-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: ISM Miss, Tsy Bill Sales Accelerate

- MNI INTERVIEW: Fed Done Hiking, Inflation To Drop: Ex-Staffer

- MNI INTERVIEW: US Service Growth Still Durable, ISM Chief Says

- MNI INTERVIEW: Inflation To Slide If Output Gap Closes-Gagnon

- MNI BOC WATCH: Hot Economy Gives Pause For Thought About Hiking

- MNI US DATA: ISM Services Slips To Only Just Above 50, Prices Paid Lowest Since May'20

US

FED: The Federal Reserve has finished hiking interest rates and will probably cut before year-end, ex-Philadelphia Fed economist Luke Tilley told MNI, a view counter to policymaker hints that a June pause might be followed with more tightening.

- “My outlook is for inflation to slow appreciably through the year,” Tilley, now chief U.S. economist at Wilmington Trust, said in an interview. Inflation will slide to 3.5% in the next couple of months, end the year just above 3% and fall to around the Fed’s 2% target by spring of 2024, he said.

- “When you get to the back half of the year and inflation has come down significantly and the economy is slow and long-term inflation expectations are very much in check, it doesn’t make any sense at all to have the fed funds rate at 5%. I think they’ll have to let off the brake a little bit.” For more see MNI Policy main wire at 1402ET.

US: U.S. services growth again showed signs of moderating in May but with price inflation cooling the Federal Reserve may not have to raise interest rates much more, Institute for Supply Management services chair Anthony Nieves told MNI Monday.

- "I still see that the composite index will still be in the low 50 percentile range, probably in the 51-52 range next month," he said in interview, again slightly downgrading views of potential growth but dismissing a recession. "I don't think we'll pull back under 50," Nieves said of the services PMI. The ISM services survey’s headline fell 1.6ppts to 50.3 in May, under the Bloomberg consensus of 52.4, due mostly to the decrease in employment and improvements in delivery times.

- "I would be more concerned if we had contraction on new orders and business activity," Nieves said of May's performance. The ISM services chief acknowledged the slower path of growth but noted survey respondents are not indicating "things are falling off the edge of the cliff here," he said. "It's further cooling in momentum right now." For more see MNI Policy main wire at 1304ET.

CANADA

BOC: The Bank of Canada is seen by a majority of economists as holding its key interest rate at the highest since 2007 Wednesday, though many warn an increase is a significant risk given the economy's continued strength.

- Nineteen economists surveyed by MNI see the target rate on overnight loans between commercial banks remaining at 4.5% and another four see a quarter-point hike at the decision due at 10am EST from Ottawa. Among Canada's five major commercial banks, two see a hike and the remaining three view the decision as a coin toss.

- That’s a sharp contrast from a few weeks ago when bets were often on a rate cut later this year to fend off a recession. Surprises are also hard to rule out given that four of the central bank's eight decisions last year bucked the economist consensus. For more see MNI Policy main wire at 1139ET.

UK

BOE: Inflation in the UK and elsewhere could fall swiftly if output drops back below potential, former Federal Reserve official Joseph Gagnon told MNI, after his research featured in a Bank of England run-down of a debate over the future path of inflation.

- In a recent presentation, BOE economist Galina Potjagailo pointed to work by groups including Gagnon and his co-author co-author Kristin Forbes, a former BOE Monetary Policy Committee member, as representative of one of two broad academic camps on the future of inflation, given the failure of mainstream central bank models to predict the current upsurge in price increases.

- Gagnon and Forbes argue that prices can respond swiftly to moves in the output gap, in contrast to the view taken in research by the Bank for International Settlements and others, who think the world may have moved into a higher inflation regime. For more see MNI Policy main wire at 0923ET.

US TSYS: ISM Miss Helps Tsys Snuff Bearish Engulfing Candle

- Treasury futures reversed early losses, gapped to new session highs (TYU3 114-03.5 high, yield tapped 3.6563% low) after May ISM services miss. Curves rebound with short end rates outperforming (2s10s taps -77.212 high).

- Despite the bounce, technical focus is on the bearish engulfing candle posted Friday, signaling the end of the recent recovery and suggesting potential for a continuation lower. Attention is on key short-term support and the bear trigger at 112-29+, the May 26 / 30 low.

