-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Payrolls Sequentially Softer, Still Exp Firm

EXECUTIVE SUMMARY

US

US: Consensus looks for a payrolls report that would imply only a marginal easing in labor market tightness in October, with supply struggling to recover to pre-pandemic levels and an u/e rate near record lows.

- The usual combination of unemployment and participation rates will guide the market reaction, with AHE perhaps having less sway coming soon after the ECI in Q3, barring a notable surprise.

- Still, an in-line reading or higher would deliver a modestly hawkish reaction, with the FOMC meeting this week renewing policymakers’ concern that they haven’t yet seen much softening in the labor market.

UK

BOE: The Bank of England's Monetary Policy Committee voted seven-to-two for a 75 basis point increase to 3.0% at its November meeting, with two members voting for smaller increases and with the MPC delivering a clear message that Bank Rate would likely have to rise less than markets had been assuming.

- The committee stuck to its guidance that it would "respond forcefully" if inflation proved more persistent but it added a line to its guidance, stating that Bank Rate was likely to rise "to a peak lower than priced into financial markets," which at the time it assessed to be 5.2%.

- Since then, the market implied peak has dipped to around 4.75%, but the MPC's projections in the Monetary Policy Report made a strong case that tightening expectations have been heavily overblown. For more see MNI Policy main wire at 0802ET.

- BOE Deputy Governor Ben Broadbent told a press conference following the decision that it was true that both further tightening was likely and that the Monetary Policy Committee thought the policy rate was "not likely not have to go as far as 5.25," the peak of the market curve used in the Bank's forecasts.

- "We never said we are aiming for a soft landing," Broadbent said. For more see MNI Policy main wire at 1135ET.

EUROPE

ECB: The European Central Bank will probably have to hike beyond March, raising key interest rates at a slower pace but for an extended period even as the economy slides into recession, Bank of Latvia Governor Martins Kazaks told MNI, also calling for the ECB to start reducing its stock of bonds in the first quarter of next year.

- At present the greatest danger is from too little monetary policy tightening, rather than too much, with inflation only likely to move back in line with the ECB’s 2% target once rates reach restrictive levels, Kazaks said in an interview in Riga.

- “We by no means need to take a pause, for instance, at the turn of the year. It does not mean that we need to raise the rate separately in each meeting, but we should continue. And we should be data driven,” said Kazaks, who in September said the ECB could continue to hike past February. (See MNI INTERVIEW: ECB Could Hike Past February – Kazaks) For more see MNI Policy main wire at 0938ET.

US TSYS: Focus On Friday's October Employment Data

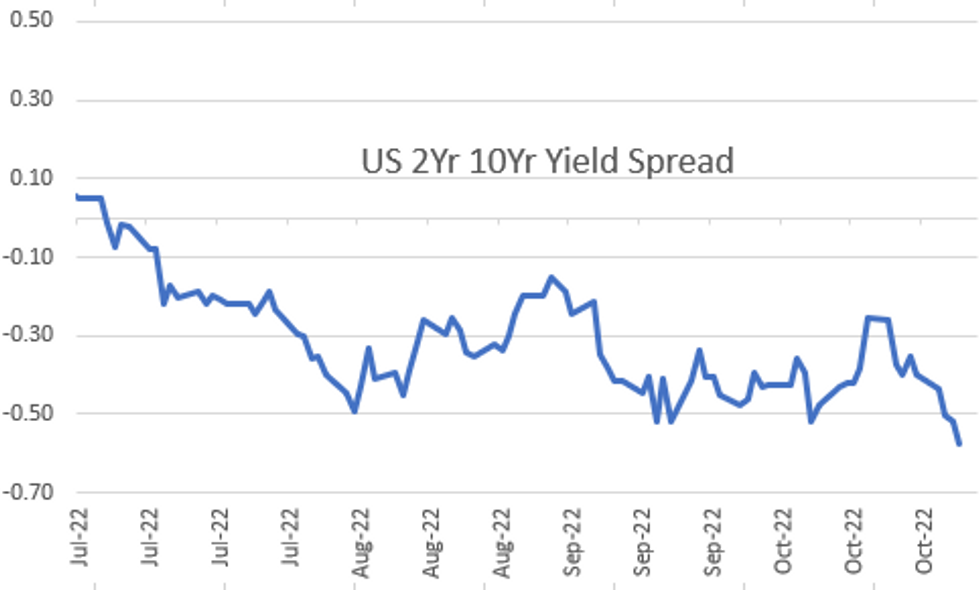

Tsy futures weaker after the bell but near late session highs, yield curves near inverted lows (2s10s currently -5.411 at -57.745). Generally quiet second half as markets await Friday's October employment data.

