-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Default Focus Over Data, Fed Speak

- MNI INTERVIEW: Fed's Barkin 'Very Open' To More Tightening

- MNI BRIEF: Kashkari Says Fed Has More Work To Do On Inflation

- MNI US: McCarthy Downbeat On Debt Ceiling Progress Ahead Of Key WH Meeting

- MNI: Empire Mfg Slides On Continued Significant Volatility

US

FED: Nascent signs of cooling consumer demand may already be pulling down price pressures, meaning the Federal Reserve can hold interest rates where they are, but Richmond Fed President Thomas Barkin is "very open" to supporting more rate rises should the data tell a different story, he said in an interview late Friday.

- The Fed's rate hikes over the past year are having an effect on consumer spending and the labor market with more to come, and the recent banking turmoil is prompting lenders to tighten credit standards, all of which should help tame inflation, Barkin said.

- "There’s a story out there that’s quite plausible: The lagged effect of rate moves combined with credit tightening in the economy combined with the erosion of pandemic-era stimulus will bring demand down and inflation down relatively quickly. But I still want to be convinced," he said.

FED: The Fed has more work to do bringing inflation back to target and shouldn't be "fooled" by a few months of positive data with price gains still far too high, Minneapolis President Neel Kashkari said Monday.

- “We need to finish the job,” Kashkari said during a question-and-answer session. “It’s still a really strong labor market out there”, even if it's not as "frothy" as it was recently, he said. Kashkari hopes inflation can be brought down in an "orderly" way without a deep recession.

US: House Speaker Kevin McCarthy (R-CA) has appeared to counter positive assessments from President Biden, Treasury Secretary Janet Yellen, and NEC Director Lael Brainard on preliminary debt-limit talks ahead of a key White House meeting between Biden and the four leaders of Congress tomorrow.

- Manu Raju at CNN tweets: "...Speaker McCarthy just offered this assessment. “It doesn't seem to me yet they want a deal, it just seems like they want to look like they are in a meeting but they aren't talking anything serious. McCarthy says they are still “far apart.” He said: “Seems like they want a default more than a deal.” McCarthy added they need a deal by "this weekend” in order “to have a timeline to be able to pass it in both houses."

- McCarthy remains the primary obstacle to political resolution. The other three Congressional leaders, including Senate Minority Leader Mitch McConnell (R-KY), have stated publicly that they will not allow the US government to default on its debt.

- Time is becoming increasingly tight with 17 days until the Treasury Department’s worst-case-scenario June 1 ‘X-date.’ Both chambers of Congress are only in session together for four of those days.

US TSYS: Markets Roundup, Yields Grind Higher Ahead Tue's Debt Limit Confab

Treasury futures held weaker levels for much of the session, curves steeper (2s10s +3.042 at -50.058) in late trade with bonds underperforming. Treasury notes in 2s to 10s have held to a narrow range after briefly extending highs after this morning's weaker than expected Empire Mfg index (-31.8 (cons -4.0) in May from +10.8). Support quickly reversed after the "noisy" metric.- A surge in swappable corporate issuance kept the pressure on rates for much of the session, over a dozen companies issued near $18B debt Monday, more to follow as the latest quarterly earning cycle winds down.

- Stocks had ignored this morning's weaker data, fixated on generally hawkish comments from Atlanta Fed Bostic (nonvoter) on sticky inflation not coming down fast enough, potential for recession (though not base case), does not expect to see rate cut until "well into 2024".

- Debt limit chatter: House Speaker Kevin McCarthy (R-CA) has appeared to counter positive assessments from President Biden, Treasury Secretary Janet Yellen, and NEC Director Lael Brainard on preliminary debt-limit talks ahead of a key White House meeting between Biden and the four leaders of Congress tomorrow.

- Punchbowl reports: "The president is scheduled to leave Wednesday for the G7 meeting in Japan. Biden will want to see significant progress in the talks before his departure in order to insulate himself from any criticism over flying to Asia with a debt-limit breach looming."

OVERNIGHT DATA

- US NY FED EMPIRE STATE MFG INDEX -31.8 MAY

- US NY FED EMPIRE MFG NEW ORDERS -28.0 MAY

- US NY FED EMPIRE MFG EMPLOYMENT INDEX -3.3 MAY

- US NY FED EMPIRE MFG PRICES PAID INDEX 34.9 MAY

US DATA: The Empire Fed manufacturing survey yet again sees a large surprise, this time to the downside as it swings to -31.8 (cons -4.0) in May from +10.8 and easily surpassed the survey low of -17.

