-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: Fed Powell: Premature to Talk of Pause

EXECUTIVE SUMMARY

US

FED: The Federal Reserve on Wednesday raised its benchmark interest rate by a widely expected 0.75 percentage point to a target range of 3.75% to 4% and added guidance on how it will determine the pace of future rate hikes that could open the door to smaller increases.

- It was the fourth consecutive 75 basis point increase in as many meetings, bringing this year's cumulative tightening of 375 basis points -- one of the most aggressive and compressed rate hike campaigns in the central bank's history. But the new guidance on future rate hikes opens the door for a smaller 50 basis point rise as soon as at its next meeting in December.

- "The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time," the FOMC said. For more see MNI Policy main wire at 1401ET.

- "It may come as soon as the next meeting or the one after that. No decision has been made," Powell told reporters after delivering an unprecedented fourth 75bp rate hike. "It is likely we'll have a discussion about this at the next meeting."

- Chair Powell stressed the rate peak is more important than the tactics the central bank uses to get there: "The question of when to moderate the pace of increases is now much less important than the question of how high to raise rates and how long to keep monetary policy restrictive which will be our principle focus." Ex-officials have told MNI the rate peak could be 5% or more.

- "We still have some ways to go. Incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected," he told reporters after the FOMC raised interest rates by 75 basis points to a 3.75% to 4% range. "Our decisions will depend on the totality of incoming data and implications for the outlook of activity and inflation."

US TSYS: Fed Delivers 75Bp Hike, "Have a Ways To Go"

Tsys weaker/off lows following whipsaw reaction to expected, fourth consecutive 75bp rate hike to target range of 3.75%-4.0%. "The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time," the FOMC said.

- Bonds gapped to new high (30YY dropped to 4.0492%) then quickly fell to session low (30YY 4.1257%) immediately after the annc.

- Bonds extended lows as Fed Chairman Powell discusses the risk of entrenched inflation and not hiking enough to get it under control. "From a risk management standpoint we want to make sure that we don't make the mistake of either failing to tighten enough or loosening policy too soon."

- Follow-up comment "It's very premature in my view to be thinking about or talking about pausing our rate hike. We have a ways to go" spurring better selling across the curve. 30YY climbs to 4.1363% high.

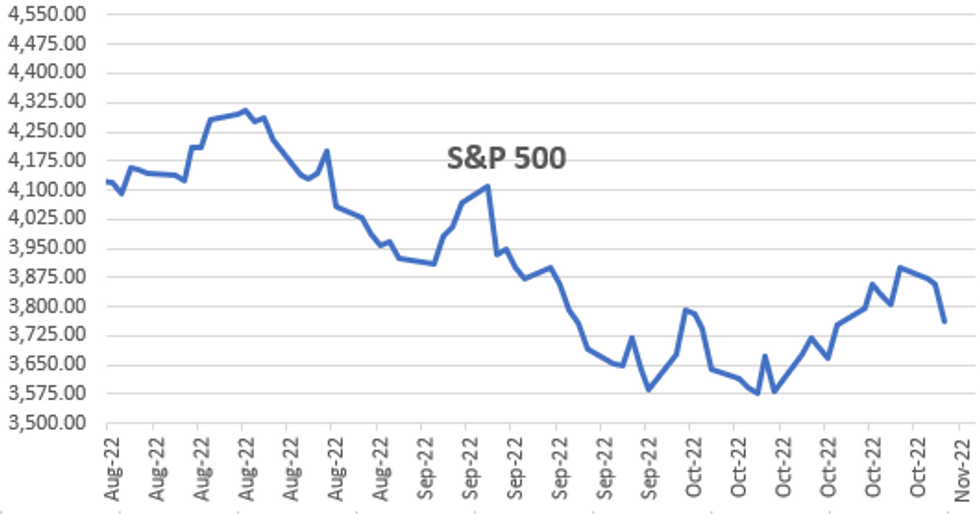

- Harkening back to September's "riskier to hike too little than too much" tone also weighed on stocks, SPX eminis -102.5 to 3763.5 after the bell.

