-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: BOC Surprise 25Bp Hike

- MNI BOC WATCH: Surprise 25BP Hike And Assessing If More Needed

- MNI INTERVIEW: BOC Hike Is A Precursor For More- Ex Adviser

US TSYS Markets Roundup: Yields Gaining, Post BOC, Bill Supply Guidance

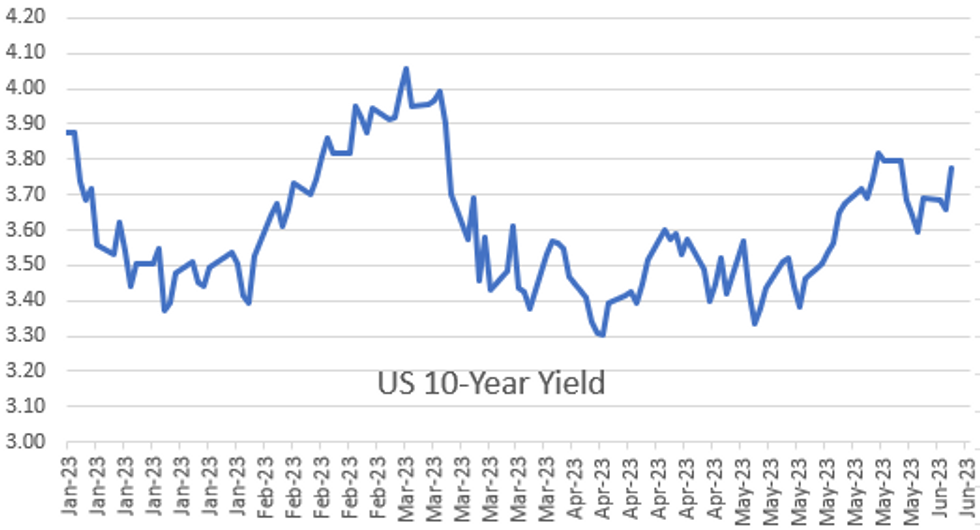

- Treasury yields have climbed to the highest levels since just prior to the debt ceiling passing Congress. Currently marking the highest level for June so far, 10Y yield is up to 3.7991% high in the aftermath of the Bank of Canada's surprise decision to hike 25bp to 4.75%, while signaling it’s prepared to go further with a strong economy threatening to leave inflation stuck well above its 2% target.

- A second, and well telegraphed factor weighing on the short end after the Tsy provided "additional guidance on bill issuance and cash balance" following the suspension of the debt limit through Jan 1 2025: plans to increase issuance of bills "to continue financing the government and to gradually rebuild the cash balance over time to a level more consistent with Treasury’s cash balance policy." Other highlights of the release:

- The knock-on effect has seen projected rate hike gain momentum in July or Sep (21.9bp and 19.1bp cumulative respectively) while chances of a June hike remains subdued around 20%.

- Broad based selling has gained in the long end, however, as Treasury curves climb off deeper inverted levels: 2s10s currently +4.755 a t -77.512 vs. -86.218 low from this morning.

CANADA

BOC: The Bank of Canada raised its key lending rate 25bps to 4.75% on Wednesday, the highest since 2001, and signaled it’s prepared to go further with a strong economy threatening to leave inflation stuck well above its 2% target.

- “Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation. In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the inflation target. The Bank remains resolute in its commitment to restoring price stability for Canadians,” policymakers led by Governor Tiff Macklem said in a statement.

- Governor Macklem's decision continues a pattern of surprising markets, as he did in four of eight meetings last year. Ahead of Wednesday's decision 19 economists surveyed by MNI predicted a hold and five predicted a quarter-point increase. Two of those calling for a hike were from Canada’s five major banks, and most economists called this a close decision and expected a hawkish statement. Today's decision appears more hawkish than many expected, containing a dozen references to surprising strength in areas like services prices and the labor market. Policymakers also said excess demand appears more persistent than thought and noted a global backdrop of stubborn underlying inflation and central bank rate hikes. For more see MNI Policy main wire at 1001ET.

BOC: The Bank of Canada's surprise interest-rate hike and a statement focused on underlying inflation dangers point to another likely move at the July 12 meeting, Stephen Gordon, a Laval University professor who advised the BOC on its last mandate renewal, told MNI Wednesday.

- The decision to hike before the next full forecast that will come alongside the July meeting is another indicator of heightened concern at the central bank, Gordon said. He spoke after the Bank raised its key rate a quarter point to the highest since 2001 at 4.75%, a move the majority of economists did not forecast.

- "It looks like they decided that they are going to stay ahead of the curve, or they aren’t going to fall behind again,” Gordon said by phone from Quebec City. “We may see in July a new Monetary Policy Report arguing that the forces behind inflation have yet to come down, and we need to do more.” For more see MNI Policy main wire at 1332ET.

