-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Terminal rate Falls to 5.54% Pre-NFP

EXECUTIVE SUMMARY

US

US DATA PREVIEW: Bloomberg consensus looks for still strong nonfarm payrolls growth of 225k in February after the storming 517k of January. If both still stand it would be only limited payback after mild weather and favourable seasonal factors seen in January.

- Revisions to that January figure are likely to play an important role after Fed Chair Powell opened the door to a 50bp hike in his Senate appearance.

- A consensus reading with minimal revisions could pave the way for 50bp on Mar 22 barring any CPI surprises Tuesday, but notable downward revisions and/or February payback could draw a significantly dovish reaction after the ramping higher of Fed rate expectations.

- Also watch average weekly hours worked after their surprise surge, a not expected but potential tick higher to the u/e rate on rounding (3.43% in Jan) and AHE growth with primary dealer skew to a hawkish surprise.

- “If it turns out that January wasn’t an outlier and the data that they have for February confirm or at least don’t undercut the January resilience in both prices and activity, then they need to be open to larger moves, at least one larger move,” Kohn said in an interview. “I’m guessing they don’t want to make 50 the baseline – keep 25 as the baseline but when the data come in that suggest they’ve falling a bit further behind where they thought they would be” the Fed might act more aggressively.

- Markets have sharply repriced the peak fed funds rate up to around 5.6% after a strong streak of economic data and hawkish testimony from Chair Jerome Powell this week. Investors and Fed officials will be scouring reports on jobs Friday and CPI Tuesday for clues as to whether the recent strength proves persistent. For more see MNI Policy main wire at 1131ET.

UK

BOE: Assuming the UK economy continues to perform “much as expected,” the Bank of England is likely to leave policy on hold at its March meeting as it awaits its May forecast round in order to make a more comprehensive assessment of developments and the likely impact of tightening.

- With the Monetary Policy Committee’s external members already having made their positions clear, and no public events currently scheduled for the five insiders ahead of the March 23 decision, the key steer for the meeting is a March 1 speech by Governor Andrew Bailey in which he said that while nothing has been decided the MPC no longer presumes further hikes will be required.

- Nonetheless, while Bailey said “the economy is evolving much as we expected it to," he stressed there were more data to come and that he would caution against assuming that hiking was over. Key Indicators ahead of the meeting include GDP on Friday, labour market data next Tuesday and CPI on March 22, the day of the policy vote, though the MPC typically downplays the importance of any single such metric in making its decisions. So far, surveys have suggested little danger of upside surprises from the labour report, with REC data showing wages flat at elevated levels. For more see MNI Policy main wire at 1035ET.

US TSYS Update: Yield Curves Remain Steeper, Fed Terminal Falls to 5.575%

- Treasury yield curves continue to climb steeper as short end rates match the post-30Y auction rally in the long end (despite the tail: 3.877% high yield vs. 3.870% WI).

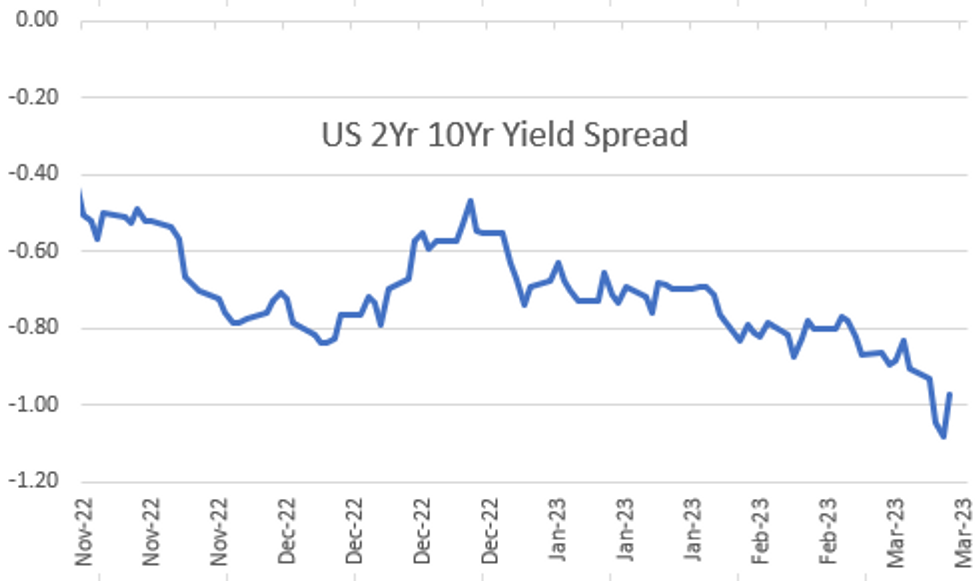

- Treasury June'23 2Y futures: TUM3 +11.25 at 101-21.62 (2Y yield falls to 4.8784% after breaching 5.08% earlier in the week. 2s10s yield curve climbs over 11bp to -97.043 high vs. -110.917 inverted low yesterday (1981 low).

