-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 2-8 December

MNI POLITICAL RISK - Trump Targets BRICS w/New Tariff Threat

MNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI ASIA OPEN: July Hike Remains Likely After Soft June NFP

- MNI INTERVIEW: Resilient Jobs Mean Fed Can Tighten More-Kamin

- MNI BRIEF: Fed’s Goolsbee-More Moderate Rate Increases To Come

- MNI BRIEF: US Jobs Lowest In 2-1/2 Years, Jobless Rate Dips

- MNI Payrolls See A Rare Miss And Large Downward Revisions

US

FED: The Federal Reserve can tighten monetary policy further after employment figures Friday showed decent job growth and strong wage gains, ex-Fed board economist Steven Kamin told MNI.

- “It’s consistent with the Fed following through on its plans to raise interest rates further,” as outlined in its last Summary of Economic Projections, said Kamin. He spent 32 years at the Federal Reserve’s Board of Governors and was director of the Division of International Finance. “I’m happy to go with the SEP on this, so two more hikes.”

- U.S. employers added 209,000 jobs in June, lower than analysts expected and the weakest reading since December of 2020, as the unemployment rate eased to 3.6% and wage growth picked up, an outcome Kamin described as a "mixed bag."

- Minutes from the Fed’s June meeting this week revealed some officials had reservations about the decision to pause, and almost all expect rates to move higher this year. The Fed held rates steady at 5-5.25% but FOMC members raised their median expectation in the SEP to 5.6% by year end. For more see MNI Policy main wire at 1331ET.

FED: The Federal Reserve may need to tighten monetary policy a little bit further this year but has already done most of the work in raising interest rates to control inflation, Chicago Fed President Austan Goolsbee said Friday. "There are some more moderate increases to come. I'm still undecided" on July, he told CNBC in an interview.

- The U.S. job market remains strong but is showing signs of slowing down as it needs to do in order for the Fed to bring inflation back down to target. “We’re getting to a more sustainable pace which is what we need to do for inflation,” Goolsbee said after a Bureau of Labor Statistics employment report showed a weaker-than-expected rise of 209,000 new jobs in June.

- Goolsbee downplayed a rise in wage growth. “Wage data is not a leading indicator of where inflation is going to go. It’s a lagging indicator of inflation. Prices move first and then wages,” he said.

US DATA: U.S. employers added 209,000 jobs in June, lower than analysts expected and the weakest reading since December of 2020, as the unemployment rate eased to 3.6% and wage growth picked up.

- Wall Street had forecast payrolls growth of 225,000, a jobless rate of 3.6% and average hourly earnings of 0.3%. AHE grew 0.4% last month, bringing the year-on-year rate to 4.4%, a trend that will be concerning for Fed officials.

- Treasury futures rebound off lows after June employment data comes in softer than forecasted. Futures markets still expect the Fed to raise rates at its July meeting.

- June payrolls growth slowed from its average monthly gain of 280,000 over the year and employment in April and May were revised down by a combined 110,000. Employment continued to trend up in government, health care, social assistance, and construction.

- As measured by the household survey, employment rose a slightly higher 273,000 last month. The labor force participation rate (62.6%) and the employment-population ratio (60.3) were unchanged in June and remain below their pre-pandemic levels.

US TSYS: Curves Remain Steeper As Bonds Trim Gains Late

- Treasury futures trade mixed after the bell, bonds trimming gains late (USU3 -3 at 116-05 vs. 116-21.5 high) while curves hold steeper but off session highs (2s10s +7.403 at -88.587 vs. -86.662 high). Generally quiet second half.

- Treasury futures gapped higher after smaller than expected at June jobs gain of 209k (cons 230K) and the key initial takeaway is the -110k two-month revision (-33k for May (so still v strong at 306k) and -77k for April).

- Futures had reversed support/traded lower post-data w/ attention on strong labor market, AHE firm at +.4, workweek extended to 34.3 hours should keep the FED on track to hike at the next FOMC meeting on July 26 (92% priced in).

- Weakness was short lived as Treasury futures bounced off session lows, see-sawing back near post-Jobs data highs at the moment as focus turned back to moderating jobs gains (and down-revisions to the two prior releases) ahead of next Wednesday's CPI (MoM 0.3% est vs. 0.1% prior; YoY 3.1% vs. 4.1% prior).

- Projected rate hike(s) receded through year end again: September cumulative of +28.6bp (30.5 high) at 5.360%, November cumulative at 34bp (37.3 high) at 5.415%, December cumulative 29.3bp (34.4 high) at 5.368%. Fed terminal at 5.42% in Nov'23.

- The Federal Reserve may need to tighten monetary policy a little bit further this year but has already done most of the work in raising interest rates to control inflation, Chicago Fed President Austan Goolsbee said Friday. "There are some more moderate increases to come. I'm still undecided" on July, he told CNBC in an interview.

