-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY248 Bln via OMO Tuesday

MNI Eurozone Inflation Insight – November 2024

MNI ASIA OPEN: No Hints From Weekly Claims Ahead Nov Jobs Data

- MNI US Payrolls Preview: Looking Beyond The Post-Strike Boost

- MNI BoC Review, Dec'23: Waiting For January, Unless Gravelle Surprises

- MNI INTERVIEW: ECB Hawks Fly Away As Germany Slows-Wyplosz

- MNI Initial Claims In Line, Continuing Claims Retrace Particularly Swift Increase

US

US NFP Preview: Bloomberg consensus sees nonfarm payrolls growth of 186k in November, up from the 150k in October owing to a 38k fewer striking workers meaning strike adjusted gains should trend lower.

- AHE is seen accelerating a tenth from the 0.2% M/M in October, but elsewhere consensus mostly looks for a consolidation of October’s softening.

- That includes an unemployment rate of 3.9% which would see greater likelihood of the FOMC raising its near-term unemployment forecast next week, although there is a mild analyst skew to a lower rate.

- We expect large sensitivity to surprises in either direction but perhaps asymmetrical risk of a stronger report which sees markets question whether the five cuts priced for 2024 is excessive, at least for now.

NEWS

BoC Review Dec'23 (MNI): Waiting For January, Unless Gravelle Surprises

The BoC left its overnight rate unchanged at 5% as heavily expected. More notably it didn’t drop its explicit hiking bias but that has done little for already large cut expectations for 2024 with the start date still seen with the April meeting.

INTERVIEW (MNI): ECB Hawks Fly Away As Germany Slows-Wyplosz

The sharp deterioration of Germany’s economy has prompted a sudden about-face by hawks at the European Central Bank, which now looks likely to start cutting rates before the Federal Reserve, by as early as the first quarter and perhaps in 50-basis-point increments, prominent economist Charles Wyplosz told MNI.

US (MNI): Window For Passing Ukraine Aid Tightens Ahead Of Holiday Recess

Erik Wasser as Bloomberg reporting on X: "Lawmakers tell me there is no way House will pass Ukraine aid in 2023. [House Speaker Mike Johnson (R-LA)] is firm on House leaving by Dec. 15 and no Senate deal in sight."

US (MNI): White House Refuses To Rule Out Reapplication Of Sanctions On Venezuela

White House National Security Council Spokesperson John Kirby has told reporters that he's, "not in a position to rule anything in or out," regarding the reapplication of sanctions on Venezuela's oil sector following what appears to be non-compliance with the terms of the deal struck in October.

US (MNI): Mexico To Establish Assessment Body On Foreign Investment

US Treasury Secretary Janet Yellen and her Mexican counterpart Rogelio Ramírez de la O have announced their, "intention to establish a bilateral working group between the United States and Mexico on foreign investment review."

SECURITY (MNI): Raisi And Putin Meet In Moscow, Iran To Deepen Cooperation With EAEU

Wires carrying comments from Iranian President Ebrahim Raisi ahead of a bilateral meeting with Russian President Vladimir Putin in Moscow.

US TSYS Markets Roundup: Inside Range, Tsys Pare Midday Gains Ahead NFP

- Treasury futures drifted off midday highs, holding to a narrow session range amid robust two-way trade ahead Friday's November employment data.

- Tsys saw delayed bid this morning after in-line weekly jobless claims data spurred buying/short covering: Initial Jobless Claims comes out in-line with expectations: 220k vs. 220k est, 219k prior revised from 218k), Continuing Claims lower than expected: 1.861M vs. 1.910M est, 1.925M prior/revised.

- Mar'24 10Y futures currently trading 111-03 last, -1.5 vs. 111-09.5 intraday high. Initial technical support well below at 109-16.5 20-day EMA. Curves steeper but off highs (3M10Y +2.133 at -128.917; 2Y10Y +1.625 at -47.473).

- Desks looking for FX tie-in after Japanese Yen extended rally overnight amid hawkish rate hike expectations from the BOJ on December 18. No obvious headline as $/Yen below 142.0 briefly vs. 147.30 overnight high.

- Focus remains on tomorrow's employment data for November after this week's lower than expected JOLTS and ADP data rekindled early 2024 rate cut projections. Bloomberg consensus sees nonfarm payrolls growth of 186k in November, up from the 150k in October owing to a 38k fewer striking workers meaning strike adjusted gains should trend lower.

OVERNIGHT DATA

US DATA: Initial jobless claims were exactly as expected in the week to Dec 2, at a seasonally adjusted 200k (cons 220k) after a fractionally upward revised 219k (initial 218k).

