-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI ASIA OPEN: Housing Could Be Doubly Disinflationary In 2023

EXECUTIVE SUMMARY

Housing Could Be Doubly Disinflationary In 2023

BLS, Census Bureau, MNI

As noted earlier in the session, the housing sector is likely to once again play a central role in broader US economic weakness in 2023.

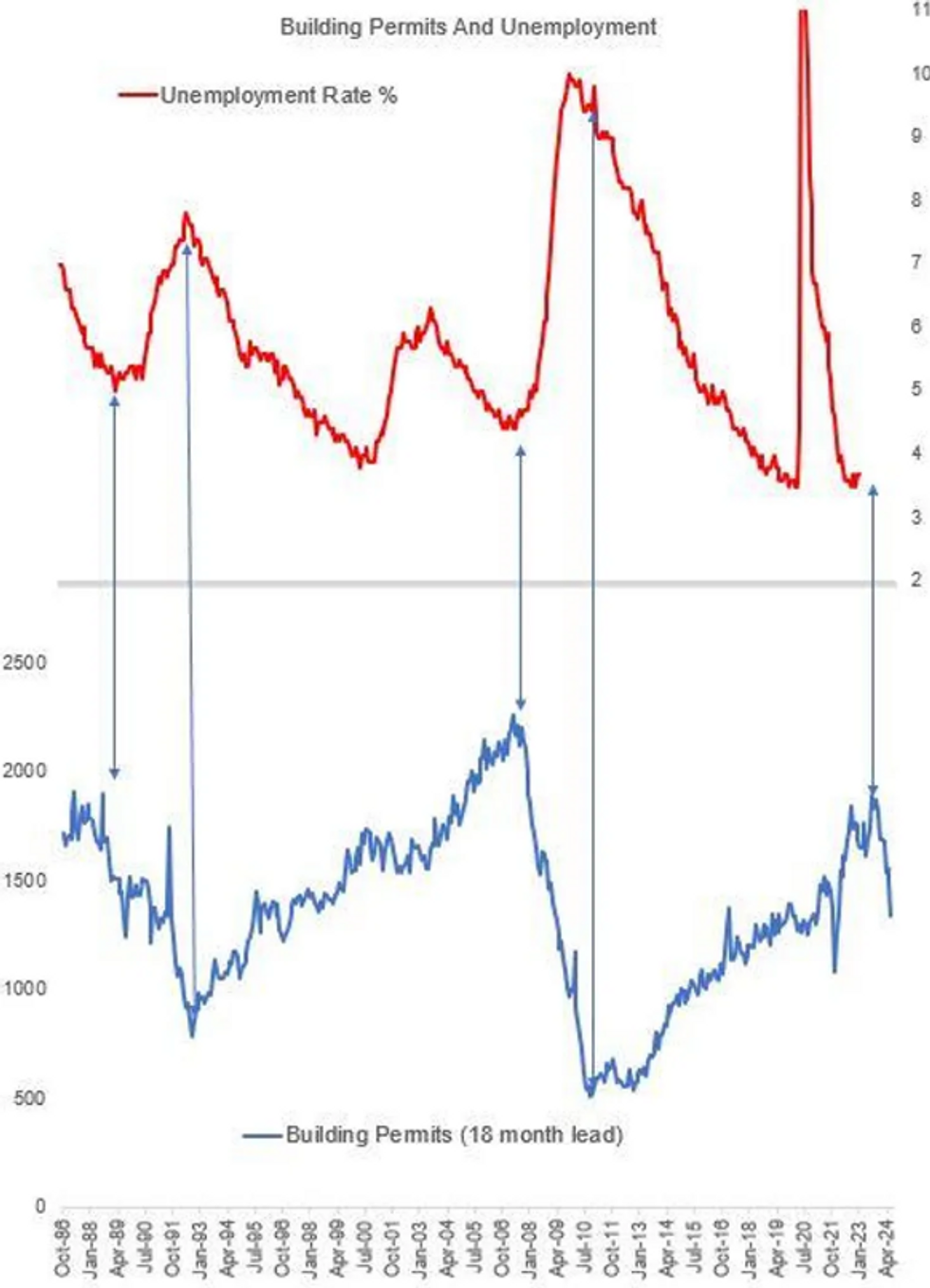

- Major turns in Building Permits leads turning points in the unemployment rate by around 1.5 years (see chart). Permits peaked at 1.9mln in December 2021, putting a labor market turn sometime in mid-2023.