- May ISM services disappointed: 50.3 (cons 52.4) after 51.9, printing the lowest since Dec’22. New orders led the decline at 52.9 (-3.2pts), driven domestically rather than external.

- The prices paid index is notable, dropping to lowest since May’20 at 56.2 (-3.4pts) as they build further on March’s particularly sharp -6.1pt drop. Employment component also fell back below 50 (49.2, -1.6pts) for first time since December.

- FOMC-dated OIS have lifted off lows seen after the ISM services miss. Near-term meetings are relatively little changed compared to the start of today’s NY session with June +7bp (unch) and July +20bp (-1.5bp) for a terminal that doesn’t fully price another hike.

- Beyond that, implied rates are down more heavily on the day but remain notably higher than before Friday’s payrolls report. For example, the 4.99% implied effective for the Dec FOMC (marking 9bp of cuts from current levels) is down 4bps since the start of the session but still 11bps higher since payrolls.

OVERNIGHT DATA

- US ISM MAY SERVICES COMPOSITE INDEX 50.3

- US ISM MAY SERVICES BUSINESS INDEX 51.5

- US ISM MAY SERVICES PRICES 56.2

- US ISM MAY SERVICES EMPLOYMENT INDEX 49.2

- US DATA: ISM services disappoint in May at 50.3 (cons 52.4) after 51.9, printing the lowest since Dec’22. New orders led the decline at 52.9 (-3.2pts), driven domestically rather than external. The prices paid index is notable, dropping to lowest since May’20 at 56.2 (-3.4pts) as they build further on March’s particularly sharp -6.1pt drop. Employment component also fell back below 50 (49.2, -1.6pts) for first time since December.

- Overall service activity continues to outperform the outright contraction signals coming from manufacturing, but the drifting lower in service activity is once again starting to be increasingly at odds with recent data strength and the Atlanta Fed Q2 GDP tracker still running at 2% annualized.

- There is, however, a wilder gulf between manufacturing and service new order components though, with the service version still comfortably above 50 albeit still low by historical standards.

- US APR FACTORY ORDERS +0.4%; EX-TRANSPORT NEW ORDERS -0.2%

- US APR DURABLE ORDERS +1.1%

- US APR NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +1.3%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 178.37 points (-0.53%) at 33579.56

- S&P E-Mini Future down 12.5 points (-0.29%) at 4274.5

- Nasdaq down 41.9 points (-0.3%) at 13195.97

- US 10-Yr yield is down 0.6 bps at 3.685%

- US Sep 10-Yr futures are up 2.5/32 at 113-29.5

- EURUSD up 0.0005 (0.05%) at 1.0713

- USDJPY down 0.32 (-0.23%) at 139.6

- WTI Crude Oil (front-month) up $0.27 (0.38%) at $72.02

- Gold is up $14.07 (0.72%) at $1962.08

- EuroStoxx 50 down 30.28 points (-0.7%) at 4293.24

- FTSE 100 down 7.29 points (-0.1%) at 7599.99

- German DAX down 87.34 points (-0.54%) at 15963.89

- French CAC 40 down 69.78 points (-0.96%) at 7200.91

US TREASURY FUTURES CLOSE

- 3M10Y +6.806, -163.166 (L: -171.839 / H: -162.214)

- 2Y10Y +1.697, -79.755 (L: -82.978 / H: -77.212)

- 2Y30Y +1.902, -59.857 (L: -65.16 / H: -56.813)

- 5Y30Y +1.546, 5.766 (L: -0.655 / H: 6.88)

- Current futures levels:

- Sep 2-Yr futures up 1.25/32 at 102-23 (L: 102-17 / H: 102-26.5)

- Sep 5-Yr futures up 2.25/32 at 108-22.25 (L: 108-08.5 / H: 108-27.5)

- Sep 10-Yr futures up 2.5/32 at 113-29.5 (L: 113-10 / H: 114-03.5)

- Sep 30-Yr futures up 1/32 at 127-31 (L: 126-25 / H: 128-08)

- Sep Ultra futures down 2/32 at 136-6 (L: 134-24 / H: 136-24)

