-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Oil Injected Volatility

EXECUTIVE SUMMARY

US

FED: Federal Reserve President Mary Daly said Monday the battle against rapid inflation is far from done and she's willing to hike the policy interest rate past 5% if needed.

- "We need to focus on really getting the job done," she told reporters after a speech. “It is way too early to call a turning point on inflation.” Any weakness in headline inflation based on gasoline prices could be misleading and core indexes of goods and services prices are a better guide, she said.

- “I would be more on the hawkish side” on hikes, adding she doesn’t like that particular word. “Inflation is a regressive tax” that must be contained, she said. Daly referenced comments made after her speech expecting fed funds to go to 5% and it could end up a quarter point above or below depending on data.

FED: The Federal Reserve needs to continue with rate hikes to bring down inflation while being careful not to ignore the drag from past tightening and signs price gains are moderating, San Francisco President Mary Daly said Monday.

- "We want to go far enough that we get the job done. That’s the resolute part. But not so far that we overdo it. And that’s the mindful part," Daly said in a speech to the Orange County Business Council in Irvine, Calif.

- Daly said the last 75bp rate hike to 3.75%-4% makes policy “modestly restrictive relative to the neutral rate of interest. And we have signaled that there is more work to do.” Her remarks didn't indicate the size of the rate hike needed at the next meeting. For more see MNI Policy main wire at 1300ET.

- As usual, the minutes could prove somewhat stale in some areas. Several FOMC officials have spoken since the meeting, much of it coming since the softer-than-expected October CPI print, which has mostly cemented pricing for a 50bp hike at the next meeting as opposed to 75bp.

- Barring a surprise in communications on that front (perhaps even merely reiterating what Powell said, that a stepdown could take place at one of the next two meetings, rather than specifically December), the discussion in the minutes over the terminal rate expectation and how long rates will be held there will be closely focused upon.

- The general expectation is that the FOMC will eye a terminal rate of at least 4.75-5.00% in the next Dot Plot (vs 4.50-4.75% last time); the risks are to a >5% rate to be signalled. Though how explicit that is made in the minutes is doubtful.

- In line with recent FOMC speaker communications, expect some pushback against the notion that a step-down to 50bp is a prelude to a pause, let alone a full-blown pivot.

- Likewise there is likely some pushback on market pricing for cuts next year - with this debate potentially characterized by the number of participants who saw the risks of over- vs under-tightening turning increasingly "two-sided" (this was "several" in the Sept minutes), how the lagged impact of tightening is characterized, and what constitutes "sufficiently restrictive" rates.

US TSYS: FI/EQ Support Evaporates as Saudis Deny Production Increase Talk

Tsys mildly weaker - back near opening levels before breaking narrow range/rallied higher earlier w/ equities following WSJ write-up that "Saudi Arabia and other OPEC members are reportedly considering production increases of up to 500K BPD."- Stocks gained and crude prices fell appr $4.5/bbl for a couple hours until Saudi officials denied headlines of a production hike - FI and equity support evaporating.

- Tsys had been holding near session highs after the $42B 2Y Note auction (including $45B 26W bills) stopped out: 4.505% high yield vs. 4.512% WI; 2.64x bid-to-cover vs. 2.59x prior.

- Tsy futures holding near session lows (shifted lower on crude oil production cut denial from Saudis) after $43B 5Y note auction (91282CFZ9) small tail: 3.974% high yield vs. 3.970% WI; 2.39x bid-to-cover vs. 2.48x the prior month. (Tsy auctions front ended ahead Thursday Thanksgiving holiday closure (full session Wednesday, Friday 1200ET close/1215ET Globex).

- Deceptively robust futures volumes at noon: TYZ2>1.5M due to pick-up in rolling to Mar'23 futures ahead next week's first notice on Wed, Nov 30.

OVERNIGHT DATA

- Oct. Chicago Fed National Activity Index at -0.05 vs 0.17 Prior

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 23.05 points (-0.07%) at 33722.91

