-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 22

MNI: PBOC Net Injects CNY76.7 Bln via OMO Monday

MNI ASIA OPEN: More Hikes Still Needed

- MNI: Some Fed Officials Wanted June 25 BP Hike - Minutes

- MNI US-CHINA: Yellen Travels To China Amid Critical Mineral Restrictions

- MNI US: "Bidenomics" Drive Could Backfire On White House

US

FED: Almost all Federal Reserve policymakers agree further interest rate hikes will likely be needed this year, and some even wanted to raise them in June despite ultimately deciding unanimously to hold steady for the first time since March 2022, according to minutes from the central bank's late released Wednesday.

- "Almost all participants noted that in their economic projections that they judged that additional increases in the target federal funds rate during 2023 would be appropriate," the report said.

- “Some participants indicated that they favored raising the target range for the federal funds rate 25 basis points at this meeting or that they could have supported such a proposal.” For more see MNI Policy main wire at 1400ET.

US: President Biden and key members of his cabinet will be dispatched across the country over the next 72 hours to tout the successes of Biden's manufacturing and infrastructure investment agenda which the White House calls “Bidenomics.”

- Today: EPA Administration Michael Regan will speak on lead pipes in Michigan.

- Tomorrow: President Biden will travel to South Carolina to deliver remarks on clean energy manufacturing. Vice President Kamala Harris will deliver remarks in Arizona on water infrastructure. Interior Secretary Deb Haaland, Health and Human Services Secretary Xavier Becerra, and Transportation Secretary Pete Buttigieg will be in New York, Ohio, and Washington State respectively to discuss offshore wind, seniors health care, and infrastructure grants.

- On Friday, Biden will deliver another speech on two of his policy initiatives – lowering prescription drug prices for seniors and ‘junk fees.’

- The locations for the events have been carefully selected to promote government investment projects in swing states ahead the 2024 general election but some analysts have warned that a stubbornly pessimistic voter view of the economy may provide Republicans opportunity to link "Bidenomics" with inflation and high energy prices.

US: US Treasury Secretary Janet Yellen will arrive in Beijing tomorrow for her first visit to China since assuming the Treasury top job two years ago.

- Her visit comes amid another period of turbulence which has seen China make its first significantly counterplay to US-led chip restrictions by announcing export controls on Germanium and Gallium - two critical and strategic minerals essential to electric vehicle and semiconductor tech.

- Yellen will be tasked with finding areas of economic common grounds and prising open reliable channels of communication with the new Chinese economic team which may lay the groundwork for more productive future cabinet-level meetings.

- US and Chinese officials and analysts have cautioned against expecting any major breakthroughs. Wu Xinbo, at Fudan University in Shanghai, said this week: "Even if her visit does not solve specific issues, it can improve the atmosphere and allow more rational voices within the administration to surface."

- Yellen will be further tasked with convincing Beijing that measures to restrict China's access high-tech components are in the interest of US national security rather than designed to restrain China's economic growth, an assertion which Beijing has publicly rejected.

US TSYS: Little React to June FOMC Minutes, Rates Near Lows

- US rates finished broadly weaker, near late session lows Wednesday, as attention quickly turned to employment data (ADP early Thu, NFP Fri) that drove yields higher in the run up to the June FOMC minutes is back in focus. ADP Employment Change 225k est vs. 278k prior; Change in Nonfarm Payrolls 225k est vs. 339k prior.

- "Almost all participants noted that in their economic projections that they judged that additional increases in the target federal funds rate during 2023 would be appropriate," the report said. “Some participants indicated that they favored raising the target range for the federal funds rate 25 basis points at this meeting or that they could have supported such a proposal.”