- Broad based buying/position unwinds noted ahead of Friday's key non-farm payrolls data (current mean estimate of +225k).

- Short-end metrics: Most notably Fed terminal rate has fallen to 5.54% in Sep-23-Oct'23 vs. 5.69% high overnight.

- Fed funds implied hikes recede with Mar'23 at 38.2bp (-4.5), May'23 cumulative 71.4bp (-4.7) to 5.290%, Jun'23 90.7bp (-4.5) to 5.483%.

OVERNIGHT DATA

- US CHALLENGER FEB. JOB CUTS RISE 410% Y/Y

- US JOBLESS CLAIMS +21K TO 211K IN MAR 04 WK

- US PREV JOBLESS CLAIMS REVISED TO 190K IN FEB 25 WK

- US CONTINUING CLAIMS +0.069M to 1.718M IN FEB 25 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 499.2 points (-1.52%) at 32299.4

- S&P E-Mini Future down 71 points (-1.78%) at 3924.5

- Nasdaq down 216.9 points (-1.9%) at 11360.04

- US 10-Yr yield is down 6.1 bps at 3.9306%

- US Jun 10-Yr futures are up 18/32 at 111-15.5

- EURUSD up 0.0031 (0.29%) at 1.0576

- USDJPY down 1.21 (-0.88%) at 136.14

- WTI Crude Oil (front-month) down $1.07 (-1.4%) at $75.58

- Gold is up $15.52 (0.86%) at $1829.28

- EuroStoxx 50 down 2.33 points (-0.05%) at 4286.12

- FTSE 100 down 49.94 points (-0.63%) at 7879.98

- German DAX up 1.34 points (0.01%) at 15633.21

- French CAC 40 down 8.88 points (-0.12%) at 7315.88

US TREASURY FUTURES CLOSE

- 3M10Y -2.622, -106.532 (L: -112.318 / H: -100.429)

- 2Y10Y +11.399, -97.315 (L: -108.565 / H: -97.043)

- 2Y30Y +16.657, -101.577 (L: -118.227 / H: -101.577)

- 5Y30Y +12.466, -33.367 (L: -45.806 / H: -33.367)

- Current futures levels:

- Jun 2-Yr futures up 10.875/32 at 101-21.25 (L: 101-09.75 / H: 101-22.625)

- Jun 5-Yr futures up 18.75/32 at 106-26.75 (L: 106-05.75 / H: 106-31.5)

- Jun 10-Yr futures up 18/32 at 111-15.5 (L: 110-22.5 / H: 111-22.5)

- Jun 30-Yr futures up 11/32 at 125-22 (L: 124-19 / H: 126-06)

- Jun Ultra futures down 3/32 at 135-31 (L: 134-31 / H: 136-28)

US 10YR FUTURE TECHS: Trend Needle Still Points South

- RES 4: 113-01 50-day EMA

- RES 3: 112-18 High Feb 17

- RES 2: 111-31+/112-03 20-day EMA / High Feb 24

- RES 1: 111-17 High Mar 6

- PRICE: 111-03 @ 16:42 GMT Mar 9

- SUP 1: 110-12+ Low Mar 02 and the bear trigger

- SUP 2: 110-06 3.00 proj of the Jan 19 - Jan 30 - Feb 2 price swing

- SUP 3: 110-00+ Lower 2.0% Bollinger Band

- SUP 4: 109-22 3.236 proj of the Jan 19 - Jan 30 - Feb 2 price swing

Treasury futures continue to trade above 110-12+, the Mar 2 low. Recent gains appear to be a correction and note that a move higher is allowing an oversold trend condition to unwind. Key short-term resistance is seen at 111-31+, the 20-day EMA. The bear trigger is 110-12+, the Mar 2 low. A break would confirm a resumption of the downtrend and open 110-06, a Fibonacci projection.

EURODOLLAR FUTURES CLOSE

- Mar 23 +0.033 at 94.810

- Jun 23 +0.075 at 94.290

- Sep 23 +0.135 at 94.180

- Dec 23 +0.185 at 94.390

- Red Pack (Mar 24-Dec 24) +0.190 to +0.215

- Green Pack (Mar 25-Dec 25) +0.105 to +0.165

- Blue Pack (Mar 26-Dec 26) +0.040 to +0.080

- Gold Pack (Mar 27-Dec27) -0.03 to +0.020

Short Term Rates

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00300 to 4.56114% (+0.00157/wk)

- 1M +0.04629 to 4.80600% (+0.09686/wk)

- 3M +0.02900 to 5.15371% (+0.16971/wk)*/**

- 6M +0.02572 to 5.49986% (+0.18315/wk)

- 12M -0.01742 to 5.86329% (+0.16886/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.57% volume: $107B

- Daily Overnight Bank Funding Rate: 4.56% volume: $290B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.096T

