-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Fed Daly Leaning Towards Two Hikes

- MNI FED Daly Sounds Like A 2-Hiker, Joins Others In Not Committing To July Hike

- MNI FED 2024 FOMC Meeting Calendar

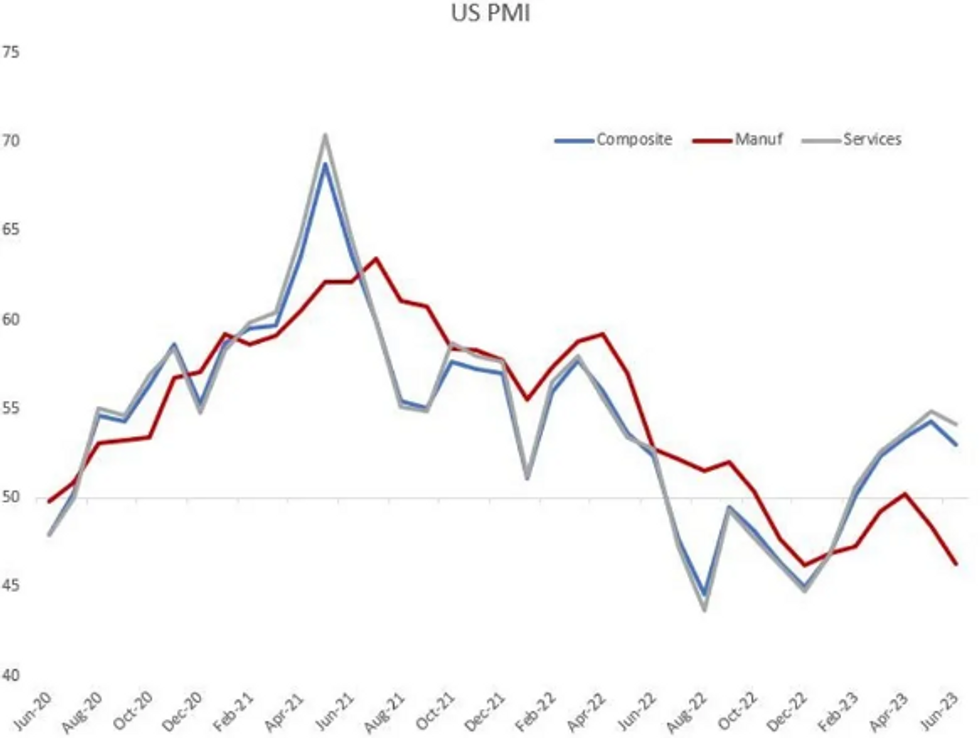

- MNI US PMIs Show Increasingly Two-Speed Economy

US

FED: San Francisco Fed Pres Daly could be one of the 9 FOMC members in the two-hike camp for 2023, telling Reuters that 50bp of further tightening this year is "a very reasonable projection at this point...but no decision, for me, has been made." Echoing Chair Powell's comments the past two weeks, Daly said "it is, in my judgment, prudent policy... to slow the pace of policy as you near the destination."

- Another common theme among FOMC members is that we haven't heard any give any predisposition toward a July hike - Daly: "I want to maintain optionality, because I think that's prudent."

- There were just 2 FOMC members who saw no further hikes in the March Dot Plot: per MNI's interview with him, one is Atlanta's Bostic; we had assumed Daly was a prime candidate to be the second, but now the main candidates are Chicago's Goolsbee, Philadelphia's Harker, or Boston's Collins - the last two of whom we haven't heard from since the June projections (Goolsbee said Wednesday that June's decision to hold was a "close call".)

- Interestingly Daly echoed concerns expressed recently by hawks Bowman and Waller that while several points of inflation are headed in the right direction, there is a worry that the housing market has bottomed and that rents may be reaccelerating. That would be a major blow to the FOMC's thesis that both core goods and shelter services inflation are set to contribute heavily to disinflation the rest of the year (with core services ex-housing being the stubborn outlier).

