-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

MNI ASIA OPEN: Discounting Policy Hawks

EXECUTIVE SUMMARY

US

FED: The rise in the 2023 Dot Plot median rate estimate and Chair Powell’s pushback against the recent easing of financial conditions made for a hawkish December FOMC meeting outcome.

- Markets interpreted Powell’s comments mostly dovishly, especially on a possible 25bp hike in February.

- But the economic outlook remains uncertain, and even after a significant and unexpected upgrade to core PCE forecasts, FOMC members still see risks to inflation to the upside.

- Expect FOMC participants to underscore the decision’s hawkishly-intended message in the coming weeks.

CANADA

BOC: The Bank of Canada is poised to say it is done hiking interest rates as the economy falls into a recession, punishing workers in a way that has been aggravated by bosses' use of Governor Tiff Macklem's bad advice to restrain pay raises, the country's top union leader told MNI.

- “I’m cautiously optimistic that maybe there is now going to be a pause to see what effect the previous increases have on us,” said Bea Bruske of the Canadian Labour Congress, which has 3 million members out of Canada's 20 million workers. “I think that was kind of signaled by the Bank of Canada Governor,” the CLC President said in an interview.

- Macklem raised rates half a point to 4.25% on Dec. 7, for a cumulative rise of 4 percentage points since March, and economists are split on whether there will be a quarter-point move at the next meeting on Jan. 26. Officials after the last decision said they are reviewing the effect of past hikes and dropped a phrase about needing to go further, saying any future action is now more data-dependent. For more see MNI Policy main wire at 1312ET.

UK

BOE: The Bank of England delivered the widely anticipated 50 basis point rate hike at its December meeting although the Monetary Policy Committee split three ways over the move, with all the Bank insiders backing the increase but externals Swati Dhingra and Silvana Tenreyro voting for unchanged rates and Catherine Mann going for a 75bps hike.

- The guidance given by the MPC was broadly unchanged from November. The majority said that if the economy evolved as expected "further increases in Bank Rate might be required" and everyone on the Committee backed the view that they would respond "forcefully" if inflation proved to be more persistent.

- Mann said that while inflation may have peaked there were signs that "price and wage pressures would stay stronger for longer" than predicted in the Bank's November Monetary Policy Report (MPR) and she argued that tougher action now would lower reduce the risk of having to keep hiking well into 2023. For more see MNI Policy main wire at 0702ET.

EUROPE

ECB: The European Central Bank raised rates by 50 basis points on Thursday and said it would continue to hike by the same increment at a steady pace to restrictive levels in response to higher inflation projections, sending market expectations for peak interest rates surging.

- The ECB will also start reducing its Asset Purchase Programme portfolio at an average rate of EUR15 billion per month from the beginning of March until the end of the second quarter of 2023, with the subsequent pace to be determined “over time" (see MNI SOURCES: Rates/QT Trade-Off Central To Next ECB Decision).

- The decision to raise all three key rates by half a point, taking the deposit rate to 2%, came after a substantial upward revision to the medium-term inflation outlook, the Governing Council said. Headline inflation is now seen at 2.3% - a third of a point above target - in 2025, while core inflation is set to hit 2.4% over the same period, according to Eurosystem staff projections. For more see MNI Policy main wire at 1129ET.

US TSYS: Off Midday Highs, Policy-Driven Vol Receding

Bonds near top end of range after extending session highs (30YY 3.4622% low ahead midday vs. 3.5605% post-ECB high) past midday. Curves bull flattening on average volumes (TYH>1.1M) following a volatile early session.

- Little react to expected 50bp hike from the BOE - not the case following ECB annc: Tsys pared gains after ECB hiked 50bp to 2.0%, focus on persistent inflation at 6.3% in 2023 (5.5% forecast).

- Data driven rebound: Tsys bounced off hawkish ECB guidance lows to new session highs (30YY back down to 3.5042% couple minutes after tapping 3.5605% high) following Empire Manufacturing sharply lower than expected at -11.2 vs. -1.0 est, weekly claims lower than expected at 211k vs. 232k est, retail sales weaker at -0.6% vs. -0.2% est.