- Giving context of recent swings, the post-2021 standard deviation is 20.7pts, whilst the index has been at these levels twice before in this cycle in Aug’22 and Jan’23.

- The six-month ahead measure meanwhile increased 3.2pts to 9.8, it’s highest since Feb and before that Jun’22.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 26.45 points (0.08%) at 33328.79

- S&P E-Mini Future up 8.5 points (0.21%) at 4146.75

- Nasdaq up 67.9 points (0.6%) at 12353.17

- US 10-Yr yield is up 3.9 bps at 3.5019%

- US Jun 10-Yr futures are down 6/32 at 115-8

- EURUSD up 0.0025 (0.23%) at 1.0874

- USDJPY up 0.37 (0.27%) at 136.07

- WTI Crude Oil (front-month) up $1 (1.43%) at $71.03

- Gold is up $4.19 (0.21%) at $2014.96

- EuroStoxx 50 down 1.47 points (-0.03%) at 4316.41

- FTSE 100 up 23.08 points (0.3%) at 7777.7

- German DAX up 3.42 points (0.02%) at 15917.24

- French CAC 40 up 3.36 points (0.05%) at 7418.21

TREASURY FUTURES CLOSE

- 3M10Y +7.054, -165.814 (L: -179.348 / H: -164.587)

- 2Y10Y +3.274, -49.826 (L: -53.614 / H: -48.943)

- 2Y30Y +4.007, -16.46 (L: -21.893 / H: -15.23)

- 5Y30Y +2.963, 37.054 (L: 32.483 / H: 37.325)

- Current futures levels:

- Jun 2-Yr futures up 0.125/32 at 103-5.25 (L: 103-03.25 / H: 103-07.5)

- Jun 5-Yr futures down 1.25/32 at 110-0.5 (L: 109-28.5 / H: 110-04.5)

- Jun 10-Yr futures down 6/32 at 115-8 (L: 115-05 / H: 115-15.5)

- Jun 30-Yr futures down 30/32 at 129-25 (L: 129-20 / H: 130-24)

- Jun Ultra futures down 1-15/32 at 137-25 (L: 137-20 / H: 139-07)

US 10YR FUTURE TECHS: (M3) Trading Above Support

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-01+ High Mar 24 and bull trigger

- RES 2: 117-00 High May 4

- RES 1: 116-16 High May 11

- PRICE: 115-07+ @ 1500ET May 15

- SUP 1: 115-01+/114-30 Low May 9 / 50-day EMA

- SUP 2: 114-10 Low May 1

- SUP 3: 113-30+ Low Apr 19 and a key support

- SUP 4: 113-26 Low Mar 22

Treasury futures are lower today but for now, continue to trade above support at 115-01+, the May 9 low and 114-30, the 50-day EMA. A clear break of this average would signal scope for a deeper retracement towards 114-10 initially, May 1 low. For bulls, a recovery would refocus attention on resistance at 117-01+, the Mar 24 high. This is the bull trigger and a break would highlight an important bullish development.

SOFR FUTURES CLOSE

- Jun 23 -0.015 at 94.910

- Sep 23 -0.010 at 95.215

- Dec 23 -0.005 at 95.670

- Mar 24 steady00 at 96.210

- Red Pack (Jun 24-Mar 25) +0.005 to +0.015

- Green Pack (Jun 25-Mar 26) +0.005 to +0.015

- Blue Pack (Jun 26-Mar 27) -0.02 to -0.005

- Gold Pack (Jun 27-Mar 28) -0.05 to -0.03

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00951 to 5.06642 (+.00665 total last wk)

- 3M +0.02287 to 5.08967 (+.02807 total last wk)

- 6M +0.04302 to 5.02849 (+.03996 total last wk)

- 12M +0.08027 to 4.68141 (+.04754 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 to 5.06229%

- 1M +0.00228 to 5.10771%

- 3M +0.01214 to 5.33043% */**

- 6M +0.04000 to 5.38314%

- 12M +0.04743 to 5.30343%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.34243% on 5/10/23

- Daily Effective Fed Funds Rate: 5.08% volume: $124B

- Daily Overnight Bank Funding Rate: 5.07% volume: $294B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.352T

- Broad General Collateral Rate (BGCR): 5.02%, $581B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $574B

- (rate, volume levels reflect prior session)