- The housing sector could prove doubly disinflationary: firstly the downturn could pose broader disinflationary effects via the wealth effect and on construction activity and job growth contracting.

- And secondly, ongoing starts in multifamily units continue to gain with a record number of total housing units currently under construction (1.709mln, unch from Oct - multi-family at a 4-decade high 932k units under construction).

- As supply comes onto the market, that could provide relief to rent prices, which are one of the key categories of inflation eyed by the Fed as it looks to pause the rate hike cycle in early 2022.

US

US DATA: Multifamily housing contributed to overall Housing Starts remaining basically steady as opposed to the expected slowdown, up 28k from Oct to 599k in Nov, offsetting single family starts dropping 35k to 828k.

- But looking ahead, they appear to be turning a corner lower: the 561k multifamily permits in Nov were the joint-lowest (with Sept 2021) since May 2021 and a 110k month drop from Oct, from 671k to 561k.

- That contributed far more to the headline permits miss than the 60k drop in permits for single family (from 841k to 781k).

- And multifamily permits fell below starts (599k) for the first time since February 2020.

- The month-to-month data is volatile, to be sure. But single-family housing activity has been weakening steadily for months, so is a known quantity. But a sustained acceleration in multifamily housing weakness will add to concerns that the economy will see more downside in 2023 than previously expected.

UK

BOE: The Bank of England looks likely to return to its usual practice of eschewing commentary on market rates, as expectations for monetary policy have moved closer to the BOE’s own internal projections after its November foray into talking down the yield curve in the wake of September’s mini-Budget.

- Longer-dated gilt yields in particular soared in the wake of the Sept 23 mini-Budget, whose unfunded tax cuts were unaccompanied by any official fiscal forecast from the Office for Budget Responsibility, and market expectations for the peak of interest rates jumped over 6%. In response Monetary Policy Committee members sought to talk down the curve both collectively and individually, and Bank Governor Andrew Bailey suggested in the press conference after the November meeting that the policy rate was likely to top out closer to 3% than to the market rate peak then calculated by the BOE at about 5.25%, which would be compatible with a peak around 4%. (See MNI POLICY: BOE Points To 4% Peak At Most, Then Rate Cuts)

- With the fiscal waters now calmed, and rates peak pricing much lower, at around 4.6%, the BOE is returning to its usual taciturnity on the market curve. While this implied peak still appears to be well above the Bank’s own view, and with the BOE’s economic analysis little changed since Bailey’s comments the month before, MPC minutes after the December meeting, when Bank Rate was increased to 3.5%, contained not a single line of commentary on market rate expectations. For more see MNI Policy main wire at 0702ET.

US TSYS: BoJ YCC Modification Weighed on Global FI Markets Overnight

Global FI markets gapped lower overnight after the BoJ deployed a surprise widening of its permitted 10-Year trading band (to -/+0.50% vs. the previous -/+0.25%) at the end of its latest monetary policy decision: modifying the YCC parameters apparently implemented to improve market functioning (the BoJ now holds over 50% of outstanding JGBs for the first time).- Most of the (average) session volume occurred in the first few hours or Asia trade, while Tsys moved sideways from early lows through the entire session. Of note, 2s10s bear steepened back to mid-Nov levels tapping -56.923 inverted high overnight, -58.199 on the close (+9.328).

- Muted reaction to US Data, a modest beat in November housing starts, but that is a huge miss in building permits - by 140,000 (1.48mn expected, 1.34mn actual). The 180k M/M drop vs October is one of the largest monthly falls ever for permits - exceeded only a handful of times, in 2020, 2015, and in 2008.

- Fed funds implied hike for Feb'23 at 34.0bp, Mar'23 cumulative 49.0bp (+2.5) to 4.828%, May'23 55.6bp (+4.5) to 4.894%, terminal at 4.88% in Jun'23.

- On Friday: Deadline for Congress to reach an agreement on a year-long omnibus spending bill to avoid a shutdown of the federal government hits Friday at 23:59:59.