- Currently, 2-Yr yield is up 5.4bps at 4.5989%, 5-Yr is up 2.6bps at 4.2934%, 10-Yr is up 4.2bps at 4.0838%, and 30-Yr is up 3.1bps at 4.1225%.

US TSYS Qtly Refunding: 5Y TIPS Upsized, 20s Unch, Buybacks Under Review

Treasury's quarterly Refunding announcement was largely in line with MNI's expectations:

- Expected nominal coupon sizes were left unchanged across the board for the coming quarter (see table below).

- 20Y Note sizes were maintained, though there had been some anticipation that they could be pared. (20s underperformed in the aftermath of the announcement.)

- TIPS and FRN sizes were left mostly unchanged, with the notable exception of the 5Y TIPS re-open in December which has been upsized by $1B to $19B. MNI had anticipated a potential uptick in TIPS sizes.

- Buybacks were on the agenda, but still in the early phases: ""Treasury expects to share its findings on buybacks as part of future quarterly refundings. Treasury has not made any decision on whether or how to implement a buyback program but will provide ample notice to the public on any decisions."

OVERNIGHT DATA

Main highlights of the ADP private payrolls beat (+239K vs +185K expected), which included a downward revision to September, (+192K vs +208K)

- ADP's chief economist: "This is a really strong number given the maturity of the economic recovery but "job changers are commanding smaller pay gains" and "the hiring was not broad-based."

- The latter is a reference to weak goods producer payrolls, which contracted by 8k (-20K manufacturing, +11k natural resources/mining, +1k construction). ADP cited producers "pulling back" due to sensitivity over rising interest rates".

- Services payrolls were solid overall (+247k) but that's mainly composed of leisure/hospitality (+210k) and trade/transportation/utilities (+84k), with the other sectors contracting.

- US MBA: MARKET COMPOSITE -0.5% SA THRU OCT 28 WK

- US MBA: REFIS +0.2% SA; PURCH INDEX -1% SA THRU OCT 28 WK

- US MBA: UNADJ PURCHASE INDEX -41% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 7.06% VS 7.16% PREV

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 497 points (-1.52%) at 32146.29

- S&P E-Mini Future down 96 points (-2.48%) at 3768.75

- Nasdaq down 357.3 points (-3.3%) at 10532.81

- US 10-Yr yield is up 4.2 bps at 4.0838%

- US Dec 10Y are down 7/32 at 110-11.5

- EURUSD down 0.0047 (-0.48%) at 0.983

- USDJPY down 0.48 (-0.32%) at 147.79

- WTI Crude Oil (front-month) up $0.82 (0.93%) at $89.20

- Gold is down $12.12 (-0.74%) at $1635.91

- EuroStoxx 50 down 29.01 points (-0.79%) at 3622.01

- FTSE 100 down 42.02 points (-0.58%) at 7144.14

- German DAX down 82 points (-0.61%) at 13256.74

- French CAC 40 down 51.37 points (-0.81%) at 6276.88

US TSY FUTURES CLOSE

- 3M10Y +5.066, -6.958 (L: -19.551 / H: -4.813)

- 2Y10Y -1.023, -51.923 (L: -52.96 / H: -45.689)

- 2Y30Y -2.051, -47.948 (L: -51.429 / H: -34.99)

- 5Y30Y +0.66, -17.198 (L: -22.502 / H: -5.391)

- Current futures levels:

- Dec 2Y down 4.375/32 at 101-30.75 (L: 101-28.875 / H: 102-09.25)

- Dec 5Y down 5.25/32 at 106-11.75 (L: 106-07.25 / H: 107-01)

- Dec 10Y down 6/32 at 110-12.5 (L: 110-05 / H: 111-09)