FED: 2024 FOMC Meeting Calendar. The Fed has released its tentative FOMC meeting calendar for 2024 - all meetings will be held Tuesday-Wednesday except for Nov 6-7 (delayed a day due to the US elections on Nov 5):

- January 30-31 (Tuesday-Wednesday)

- March 19-20 (Tuesday-Wednesday)

- April 30-May 1 (Tuesday-Wednesday)

- June 11-12 (Tuesday-Wednesday)

- July 30-31 (Tuesday-Wednesday)

- September 17-18 (Tuesday-Wednesday)

- November 6-7 (Wednesday-Thursday)

- December 17-18 (Tuesday-Wednesday)

- January 28-29, 2025 (Tuesday-Wednesday)

US TSYS: US PMIs Follow Weaker EGB Metric's Lead

- Treasury futures trading firmer after the bell, but holding to narrow range since late morning after scaling off from post-data highs: TYU3 currently 113-01.5 +10 vs. 113-15.5 high; 2s10s curve at -101.173 after extending inversion to -103.544 low vs. March' 40Y low around -110.0.

- Fast two-way trade noted earlier as front month Treasury futures extended support then reversed after S&P Global US PMI data comes out lower than expected: Manufacturing PMI (46.3 vs. 48.5 est); Services PMI (54.1 vs. 54.0 est) Composite PMI (53.0 vs. 53.5 est).

- Treasury futures tracked higher EGBs overnight after lower than projected European PMIs overnight (France servicer PMI 48 vs 52.1 est; Germany mfg PMI 41.0 vs. 43.5 est; EU and UK softer as well).

- Cooler inflation metrics slightly tempered projected US rate hike at one of the next three meetings, though Nov'23 implied rate still fully pricing in a hike. First full 25bp rate CUT has pushed out to May 2024.

- Atlanta Fed Pres Bostic (non-voter in 2023) comments at Bank event with CFOs contributing to latest move: NOT SEEING ELEMENTS OF RISK APPEARING IN ECONOMY, Bbg.

- Meanwhile, SF Fed Pres Daly could be one of the 9 FOMC members in the two-hike camp for 2023, telling Reuters that 50bp of further tightening this year is "a very reasonable projection at this point...but no decision, for me, has been made." Echoing Chair Powell's comments the past two weeks, Daly said "it is, in my judgment, prudent policy... to slow the pace of policy as you near the destination."

OVERNIGHT DATA

- US JUN FLASH S&P MANUF PMI 46.3 (FCST 48.5); MAY 48.4

- US JUN FLASH S&P SERVICES PMI 54.1 (FCST 54.0); MAY 54.9

- US JUN FLASH S&P COMPOSITE PMI 53.0 (FCAST 53.5); MAY 54.3

US DATA: June's preliminary US PMI report paints a picture of a two-speed economy, wherein services (PMI 54.1, vs 54.0 expected and 54.9 prior) remain strong while manufacturing (46.3, vs 48.5 expected and 48.4 prior) is weakening further.

- Services PMI began exceeding Manufacturing at the turn of the year and hasn't looked back as the latter moves further below the expansionary/contractionary 50 mark.

- Overall the strength in services activity and inflation probably outweighs the weakness in manufacturing in terms of the impact on overall activity and inflation, though the deterioration in employment dynamics is notable.

- A few passages from the S&P Global report underlining these themes:

- On the acceleration in cost inflation: "Following a loss of momentum in May, price pressures gained intensity in June. The rate of cost inflation across goods and services picked up to a robust pace. The reigniting of cost inflationary pressures was driven by the service sector amid increased wage bills....[but] manufacturing firms recorded a further decrease in input prices amid falling raw material prices, which fell at the fastest rate since May 2020."

- Selling prices increased the slowest since Oct 2020, though, largely on a drop in manufacturing selling prices.

- On jobs: "The pace of employment growth ... eased to the softest since January, reflecting a combination of lower demand for staff and poor candidate availability."

- On new orders: "the second-fastest in just over a year. The upturn was entirely driven by service providers, however, as manufacturers reported the sharpest drop in new orders since December, citing weak customer confidence and destocking by clients."

- On confidence: 6-month low for manufacturers amid concerns over inflation and lower sales; but services firms had the strongest positive sentiment since May 2022.