- Tsys opened weaker, adding to Wed's post-FOMC action after Chairman Powell's hawkish rebuttal to the expected 75bp rate hike while short end back to gradually pricing in an unprecedented fifth 75bp hike in December.

- Little react to expected BOE 75bp hike earlier while Tsys extended lows after small pick-up in continuing claims to 1.485M (1.450M est), weekly claims little softer at 218k vs. 220k est. Unit Labor Costs lower than exp: 3.5% vs. 4.0% est.

- Tsys bounced off midmorning lows (30YY tapped 4.2298%) after weaker than expected ISM Non-Manufacturing at 54.4 vs expected 55.3 (56.7 prior), ending for consecutive months of stronger data.

- Fed out of media blackout Friday: Boston Fed Pres Collins on economy/policy outlook at a Brookings conf (text and Q&A expected) at 1000ET, while CNBC expected to interview Richmond Fed Pres Barkin at same time.

- Currently, 2-Yr yield is up 7.5bps at 4.695%, 5-Yr is up 4.1bps at 4.35%, 10-Yr is up 2.1bps at 4.1217%, and 30-Yr is up 1.1bps at 4.1512%.

OVERNIGHT DATA

- US JOBLESS CLAIMS -1K TO 217K IN OCT 29 WK

- US PREV JOBLESS CLAIMS REVISED TO 218K IN OCT 22 WK

- US CONTINUING CLAIMS +0.047M to 1.485M IN OCT 22 WK

- US SEP TRADE GAP -$73.3B VS AUG -$65.7B

- US Q3 PREL UNIT LABOR COSTS +3.5% VS Q2 +8.9%; Y/Y +6.1%

- US Q3 PREL NONFARM PRODUCTIVITY +0.3% VS Q2 -4.1%; Y/Y -1.4%

- US SEP FACTORY ORDERS +0.3%; EX-TRANSPORT NEW ORDERS -0.1%

- US SEP DURABLE ORDERS +0.4%

- US SEP NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT -0.4%

- US ISM OCT SERVICES COMPOSITE INDEX 54.4

- US ISM OCT SERVICES BUSINESS INDEX 55.7

- US ISM OCT SERVICES PRICES 70.7

- US ISM OCT SERVICES EMPLOYMENT INDEX 49.1

- US ISM OCT SERVICES NEW ORDERS 56.5

- CANADIAN SEP TRADE BALANCE CAD +1.1 BILLION

- CANADA SEP EXPORTS CAD 66.4 BLN, IMPORTS CAD 65.2 BLN

- CANADA REVISED AUG MERCHANDISE TRADE BALANCE CAD +0.6 BLN

- CANADIAN SEP BUILDING PERMITS -17.5% MOM

- CANADA RESIDENTIAL BUILDING PERMITS -15.6%; NON-RESIDENTIAL -21.5%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 4.58 points (-0.01%) at 32144.57

- S&P E-Mini Future down 22.5 points (-0.6%) at 3746.25

- Nasdaq down 123.9 points (-1.2%) at 10401.91

- US 10-Yr yield is up 2.1 bps at 4.1217%

- US Dec 10Y are down 19.5/32 at 110-0.5

- EURUSD down 0.006 (-0.61%) at 0.9758

- USDJPY up 0.32 (0.22%) at 148.23

- WTI Crude Oil (front-month) down $1.75 (-1.94%) at $88.26

- Gold is down $3.51 (-0.21%) at $1631.71

- EuroStoxx 50 down 28.83 points (-0.8%) at 3593.18

- FTSE 100 up 44.49 points (0.62%) at 7188.63

- German DAX down 126.55 points (-0.95%) at 13130.19

- French CAC 40 down 33.6 points (-0.54%) at 6243.28

US TSY FUTURES CLOSE

- 3M10Y +0.101, -3.945 (L: -6.163 / H: 8.102)