US 10YR FUTURE TECHS: (U3) Bearish Engulfing Candle

- RES 4: 115-19 High May 18

- RES 3: 115-07+ 1.0% 10-dma Envelope

- RES 2: 115-04 50-day EMA

- RES 1: 114-03+ / 115-00 Intraday high / High Jun 1

- PRICE: 113-29 @ 1520 ET Jun 5

- SUP 1: 113-10 Low Jun 05

- SUP 2: 112-29+ Low May 26 / 30 and key support

- SUP 3: 112-16 76.4% retracement of the Mar 2 - May 4 rally

- SUP 4: 111-20+ Low Mar 10

Treasury futures faltered Friday and have extended the pullback from 115-00, the Jun 1 high. A rally into the close failed to materially alter the picture. This keeps focus on the bearish engulfing candle posted Friday, signaling the end of the recent recovery and suggesting potential for a continuation lower. Attention is on key short-term support and the bear trigger at 112-29+, the May 26 / 30 low. A break of this level would resume the downtrend since May 4. Key resistance is at 115-00, where a break is required to reinstate a bullish theme.

SOFR FUTURES CLOSE

- Jun 23 +0.010 at 94.733

- Sep 23 +0.015 at 94.785

- Dec 23 +0.035 at 95.080

- Mar 24 +0.050 at 95.535

- Red Pack (Jun 24-Mar 25) +0.035 to +0.060

- Green Pack (Jun 25-Mar 26) +0.030 to +0.035

- Blue Pack (Jun 26-Mar 27) +0.035 to +0.040

- Gold Pack (Jun 27-Mar 28) +0.030 to +0.040

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00935 to 5.15002 (-.01277 total last wk)

- 3M +0.02289 to 5.25323 (-.03340 total last wk)

- 6M +0.04226 to 5.28773 (-.05289 total last wk)

- 12M +0.06557 to 5.09254 (-.13117 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00086 to 5.06471%

- 1M +0.00200 to 5.19057%

- 3M +0.01285 to 5.0914 */**

- 6M +0.03986 to 5.66329%

- 12M +0.12228 to 5.77957%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.51671% on 5/31/23

- Daily Effective Fed Funds Rate: 5.08% volume: $141B

- Daily Overnight Bank Funding Rate: 5.06% volume: $309B

- Secured Overnight Financing Rate (SOFR): 5.07%, $1.475T

- Broad General Collateral Rate (BGCR): 5.05%, $609B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $600B

- (rate, volume levels reflect prior session)

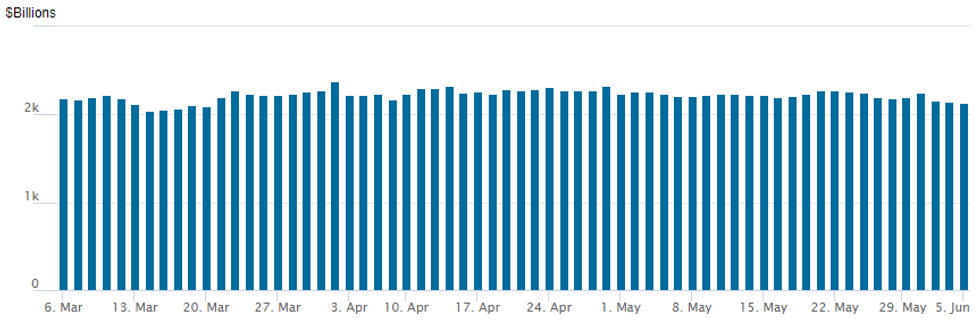

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,131.417B w/ 105 counterparties, compares to prior $2,142.102B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $3.5B Capital One 2Pt Outpaced $3.25B Truist, $2.5B John Deere

- At least $20.7B high-grade corporate bonds to price Monday, still waiting for Ford to launch.