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 213.09 points (-0.63%) at 33734.2

- S&P E-Mini Future down 33.25 points (-0.75%) at 4390.5

- Nasdaq down 132.5 points (-1%) at 13498.26

- US 10-Yr yield is down 5 bps at 3.7444%

- US Sep 10-Yr futures are up 9.5/32 at 113-1

- EURUSD down 0.0065 (-0.59%) at 1.0891

- USDJPY up 0.69 (0.48%) at 143.8

- Gold is up $6.86 (0.36%) at $1920.77

- EuroStoxx 50 down 32.86 points (-0.76%) at 4271.61

- FTSE 100 down 40.16 points (-0.54%) at 7461.87

- German DAX down 158.22 points (-0.99%) at 15829.94

- French CAC 40 down 39.86 points (-0.55%) at 7163.42

US TREASURY FUTURES CLOSE

- 3M10Y -5.774, -156.461 (L: -162.643 / H: -152.77)

- 2Y10Y -1.546, -101.388 (L: -103.544 / H: -99.312)

- 2Y30Y -1.044, -93.491 (L: -96.008 / H: -90.286)

- 5Y30Y -0.148, -17.844 (L: -19.186 / H: -13.883)

- Current futures levels:

- Sep 2-Yr futures up 2.75/32 at 102-1.875 (L: 101-30.25 / H: 102-06)

- Sep 5-Yr futures up 5.75/32 at 107-23.75 (L: 107-16.75 / H: 108-03)

- Sep 10-Yr futures up 9.5/32 at 113-1 (L: 112-22 / H: 113-15.5)

- Sep 30-Yr futures up 26/32 at 127-26 (L: 127-00 / H: 128-20)

- Sep Ultra futures up 1-5/32 at 137-6 (L: 136-00 / H: 138-03)

US 10YR FUTURE TECHS: (U3) Bear Threat Remains Present

- RES 4: 115-00 High Jun 1 and a key resistance

- RES 3: 114-06+/114-12 High Jun 6 / 50-day EMA

- RES 2: 114-00 High Jun 13

- RES 1: 113.18 - High Jun 15

- PRICE: 113-02+ @ 1145ET Jun 23

- SUP 1: 112-12+ Low Jun 14 and the bear trigger

- SUP 2: 112-00 Low Mar 10

- SUP 3: 111-14+ Low Mar 9

- SUP 4: 110-27+ Low Mar 2 and key support

Treasury futures continue to trade inside the recent range. The trend outlook is unchanged and remains bearish. Support at 112-29+, the May 26 / 30 low has recently been cleared. This signals scope for 112-00, the Mar 10 low. Further out, scope is seen for a move towards 110-27+, the Mar 2 low and a key support. Short-term gains are considered corrective. Initial firm resistance is at 114-00, the Jun 13 high.

SOFR FUTURES CLOSE

- Jun 23 +0.010 at 94.785

- Sep 23 +0.020 at 94.665

- Dec 23 +0.045 at 94.785

- Mar 24 +0.070 at 95.090

- Red Pack (Jun 24-Mar 25) +0.050 to +0.080

- Green Pack (Jun 25-Mar 26) +0.030 to +0.040

- Blue Pack (Jun 26-Mar 27) +0.030 to +0.040

- Gold Pack (Jun 27-Mar 28) +0.040 to +0.050

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00556 to 5.08367 (+.00738/wk)

- 3M -0.00756 to 5.23870 (+.03186/wk)

- 6M -0.00541 to 5.32909 (+.03971/wk)

- 12M +0.00915 to 5.28360 (+.05398/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00143 to 5.06757%

- 1M -0.00200 to 5.14843%

- 3M +0.00228 to 5.54414% */**

- 6M +0.00772 to 5.69029%

- 12M +0.02415 to 5.92529%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.55743% on 6/12/23

- Daily Effective Fed Funds Rate: 5.07% volume: $132B

- Daily Overnight Bank Funding Rate: 5.06% volume: $297B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.354T

- Broad General Collateral Rate (BGCR): 5.03%, $607B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $594B

- (rate, volume levels reflect prior session)

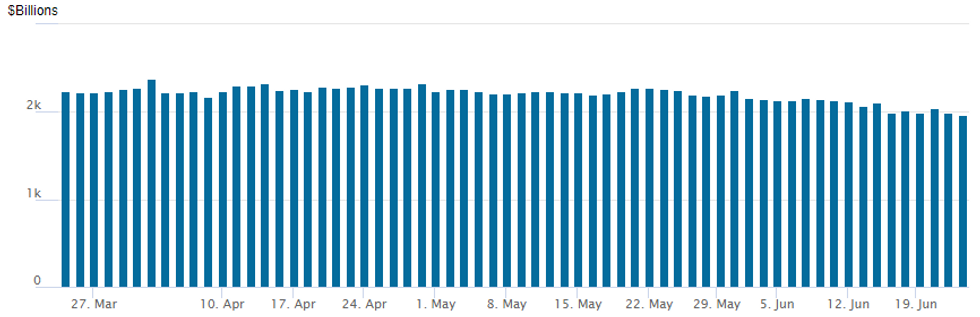

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $1,969.380B w/ 101 counterparties, compared to $1,994.711B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $18.65B Corporate Debt Priced on Week