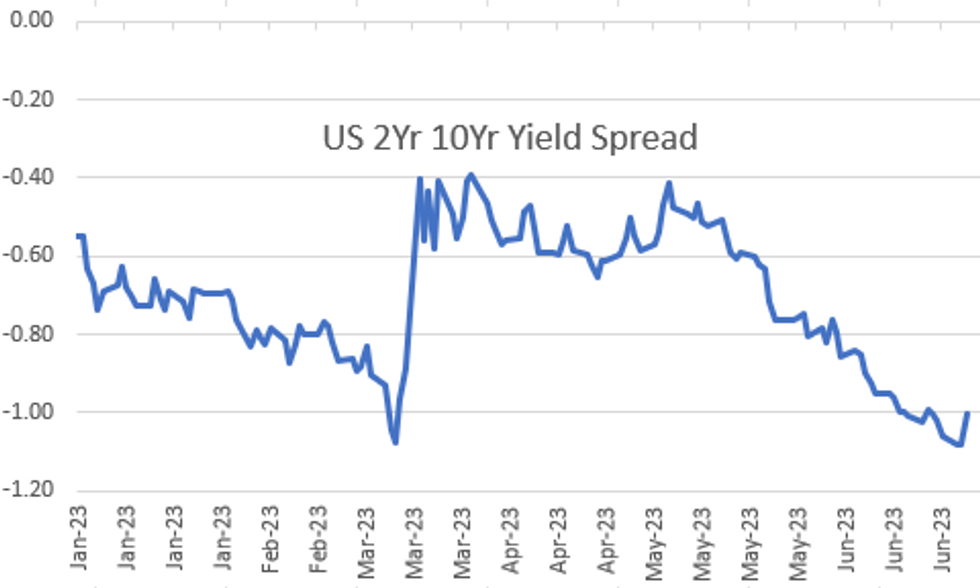

- Front month 10Y futures just marked 111-10.5 low (-19.5; yld 3.9434% high) before bouncing to 111-13 after the bell. Key technical support remains at 110-27+, the Mar 2 low. Curves remain steeper with short end rates outperforming (2s10s +7.831 at -100.717).

- There has been very little change in implied Fed rates with the dust settled on the FOMC minutes, which revealed that “some” participants favored hiking 25bps last month or could have supported such a proposal.

- FOMC-dated OIS sits with a 21.5bp hike for the Jul 26 decision, building to a cumulative 33bp of hikes to a terminal 5.40% in November, before 4bp of cuts to year-end and 51bp of cuts to Jun’24.

OVERNIGHT DATA

- US REDBOOK: JUN STORE SALES +0.6% V YR AGO MO

- US REDBOOK: STORE SALES +0.7% WK ENDED JUL 01 V YR AGO WK

- US MAY FACTORY ORDERS +0.3%; EX-TRANSPORT NEW ORDERS -0.5%

- US MAY DURABLE ORDERS +1.8%

- US MAY NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.7%

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 101.57 points (-0.3%) at 34285.9

- S&P E-Mini Future down 3.75 points (-0.08%) at 4485.25

- Nasdaq down 3.1 points (0%) at 13804.76

- US 10-Yr yield is up 9.1 bps at 3.9454%

- US Sep 10-Yr futures are down 19/32 at 111-11

- EURUSD down 0.0025 (-0.23%) at 1.0855

- USDJPY up 0.22 (0.15%) at 144.64

- WTI Crude Oil (front-month) up $2.2 (3.15%) at $71.93

- Gold is down $9.7 (-0.5%) at $1916.79

- EuroStoxx 50 down 40.28 points (-0.92%) at 4350.71

- FTSE 100 down 77.62 points (-1.03%) at 7442.1

- German DAX down 101.59 points (-0.63%) at 15937.58

- French CAC 40 down 59.12 points (-0.8%) at 7310.81

US TREASURY FUTURES CLOSE

- 3M10Y +10.011, -141.203 (L: -156.675 / H: -141.005)

- 2Y10Y +7.388, -101.16 (L: -107.132 / H: -99.83)

- 2Y30Y +6.517, -101.159 (L: -104.541 / H: -98.826)

- 5Y30Y +1.483, -31.283 (L: -31.553 / H: -22.331)

- Current futures levels:

- Sep 2-Yr futures down 1.375/32 at 101-16.75 (L: 101-16.5 / H: 101-24.5)