- Real vol continues to deliver: Tsys scaled off post-data highs amid hawkish comments from ECBs Lagarde regarding 50bp hikes "for some time".

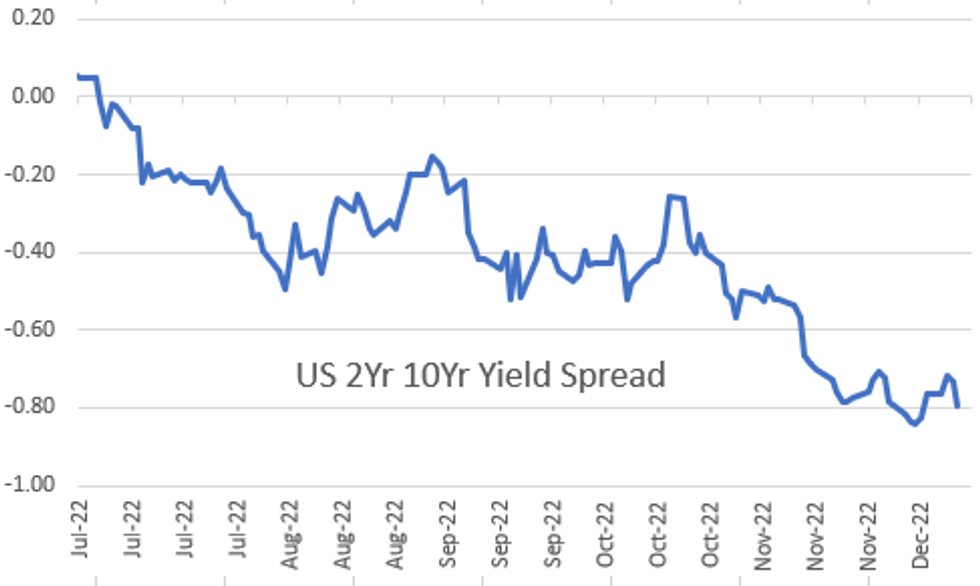

- While weaker than forecasted data (claims, retail sales and NY mfg index) helped futures jump off post-ECB lows to new session highs, yield curves remain stubbornly flatter: 2s10s -6.648 at -80.667.

- In-line trade: large 5s/10Y ultra-bond flattener block: -18,125 FVH3 109-10, sell through 109-13.5 post-time bid vs. +8,079 UXTH3 121-30, through 121-29.5 post-time offer.

OVERNIGHT DATA

- US JOBLESS CLAIMS -20K TO 211K IN DEC 10 WK

- US PREV JOBLESS CLAIMS REVISED TO 231K IN DEC 03 WK

- US CONTINUING CLAIMS +0.001M to 1.671M IN DEC 03 WK

- US NY FED EMPIRE STATE MFG INDEX -11.2 DEC

- US NY FED EMPIRE MFG NEW ORDERS -3.6 DEC

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 14.0 DEC

- US NY FED EMPIRE MFG PRICES PAID INDEX 50.5 DEC

- US NOV RETAIL SALES -0.6%; EX-MOTOR VEH -0.2%

- US OCT RETAIL SALES REVISED +1.3%; EX-MV +1.2%

- US NOV RET SALES EX GAS & MTR VEH & PARTS DEALERS -0.2% V OCT +0.8%

- US NOV RET SALES EX MTR VEH & PARTS DEALERS -0.2% V US NOV +1.2%

- US NOV RET SALES EX AUTO, BLDG MATL & GAS +0.0% V OCT +0.7%

- The result is a 3-month trend rate for the control group slowed from 6% to 3.6% annualized, in nominal terms, the softest since Dec'21.