- 2Y10Y -5.623, -57.957 (L: -58.585 / H: -51.271)

- 2Y30Y -6.574, -55.006 (L: -56.179 / H: -47.104)

- 5Y30Y -3.109, -20.233 (L: -23.061 / H: -15.54)

- Current futures levels:

- Dec 2Y down 8.5/32 at 101-24.75 (L: 101-22.125 / H: 101-29.875)

- Dec 5Y down 16/32 at 106-1.75 (L: 105-22.25 / H: 106-10)

- Dec 10Y down 20/32 at 110-0 (L: 109-12 / H: 110-09.5)

- Dec 30Y down 13/32 at 120-10 (L: 118-22 / H: 120-15)

- Dec Ultra 30Y down 15/32 at 128-20 (L: 126-26 / H: 128-31)

US 10YR FUTURE TECH: (Z2) Sell-Off Exposes Key Support

- RES 4: 113-30 High Oct 4

- RES 3: 113-00 50-day EMA

- RES 2: 112-22+ High Oct 6

- RES 1: 111-03/111-31 20-day EMA / High Oct 27

- PRICE: 110-01 @ 1510ET Nov 3

- SUP 1: 109-13+ Low Oct 31

- SUP 2: 108-26+ Low Oct 21 and the bear trigger

- SUP 3: 108-06+ Low Oct 2007 (cont)

- SUP 4: 107.06 3.0% 10-dma envelope

Treasuries continue to weaken and remain below last week’s high of 111-31 on Oct 27 - a key short-term resistance. A break of this hurdle would signal scope for an extension higher near-term and expose the 50-day EMA at 112-29. However, today’s extension lower exposes the key support and bear trigger at 108-26+, the Oct 21 low. A break of this support would confirm a resumption of the primary downtrend.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.040 at 94.845

- Mar 23 -0.075 at 94.590

- Jun 23 -0.115 at 94.555

- Sep 23 -0.135 at 94.720

- Red Pack (Dec 23-Sep 24) -0.165 to -0.145

- Green Pack (Dec 24-Sep 25) -0.13 to -0.08

- Blue Pack (Dec 25-Sep 26) -0.065 to -0.05

- Gold Pack (Dec 26-Sep 27) -0.045 to -0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.75015 to 3.81329% (+0.74943/wk)

- 1M +0.01086 to 3.84657% (+0.07886/wk)

- 3M +0.02314 to 4.53157% (+0.09200/wk) * / **

- 6M +0.02658 to 4.99729% (+0.06643/wk)

- 12M +0.11757 to 5.65357% (+0.28457/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.53157% on 11/3/22

- Daily Effective Fed Funds Rate: 3.08% volume: $108B

- Daily Overnight Bank Funding Rate: 3.07% volume: $289B

- Secured Overnight Financing Rate (SOFR): 3.05%, $1.021T

- Broad General Collateral Rate (BGCR): 3.01%, $405B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $391B

- (rate, volume levels reflect prior session)

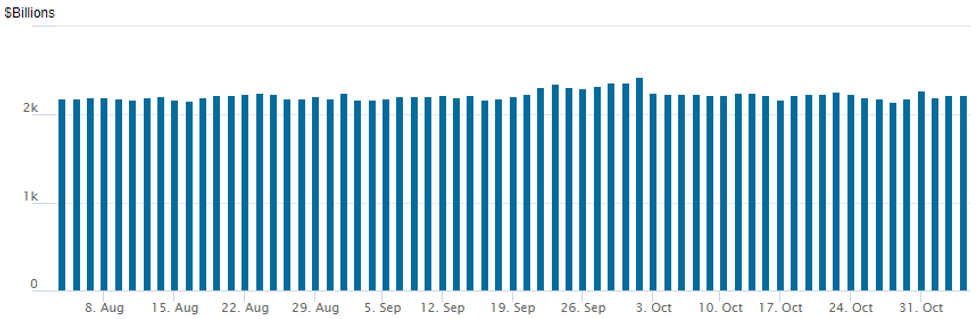

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,219.791B w/ 105 counterparties vs. $2,229.861B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: NatWest, SoCal Edison Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/03 $1.5B #NatWest 4NC3 +285

- 11/03 $1.5B #Southern California Edison 5Y +150, 10Y +190

- 11/03 Chatter: Dish Network $2B 5NC2 for Friday

EGBs-GILTS CASH CLOSE: BoE Delivers 75bp Hike, Long End Gilts Weaken

European bonds continued to weaken Thursday following the lead of a hawkish Fed late Wednesday, with Bunds outperforming Gilts at the long end, and vice versa.