OVERNIGHT DATA

- US NOV HOUSING STARTS 1.427M; PERMITS 1.342M

- US OCT STARTS REVISED TO 1.434M; PERMITS 1.512M

- US NOV HOUSING COMPLETIONS 1.490M; OCT 1.345M (REV)

- US DEC PHILADELPHIA FED NONMFG INDEX -17.1

- US REDBOOK: DEC STORE SALES +6.4% V YR AGO MO

- US REDBOOK: STORE SALES +7.6% WK ENDED DEC 17 V YR AGO WK

- CANADA OCT RETAILS +1.4% VS FORECAST +1.5%, SEPT -0.6%

- CANADIAN OCT RETAIL SALES VOLUMES WERE UNCHANGED

- RETAIL EX-AUTOS +1.7% VS FORECAST +1.1%, PRIOR -0.8%

- CANADA RETAIL EX-AUTOS & GAS +0.9% VS SEPT REVISED -0.3%

- CANADIAN NOV FLASH ESTIMATE RETAIL SALES -0.5%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 73.32 points (0.22%) at 32833.19

- S&P E-Mini Future up 2 points (0.05%) at 3847.5

- Nasdaq down 5.5 points (-0.1%) at 10541.42

- US 10-Yr yield is up 10.2 bps at 3.6862%

- US Mar 10-Yr futures are down 20/32 at 113-16.5

- EURUSD up 0.0009 (0.08%) at 1.0616

- USDJPY down 5.34 (-3.9%) at 131.59

- WTI Crude Oil (front-month) up $0.9 (1.2%) at $76.09

- Gold is up $29.83 (1.67%) at $1817.71

- EuroStoxx 50 down 8.75 points (-0.23%) at 3802.49

- FTSE 100 up 9.31 points (0.13%) at 7370.62

- German DAX down 58.21 points (-0.42%) at 13884.66

- French CAC 40 down 22.86 points (-0.35%) at 6450.43

US TSY FUTURES CLOSE

- 3M10Y +5.973, -63.129 (L: -78.897 / H: -61.017)

- 2Y10Y +9.353, -58.174 (L: -67.316 / H: -56.923)

- 2Y30Y +9.453, -53.148 (L: -62.647 / H: -51.614)

- 5Y30Y +3.05, -5.072 (L: -8.387 / H: -2.832)

- Current futures levels:

- Mar 2-Yr futures down 0.875/32 at 102-29.125 (L: 102-26.375 / H: 102-30.875)

- Mar 5-Yr futures down 10.25/32 at 108-24.5 (L: 108-19.5 / H: 109-03.5)

- Mar 10-Yr futures down 20/32 at 113-16.5 (L: 113-10 / H: 114-05.5)

- Mar 30-Yr futures down 55/32 at 128-2 (L: 127-19 / H: 129-22)

- Mar Ultra futures down 90/32 at 138-26 (L: 138-11 / H: 141-13)

US 10YR FUTURE TECHS: (H3) Breaches Support

- RES 4: 116-25 2.0% 10-dma envelope

- RES 3: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 2: 115-14 50% Aug - Oct Downleg

- RES 1: 114-23/115-11+ High Dec 19 / 13 and the bull trigger

- PRICE: 113-20 @ 11:28 GMT Dec 20

- SUP 1: 113-11+ Intraday low

- SUP 2: 112-11+ Low Nov 21 and a key short-term support

- SUP 3: 112-05+ Low Nov 14

- SUP 4: 110-22 Low Nov 10

Treasury futures have started this week on a bearish note. Today’s move lower has resulted in a break of support at 113-22+, the Dec 12 low and a key short-term level. This undermines the recent bull theme and instead suggests scope for a deeper retracement. The focus is on 112-11+, the Nov 21 low. Note that the contract has pierced the 50-day EMA - at 113-15. A clear break would strengthen the bear threat. Key resistance is at 115-11+.

