-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: FOMC Hike, Beginning of the End?

- MNI: Fed Raises Rates To Highest In 16 Years, More Possible

- MNI BRIEF: Powell-Fed May Already Be Sufficiently Restrictive

- MNI INTERVIEW: Services Peaking As Fed Hikes Gain Traction-ISM

- MNI: U.S. Treasury Expects To Begin Buybacks In 2024

US

FED: The Federal Reserve Wednesday raised interest rates by a quarter percentage point to its highest level since 2007, leaving the door open to more rate increases but suggesting officials have become less certain about how much more to tighten policy.

- "In determining the extent to which additional policy firming may be appropriate to return inflation to 2% over time, the committee will take into account the cumulative tightening of monetary policy, the lags which monetary policy affects economic activity and inflation, and economic and financial developments,” the Fed said in its May meeting statement.

- The increase brought the fed funds rate to a 5%-5.25% range that investors are hoping could be the peak for this cycle. Benchmark rates now match the peak outlined by the Fed at its March Summary of Economic Projections. Fed Chair Jerome Powell will face a range of questions in his upcoming press conference, including whether his views on rates have changed since then, and how he’s weighing rising financial stability risks with persistent inflation concerns. For more see MNI Policy main wire at 1401ET.

FED: It will take a few months of data for Federal Reserve officials to determine whether their monetary policy is already at the "sufficiently restrictive" level needed to bring down inflation back to 2%, but the Fed may be close to that level or already there, Fed Chair Jerome Powell said Wednesday.

- "We may not be far off we may possibly be even at that level," Powell said. "Policy is tight. I think real rates are probably -- you can calculate them many different ways but one way is to look at the nominal rate and subtract a reasonable estimate of one year inflation. You have 2% real rates. That's meaningfully above what many people would assess as the neutral rate."

US: U.S. services growth showed signs of reaching a ceiling in April but price inflation remains hot and the Federal Reserve is unlikely to cut interest rates this year, Institute for Supply Management services chair Anthony Nieves told MNI Wednesday.

- "We'll continue to see the PMI in the low to mid 50s range. I don't anticipate going up and having a spike anytime soon even with the growth of new orders," he said. That would be a slower path of growth than seen last year and in January and February, before a dip in March.

- The ISM services survey’s headline edged up 0.7ppts to 51.9 in April, a tenth of a percentage point under the Bloomberg consensus. "As things are starting to stabilize, demand has waned a bit. We saw that when we contracted back in December and what we're seeing now is just steady incremental growth month over month," Nieves said. "Consumers aren't spending as much." For more see MNI Policy main wire at 1220ET.

US TSY: The U.S. Treasury said Wednesday it expects to begin a regular buyback program in 2024 for cash management and to support Treasury market liquidity. Buyback operations would not be used to fundamentally change the overall maturity profile of the debt outstanding and would not be used to mitigate episodes of acute market stress, according to slides from Treasury's Office of Debt Management.

- "Based on feedback from a broad variety of market participants, including the Treasury Borrowing Advisory Committee and primary dealers, Treasury believes it would be beneficial to conduct regular buyback operations for cash management and liquidity support purposes," Josh Frost, Treasury's assistant secretary for financial markets, said in a statement.

- "Treasury anticipates designing a buyback program that will be conducted in a regular and predictable manner, initially sized conservatively, and not intended to meaningfully change the overall maturity profile of marketable debt outstanding." For more see MNI Policy main wire at 0830ET.

US TSYS: Yields Recede, Fed Opens Door to June Pause

- Wednesday's session remained volatile as Treasury futures extended highs after the FOMC delivered an expected 25bp rate hike to 5.0-5.25% range, support driven by the the Fed opening the door to a pause at the next meeting on June 14.

- The Fed rate path slipped lower after Chairman Powell's press conference, the June meeting dips 2bps to 5.08% but is still +1bps since the announcement.

- Assuming an effective rate of 5.08%, it largely marks a perceived end to the tightening cycle, with today’s hike priced to be unwound with Sep at -27ps to 4.81% (now -1bp post-decision having been +3bp in the presser). December cumulative at 74bp of cuts to 4.35% (now -1.5bp post-decision having been ~4.42%.

- Early Data driven volatility: Treasury futures pared gains after higher than expected ADP employment gain of +296k (+148k est). Little reaction to a minimal downward revision for the final April S&P Global US Service PMI. Rates extended highs but drew fast selling after ISM Service index data showed ongoing volatile new orders.