OVERNIGHT DATA

- US MBA: REFIS -1% SA; PURCH INDEX -2% SA THRU JUNE 2 WK

- US MBA: UNADJ PURCHASE INDEX -27% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.81% VS 6.91% PREV

- US MBA: MARKET COMPOSITE -1.4% SA THRU JUN 02 WK

- US APR TRADE GAP -$74.6B VS MAR -$60.6B

- US APR CONSUMER CREDIT +$23.0B

- US APR REVOLVING CREDIT +$13.5B

- US APR NONREVOLVING CREDIT +$9.5B

- CANADA Q1 LABOR PRODUCTIVITY -0.6% QOQ

- CANADA Q1 HOURLY COMPENSATION +0.7% QOQ

- CANADIAN APR TRADE BALANCE CAD +1.9 BILLION

- CANADA APR EXPORTS CAD 64.8 BLN, IMPORTS CAD 62.9 BLN

- CANADA REVISED MAR MERCHANDISE TRADE BALANCE CAD +0.2 BLN

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 105.14 points (0.31%) at 33676.88

- S&P E-Mini Future down 12.75 points (-0.3%) at 4276.75

- Nasdaq down 137.2 points (-1%) at 13139.26

- US 10-Yr yield is up 12 bps at 3.7797%

- US Sep 10-Yr futures are down 18/32 at 113-7

- EURUSD up 0.0009 (0.08%) at 1.0702

- USDJPY up 0.48 (0.34%) at 140.11

- WTI Crude Oil (front-month) up $0.72 (1%) at $72.45

- Gold is down $20.93 (-1.07%) at $1942.63

- EuroStoxx 50 down 3.31 points (-0.08%) at 4291.91

- FTSE 100 down 3.76 points (-0.05%) at 7624.34

- German DAX down 31.88 points (-0.2%) at 15960.56

- French CAC 40 down 6.21 points (-0.09%) at 7202.79

US TREASURY FUTURES CLOSE

- 3M10Y +11.773, -152.369 (L: -170.128 / H: -150.948)

- 2Y10Y +5.236, -77.031 (L: -86.218 / H: -76.612)

- 2Y30Y +2.456, -61.345 (L: -70.688 / H: -60.647)

- 5Y30Y -1.596, 1.723 (L: -2.983 / H: 2.879)

- Current futures levels:

- Sep 2-Yr futures down 1.875/32 at 102-17.375 (L: 102-13.625 / H: 102-22)

- Sep 5-Yr futures down 8.75/32 at 108-8.5 (L: 108-02.5 / H: 108-24.25)

- Sep 10-Yr futures down 17.5/32 at 113-7.5 (L: 113-01 / H: 114-02.5)

- Sep 30-Yr futures down 1-11/32 at 126-18 (L: 126-12 / H: 128-16)

- Sep Ultra futures down 1-20/32 at 134-25 (L: 134-16 / H: 137-10)

US 10YR FUTURE TECHS: (U3) Bearish Outlook

- RES 4: 115-19 High May 18

- RES 3: 115-04+ 1.0% 10-dma Envelope

- RES 2: 115-01 50-day EMA

- RES 1: 114-19 / 115-00 20-day EMA / High Jun 1

- PRICE: 113-05 @ 1210 ET Jun 7

- SUP 1: 113-02+ Low Jun 06

- SUP 2: 112-29+ Low May 26 / 30 and key support

- SUP 3: 112-16 76.4% retracement of the Mar 2 - May 4 rally

- SUP 4: 111-20+ Low Mar 10

Treasury futures continue to trade below last week’s 115-00 high, on Jun 1. Price action that day is a bearish engulfing candle, signalling the end of the recent recovery and suggesting potential for a continuation lower. Attention is on key support and the bear trigger at 112-29+, the May 26 / 30 low. Clearance of this level would resume the downtrend that started May 4. A break of 115-00 is required to reinstate a bullish theme.

SOFR FUTURES

- Jun 23 steady at 94.745

- Sep 23 steady at 94.785

- Dec 23 -0.030 at 95.015

- Mar 24 -0.060 at 95.405

- Red Pack (Jun 24-Mar 25) -0.08 to -0.065

- Green Pack (Jun 25-Mar 26) -0.075 to -0.065

- Blue Pack (Jun 26-Mar 27) -0.095 to -0.08

- Gold Pack (Jun 27-Mar 28) -0.095 to -0.09

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00725 to 5.13117 (-.01000/wk)

- 3M -0.00076 to 5.23808 (+.00774/wk)

- 6M +0.00093 to 5.27788 (+.03241/wk)

- 12M +0.00902 to 5.10379 (+.07682/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00257 to 5.06614%

- 1M -0.01943 to 5.18171%

- 3M -0.00343 to 5.50986 */**

- 6M -0.00100 to 5.64357%

- 12M +0.00215 to 5.74629%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.51671% on 5/31/23

- Daily Effective Fed Funds Rate: 5.08% volume: $144B

- Daily Overnight Bank Funding Rate: 5.07% volume: $307B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.414T

