-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: FOMC, ECB, BOJ Policy Annc's in Week Ahead

- MNI Fed Preview - June 2023: How To Communicate A Hawkish Hold

- MNI INTERVIEW: Policy Lags Argue For Fed Pause, Blinder Says

- MNI SOURCES: ECB Seen Likely Hiking Twice More

- MNI: Weak Price Data Adds To Rate Pressure On PBOC- Economists

- MNI Atlanta Fed Wage Tracker Slowly Moderated In May, Led By Job Switchers

US

FED: The FOMC’s tightening cycle is likely to “skip” June’s meeting, with the Committee holding rates at 5.00-5.25% while signaling that it currently expects to hike at the following meeting in July.

- While data and events since early May have on balance probably justified another 25bp hike, some data have left room for doubt, and the FOMC has set a fairly high bar to further tightening.

- In an effort to maintain a hiking bias, the Statement’s forward rate guidance is likely to remain unchanged, with the updated economic projections showing that an additional rate hike is expected by year-end.

- The main reason to galvanize communications around a bias of future hikes is not just to placate the hawks, but to ensure that expectations of a cut don't rise with any hint that the FOMC is implying the next move will be down.

FED: The FOMC is likely to leave its benchmark interest rates unchanged next week, but a "really bad looking" CPI report could still prompt a surprise quarter-point increase, former Federal Reserve Vice Chair Alan Blinder told MNI, adding he would urge policymakers not to raise rates any further.

- "The FOMC is beginning to divide into dovish and hawkish factions, and the worse the CPI report, the more it strengthens the hawks’ hands. The better the report the more it strengthens the doves’ hands. Chair Powell is right in the middle," he said in an interview.

- "When the Fed started on this quest to push the inflation rate down, everybody on the Fed knew they were late getting started and they’d have to go quite a bit higher," he said. "But now where they are, there are lots of live questions over whether and why to go higher or to stop right here."

- The FOMC has lifted its fed funds rate to a 5%-5.25% target range in little over a year and is set to update its three-year projections at its June meeting. Futures traders expect just a 28% chance of a quarter-point move next week, though the peak rate is priced slightly higher at 5.285% by August. For more see MNI Policy main wire at 1030ET.

EUROPE

ECB: European Central Bank officials are converging on two more 25bp hikes, with a July increase probably following one certain for June, as updated macroeconomic projections are likely to show inflation weakening to the 2% level by 2025 based on current markets curves implying a peak deposit rate of about 3.75%, eurosystem sources told MNI.

- Next week’s decision should be straightforward, containing not just a hike to 3.5% but also confirmation of an end to reinvestments under the ECB’s Asset Purchase Programme. The statement is likely to repeat that rates should remain at restrictive levels for however long is necessary, while retaining the commitment to data-dependant meeting-by-meeting decisions, and would certainly avoid any phrasing which might be interpreted as pointing to cuts any time soon.

- “The projections will heavily imply there will be another hike to come, which could be July or September, but I'd favour July unless there is a nasty surprise in the lending survey data,” said an official at one national central bank. For more see MNI Policy main wire at 0823ET.

CHINA

PBOC: China’s economy continued to show disinflationary pressure in May as both CPI and PPI declined m/m and annual factory gate inflation fell to the lowest level in over seven years, with economists telling MNI that the People’s Bank of China (PBOC) is likely to cut the MLF moderately, but faces constraints around further Fed rate hikes and a weakening yuan.

- Producer prices fell 4.6% y/y in May, following on from a 3.6% decline in April, dipping to the lowest year-on-year reading in over seven years, with CPI gaining 0.2% y/y, up from April’s 0.1%, according to data released by the National Bureau of Statistics on Friday.

- May’s price data - which showed weakness beyond just base effects - strengthens calls for the authorities to increase policy support, following Wednesday's announcement that China’s export sector also contracted by 7.5% y/y in May. For more see MNI Policy main wire at 0738ET.