- Along with today's largely-expected 75bp hike (with a 7-2 vote), the BoE meeting communications also suggested that the recent market implied peak rate of 5.25% was too high.

- The UK long end underperformed in a bear steepening move, with BoE's Ramsden noting that the bank could start selling longer-end Gilts in the new year.

- The German curve saw very slight bear flattening. MNI interviewed ECB's Kazaks who said the bank would probably have to continue hiking past March, while calling for the ECB to start rolling off its APP holdings in Q1 next year.

- Attention Friday is on the US Employment Report.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is up 10.3bps at 2.085%, 5-Yr is up 10.5bps at 2.128%, 10-Yr is up 10.4bps at 2.245%, and 30-Yr is up 7.2bps at 2.169%.

- UK: The 2-Yr yield is up 3.7bps at 3.095%, 5-Yr is up 8bps at 3.443%, 10-Yr is up 12.2bps at 3.521%, and 30-Yr is up 14.8bps at 3.719%.

- Italian BTP spread up 1.8bps at 217.4bps / Spanish down 1.6bps at 107.3bps

FOREX: GBPUSD Sinks 2% In Fed/BoE Aftermath

- The US Dollar surged on Thursday as markets digested a hawkish FOMC press conference and the greenback extended the strong reversal higher from late Wednesday. The expectation of a higher terminal rate for the Fed continues to see pressure on front-end rates, underpinning a significant 1.45% advance for the USD index.

- The biggest victim to the dollars advance has been GBP. Cable had dropped roughly 150pips in advance of the Bank of England decision/statement and despite delivering a substantial 75bp hike, the lacklustre growth forecasts and rhetoric on rates dampened GBP sentiment further.

- The pair remains close to the lows at 1.1170 as of writing, down 2% on the session. Having now broken below support at 1.1272, the next target on the downside resides at 1.1061, the October 21 low, before 1.0924, low on Oct 12 and a key short-term support.

- In a relatively less pronounced move, EUR/USD (-0.62%) is now back below key support at 0.9812 today, which marked the top of the bear channel that was breached last week. A clear break of this support now undermines the recent bullish outlook and signals scope for a deeper pullback.

- Showing impressive resilience in the face of a firmer USD are both the Mexican peso and the Brazilian Real, with the latter continuing to benefit from the apparent smooth transition occurring following former President Lula’s victory in Sunday’s presidential election.

- Markets largely consolidated in the hours approaching the APAC crossover in anticipation of tomorrow’s release of October non-farm payrolls. Consensus looks for a payrolls report that would imply only a marginal easing in labor market tightness in October, with supply struggling to recover to pre-pandemic levels and an u/e rate near record lows.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/11/2022 | 0030/1130 | *** |  | AU | RBA Statement on Monetary Policy |

| 04/11/2022 | 0030/1130 | *** |  | AU | Retail trade quarterly |

| 04/11/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 04/11/2022 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 04/11/2022 | 0745/0845 | * |  | FR | Industrial Production |

| 04/11/2022 | 0800/0900 | ** |  | ES | Industrial Production |

| 04/11/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/11/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/11/2022 | 0845/0945 |  | EU | ECB de Guindos Speech at Naturgy Foundation/IESE School | |

| 04/11/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/11/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/11/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/11/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/11/2022 | 0930/1030 |  | EU | ECB Lagarde Open Lecture | |

| 04/11/2022 | 1000/1100 | ** |  | EU | PPI |

| 04/11/2022 | - |  | DE | G7 Foreign Ministers summit in Germany | |

| 04/11/2022 | 1215/1215 |  | UK | BOE Pill & Shortall MonPol Report National Agency briefing | |

| 04/11/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 04/11/2022 | 1230/0830 | *** |  | US | Employment Report |

| 04/11/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 04/11/2022 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 04/11/2022 | 2000/1600 |  | US | Fed's Financial Stability Report |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.