- Focus now on Friday's headline employment data for April, current mean estimate at +175k vs. 236k prior. Goldman Sachs raised their nonfarm payroll growth forecast by 25k to 250k after this morning's ADP and consistent with evidence from other Big Data sources.

OVERNIGHT DATA

- ADP RESEARCH INSTITUTE SAYS U.S. ADDED 296,000 JOBS IN APRIL

- ADP US APRIL SERVICE-PROVIDING JOBS UP 229,000

- ADP US APRIL GOODS-PRODUCING JOBS UP 67,000

- US S&P GLOBAL APRIL SERVICES PMI AT 53.6 VS 52.6 LAST MONTH

- US S&P GLOBAL APRIL COMPOSITE PMI AT 53.4 VS 52.3 PRIOR

- US ISM APR SERVICES COMPOSITE INDEX 51.9US ISM APR SERVICES COMPOSITE INDEX 51.9

- US ISM APR SERVICES BUSINESS INDEX 52

- US ISM APR SERVICES PRICES 59.6

- US ISM APR SERVICES EMPLOYMENT INDEX 50.8

- US MBA: REFIS +1% SA; PURCH INDEX -2% SA THRU APRIL 28 WK

- US MBA: UNADJ PURCHASE INDEX -32% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.50% VS 6.55% PREV

- US MBA: MARKET COMPOSITE -1.2% SA THRU APR 28 WK

ADP Sees Surprising Broad-Based Strength

ADP employment was much stronger than expected in April, rising 296k (cons 150k) after a minimally revised 142k (initial 145k), for its strongest monthly print since July.

- As of today’s data post prior benchmark revisions, ADP employment growth has only exceeded private payrolls in two of the past twelve months, undershooting by an average -55k per month.

- Gains by industry are broad-based but most outsized in the 20-49 employees category.

- Press release summary: “The slowdown in pay growth gives the clearest signal of what's going on in the labor market right now. Employers are hiring aggressively while holding pay gains in check as workers come off the sidelines. Our data also shows fewer people are switching jobs.”

Service PMI Sees Minimal Revision But Fastest Rate Of Job Creation Since Aug

A minimal downward revision for the final April S&P Global US Service PMI, holding onto its at-the-time surprise increase from 52.6 to 53.6 (initial 53.7) for what is still the highest since Apr’22.

- Notable ahead of payrolls on Friday: “Stronger demand conditions put pressure on capacity as backlogs of work rose again, spurring a quicker increase in employment. The rate of job creation was the fastest since last August.”

- “Concurrently, inflationary pressures regained momentum. Service sector input costs rose at the steepest rate for three months, while the increase in selling prices quickened to the fastest since August 2022.” More details here.

- The upcoming ISM Services remains key though.

ISM Services Close To Expected Whilst New Orders Volatility Remains

The ISM Service index was very close to expected as it increased to 51.9 (cons 51.8) from 51.2.

- Prices paid and employment sub-components didn’t move the needle, with prices paid up just 0.1pp to 59.6 after the prior month’s 6pt drop (in contrast to the latest build in PMI price pressures) and employment falling 0.5pps to 50.8.

- Volatility in new orders continues but doesn’t offset prior weakness (+3.9pts after -10.4pts in Mar) with new export orders particularly noisy as they bounced +17.2pts after -18.0pts.

- Despite the noise, the level of new orders (56.1) remains far stronger than in mfg (45.7), helping drive the still sizeable discrepancy between overall mfg and service indices, with the relative strength of services helping support real GDP growth of 1.6% Y/Y in Q1.

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 272.93 points (-0.81%) at 33413.04

- S&P E-Mini Future down 29.5 points (-0.71%) at 4107.75

- Nasdaq down 52.9 points (-0.4%) at 12029.18

- US 10-Yr yield is down 7.2 bps at 3.3524%

- US Jun 10-Yr futures are up 24/32 at 116-10

- EURUSD up 0.0057 (0.52%) at 1.1056

- USDJPY down 1.58 (-1.16%) at 134.98

- WTI Crude Oil (front-month) down $3.4 (-4.74%) at $68.25

- Gold is up $17.32 (0.86%) at $2033.70

- EuroStoxx 50 up 15.33 points (0.36%) at 4310.18

- FTSE 100 up 15.34 points (0.2%) at 7788.37

- German DAX up 88.12 points (0.56%) at 15815.06

- French CAC 40 up 20.63 points (0.28%) at 7403.83

US TREASURY FUTURES CLOSE

- 3M10Y -12.907, -188.78 (L: -188.999 / H: -175.898)