- The four-week average has held at 220-221k for four weeks now, above the low 200s in October but only back to very similar levels to the 2019 average.

- Continuing claims meanwhile were solidly lower than expected in the week to Nov 25 at a seasonally adjusted 1861k (cons 1910k) after 1925k (initial 1927k), reversing a majority of the particularly sharp 84k increase from the week prior.

- It could well be some unwinding of the prior week which saw a seasonal adjustment process that looked to have biased SA continuing claims too high. The overall trend of higher continuing claims and the implied reduced labor market churn remains in place.

US OCT. WHOLESALE SALES FALL 1.3% M/M; EST. +1.0%

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 57.29 points (0.16%) at 36113.11

- S&P E-Mini Future up 31 points (0.68%) at 4587.25

- Nasdaq up 173.6 points (1.2%) at 14322.05

- US 10-Yr yield is up 2.3 bps at 4.1267%

- US Mar 10-Yr futures are up 0.5/32 at 111-5

- EURUSD up 0.0035 (0.33%) at 1.0799

- USDJPY down 3.87 (-2.63%) at 143.45

- WTI Crude Oil (front-month) up $0.11 (0.16%) at $69.49

- Gold is up $4.45 (0.22%) at $2029.97

- European bourses closing levels:

- EuroStoxx 50 down 9.49 points (-0.21%) at 4473.77

- FTSE 100 down 1.66 points (-0.02%) at 7513.72

- German DAX down 27.45 points (-0.16%) at 16628.99

- French CAC 40 down 7.47 points (-0.1%) at 7428.52

US TREASURY FUTURES CLOSE

- 3M10Y +3.651, -127.399 (L: -131.859 / H: -122.973)

- 2Y10Y +3.975, -45.123 (L: -48.908 / H: -43.346)

- 2Y30Y +4.492, -33.579 (L: -38.45 / H: -31.421)

- 5Y30Y +2.016, 12.916 (L: 9.682 / H: 13.977)

- Current futures levels:

- Mar 2-Yr futures up 1.375/32 at 102-15.375 (L: 102-11.625 / H: 102-16.375)

- Mar 5-Yr futures up 1.25/32 at 107-19.5 (L: 107-10.5 / H: 107-22.5)

- Mar 10-Yr futures steady at at 111-4.5 (L: 110-23 / H: 111-09.5)

- Mar 30-Yr futures down 10/32 at 120-8 (L: 119-20 / H: 120-25)

- Mar Ultra futures down 14/32 at 128-18 (L: 127-24 / H: 129-10)

US 10Y FUTURE TECHS: (H4) Heading North

- RES 4: 112-16 1.50 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 112-03 1.382 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 2: 111-19 1.236 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 1: 111-09+ Intraday high

- PRICE: 111-04+ @ 1500 ET Dec 7

- SUP 1: 109-16+ 20-day EMA

- SUP 2: 108-18+ Low Nov 27 and a key short-term support

- SUP 3: 107-22 Low Nov 14

- SUP 4: 107-11+ Low Nov 13 and a reversal trigger

The trend direction in Treasuries remains up and the contract is trading closer to its recent highs. The contract has cleared 110-25, the 1.00 projection of the Oct 19 - Nov 3 - Nov 13 price swing. This reinforces the bull theme and a continuation higher would open 111-19, the 1.236 projection. Note that moving average studies are also in a bull-mode position. Initial key support is at 108-18+, the Nov 27 low.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 +0.003 at 94.633

- Mar 24 +0.010 at 94.895

- Jun 24 +0.030 at 95.260

- Sep 24 +0.040 at 95.630

- Red Pack (Dec 24-Sep 25) +0.025 to +0.040

- Green Pack (Dec 25-Sep 26) steady to +0.015

- Blue Pack (Dec 26-Sep 27) -0.005 to steady

- Gold Pack (Dec 27-Sep 28) -0.01 to steady

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00843 to 5.35739 (+0.01073/wk)

- 3M -0.00830 to 5.37183 (-0.00340/wk)

- 6M -0.00848 to 5.30158 (-0.03932/Wk)

- 12M -0.00289 to 5.02927 (-0.08914/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (-0.01), volume: $1.707T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $609B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $596B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $103B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $253B