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.005 at 94.930

- Jun 23 steady at 94.920

- Sep 23 steady at 95.085

- Dec 23 -0.020 at 95.400

- Red Pack (Mar 23-Dec 24) -0.075 to -0.05

- Green Pack (Mar 24-Dec 25) -0.095 to -0.075

- Blue Pack (Mar 25-Dec 26) -0.135 to -0.11

- Gold Pack (Mar 26-Dec 27) -0.145

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00486 to 4.31543% (-0.00157/wk)

- 1M +0.00743 to 4.36129% (+0.00843/wk)

- 3M +0.01428 to 4.75257% (+0.00671/wk)*/**

- 6M +0.02685 to 5.17671% (-0.01015/wk)

- 12M +0.03100 to 5.45871% (-0.02015/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $91B

- Daily Overnight Bank Funding Rate: 4.32% volume: $259B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.087T

- Broad General Collateral Rate (BGCR): 4.27%, $414B

- Tri-Party General Collateral Rate (TGCR): 4.33%, $399B

- (rate, volume levels reflect prior session)

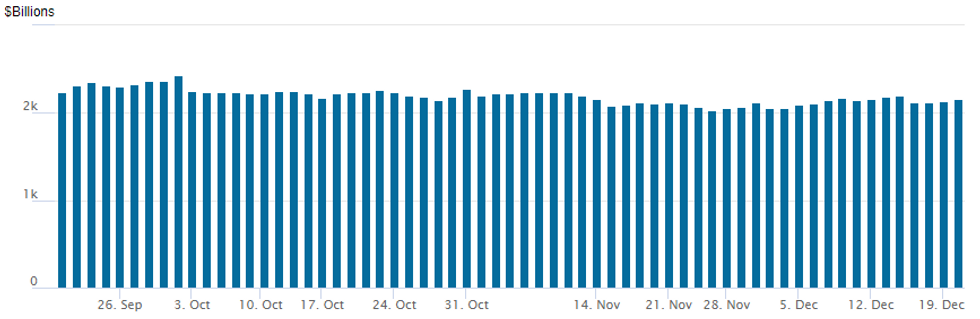

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,159.408B w/ 98 counterparties vs. $2,134.765B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EGBs-GILTS CASH CLOSE: Semi-Core Suffers On BoJ Surprise

European curves steepened Tuesday after the Bank of Japan's surprise decision to raise the upper yield boundary of the 10Y JGB by 25bp.

- German and UK yields closed firmly higher (around double-digits basis points), with the exception of 2Y UK yields which were lower on the day.

- OATs underperformed, with 10Y wider by 2bp of Bunds to the widest close since Nov 1(56.5bp). Weaker Japanese demand post-BoJ decision was seen as a factor.

- Periphery spreads widened at the open but narrowed over the session as equities recovered alongside the US dollar softening.

- In data, German PPI and Eurozone consumer confidence were softer than expected, but there was little attention paid, with all eyes on the BoJ move.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.7bps at 2.517%, 5-Yr is up 9.4bps at 2.333%, 10-Yr is up 10.1bps at 2.304%, and 30-Yr is up 12.4bps at 2.187%.

- UK: The 2-Yr yield is down 0.4bps at 3.683%, 5-Yr is up 8.8bps at 3.579%, 10-Yr is up 9.4bps at 3.596%, and 30-Yr is up 6.8bps at 3.892%.

- Italian BTP spread down 0.7bps at 217.2bps / Spanish up 1.3bps at 110.1bps

FOREX: JPY Extends Strength Through London Close

- USDJPY broke lower still into the London close following the BoJ's YCC tweak overnight. The pair hit extended daily lows of 131.01 and making for a 6 point drop on the day. Key support at 131.74 has now given way, opening losses toward late August lows of 130.41 for direction.

- Moving average studies are in a bear-mode position and price remains well below the 20-day EMA. The daily RSI is nearing oversold territory, which could slow downside progress from here on, but the overarching theme remains negative for now.

- The risk backdrop was generally negative, with equity markets across Europe and the US failing to stage a sufficient recovery off the post-BOJ lows. As a result, AUD and NZD were among the poorest performers in G10, with AUD/USD now looking more comfortable below the 100-dma of 0.6664.

- EUR traded more favourably, although EURUSD remains below last week’s highs. The latest pullback is considered corrective - for now. Last week’s break higher confirmed a resumption of the uptrend and maintains the price sequence of higher highs and higher lows. The focus is on 1.0736 next, a Fibonacci projection.

- Focus Wednesday turns to UK public sector net borrowing data, Canadian inflation and US existing home sales for November. There are no central bank speakers of note.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2022 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 21/12/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 21/12/2022 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 21/12/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/12/2022 | 1330/0830 | *** |  | CA | CPI |

| 21/12/2022 | 1330/0830 | * |  | US | Current Account Balance |

| 21/12/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 21/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.