- It adds downside risk to next week's consumer spending (Dec 23), consensus for which is already seen slowing from 0.8% to 0.2% M/M, and with particular focus on what happened in real terms.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 755.77 points (-2.23%) at 33212.74

- S&P E-Mini Future down 102.25 points (-2.54%) at 3928.75

- Nasdaq down 347 points (-3.1%) at 10825.14

- US 10-Yr yield is down 2.9 bps at 3.4481%

- US Mar 10Y are up 6.5/32 at 114-29.5

- EURUSD down 0.0049 (-0.46%) at 1.0633

- USDJPY up 2.3 (1.7%) at 137.78

- WTI Crude Oil (front-month) down $1.16 (-1.5%) at $76.11

- Gold is down $29.92 (-1.66%) at $1777.27

- EuroStoxx 50 down 139.56 points (-3.51%) at 3835.7

- FTSE 100 down 69.76 points (-0.93%) at 7426.17

- German DAX down 473.97 points (-3.28%) at 13986.23

- French CAC 40 down 208.02 points (-3.09%) at 6522.77

US TSY FUTURES CLOSE

- 3M10Y -2.431, -87.868 (L: -91.415 / H: -84.309)

- 2Y10Y -5.838, -79.857 (L: -81.279 / H: -73.48)

- 2Y30Y -7.735, -76 (L: -79.297 / H: -68.973)

- 5Y30Y -6.002, -14.139 (L: -17.644 / H: -8.823)

- Current futures levels:

- Mar 2Y down 0.5/32 at 102-31 (L: 102-29 / H: 103-02.375)

- Mar 5Y up 3/32 at 109-14.25 (L: 109-07.5 / H: 109-19.25)

- Mar 10Y up 7/32 at 114-30 (L: 114-18 / H: 115-02.5)

- Mar 30Y up 30/32 at 132-3 (L: 130-25 / H: 132-15)

- Mar Ultra 30Y up 1-12/32 at 145-1 (L: 143-03 / H: 145-29)

(H3) Trend Needle Points North Bullish

- RES 4: 116-23+ 2.0% 10-dma envelope

- RES 3: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 2: 115-14 50% Aug - Oct Downleg

- RES 1: 115-11+ High Dec 13

- PRICE: 114-30+ @ 1500ET Dec 15

- SUP 1: 113-22+/113-10 Low Dec 12 / 50-day EMA

- SUP 2: 112-11+ Low Nov 21 and a key short-term support

- SUP 3: 112-05+ Low Nov 14

- SUP 4: 110-22 Low Nov 10

Treasury futures remain below Tuesday’s high. This week’s print above resistance at 115-06+, Dec 7 high and the bull trigger, is a positive development. A clear break of this hurdle would confirm a resumption of the current uptrend and pave the way for a climb towards 115-26, a Fibonacci projection. Key short-term support has been defined at 113-22+, Dec 12 low. A reversal lower and a break of this level would threaten bullish conditions.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.005 at 95.260

- Mar 23 -0.040 at 94.925

- Jun 23 -0.040 at 94.890

- Sep 23 -0.035 at 95.065

- Red Pack (Dec 23-Sep 24) -0.02 to +0.010

- Green Pack (Dec 24-Sep 25) +0.020 to +0.035

- Blue Pack (Dec 25-Sep 26) +0.040 to +0.050

- Gold Pack (Dec 26-Sep 27) +0.050 to +0.055

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.50243 to 4.31829% (+0.50029/wk)

- 1M +0.01285 to 4.33771% (+0.06885/wk)

- 3M +0.00142 to 4.73771% (+0.00557/wk)*/**

- 6M +0.02700 to 5.15229% (+0.01258/wk)

- 12M +0.06043 to 5.46729% (-0.03214/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $101B

- Daily Overnight Bank Funding Rate: 3.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.045T

- Broad General Collateral Rate (BGCR): 3.76%, $411B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $397B

- (rate, volume levels reflect prior session)