OVERNIGHT DATA

- US: Payrolls smaller than expected at 209k in June (cons 230K) and the key initial takeaway is the -110k two-month revision. The latter is split between -33k for May (so still v strong at 306k) and -77k for April.

- The 3-month average dipped from 247k to 244k, six-month still 278k. Also note the larger than expected govt contribution once again, private more muted at 149k (cons 200k) along with -98k two-month revision. 3mma of 196k.

- US JUN NONFARM PAYROLLS +209K; PRIVATE +149K, GOVT +60K

- US PRIOR MONTHS PAYROLLS REVISED: MAY +306K; APR +217

- US JUN AVERAGE HOURLY EARNINGS +0.4% Vs MAY +0.4%; +4.4% YOY

- US JUN AVERAGE WEEKLY HOURS 34.4 HRS

- US JUN UNEMPLOYMENT RATE 3.6%

- US DATA: AHE Unrounded - Jun'23 Small 0.4 for AHE (cons 0.3), May upward revision marginal

- Total AHE: M/M (SA): 0.359% vs. 0.360% in May; Y/Y (SA): 4.351% vs. 4.367% in May

- AHE Non-Supervisory: M/M (SA): 0.383% vs. 0.384% in May; Y/Y (SA): 4.722% vs. 4.856% in May

- CANADIAN JUNE JOBS +59.9K VS FORECAST +20K, PRIOR -17.3K

- CANADA JUN JOBLESS RATE 5.4% VS FORECAST 5.2%, PRIOR 5.2%

- CANADA FULL-TIME JOBS +109.6K, PART-TIME -49.8K

- CANADA HOURLY WAGES +4.2% YEAR-OVER-YEAR VS PRIOR +5.1%

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 3.17 points (0.01%) at 33926.67

- S&P E-Mini Future up 15.25 points (0.34%) at 4462.75

- Nasdaq up 84.7 points (0.6%) at 13764.1

- US 10-Yr yield is up 1.7 bps at 4.0456%

- US Sep 10-Yr futures are up 2.5/32 at 110-22

- EURUSD up 0.008 (0.73%) at 1.097

- USDJPY down 1.93 (-1.34%) at 142.14

- WTI Crude Oil (front-month) up $2.09 (2.91%) at $73.90

- Gold is up $15.58 (0.82%) at $1926.49

- EuroStoxx 50 up 13.51 points (0.32%) at 4236.6

- FTSE 100 down 23.56 points (-0.32%) at 7256.94

- German DAX up 74.86 points (0.48%) at 15603.4

- French CAC 40 up 29.59 points (0.42%) at 7111.88

US TREASURY FUTURES CLOSE

3M10Y +1.102, -132.752 (L: -143.275 / H: -128.336)

2Y10Y +8.068, -87.922 (L: -100.025 / H: -86.662)

2Y30Y +9.839, -89.19 (L: -101.663 / H: -85.993)

5Y30Y +5.329, -29.653 (L: -40.275 / H: -26.316)

Current futures levels:

Sep 2-Yr futures up 4.75/32 at 101-17.75 (L: 101-11.75 / H: 101-23)

Sep 5-Yr futures up 6.5/32 at 106-10.25 (L: 105-31.25 / H: 106-23)

Sep 10-Yr futures up 2.5/32 at 110-22 (L: 110-09.5 / H: 111-00)

Sep 30-Yr futures down 11/32 at 123-22 (L: 123-08 / H: 124-15)

Sep Ultra futures down 29/32 at 131-29 (L: 131-15 / H: 133-05)

US 10Y FUITURE TECHS: (U3) Shallow Bounce Despite Soft Payrolls

- RES 4: 113-23 50-day EMA

- RES 3: 112-23 20-day EMA

- RES 2: 112-12+ Low Jun 14

- RES 1: 111-15 High Jul 6

- PRICE: 110-24 @ 1240 ET Jul 7

- SUP 1: 110-05 Low Jul 6

- SUP 2: 110-00 Low Nov 9 2022 (cont)

- SUP 3: 109-14 Low Nov 8 2022 (cont)

- SUP 4: 109-10+ Low Nov 4 2022 (cont)

Treasury futures bounced Friday on the back of a weaker-than-expected payrolls release. The bounce saw prices recoup a small part of the Thursday decline, but the shallow recovery will limit any extension of a short-term rally. This keeps resistance intact and - for now - out of reach at 111-15. Price action earlier in the week strengthens bearish conditions and sets the scene for a continuation lower. This has opened the 110-00 handle next. Moving average studies are in bear-mode position, reinforcing current trend conditions. Initial firm resistance is seen at 112-12+, the Jun 14 low.