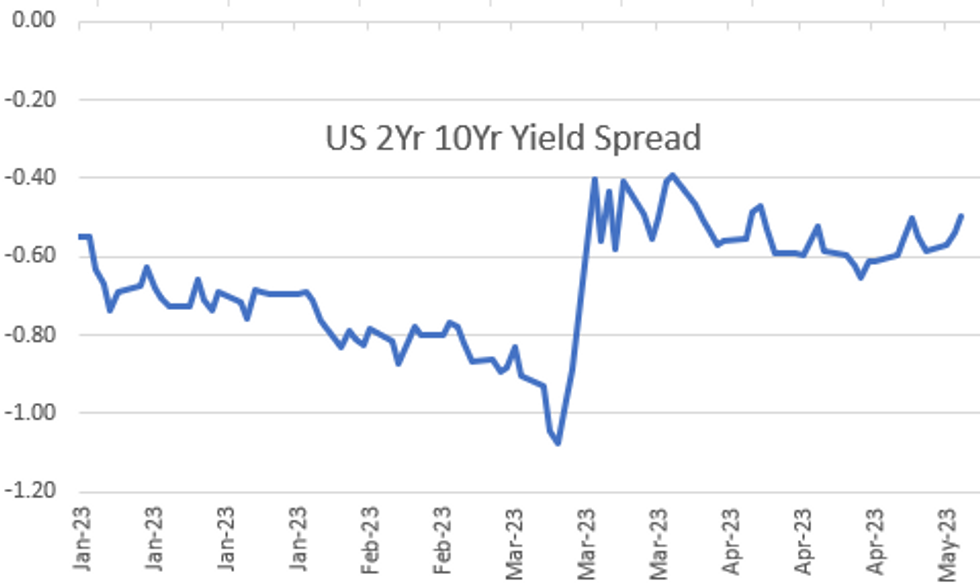

- 2Y10Y +4.015, -49.953 (L: -57.755 / H: -49.166)

- 2Y30Y +8.027, -17.326 (L: -29.475 / H: -16.565)

- 5Y30Y +8.382, 34.474 (L: 23.9 / H: 35.055)

- Current futures levels:

- Jun 2-Yr futures up 8.25/32 at 103-16 (L: 103-06.625 / H: 103-16.25)

- Jun 5-Yr futures up 19.25/32 at 110-22 (L: 110-02 / H: 110-22.25)

- Jun 10-Yr futures up 24.5/32 at 116-10.5 (L: 115-17.5 / H: 116-10.5)

- Jun 30-Yr futures up 1-03/32 at 132-17 (L: 131-16 / H: 132-29)

- Jun Ultra futures up 1-12/32 at 141-30 (L: 140-21 / H: 142-13)

SOFR FUTURES CLOSE

- Jun 23 -0.005 at 94.980

- Sep 23 +0.075 at 95.330

- Dec 23 +0.150 at 95.80

- Mar 24 +0.20 at 96.350

- Red Pack (Jun 24-Mar 25) +0.160 to +0.205

- Green Pack (Jun 25-Mar 26) +0.110 to +0.145

- Blue Pack (Jun 26-Mar 27) +0.080 to +0.10

- Gold Pack (Jun 27-Mar 28) +0.055 to +0.075

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00552 to 5.04042 (+.05473 total last wk)

- 3M -0.05194 to 5.05947 (-.01625 total last wk)

- 6M -0.09477 to 5.02694 (-.07071 total last wk)

- 12M -0.13436 to 4.75162 (-.14781 total last wk)

- O/N -0.00400 to 4.81086%

- 1M -0.01229 to 5.08157%

- 3M -0.01000 to 5.32629% */**

- 6M -0.03843 to 5.39443%

- 12M -0.13572 to 5.29957%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.33269% on 5/2/23

- Daily Effective Fed Funds Rate: 4.83% volume: $118B

- Daily Overnight Bank Funding Rate: 4.82% volume: $273B

- Secured Overnight Financing Rate (SOFR): 4.81%, $1.537T

- Broad General Collateral Rate (BGCR): 4.78%, $565B

- Tri-Party General Collateral Rate (TGCR): 4.78%, $556B

- (rate, volume levels reflect prior session)