- Sep 5-Yr futures down 8.75/32 at 106-18.25 (L: 106-17.75 / H: 107-08.5)

- Sep 10-Yr futures down 19/32 at 111-11 (L: 111-10.5 / H: 112-12.5)

- Sep 30-Yr futures down 1-13/32 at 125-7 (L: 125-05 / H: 127-07)

- Sep Ultra futures down 1-22/32 at 134-6 (L: 134-02 / H: 136-23)

US 10YR FUTURE TECHS: (U3) Weakness Resumes

- RES 4: 115-00 High Jun 1 and a reversal trigger

- RES 3: 114-06+ High Jun 6

- RES 2: 113-30+/114-00 50-day EMA / High Jun 13

- RES 1: 112-21/113-18 Low Jun 22 / High Jun 15 and key resistance

- PRICE: 111-12 @ 1445 ET Jul 5

SUP 1: 111-20+ Low Jul 05SUP 2: 111-14+ Low Mar 9- SUP 3: 110-27+ Low Mar 2 and key support

- SUP 4: 110-00 Low Nov 9 2022 (cont)

Treasury futures continue to deteriorate, keeping the outlook negative for now. This extends the extension lower from last week, keeping the contract at recent lows. Support at 112-12+, the Jun 14 low, has been cleared. This marked the end of a period of consolidation and confirms a resumption of the current downtrend. The focus is on 111-14+, the Mar 9 low, while further out, scope is seen for a move towards 110-27+, the Mar 2 low and key support. Initial firm resistance is seen at 113-18, the Jun 15 high.

SOFR FUTURES CLOSE

- Sep 23 +0.005 at 94.60

- Dec 23 +0.015 at 94.635

- Mar 24 +0.005 at 94.840

- Jun 24 -0.020 at 95.155

- Red Pack (Sep 24-Jun 25) -0.07 to -0.035

- Green Pack (Sep 25-Jun 26) -0.10 to -0.085

- Blue Pack (Sep 26-Jun 27) -0.115 to -0.105

- Gold Pack (Sep 27-Jun 28) -0.115 to -0.11

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00293 to 5.14533 (+.06004 total last wk)

- 3M +0.00802 to 5.27676 (+.03768 total last wk)

- 6M +0.00087 to 5.38174 (+.06243 total last wk)

- 12M +0.01327 to 5.38481 (+.12649 total last wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $124B

- Daily Overnight Bank Funding Rate: 5.07% volume: $259B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.579T

- Broad General Collateral Rate (BGCR): 5.05%, $575B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $565B

- (rate, volume levels reflect prior session)

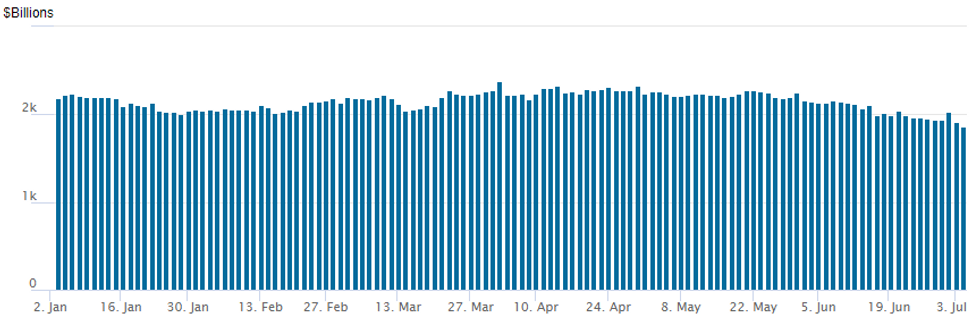

FED Reverse Repo Operation

NY Federal reserve/MNI

NY Fed reverse repo usage falls to $1,867.061B, lowest since May'22, w/ 102 counterparties, compared to $1,909.639B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $1.5B Nomura 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/05 $2.5B #BFCM $1.4B 3Y +130, $350M 3Y SOFR+140, $750M 5Y +155

- 07/05 $1.75B #American Honda $950M 3Y +70, $800M 5Y +90

- 07/05 $1.5B #Nomura $900M 5Y +183, $600M 10Y +215

- 07/05 $Benchmark IFC 5Y SOFR+35a

- 07/05 $Benchmark Shinhan Financial 5Y investor calls

EGBs-GILTS CASH CLOSE: Selloff Defies Soft Eurozone Data (Again)

Bunds and Gilts reversed an intraday rally to finish lower Wednesday, with weakness accelerating into the cash close as the UK and German core curves bear steepened.