US TSYS: Fading Canada Jobs Move, Tsys Weaker Ahead FOMC, ECB, Boj Annc

- Treasury futures holding modestly weaker levels after the bell, near the middle of a decent session range. On what would have been a quiet Friday session ahead next week's FOMC (Wed), ECB (Thu) and BOJ (Fri) policy announcements, futures gapped off weaker levels following a drop in Canada employment data (-17.3k vs. +25k exp).

- Treasuries scaled back from post-Canada employment data induced highs, levels are back near opening levels with front month 10Y futures at 113-13 (-10.5). Curves extend inversion (2s10s -5.543 at -85.851) as short end rates underperformed ahead next week's bill and coupon supply (large 2s/30Y ultra flattener also note: -13,328 TUU3 102-13.75, through 102-14.12 post-time bid vs. +2,364 WNU3 135-12.

- Fed Funds implied rates are drawing to the end of the week with yesterday’s initial claims spike still weighing on pricing for next week’s FOMC but meetings later on in the year having clawed back the drop.

- The further trimming of cuts sees just 24bp from July’s terminal to year-end and 38bp from July to Jan for the smallest since Mar 09 as rate cut expectations began to surge on regional banking woes.

- Cumulative changes from current 5.08% effective: +7bp Jun (+0.5bp on the day), +20bp Jul (+0.5bp), +18.5bp Sep (+1.5bp), +9bp Nov (+2.5bp), -4bp Dec (+3.5bp) and -18bp Jan (+5bp).

OVERNIGHT DATA

- CANADIAN MAY JOBS -17.3K VS FORECAST +25K, PRIOR +41.4K

- CANADA MAY JOBLESS RATE 5.2% VS FORECAST 5.1%, PRIOR 5%

- CANADA HOURLY WAGES +5.1% YEAR-OVER-YEAR

- CANADA FULL-TIME JOBS -32.7K, PART-TIME +15.5K

- YOUTH AND SERVICE WORKERS LED CANADA JOBS DECLINE

- CANADA Q1 INDUSTRIAL CAPACITY UTILIZATION RATE 81.9%

- CANADA FACTORY CAPACITY UTILIZATION RATE 78.1%

US WAGE TRACKER: Released unusually late yesterday, the Atlanta Fed wage tracker for May showed overall wage growth moderating very slightly from 6.1% to 6.0% Y/Y.

- The move came with further but mild compression in the excess job switchers have been commanding over job stayers at 6.8 from 6.9% Y/Y vs an unchanged 5.7% Y/Y.

- Aside from February’s 1.0, the 1.1pp gap between the two is the lowest since Jan’22.

- However, the relative stickiness of job stayers in the 5-6% Y/Y range over the past year suggests overall wage growth might struggle to break below this as froth subsides, at least for now.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 50.42 points (0.15%) at 33883.71

- S&P E-Mini Future up 8.5 points (0.2%) at 4307.25

- Nasdaq up 44 points (0.3%) at 13282.89

- US 10-Yr yield is up 2.3 bps at 3.7413%

- US Sep 10-Yr futures are down 11/32 at 113-12.5

- EURUSD down 0.0033 (-0.31%) at 1.075

- USDJPY up 0.48 (0.35%) at 139.4

- WTI Crude Oil (front-month) down $1.12 (-1.57%) at $70.21

- Gold is down $3.99 (-0.2%) at $1961.48

- EuroStoxx 50 down 7.89 points (-0.18%) at 4289.79

- FTSE 100 down 37.38 points (-0.49%) at 7562.36

- German DAX down 40.12 points (-0.25%) at 15949.84

- French CAC 40 down 9.01 points (-0.12%) at 7213.14

US TREASURY FUTURES CLOSE

- 3M10Y +2.565, -150.443 (L: -158.277 / H: -147.085)

- 2Y10Y -5.965, -86.273 (L: -86.291 / H: -78.974)

- 2Y30Y -8.759, -72.091 (L: -72.211 / H: -62.061)

- 5Y30Y -6.283, -3.497 (L: -3.948 / H: 3.253)

- Current futures levels:

- Sep 2-Yr futures down 5.5/32 at 102-13.375 (L: 102-13 / H: 102-19.25)

- Sep 5-Yr futures down 10.25/32 at 108-6.75 (L: 108-04.25 / H: 108-16.75)

- Sep 10-Yr futures down 11/32 at 113-12.5 (L: 113-06.5 / H: 113-23)

- Sep 30-Yr futures down 4/32 at 127-16 (L: 126-26 / H: 127-22)

- Sep Ultra futures down 1/32 at 136-1 (L: 135-03 / H: 136-10)

US 10YR FUTURE TECHS: (U3) Key Support Remains Intact - For Now

- RES 4: 115-29+ High May 17

- RES 3: 115-19 High May 18

- RES 2: 115-00 High Jun 1 and a key resistance

- RES 1: 114-06+ / 114-29 High Jun 6 / 50-day EMA

- PRICE: 113-12 @ 16:35 BST Jun 9

- SUP 1: 112-29+ Low May 26 / 30 and key support

- SUP 2: 112-16 76.4% retracement of the Mar 2 - May 4 rally

- SUP 3: 112-00 Low Mar 10

- SUP 4: 111-14+ Low Mar 9

Treasury futures bounced Thursday, leaving support at 112-29+ intact. Nonetheless, the outlook remains negative for now, following the bearish engulfing candle pattern on June 2. The candle highlights a reversal and the bear trigger at 112-29+, May 26 / 30 low, remains exposed. Clearance of this level would resume the downtrend that started May 4 and open 112-16+, a Fibonacci retracement. Initial firm resistance is at 114-06+, the Jun 6 high.

SOFR FUTURES CLOSE

- Jun 23 -0.008 at 94.738

- Sep 23 -0.035 at 94.760

- Dec 23 -0.070 at 94.965

- Mar 24 -0.110 at 95.315

- Red Pack (Jun 24-Mar 25) -0.13 to -0.095

- Green Pack (Jun 25-Mar 26) -0.09 to -0.06

- Blue Pack (Jun 26-Mar 27) -0.055 to -0.03

- Gold Pack (Jun 27-Mar 28) -0.025 to -0.015

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00076 to 5.14562 (+.00445/wk)

- 3M -0.00905 to 5.24154 (+.01120/wk)

- 6M -0.02492 to 5.26715 (+.02168/wk)

- 12M -0.04345 to 5.10273 (+.07576/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00258 to 5.06671%

- 1M -0.00314 to 5.21929%

- 3M +0.00472 to 5.54443 */**

- 6M +0.00314 to 5.65971%

- 12M -0.00414 to 5.78386%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.54443% on 6/9/23

- Daily Effective Fed Funds Rate: 5.08% volume: $136B

- Daily Overnight Bank Funding Rate: 5.07% volume: $293B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.402T

- Broad General Collateral Rate (BGCR): 5.04%, $597B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $586B

- (rate, volume levels reflect prior session)

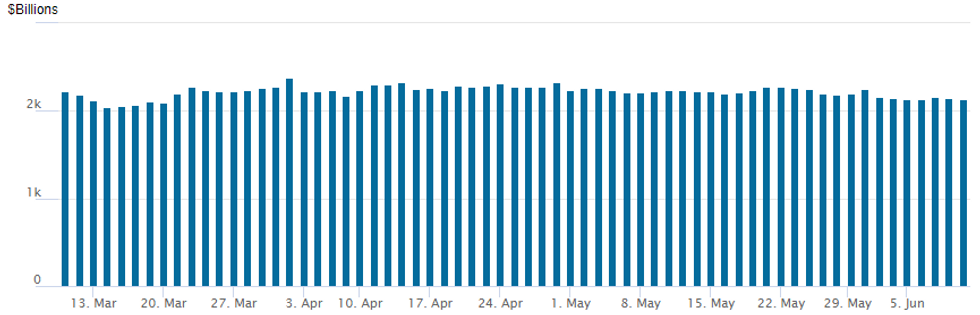

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,127.652B w/ 102 counterparties, compared to $2,141.798B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

EGBs-GILTS CASH CLOSE: Flattening Theme Continues To End The Week

The German and UK curves twist flattened Friday, continuing the recent flattening trend amid short-end/belly underperformance.