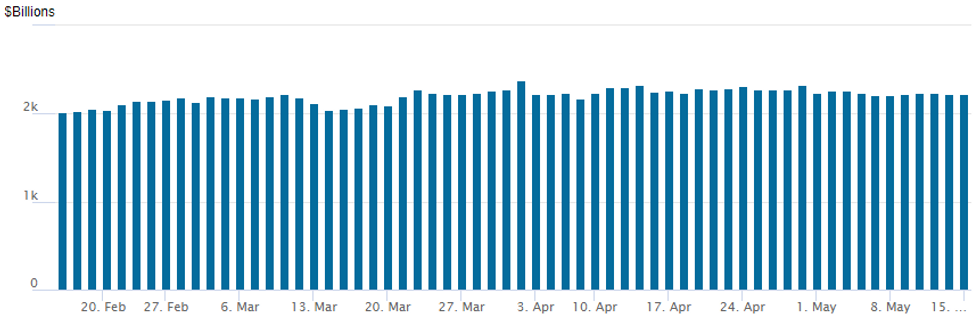

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,220.927B w/ 103 counterparties, compares to prior $2,229.199B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: At Least $17.75B Corporate Debt to Price Monday

Still waiting for Saudi Arabia 2pt to launch

- Date $MM Issuer (Priced *, Launch #)

- 05/15 $2.5B #Florida Power & Light $500M 3Y +80, $750M 5Y +95, $500M 7Y +115, $750M 10Y +130

- 05/15 $2B #Toyota Motor Cr $1B 3Y +80, $300M 3Y SOFR+89, $700M 7Y +110

- 05/15 $2B #State Street $1B 3NC2 +110, $1B 11NC10 +165

- 05/15 $1.75B #Westpac 5Y SOFR+92

- 05/15 $1.75B BGK 10Y +190

- 05/15 $1.5B #Southern Co $750M 5Y +143, $750M 10Y +173

- 05/15 $1.5B #FMC Corp $500M 3Y +150, $00M 10Y +215, $500M 30Y +255

- 05/15 $1.4B #LKQ $800M 5Y +235, $600M 10Y +285

- 05/15 $1.2B #PacifiCorp 31Y +165

- 05/15 $900M #AES Corp 5Y +200

- 05/15 $750M #Weyerhauser 3Y +120

- 05/15 $500M #Eaton Corp 5Y +90

- 05/15 $Benchmark Saudi Arabia Sukuk 6Y +80, 10Y +100

- 05/15 $Benchmark Tokyo 3Y, 5Y investor calls

- 05/15 $Benchmark Pfizer multi-tranche (2-40Y) investor calls re: $43B Seagen deal financing

EGBs-GILTS CASH CLOSE: Mildly Bear Steeper To Start The Week

The German and UK curves bear steepened modestly Monday, with Gilts marginally underperforming as core FI failed to recover from losses at the open.

- European-specific catalysts were limited, with US data providing the biggest single market mover on a weak Empire State manufacturing survey. However, a pickup in corporate issuance helped keep a lid on nascent rallies.

- Periphery EGBs outperformed, led by GGBs- Greek legislative elections and Moody's review of Italy eyed in the coming weekend.

- There was little discernable reaction to BoE Pill's comments after the close (noted risk of second-round effects). ECB / BoE hike pricing was basically unchanged on the day, with 48bp and 45bp seen remaining in the respective tightening cycles.

- UK labour market data features Tuesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1bps at 2.604%, 5-Yr is up 2.5bps at 2.246%, 10-Yr is up 3.3bps at 2.309%, and 30-Yr is up 5.1bps at 2.513%.

- UK: The 2-Yr yield is up 2.5bps at 3.826%, 5-Yr is up 2.7bps at 3.628%, 10-Yr is up 3.9bps at 3.817%, and 30-Yr is up 3.4bps at 4.25%.

- Italian BTP spread down 2.8bps at 187.7bps / Greek down 4.1bps at 170.4bps

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 16/05/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 16/05/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 16/05/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 16/05/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/05/2023 | 0900/1100 | *** |  | EU | GDP (p) |

| 16/05/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 16/05/2023 | 0900/1100 | * |  | EU | Employment |

| 16/05/2023 | 0900/1100 | ** |  | IT | Italy Final HICP |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/05/2023 | - |  | EU | ECB de Guindos in ECOFIN Meeting | |

| 16/05/2023 | 1215/0815 |  | US | Cleveland Fed's Loretta Mester | |

| 16/05/2023 | 1230/0830 | *** |  | CA | CPI |

| 16/05/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/05/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 16/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/05/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 16/05/2023 | 1400/1000 | * |  | US | Business Inventories |

| 16/05/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 16/05/2023 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 16/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/05/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 16/05/2023 | 1615/1215 |  | US | New York Fed's John Williams | |

| 16/05/2023 | 1915/1515 |  | US | Dallas Fed's Lorie Logan | |

| 16/05/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 16/05/2023 | 2300/1900 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.