- Date $MM Issuer (Priced *, Launch #)

- 06/23 No new corporate debt issuance Friday, $18.65B priced on the week

- $5.8B Priced Thursday

- 06/22 $4.25B *Nasdaq $500M 2Y +90, $1B 5Y +135, $1.25B +10Y +175, $750M 30Y +210, $750M 40Y +225

- 06/22 $1B *BBVA Mexico 15NC10 8.45%

- 06/22 $550M *COSAN Luxembourg 2030 note, 7.5%

EGBs-GILTS CASH CLOSE: Bunds Soar As Eurozone Growth Concerns Resurface

Weaker-than-expected European PMI readings boosted Gilts and Bunds Friday, with the latter outperforming as Eurozone growth concerns returned to the fore.

- German yields fell sharply in a bull flattening move after flash Eurozone June flash PMIs disappointed and showed signs of price pressures easing.

- Though UK PMIs were also on the weak side, Gilts lagged the rally slightly as UK retail sales data were solid, and BoE hike pricing continued to gain after Thursday's surprise 50bp hike.

- 2s10s German spreads fell to post-1990 lows; UK's post-2000 lows.

- After the PMI gains, Bunds traded the rest of the session with a slightly positive drift, with Gilts fading, with both finishing much stronger on the day.

- ECB's de Cos said it's not possible to anticipate the September decision at this point, especially given the weak PMI data.

- Greek spreads underperformed on the periphery, giving up some of the recent gains ahead of this weekend's elections (analysis on election implications for GGBs here).

- Next week's highlights include June inflation for multiple Eurozone countries and the ECB's Sintra forum.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 11.5bps at 3.106%, 5-Yr is down 14.7bps at 2.495%, 10-Yr is down 14.1bps at 2.353%, and 30-Yr is down 10.5bps at 2.404%.

- UK: The 2-Yr yield is up 10bps at 5.177%, 5-Yr is up 0.9bps at 4.571%, 10-Yr is down 4.7bps at 4.32%, and 30-Yr is down 3.5bps at 4.45%.

- Italian BTP spread down 1.1bps at 162.6bps / Greek up 1.2bps at 125bps

FOREX: Greenback Bounce Extends Amid Souring Sentiment, USDJPY Nears 144.00

- Risk sentiment was dented on Friday as disappointing flash PMIs in Europe sparked global growth concerns once again. Amid pressure on major equity benchmarks, the greenback prospered with the USD index (+0.56%) extending the firm bounce to around one percent from Thursday’s lows.

- Following the data, and the particularly poor prints in France and Germany, the Euro is among the poorest performers in G10 Friday, as ECB market-implied pricing has adjusted lower. The EURUSD pullback is considered corrective - for now. Attention turns to support at 1.0853, the 20-day EMA. A clear break of this average would signal scope for a deeper pullback and this would open 1.0804, the Jun 15 low.

- With the price action so closely linked to risk and the commodity complex also under pressure, the Australian dollar was the weakest in G10, falling 1.10% on the session.

- Despite marginally lower core yields, the greenback strength was most notable against the Japanese yen in the second half of Friday trade. A small dip to 1.4272 for USDJPY around the cash equity open was met with fierce support and the pair ramped to fresh-trend highs of 143.87. The pair trades close to the best levels as we approach the weekend close.

- Market participants will be on close watch for any comments from officials as the yen slumps toward levels where the government intervened last year. The party line has remained consistent, that Japan will closely watch currency moves and won't rule out any options, last laid out by a top currency diplomat on May 30 after financial authorities met in the wake of the yen's slide to a six-month low against the USD. 144.40 is a notable target on the topside, the 1.382 Fibonacci projection of the Jan 16 - Mar 8 - Mar 24 price swing.

- German IFO data kicks off next week’s data docket with potential comments from SNB’s Jordan and ECB’s Lagarde. The focus next week will be on a host of fresh inflation data across G10 as well as China manufacturing and non-manufacturing PMIs.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/06/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 26/06/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/06/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/06/2023 | 1730/1930 |  | EU | ECB Lagarde Opens ECB Forum |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.