- The biggest data of the day appeared mostly dovish. French and Spanish industrial production on the one hand were above-expected, but the more important Spanish and Italian services PMIs disappointed, and an ECB survey showed a continued decline in eurozone consumers' 1-year inflation expectations.

- The release of downwardly revised Eurozone Composite final PMI alongside the soft ECB survey helped boost EGBs briefly, but other than that there was a lack of overt triggers for the weakness. That dynamic was similar to Monday's bear flattening on weak manufacturing PMI.

- One factor potentially weighing was plenty of supply looming Thursday including 10/20/30-year French OATs, 6/10/50-year Spanish Oblis.

- Overall UK instruments underperformed, with BoE terminal Bank Rate pricing hitting a fresh high above 6.4%. BTP spreads tightened, reversing Tuesday's widening (which was the biggest daily move in 2 months).

- Thursday's docket includes the BOE's decision maker panel survey, German factory orders and Eurozone retail sales.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.5bps at 3.236%, 5-Yr is up 0.9bps at 2.61%, 10-Yr is up 2.5bps at 2.478%, and 30-Yr is up 4.2bps at 2.49%.

- UK: The 2-Yr yield is up 5.8bps at 5.377%, 5-Yr is up 9bps at 4.778%, 10-Yr is up 7.8bps at 4.494%, and 30-Yr is up 6.6bps at 4.488%.

- Italian BTP spread down 5.7bps at 168.9bps / Spanish up 3.8bps at 105.4bps

FOREX: Higher Yields Through London Close Fuel USD Rebound

- The greenback started the European session generally firmer, but faded across the morning before a run higher for US yields helped underpin the currency and stage a solid bounce through the London close. The US 10y yield showed back above 3.90%, hitting the highest level since early March and dragging the greenback along with it.

- The firming USD was more notable against high beta currencies, helping tip AUD/USD back through the 200-, 100- and 50-dmas all touched on Wednesday. Prices are now chewing through the corrective bounce off 0.6596, which marks a key level for any further breakout lower.

- AUD/USD options markets were also among the few seeing above-average volumes, largely due to solid demand for downside hedges. Local media also continues to speculate on the identity of the next RBA governor after Lowe's term expires in September. An announcement is expected within two weeks, and current Treasury Secretary Kennedy is among the frontrunners, according to reports.

- USD/CNH traded firmer, bucking the trend observed since the beginning of the week. The moves come despite more pressure on large commercial banks to trim their rates on USD deposit facilities, with local media also stressing the availability of tools to ensure FX stability. Nonetheless, USD/CNH traded back above 7.26, narrowing the gap with the first topside level of 7.2857.

- Focus for the Thursday session initially turns to Australian trade balance data, and German factory orders ahead of a slew of US releases: ADP Employment Change, ISM Services and weekly jobless claims are all on the docket. Fed's Logan and ECB's Nagel are also set to make appearances.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/07/2023 | 0130/1130 | ** |  | AU | Trade Balance |

| 06/07/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/07/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/07/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/07/2023 | 0830/0930 |  | UK | BOE DMP Survey | |

| 06/07/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/07/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 06/07/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 06/07/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/07/2023 | 1230/0830 | ** |  | US | Wholesale Trade |

| 06/07/2023 | 1245/0845 |  | US | Dallas Fed's Lorie Logan | |

| 06/07/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 06/07/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/07/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 06/07/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 06/07/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 06/07/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/07/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.