SOFR FUTURES CLOSE

- Sep 23 +0.020 at 94.585

- Dec 23 +0.045 at 94.620

- Mar 24 +0.070 at 94.840

- Jun 24 +0.095 at 95.185

- Red Pack (Sep 24-Jun 25) +0.060 to +0.095

- Green Pack (Sep 25-Jun 26) +0.015 to +0.045

- Blue Pack (Sep 26-Jun 27) -0.02 to +0.005

- Gold Pack (Sep 27-Jun 28) -0.06 to -0.035

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01222 to 5.17701 (+.03623/wk)

- 3M +0.01757 to 5.29847 (+.03011/wk)

- 6M +0.03354 to 5.41500 (+.03354/wk)

- 12M +0.07632 to 5.45445 (+.05763/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $119B

- Daily Overnight Bank Funding Rate: 5.07% volume: $269B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.573T

- Broad General Collateral Rate (BGCR): 5.04%, $583B

- Tri-Party General Collateral Rate (TGCR): 5.04%, $577B

- (rate, volume levels reflect prior session)

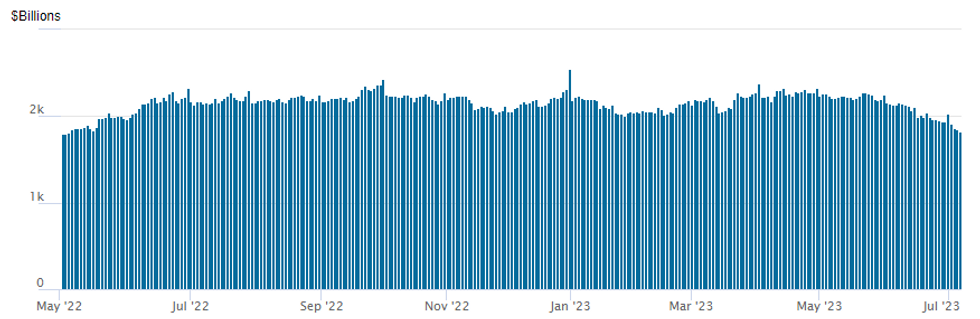

FED REVERSE REPO OPERATION: Continued Decline

NY Federal Reserve/MNI

The deluge in Treasury Bill issuance post debt ceiling postponement continues to sap NY Fed reverse repo usage. Latest operation shows $1,822.303B, lowest since early May'22, w/ 99 counterparties, compared to $1,854.256B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

FOREX: Greenback Sinks as NFP Falls Short of Heightened Expectations

- The June payrolls report disappointed those that had upped their expectations after a blowout ADP report just one day prior. Headline payrolls added 209k jobs across June, the lowest in over three years, and a solid revision lower for the May release also dampened the strength of the report.

- While the unemployment rate fell, markets marked down the pricing of the Fed tightening cycle this year, There continues to be circa 21-22bp priced for the Jul 26 decision, with the cumulative +35bp of hikes to a terminal of 5.43% in November trimmed slightly. Cuts into 2024 widened on the day, building to 55bps to Jun'24 and 125bp to Dec'24.

- This, allied with a pullback in the longer-end worked against the USD, which slipped against all others in G10.

- The USD Index made a convicing break through the 50-dma, hitting the lowest levels since late June to narrow the gap with key support at the mid-June low of 101.921. The JPY was one of the primary beneficiaries, pressuring USD/JPY to erase the entirety of the rally posted since Jun23.

- NOK performed well, rising against most others on the back of a bounce in risk as well as a rebound in the oil price. Moves in the NOK shrugged off near-term weakness evident in poor industrial production figures for May, turning focus to next week's CPI.

- US inflation takes primacy in the coming week, with markets expecting M/M headline and core to be propped up to 0.3%, but for Y/Y to post another sequential slowdown to 3.1% and 5.0% for headline and core respectively.

MONDAY/TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/07/2023 | 0730/0830 |  | UK | BOE Bailey Panels Rencontres Economiques | |

| 10/07/2023 | 0130/0930 | *** |  | CN | CPI |

| 10/07/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 10/07/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 10/07/2023 | - | *** |  | CN | Money Supply |

| 10/07/2023 | - | *** |  | CN | New Loans |

| 10/07/2023 | - | *** |  | CN | Social Financing |

| 10/07/2023 | 1230/0830 | * |  | CA | Building Permits |

| 10/07/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/07/2023 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 10/07/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 10/07/2023 | 1500/1100 |  | US | Cleveland Fed's Loretta Mester | |

| 10/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 10/07/2023 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 10/07/2023 | 1900/1500 | * |  | US | Consumer Credit |

| 10/07/2023 | 1900/2000 |  | UK | BOE Bailey Speech at Financial & Professional Services Dinner |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.