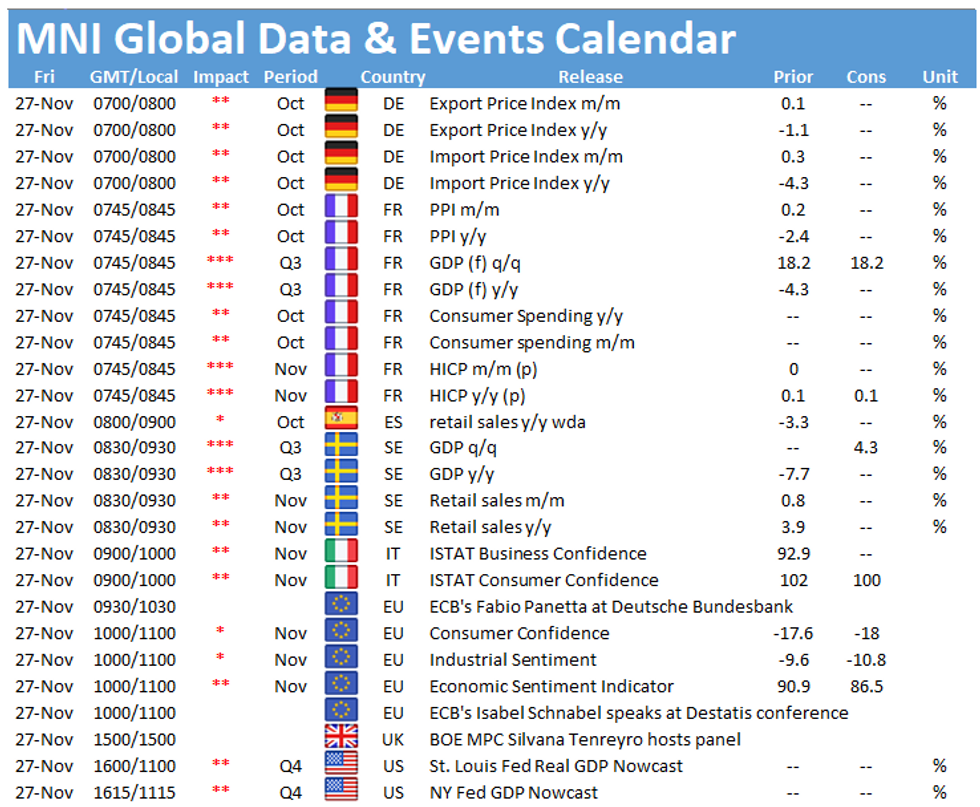

Focus Friday turns to French inflation & GDP numbers and speeches from ECB's Panetta & Schnabel. Nonetheless, partial closures across the US will likely keep action muted.

BOND SUMMARY: Steady Gains On Thanksgiving Thursday

With U.S. markets closed for Thanksgiving holidays, core FI on both sides of the Atlantic (futures in the case of US Tsys) saw steady gains albeit on predictably light volumes.

- The European rally accelerated in the afternoon following comments by ECB's Lane and release of the October Governing Council meeting accounts which were consistent with further easing in December. Cash curves flattened, with Gilts outperforming Bunds.

- Periphery EGBs had a strong day - Portugal 10s touching negative yielding territory - but spreads finished slightly wider as Bunds rallied.

- Very little on the agenda Friday in the U.S. with a half day for market trading. In Europe we get ECB's Panetta and Schnabel speaking, Italian bond supply, and French flash Nov inflation data.

- Dec Bund futures (RX) up 22 ticks at 175.55 (L: 175.16 / H: 175.57)

- Mar Gilt futures (G) up 35 ticks at 134.52 (L: 134.07 / H: 134.56)

- Dec U.S. 10-Yr futures (TY) up 6/32 at 138-14.5 (L: 138-07.5 / H: 138-14.5)

- Italy / German 10-Yr spread 0.6bps wider at 118.9bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.