- With the ECB (next week) and BoE decisions in sight, the 2y segments on both curves resumed their recent rise. BoE peak rate pricing rose by 4bp to end a mixed but mostly hawkish week.

- An MNI Policy sources noted today, officials are converging on two more 25bp hikes, with a July increase probably following one certain for June.

- German 2s10s (-54.4bp) reached the most inverted closing level since mid-March; the UK equivalent is the most inverted since late Feb (-30.9bp).

- After hours we get a Fitch ratings review on Greece; GGB spreads tightened marginally having already outperformed Thursday. BTPs outperformed as BTP Valore sales closed with over E18bln in sales.

- Next week's calendar is very busy, with the ECB highlighting the European docket (and heavy EGB supply besides), but attention also on US inflation data and the Federal Reserve meeting, as well as the Bank of Japan decision.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 2.2bps at 2.916%, 5-Yr is up 0.2bps at 2.422%, 10-Yr is down 2.5bps at 2.377%, and 30-Yr is down 4.6bps at 2.516%.

- UK: The 2-Yr yield is up 4.1bps at 4.541%, 5-Yr is up 3.8bps at 4.25%, 10-Yr is up 0.6bps at 4.239%, and 30-Yr is down 0.6bps at 4.482%.

- Italian BTP spread down 4.7bps at 173.7bps/ Greek down 0.3bps at 128.6bps

FOREX: Antipodeans Perform Well, EURGBP Plumbs Fresh Year-to-Date Lows

- Despite the USD index’s moderate strength on Friday, the likes of AUD and NZD have remained well supported on Friday, rising between 0.4%-0.55% as we approach the weekend close.

- Aussie’s post RBA rally is extending and the AUDUSD bull cycle that started on May 31 remains in play with the pair trading at its recent highs. Resistance at the 50-day EMA has been cleared. The break higher strengthened on the break of 0.6733, 76.4% of the downleg in May.

- Continued progress for GBPUSD, following the break of key resistance at 1.2545, points to a stronger signal of a bottoming out of prices. 1.2592 is next up, a Fibonacci retracement which has capped the topside in today’s session and 1.2680 remains the key topside level.

- Perhaps more interesting is the cross, with EURGBP declining for four consecutive sessions and continuing to press to new YTD lows into the Friday close. The primary trend direction remains down, highlighted by a bearish price sequence of lower lows and lower highs. The focus is on 0.8547 – which has been pierced - the Dec 1 2022 low and a key support.

- The offshore Yuan (-0.30%) underperformed on Friday as greater-than-expected economic headwinds are putting pressure on the People’s Bank of China to ease policy. Following its recent guidance for banks to lower interest on deposits, this may indicate a higher likelihood of a cut to its medium-term lending facility rate as soon as next week, policy advisors and analysts told MNI. A sustained break above 7.1500 for USDCNH might expose bull channel top resistance, currently located around 7.1700.

- Lots of event risk next week highlighted by US inflation data, the FOMC meeting and the ECB rate decision. The week will also conclude with the June Bank of Japan meeting.

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/06/2023 | - | *** |  | CN | Money Supply |

| 12/06/2023 | - | *** |  | CN | New Loans |

| 12/06/2023 | - | *** |  | CN | Social Financing |

| 12/06/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 12/06/2023 | 1530/1130 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 12/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 12/06/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 13/06/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 13/06/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/06/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 13/06/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/06/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/06/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/06/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/06/2023 | 1230/0830 | *** |  | US | CPI |

| 13/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/06/2023 | 1400/1500 |  | UK | BOE Bailey Lords Economic Affairs Committee Hearing | |

| 13/06/2023 | 1400/1000 |  | US | Treasury Secretary Janet Yellen | |

| 13/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/06/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 13/06/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.