- S&P E-Mini Future down 15.75 points (-0.4%) at 3958.75

- Nasdaq down 114.5 points (-1%) at 11032.2

- US 10-Yr yield is up 0.6 bps at 3.8344%

- US Dec 10Y are down 2.5/32 at 112-7

- EURUSD down 0.0087 (-0.84%) at 1.0238

- USDJPY up 1.7 (1.21%) at 142.08

- WTI Crude Oil (front-month) down $0.35 (-0.44%) at $79.73

- Gold is down $13.07 (-0.75%) at $1737.63

- EuroStoxx 50 down 15.56 points (-0.4%) at 3909.28

- FTSE 100 down 8.67 points (-0.12%) at 7376.85

- German DAX down 51.93 points (-0.36%) at 14379.93

- French CAC 40 down 10.01 points (-0.15%) at 6634.45

US TSY FUTURES CLOSE

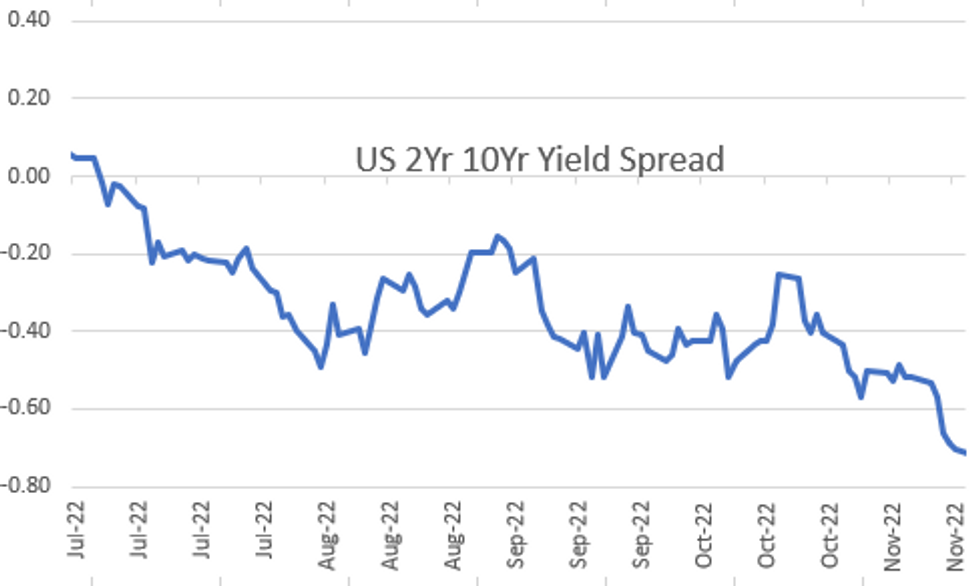

- 3M10Y +2.859, -39.471 (L: -51.394 / H: -38.25)

- 2Y10Y -0.955, -72.003 (L: -75.741 / H: -69.8)

- 2Y30Y -2.832, -64.165 (L: -66.791 / H: -59.502)

- 5Y30Y -2.194, -10.793 (L: -11.76 / H: -6.511)

- Current futures levels:

- Dec 2Y down 2.25/32 at 102-2.875 (L: 102-02.625 / H: 102-06.125)

- Dec 5Y down 4/32 at 107-16.25 (L: 107-15.75 / H: 107-27.5)

- Dec 10Y down 2.5/32 at 112-7 (L: 112-04 / H: 112-23)

- Dec 30Y down 3/32 at 125-11 (L: 125-07 / H: 126-13)

- Dec Ultra 30Y up 8/32 at 133-9 (L: 132-28 / H: 134-15)

(Z2) Corrective Pullback

- RES 4: 115-14+ 50.0% retracement of the Aug 2 - Oct 21 downleg

- RES 3: 114-17 High Sep 20

- RES 2: 113-30 High Oct 4 and a key resistance

- RES 1: 113-11 High Nov 16

- PRICE: 112-14 @ 1515 GMT Nov 21

- SUP 1: 111-20/110-12+ 20-day EMA / Low Nov 10

- SUP 2: 109+10+ Low Nov 04

- SUP 3: 108-26+ Low Oct 21 and the bear trigger

- SUP 4: 108-06+ Low Oct 2007 (cont)

The short-term trend condition in Treasury futures is bullish and the latest retracement appears to be a correction. Recent gains have resulted in a break of 112-13+, the 50-day EMA. A continuation higher would strengthen current bullish conditions and open 113-30, the Oct 4 high and a key resistance. On the downside, initial firm support is at 111-20, the 20-day EMA. A break of this average would signal scope for a deeper retracement.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.005 at 95.010

- Mar 23 -0.025 at 94.725

- Jun 23 -0.035 at 94.670

- Sep 23 -0.055 at 94.840

- Red Pack (Dec 23-Sep 24) -0.05 to -0.025

- Green Pack (Dec 24-Sep 25) -0.04 to -0.03

- Blue Pack (Dec 25-Sep 26) -0.04 to -0.025

- Gold Pack (Dec 26-Sep 27) -0.015 to -0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00071 to 3.81143% (-0.00272 total last wk)

- 1M +0.02229 to 3.97900% (+0.07142 total last wk)

- 3M +0.02700 to 4.69186% (+0.03872 total last wk) * / **

- 6M +0.02886 to 5.17157% (+0.05871 total last wk)

- 12M 0.05643 to 5.56586% (+0.05814 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.69186% on 11/21/22

- Daily Effective Fed Funds Rate: 3.83% volume: $102B

- Daily Overnight Bank Funding Rate: 3.82% volume: $283B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.037T

- Broad General Collateral Rate (BGCR): 3.76%, $411B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $400B

- (rate, volume levels reflect prior session)