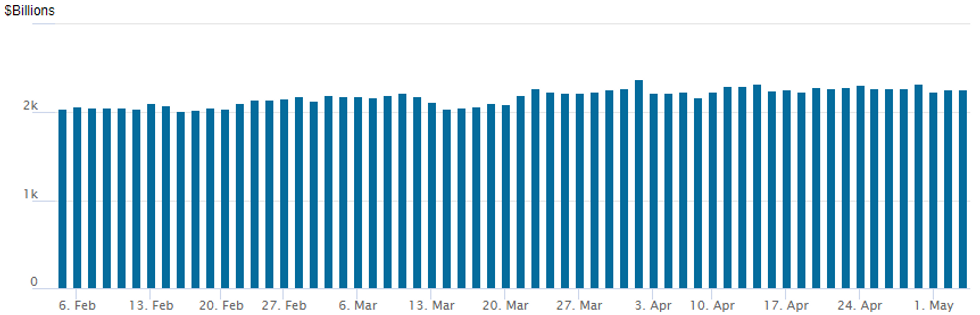

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips back to $2,258.222B w/ 102 counterparties, compares to prior $2,267.130B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: Issuers Sidelined Ahead FOMC

No new US$ debt issuance going into Wednesday's FOMC announcement

- Date $MM Issuer (Priced *, Launch #)

- $5B Priced Tuesday, $26.55B running total for the week

- 05/02 $4B *Barclays $2B 4NC3 +215, $2B 11NC10 +280

- 05/02 $1B *Glencore $500M 5Y +195, $500M 10Y +230

EGBs-GILTS CASH CLOSE: Peripheries Impress Pre-ECB

Gilts and Bunds traded mixed Wednesday, with yields climbing from morning lows as the post-close Fed decision and Thursday's ECB came into sight.

- The German curve twist flattened, while the UK saw a mostly parallel shift with yields up 3bp apart from 5Yrs which were up just 2bp.

- Periphery EGBs impressed, with 10Y Italy and Greek spreads respectively down 4bp and 9bp vs Bunds. Sharp BTP spread tightening into the cash close was noteworthy, ahead of the ECB decision Thursday.

- ECB and BoE hike pricing closed on firmer footing, up 3.7bp to 3.72% and 1.6bp to 4.93%, respectively. 25bp hikes are seen as near-locks for May.

- In the ECB's case, a 50bp raise tomorrow has about 15-20% probability attached. Our preview for Thursday's highlight - the ECB decision - is here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.7bps at 2.641%, 5-Yr is unchanged at 2.245%, 10-Yr is down 1.1bps at 2.247%, and 30-Yr is down 0.9bps at 2.371%.

- UK: The 2-Yr yield is up 3.1bps at 3.768%, 5-Yr is up 1.8bps at 3.569%, 10-Yr is up 2.7bps at 3.696%, and 30-Yr is up 3.3bps at 4.095%.

- Italian BTP spread down 4.4bps at 187.1bps / Greek down 8.9bps at 184.7bps

FOREX: USD Index Weakens 0.6%, Fed Less Certain On Future Tightening

- The USD index weakened ahead of the FOMC rate decision on Wednesday and received another jolt lower as the Fed statement signalled less certainty on future tightening of policy. Despite leaving the door open to more increases, the Fed’s language affirms a meeting-by-meeting approach.

- Despite the initial blip lower which stretched the DXY’s decline to around 0.85%, the index pared those extended losses as the press conference approached. Approaching the APAC crossover, the USD index sits with around 0.6% losses.

- USDJPY traded as low as 134.84 but quickly traded back to levels around 135.50 throughout the press conference. The pair has slipped lower in most recent trade confirming the Japanese Yen as the best performer in G10 on Wednesday. The move lower for USDJPY is a correction following the steep rally witnessed following the Bank of Japan last week. Of note, USDJPY traded within 14 pips of the 2023 highs (137.91) on Tuesday which remains the key resistance for the pair.

- In similar vein, the Swiss Franc also shone, as growth concerns remain the key driver, with bank stability still a background concern, keeping major equity indices at depressed levels.

- CAD trades broadly unchanged on the session, once again underperforming amid the ongoing rout for oil futures where Front-month WTI receded another 4.5%, briefly printing below the $68 mark.

- On Thursday, markets turn their focus to the ECB, who is set to hike its key policy rates by 25bp on May 4, with latest inflation and banking sector data diminishing the case for 50bp.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/05/2023 | 0130/1130 | ** |  | AU | Trade Balance |

| 04/05/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 04/05/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 04/05/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 04/05/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/05/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/05/2023 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 04/05/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/05/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 04/05/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/05/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 04/05/2023 | 0900/1100 | ** |  | EU | PPI |

| 04/05/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 04/05/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 04/05/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 04/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 04/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 04/05/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 04/05/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 04/05/2023 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 04/05/2023 | 1245/1445 |  | EU | ECB Post-Meeting Press Conference | |

| 04/05/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 04/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 04/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 04/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/05/2023 | 1650/1250 |  | CA | BOC Governor speech/press conference. |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.