- Dec 30Y down 18/32 at 120-15 (L: 120-04 / H: 121-31)

- Dec Ultra 30Y down 12/32 at 129-1 (L: 128-13 / H: 130-20)

(Z2) Remains Below First Resistance

- RES 4: 113-30 High Oct 4

- RES 3: 113-00 50-day EMA

- RES 2: 112-22+ High Oct 6

- RES 1: 111-31 High Oct 27

- PRICE: 110-19 @ 10:18 GMT Nov 2

- SUP 1: 110-12 Low Oct 31

- SUP 2: 109-20/108-26+ Low Oct 25 / 21 and the bear trigger

- SUP 3: 108-06+ Low Oct 2007 (cont)

- SUP 4: 107.04 3.0% 10-dma envelope

Treasuries continue to trade at this week’s lows and below last week’s high of 111-31 on Oct 27 - the key short-term resistance. A break of this hurdle would signal scope for an extension higher near-term and expose the 50-day EMA at 113-00. Monday’s low of 110-12 is first support where a break would signal scope for a deeper pullback towards 108-26+, the Oct 21 low and the bear trigger.

US EURODOLLAR FUTURES CLOSE

- Dec 22 steady at 94.880

- Mar 23 -0.020 at 94.665

- Jun 23 -0.055 at 94.665

- Sep 23 -0.10 at 94.830

- Red Pack (Dec 23-Sep 24) -0.145 to -0.13

- Green Pack (Dec 24-Sep 25) -0.115 to -0.07

- Blue Pack (Dec 25-Sep 26) -0.05 to -0.01

- Gold Pack (Dec 26-Sep 27) -0.01 to +0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00428 to 3.06314% (-0.00072/wk)

- 1M -0.00586 to 3.83571% (+0.06800/wk)

- 3M +0.04872 to 4.50843% (+0.06886/wk) * / **

- 6M +0.05214 to 4.97071% (+0.03985/wk)

- 12M +0.09057 to 5.53600% (+0.16700/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.50843% on 11/2/22

- Daily Effective Fed Funds Rate: 3.08% volume: $108B

- Daily Overnight Bank Funding Rate: 3.07% volume: $289B

- Secured Overnight Financing Rate (SOFR): 3.05%, $1.079T

- Broad General Collateral Rate (BGCR): 3.01%, $420B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $395B

- (rate, volume levels reflect prior session)

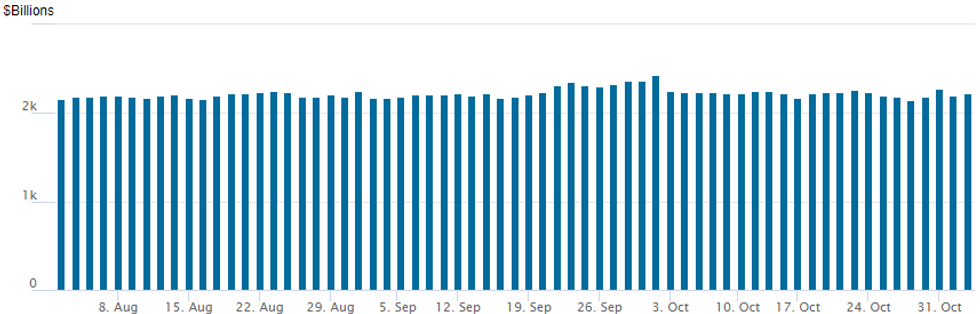

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to $2,229.861B w/ 108 counterparties vs. $2,200.510B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $2B Dish Network Friday

- Date $MM Issuer (Priced *, Launch #)

- 11/02 Issuers sidelined ahead FOMC, talk Dish Network $2B 5NC2 for Friday

- $2.5B Priced Tuesday

- 11/01 $1.5B *Ford Motor Co 5Y 7.35%

- 11/01 $1B *State Street Bank $500M 4NC3 +125, $500M 6NC5 +155

EGBs-GILTS CASH CLOSE: Pre-BoE Short-End Gilt Rally Continues

Short-end Gilts rallied strongly again ahead of the BoE, leading to bull steepening in the UK curve Wednesday. The German curve twist flattened, while periphery EGBs were mixed.