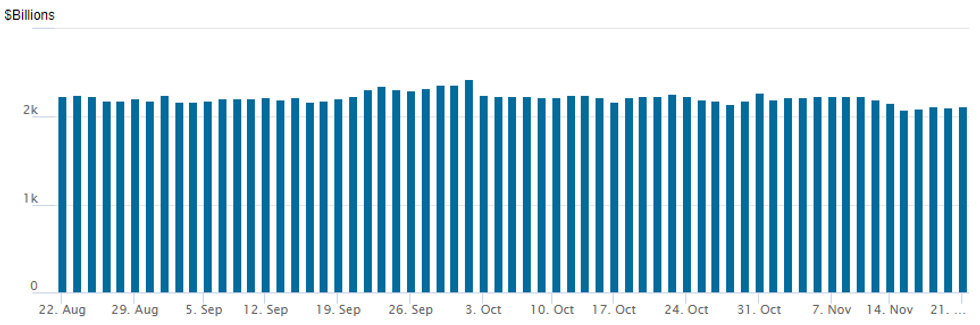

FED Reverse Repo Operation

FED Reverse Repo Operation/MNI

NY Fed reverse repo usage climbs to $2,125.426B w/ 93 counterparties vs. $2,113.413B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $2B Mercedes-Benz 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/21 $2B #Mercedes-Benz $850M 2Y +98, $650M 3Y +115, $500M 5Y +135

- 11/21 $750M #Discover Financial 10Y +295

- 11/21 $650M ASB Bank 5Y +140

- 11/21 $Benchmark ArcelorMittal 5Y +275a, 10Y +325a

- Expected to issue Tuesday:

- 11/22 $Benchmark Swedish Export Credit (SEC) 2025 SOFR+51a

EGBs-GILTS CASH CLOSE: Core Yields Drop Alongside Oil Prices

The UK and German curves bull flattened to open the week, with periphery EGB spreads marginally wider.

- After a mixed morning session, Bund and Gilt futures jumped to session highs in the afternoon as oil prices plummeted (front Brent dropped $6%) on a WSJ report that OPEC+ was considering raising output.

- ECB Chief Economist Philip Lane told MNI that he didn't think December would mark the last rate hike, but the Governing Council would consider slowing the pace of hikes at the next meeting.

- Rate futures largely took the comments in stride.

- BTPs underperformed, with spreads widening throughout the session, accelerating toward the cash close on no particular catalyst.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.1bps at 2.095%, 5-Yr is down 1.7bps at 1.969%, 10-Yr is down 2.5bps at 1.989%, and 30-Yr is down 2.2bps at 1.907%.

- UK: The 2-Yr yield is up 0.9bps at 3.188%, 5-Yr is down 2bps at 3.275%, 10-Yr is down 5.5bps at 3.184%, and 30-Yr is down 8.2bps at 3.306%.

- Italian BTP spread up 3.4bps at 191.8bps / Greek up 2.6bps at 227.5bps

FOREX: Greenback Strength Underpinned By China Covid Backdrop

- Concerns in China have been renewed as Beijing reported two more Covid deaths on Sunday amid a spike in cases, heightening concern the capital could see a return of tougher restrictions. The news has aided the greenback bid/recovery on Monday and the USD index has risen 0.8% throughout the session.

- USD strength has been broad based alongside pressure on major equity indices. The Japanese Yen and the Australian dollar are the weakest performers across G10.

- USD/JPY traded comfortably back above the previously well-held 100-dma resistance of 141.03 and the pair has significantly narrowed the gap with the next upside resistance level of 142.48, the November 11th high.

- The euro was also among the early victims to the greenback’s advance, weakening further upon release of an MNI interview with ECB's Lane. Lane flagged that the ECB will consider a slower pace of tightening at the December meeting, with the governing council weighing signs that bank lending conditions are already tightening against accelerating wage inflation.

- EUR/USD traded to a low of 1.0223 Monday, narrowing the gap with support at 1.0193 - the 38.2% retracement for the November upleg.

- Canadian retail sales and US Richmond Manufacturing are data points on Tuesday. There may be potential comments from Fed’s Mester, George and Bullard which will be monitored ahead of Wednesday’s FOMC minutes and the Thanksgiving Holiday. Wednesday will also see the RBNZ decision and the release of Eurozone PMIs.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/11/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 22/11/2022 | 0900/1000 | ** |  | EU | EZ Current Account |

| 22/11/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 22/11/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/11/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/11/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 22/11/2022 | 1600/1100 |  | US | Cleveland Fed's Loretta Mester | |

| 22/11/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/11/2022 | 1645/1145 |  | CA | BOC's Sr Deputy Rogers talk on financial stability | |

| 22/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 22/11/2022 | 1915/1415 |  | US | Kansas City Fed's Esther George | |

| 22/11/2022 | 1945/1445 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.