- Date $MM Issuer (Priced *, Launch #)

- 06/05 $3.5B #Capital One $1.75B 6NC5 +248, $1.75B 11NC10 +268

- 06/05 $3.25B #Truist Financial $1.5B 4NC3 +193, $1.75B 11NC10 +218

- 06/05 $2.5B #Deere Capital $600M 2Y +50, $600M 3Y +65, $300M 3Y SOFR+79, $1B 7Y +95

- 06/05 $2.25B #Bank of Nova Scotia $1.1B 2Y +100, $400M $2Y SOFR+109, $750M 5Y +147

- 06/05 $1.75B #Macquarie $700M 3Y +110, $300M 3Y SOFR+124, $750M 11NC10 +220

- 06/05 $1.6B #Burlington Northern 30Y +130

- 06/05 $1.5B #Dollar General $500M 5Y +137, $1B 10Y +177

- 06/05 $1.5B #BNP Paribas 6NC5 +150

- 06/05 $1.35B #ANZ Bank 3Y SOFR+73

- 06/05 $800M #HP Enterprise $250M 2024 Tap +105, $550M 5Y +145

- 06/05 $700M #Northwestern Mutual 5Y +107

- 06/05 $Benchmark Ford Motor Cr 3Y, 3Y SOFR, 7Y

EGBs-GILTS CASH CLOSE: Bear Flattening Resumes

The German and UK curves continued Monday where they left off on Friday with more bear flattening, as dovish central bank hike prospects were reconsidered.

- While curve inversions continue to deepen, the market action of the past couple of sessions has contrasted with the bull flattening seen in the first half of last week amid softer-than-expected Eurozone inflation readings.

- With ECB and BoE peak rate prospects up 2-3bp on the day, Schatz and 2Y UK yields rose 8+bp and are up 19bp from last week's lows; for 10Ys, Bund is up 15bp from last week's low with Gilt up 11bp.

- Central bank commentary didn't move the needle (ECB's Lagarde, Vujcic, Nagel), while European Services/Composite PMIs were mixed (and mostly finals).

- A disinflationary US Services ISM report dragged down European yields in mid-afternoon, but they soon rebounded.

- Periphery EGB spreads were little changed. The BTP Valore retail bond saw strong orders on its first day of sale (over E5.4bln).

- Tuesday sees Eurozone retail sales and consumer survey, along with German factory orders.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8.7bps at 2.889%, 5-Yr is up 6.6bps at 2.403%, 10-Yr is up 6.9bps at 2.381%, and 30-Yr is up 5.6bps at 2.545%.

- UK: The 2-Yr yield is up 8.2bps at 4.445%, 5-Yr is up 6.7bps at 4.169%, 10-Yr is up 5.2bps at 4.208%, and 30-Yr is up 3.1bps at 4.511%.

- Italian BTP spread down 0.1bps at 175.7bps / Spanish down 0.8bps at 99.5bps

FOREX: DXY Hovers Around Unchanged As ISM Services PMI Takes Shine Off Greenback

- Early greenback strength on Monday, largely an extension of post-payrolls demand, dissipated in US hours as weaker US data took the shine off the renewed greenback optimism. USDJPY was the most impacted following the data, as has regularly been the case in recent times given the sensitivity to US yields.

- Lower than expected final S&P PMIs set the tone for the pair, with the downside move gaining traction through the overnight lows and then extending on the significant miss for ISM services index (52.4 vs 50.3 est.).

- After reaching as high as 140.45 in early Europe, USDJPY sank to a fresh low of 139.25 although around 50 pips of that move have been pared as we approach the APAC crossover.

- Bullish conditions remain intact with pullbacks appearing to be corrective at this juncture. Recent highs resulted in a test of the top of a bull channel, drawn from the Jan 16 low which intersects at 141.01 today and represents a key resistance. A clear break of it would reinforce bullish conditions and open 141.61, the Nov 23 2022 high. Key support to watch is 138.20, the 20-day EMA.

- Yen weakness beyond the 140.00 level has drawn increased verbal rhetoric from Japan authorities in recent weeks, so this will likely remain a focus point going forward if we see meaningful weakness beyond this figure level. Labour cash earnings and household spending data is due overnight. Final Q1 GDP figures will be released on Thursday, as well as April current account data.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/06/2023 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 06/06/2023 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 06/06/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/06/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 06/06/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/06/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/06/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/06/2023 | 1230/0830 | * |  | CA | Building Permits |

| 06/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/06/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/06/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.