- With global attention on the Federal Reserve meeting outcome after European hours Wednesday, volumes were on the light side and trading was mostly within limited ranges.

- 2Y Gilt yields stood out again, falling by double-digits for the second consecutive session - now off 26bp since Monday's close.

- BoE hike pricing slipped further down the rates strip but there is still around 88% of a 75bp (as opposed to 50bp) hike still priced for Thursday's decision, in line with MNI's preview.

- Not much change in ECB pricing, having already reversed most of last Thursday's bullish move in the past 3 sessions.

- BTPs underperformed on the EGB periphery with spreads slightly wider; GGBs tightened 1.5bp to Bunds.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is up 4.1bps at 1.982%, 5-Yr is up 4bps at 2.023%, 10-Yr is up 1bps at 2.141%, and 30-Yr is down 4.3bps at 2.097%.

- UK: The 2-Yr yield is down 12.7bps at 3.058%, 5-Yr is down 14.1bps at 3.363%, 10-Yr is down 7.1bps at 3.399%, and 30-Yr is down 1.5bps at 3.571%.

- Italian BTP spread up 2.5bps at 215.6bps / Greek down 1.5bps at 244.2bps

FOREX: Greenback Extends Reversal & Strengthening After Presser Ends

- The initial weakness in the US Dollar following the FOMC statement has abated with most G10 pairs trading back to pre-announcement levels and the USD reversal/strength extending in recent trade amid Chair Powell confirming it is 'very premature' to think about pausing rate hikes amid other hints that it is not clear they will slow the pace in December.

- EURUSD sharply lower back through 0.9880 and then through the lows of the day after previously reaching a high of 0.9976.

- As noted earlier, further weakness is now testing the validity of last week's reversal higher and whether the channel top that previously marked firm resistance will now act as support.

- The channel top now intersects at 0.9821, closely matching the current low of 0.9823.

- Overall, the USD index is 0.44% higher on the session and the sharp reversal lower for major equity indices has prompted a substantial reversal in the likes of AUD and NZD, previously trading with 1.5% gains and now in negative territory against the greenback.

- Likewise, USDJPY has completed a significant round trip, bouncing from a low of 145.68 and now trading 200 pips higher as of writing.

- Focus immediately will turn to the latest set of employment data on Friday for the next major determinant of the greenback’s direction.

- Worth noting it is a Japanese holiday on Thursday and the major risk event if the Bank Of England’s monetary policy decision/statement.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/11/2022 | 0030/1130 | ** |  | AU | Trade Balance |

| 03/11/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/11/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/11/2022 | 0730/0830 | *** |  | CH | CPI |

| 03/11/2022 | 0805/0905 |  | EU | ECB Lagarde Panels Latvijas Banka Conference | |

| 03/11/2022 | 0810/0910 |  | EU | ECB Panetta Speech at ECB Money Market Conference | |

| 03/11/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 03/11/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/11/2022 | 0950/1050 |  | EU | ECB Elderson Panels Latvijas Banka Conference | |

| 03/11/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 03/11/2022 | - |  | DE | G7 Foreign Ministers summit in Germany | |

| 03/11/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/11/2022 | 1230/0830 | * |  | CA | Building Permits |

| 03/11/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 03/11/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 03/11/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/11/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/11/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/11/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/11/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/11/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 03/11/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 03/11/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 03/11/2022 | 1730/1330 |  | CA | BOC Deputy Beaudry gives opening remarks before academic lecture | |

| 03/11/2022 | 2000/1600 |  | CA | Canada FM Freeland presents fiscal update | |

| 03/11/2022 | 2030/2030 |  | UK | BOE Mann Panels American Enterprise Institute |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.