-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN - China Plenum Doubles Down on Effective Growth

EXECUTIVE SUMMARY:

- CHINA PLENUM PROMOTES PROSPERITY, PLEDGES TO DEEPEN REFORM

- XI ELEVATED TO SAME STATUS AS MAO, XIAOPING

- USD INDEX EXTENDS CPI RALLY, TOUCHES FRESH 2021 HIGH

Figure 1: DAX at a fresh alltime high

US

US (Bloomberg): White House Team Weighing Fed Sees No Issue With Powell Trades

Top White House officials don't believe that Federal Reserve Chair Jerome Powell's sale of shares in a stock index fund last year disqualify him from being appointed to a second term, according to people familiar with the matter.

EUROPE

UK (MNI): New Fiscal Rules Ease Political Pressure On BOE

The exclusion of Bank of England operations from new UK public-sector borrowing rules should give the Treasury more control over meeting its targets and ease political pressure on BOE policy making, an analyst at influential think-tank the Institute for Fiscal Studies told MNI.

ASIA

CHINA (MNI): China Plenum Flags Fair, Open, High-Quality Growth

China's Communist Party will continue pushing for high-quality development, deepen reform and opening-up, promote common prosperity and strengthen the power in technology as the country faces a "new development pattern", according to the communique of the 6th plenum of the 19th CPC Central Committee.

The four-day closed-door session, chaired by President Xi Jinping, agreed the world's second-largest economy has made "obvious improvement" towards balanced, coordinated, and sustainable development, with the economy seeing fairer, more secure, and more effective growth, the communique said.

DATA

MNI DATA BRIEF: UK Sept Trade Deficit Widens, EU Imports Lag (MNI)

The UK trade deficit widened to GBP 2.777 billion in September from a shortfall of GBP1.880 billion in August. according data release by the Office National Statistics on Thursday. The goods trade gap expanded to GBP14.736 billion from GBP13.714 billion in August.

With renewed tensions building between London and Brussels over the trade agreement, imports from non-EU countries rose to GBP 21.922 billion, while imports from the EU increased more gently, to GBP19.256 billion, a ninth straight month of non-EU outperformance.

EGBs-GILTS CASH CLOSE: Gilts Recover Some Losses

Gilts retraced some of the prior session's steep losses, while the Bund curve weakened in mixed fashion Thursday. This was a much quieter session compared with those of the prior week, with the US cash Treasury holiday sapping liquidity.

- UK GDP was the session's major data point, disappointing on the initial Q3 reading, and arguably helping underpin the short end of the curve.

- Periphery spreads widened slightly, led by Greece (10Y out 4bp vs Germany).

- While there were multiple central bank speakers today, none made much market impact.

- Following Ireland and Italy's auctions today, no supply Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.7bps at -0.693%, 5-Yr is up 2bps at -0.516%, 10-Yr is up 1.6bps at -0.231%, and 30-Yr is up 1.4bps at 0.073%.

- UK: The 2-Yr yield is down 1.1bps at 0.565%, 5-Yr is down 1bps at 0.705%, 10-Yr is down 0.5bps at 0.92%, and 30-Yr is up 0.6bps at 1.06%.

- Italian BTP spread up 1bps at 119.3bps / Greek up 4bps at 143.8bps

FOREX: US Dollar Maintains Upward Trajectory, CAD Underperforms

- Following yesterday's strong CPI-fuelled rally, the greenback maintained its ascent on Veteran's day Thursday. The dollar index (DXY) broke above 95.00 for the first time since July 2020, rising 0.32% as of writing.

- The buoyant dollar solidified the EURUSD break of 1.15 and confirming the resumption of the downtrend. Moving average studies remain in bear mode, reinforcing current trend conditions and the focus now turns to 1.1375, a Fibonacci projection.

- AUD and NZD continued to suffer, both dropping roughly 0.5% and extending their losing streaks to three sessions. AUDUSD extends the current short-term bear cycle where the continued weakness suggests scope for a deeper pullback, opening 0.7261 next, a Fibonacci retracement. A firm support lies just below, at 0.7241, the base of a bull channel drawn from the Aug 20 low.

- The Canadian dollar was the worst performer on Thursday after breaking back above 1.2500 for the first time since October 8. Despite a firmer commodity complex, the broad dollar strength and continued unwind for CAD since the October central bank statement continue to underpin the price action.

- After breaking the Oct/Nov highs, USDCAD traded consistently higher to just shy of 1.2600. Resistance has been breached above 1.2562 which is considered technically constructive.

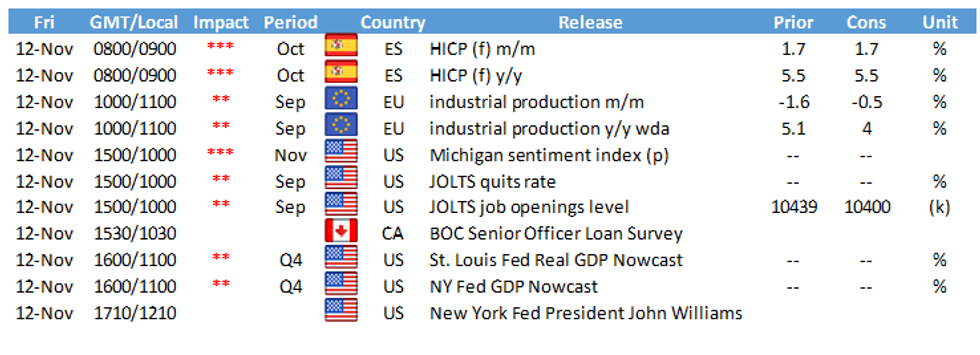

- A quiet data calendar on Friday with Eurozone Industrial production followed by US Jolts Job openings and UoMichigan Sentiment data to wrap up the week. The US Treasury are also scheduled to release their bi-annual currency report.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.