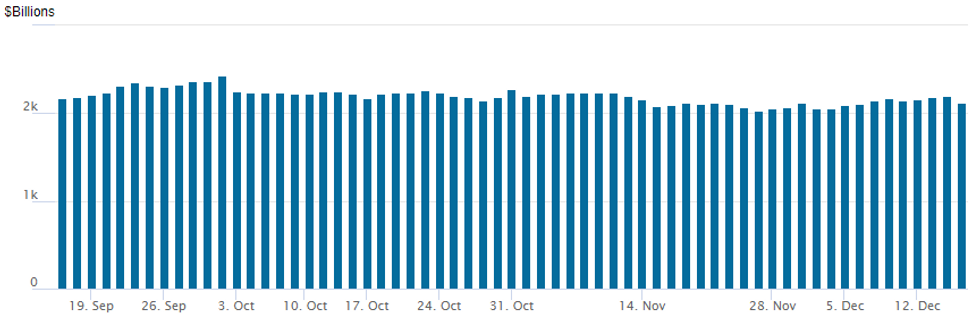

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,123.995B w/ 98 counterparties vs. $2,192.864B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EGBs-GILTS CASH CLOSE: Dovish BoE Contrasts With Very Hawkish ECB

A hugely busy session Thursday centred on central bank decisions saw EGB yields soar and Gilt yields decline, with periphery spreads widening sharply.

- The BoE hiked by 50bp as expected, but the dovish-leaning 3-way vote split and suggestion that UK inflation had peaked pulled UK yields lower.

- In contrast, the ECB meeting was very hawkish: while the expected 50bp hike was duly delivered, the statement revealed concrete details on QT to start next March, and noted rates "will still have to rise significantly at a steady pace".

- The resultant EGB selloff extended after Lagarde said this could mean 50bp hikes at each of the next 2-3 meetings.

- BTPs saw their biggest sell-off since March 2020, with 10Y yields up 30bp and spreads to Bunds 16bp wider.

- The schedule picks up first thing Friday with UK retail sales and Europe PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 25.4bps at 2.387%, 5-Yr is up 22.7bps at 2.16%, 10-Yr is up 14.3bps at 2.083%, and 30-Yr is up 4.6bps at 1.89%.

- UK: The 2-Yr yield is down 5.5bps at 3.396%, 5-Yr is down 6.6bps at 3.231%, 10-Yr is down 7.1bps at 3.244%, and 30-Yr is down 4.7bps at 3.649%.

- Italian BTP spread up 15.7bps at 208.3bps /Spanish up 4.6bps at 107.8bps

FOREX: Dampened Sentiment Bolsters Greenback, AUDUSD Plummets

- The widespread dampening of risk sentiment across global markets has prompted a strong recovery for the US Dollar on Thursday. The USD index has seen a strong recovery over the course of the US session, advancing 0.75% on the day as hawkish central bank rhetoric continues to hamper the mood across equity indices

- Despite a hawkish ECB president Lagarde, EURUSD had a swift turn lower, making new session lows below 1.0600, soon after reaching fresh six-month highs during the press conference at 1.0735.

- Losses against the greenback are broad based across G10, however, underperformance for commodities and in particular metals is significantly weighing on AUD, which has plummeted ~2.5%.

- Despite overall bullish trend conditions AUDUSD has broken initial support at 0.6731, the 20-day EMA and is now approaching the key support level of 0.6657, the 50-day EMA. A clear break of this average would highlight a possible reversal and signal scope for a deeper retracement.

- Not quite as extreme, yet still substantial, GBP, JPY and NZD have all lost between 1.5-1.9% on the session.

- Amid the hawkish ECB, EURGBP (+1.45%) has broken above the 50-day EMA, at 0.8653, which marked a key short-term resistance point and in turn eases the bearish technical threat. This opens up a move to 0.8778, the Nov 16 high.

- No rest on the economic calendar with UK retail sales and Eurozone PMIs headlining a busy European docket on Friday.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/12/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 16/12/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 16/12/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 16/12/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 16/12/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 16/12/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 16/12/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 16/12/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 16/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 16/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 16/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 16/12/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 16/12/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 16/12/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 16/12/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 16/12/2022 | 1000/1100 | ** |  | IT | Italy Final HICP |

| 16/12/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 16/12/2022 | 1030/1330 |  | RU | Russia Central Bank Key Rate Decision | |

| 16/12/2022 | - |  | US | 'Continuing Resolution On US Government Funding Expires | |

| 16/12/2022 | - |  | UK | BOE Announce Q1 Active Gilt Sales Schedule | |

| 16/12/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 16/12/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 16/12/2022 | 1700/1200 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.