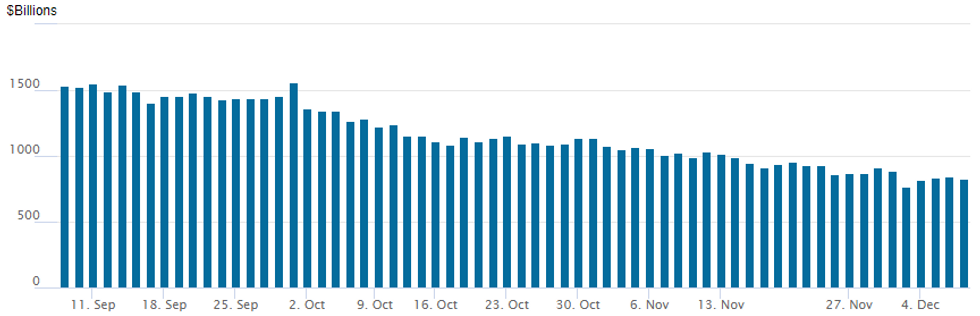

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage recedes to $825.734B w/ 83 counterparties vs. $846.498B yesterday. Operation usage fell to the lowest level since early July 2021 of $768.543B on December 1. Usage fell below $1T for the first time since August 2021 last on November 9 ($993.314B).

PIPELINE $1B Republic Services 2Pt Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 12/07 $1B #Republic Services $350M 2029 tap +75, $650M 10Y +95

- 12/07 $600M #Athene 10Y +200

- $4B Priced Wednesday

- 12/06 $2B *RBC 3Y SOFR+53

- 12/06 $1B *America Electric Power (AEP) 5Y +112.5

- 12/06 $Benchmark Athene investor calls

EGBs-GILTS CASH CLOSE: Gilts Underperform As Rally Steadies Out

European yields were little changed Thursday, a contrast to the large rally in the previous two sessions, with Gilts underperforming Bunds.

- The session began with global core FI on the back foot, as Japanese yields spiked on senior BoJ officials implying they were eyeing an exit to negative rate policy.

- A weak German industrial production report helped yields reverse lower, though the rally had mostly petered out by midday.

- Afternoon trade was mixed, with US jobs data not really moving the needle, ahead of Friday's key US employment report.

- Periphery EGB spreads reversed early tightening and closed modestly wider, led by Greece.

- Friday's session brings a fairly limited European schedule, with an appearance by ECB's Muller and German final inflation the early highlights.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.4bps at 2.596%, 5-Yr is down 2.8bps at 2.137%, 10-Yr is down 0.9bps at 2.191%, and 30-Yr is up 2.9bps at 2.402%.

- UK: The 2-Yr yield is up 2.3bps at 4.517%, 5-Yr is up 2.7bps at 4.029%, 10-Yr is up 2.5bps at 3.968%, and 30-Yr is up 1.1bps at 4.46%.

- Italian BTP spread up 1.1bps at 174.6bps / Greek up 2bps at 118.3bps

FOREX USDJPY Declines 2.65%, Briefly Trades Below 142.00 Amid Ongoing BOJ Speculation

- Thursday’s moves in currency markets were dominated by the Japanese Yen strength. Initial JPY demand was triggered by the cumulative effect of appearances from BoJ's Himono and Ueda, both of which strongly suggested that the BoJ are already considering how to exit NIRP once economic conditions justifying a policy switch are met. A poorly received longer-end JGB auction added to the early JPY impetus.

- Throughout the session, JPY dips remained shallow, and the path of least resistance remained lower for USDJPY as markets continued to speculate over the BOJ and liquidity was tested ahead of tomorrow’s US employment report. Session ranges were already notable through to the Europe close with USDJPY breaching below 144.50 from an overnight high of 147.32. However, a sharp bout of further weakness for the pair was triggered as the sell-off gathered momentum, with a confluence of technical levels being breached amid very thin trade. Bloomberg recorded the low as 141.71, an impressive 3.8% from the day’s peak, before markets stabilised and USDJPY came to rest around 143.50, still down 2.65% on the session.

- In a day dominated by the JPY volatility in currency markets, the greenback broadly traded on the backfoot with some softer US data assisting the USD weakness. This has prompted the DXY to unwind the majority of the week’s climb, declining around 0.65% on the session.

- More constructive price action for the major equity benchmarks have underpinned the likes of AUD and NZD, which have also performed well. AUDUSD has risen back above 0.6600 after overnight lows closely matched the previous breakout zone around 0.6525.

- All focus for global markets will be on tomorrow’s US non-farm payrolls release. Bloomberg consensus sees nonfarm payrolls growth of 186k in November, up from the 150k in October owing to a 38k fewer striking workers meaning strike adjusted gains should trend lower.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/12/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 08/12/2023 | 0700/0800 | ** |  | SE | Private Sector Production m/m |

| 08/12/2023 | 0730/0830 |  | EU | ECB's De Guindos participates in ECOFIN meeting | |

| 08/12/2023 | 0930/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 08/12/2023 | 1330/0830 | *** |  | US | Employment Report |

| 08/12/2023 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 08/12/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/12/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.