- Broad General Collateral Rate (BGCR): 4.51%, $466B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $453B

- (rate, volume levels reflect prior session)

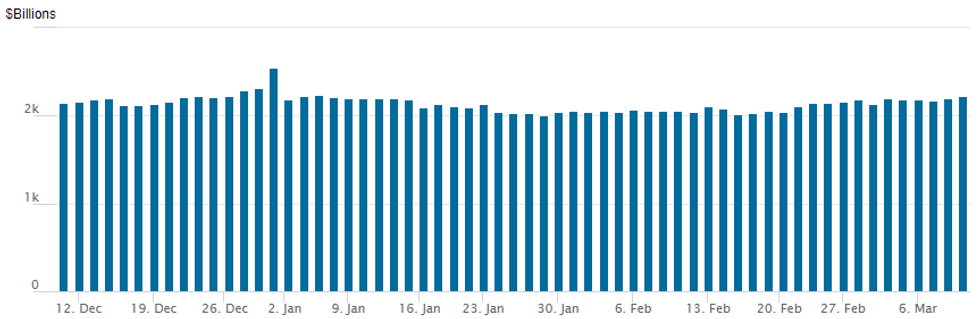

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,229.623B w/ 101 counterparties vs. prior session's $2,193.237B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $2.55B Corporate Bonds to Price

- Date $MM Issuer (Priced *, Launch #)

- 03/09 $1.25B #HSBC 2Y +80 (2Y SOFR leg dropped)

- 03/09 $700M #AEP Transmission 30Y +157

- 03/09 $600M #OCI 10Y +280

EGBs-GILTS CASH CLOSE: Re-Steepening Ahead Of US Jobs Report

European curves partially reversed the sharp flattening of the prior two sessions on Thursday.

- After gapping lower on the open (with no discernable trigger - ECB's Villeroy reiterated his view that peak of inflation is likely to be seen in H1), US data was central to the EGB/Gilt rally.

- Weaker-than-expected US jobless claims figures providedsome relief ahead of Friday's closely-eyed jobs report.

- The German curve twist steepened, with the UK's bear steepening.

- Periphery EGB spreads tightened as risk assets rallied on the US jobless claims miss.

- MNI's Policy Team took a look ahead at the BoE's meeting in 2 weeks' time, eyeing a rate hold unless data surprises.

- Friday's European slate is highlighted by UK GDP and final German CPI. ECB's Panetta appears as well.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.9bps at 3.277%, 5-Yr is down 3.9bps at 2.794%, 10-Yr is down 0.3bps at 2.643%, and 30-Yr is up 4.6bps at 2.589%.

- UK: The 2-Yr yield is up 2bps at 3.811%, 5-Yr is up 1.8bps at 3.688%, 10-Yr is up 3.1bps at 3.796%, and 30-Yr is up 4.1bps at 4.122%.

- Italian BTP spread down 3.6bps at 174.6bps / Spanish down 1.5bps at 100.2bps

FOREX: Rally In Short End Rates Having More Moderate USD Impact

- Despite US two-year yields falling as much as 16bps on Thursday following the release of softer US data, the impact on the US Dollar has been more measured, potentially offset by the weakness across equity markets. The USD index is currently showing declines of around 0.45% as we approach Friday’s APAC crossover, a move that only partially retraces the 1.5% rally from Tuesday’s open before Fed Chair Powell made his remarks.

- Understandably, given the sensitivity to yield differentials, the Japanese yen is the best performer in today’s session. USDJPY is once again attempting to breach the 136 handle, narrowing the gap with session lows at 135.95. Ahead of tomorrow’s US employment data, attention will be on initial firm support at 135.37, before the 20-day EMA that currently intersects at 135.04.

- With equities extending intra-day weakness in recent trade, antipodean currencies sit relatively softer in the G10 space, posting just moderate gains amid the broad greenback decline.

- Notably, the Chinese Yuan is also weaker on the day following the much lower-than-expected February CPI release (1.0% vs. Exp. 1.9%) overnight, reinforcing the importance of PBoC policy for H1.

- EURUSD price action has remained dull, with the pair eventually breaching yesterday’s narrow range to the topside in a slow grinding fashion. Market participants will have their attention on 1.0533, of which a sustained break would confirm a resumption of the downtrend and open 1.0484, the Jan 6 low and a key support.

- A packed docket on Friday with the BOJ decision kicking us off. Final German CPI and UK GDP highlight the European calendar before both US and Canada employment reports.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/03/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 10/03/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 10/03/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 10/03/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 10/03/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 10/03/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/03/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 10/03/2023 | 0745/0845 | * |  | FR | Foreign Trade |

| 10/03/2023 | 0900/1000 | ** |  | IT | PPI |

| 10/03/2023 | 0900/1000 |  | EU | ECB Panetta Presentation on Digital Euro | |

| 10/03/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/03/2023 | 1330/0830 | *** |  | US | Employment Report |

| 10/03/2023 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.