- Broad General Collateral Rate (BGCR): 5.03%, $604B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $594B

- (rate, volume levels reflect prior session)

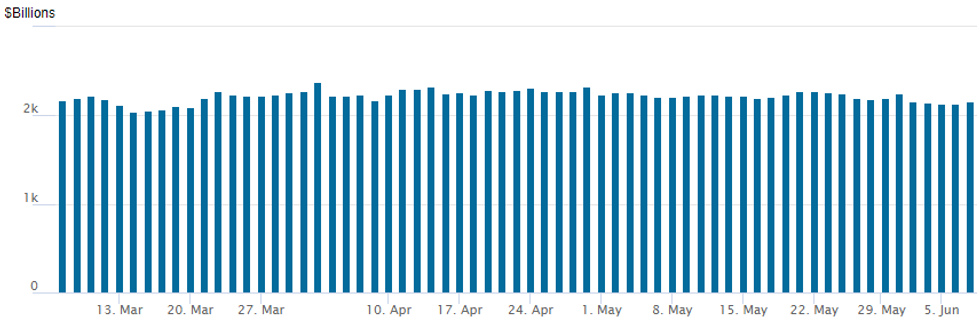

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,161.556B w/ 108 counterparties, compared to $2,134.638B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

EGBs-GILTS CASH CLOSE: Sharply Weaker On Supply And BoC Surprise

Large supply weighed heavily on EGBs Wednesday morning, with losses accelerating in the afternoon after a Bank of Canada rate hike that wasn't fully expected.

- With core euro FI already on the back foot in the face of heavy corporate issuance and large sovereign supply (including E13B in Spain 10Y syndication), the BoC move delivered another blow, triggering weakness in Treasuries that transmitted across the Atlantic.

- The BoC's hawkishness boosted the implied cumulative hiking priced for the ECB and BoE by 3bp / 7bp respectively, to fresh June highs. The German and UK curve bellies underperformed slightly in the aftermath.

- While Spain's large issuance was a key talking point, BTPs underperformed, with spread widening

- The session's data was on the weak side (German industrial production, Italy retail sales), but didn't have any lasting impact. Nor did commentary by Schnabel, Makhlouf or Knot alter any ECB rate expectations.

- Ireland rounds out the week's Euro sovereign supply Thursday, while we also get Eurozone final Q1 GDP data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8.4bps at 2.938%, 5-Yr is up 9bps at 2.474%, 10-Yr is up 8.4bps at 2.456%, and 30-Yr is up 4.9bps at 2.604%.

- UK: The 2-Yr yield is up 9.4bps at 4.572%, 5-Yr is up 7.2bps at 4.256%, 10-Yr is up 4.4bps at 4.251%, and 30-Yr is up 2.8bps at 4.501%.

- Italian BTP spread up 4.3bps at 182.7bps/ Spanish up 1.8bps at 101.7bps

FOREX: USD Index Recovers Back To Unchanged, CAD Surge Short-Lived

- USDCAD was in focus on Wednesday as the bank of Canada surprised the market with a 25bp hike. USDCAD weakened into the decision and extended this move to print as low as 1.3322 in the immediate aftermath. However, the move was fairly short-lived as greenback strength throughout the US session stalled any downside momentum for the pair.

- Assisted by the BOC’s hawkishness, US yields climbed between 10-15bps across the curve at one point which buoyed the US dollar. After some initial weakness, the USD index rose around 0.5% to trade back to unchanged on the session.

- With yield differentials widening, the Japanese Yen has suffered with USDJPY rising as much as 120 pips from the lows to print 140.23 in late trade. Trend conditions in USDJPY remains bullish. Attention is on key resistance at the top of a bull channel, drawn from the Jan 16 low, which intersects at 141.11 today. A clear break of this level would reinforce a bullish theme and open 141.61, the Nov 23 2022 high. Key support to watch is 138.45, the 20-day EMA.

- Some renewed pressure on major global equity indices, the move higher in U.S. Tsy yields and the associated bounce for the greenback all led USD/CNH back towards the day’s highs with the pair printing a fresh year-to-date high of 7.1533 approaching the APAC crossover on Wednesday. A sustained break above 7.1500 might expose bull channel top resistance, currently located at CNH7.1665. It is worth noting that both domestic PPI and CPI data for May will cross on Friday.

- A very light global economic calendar on Thursday as all eyes remain focused on the US CPI print next week, which precedes the June FOMC decision.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/06/2023 | 2350/0850 | ** |  | JP | GDP (r) |

| 08/06/2023 | 0001/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 08/06/2023 | 0130/1130 | ** |  | AU | Trade Balance |

| 08/06/2023 | 0900/1100 | *** |  | EU | GDP (final) |

| 08/06/2023 | 0900/1100 | * |  | EU | Employment |

| 08/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 08/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/06/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 08/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/06/2023 | 1920/1520 |  | CA | BOC Deputy Beadury speech |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.