-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Policy Path Re-Think On Surprise Jobs Surge

EXECUTIVE SUMMARY

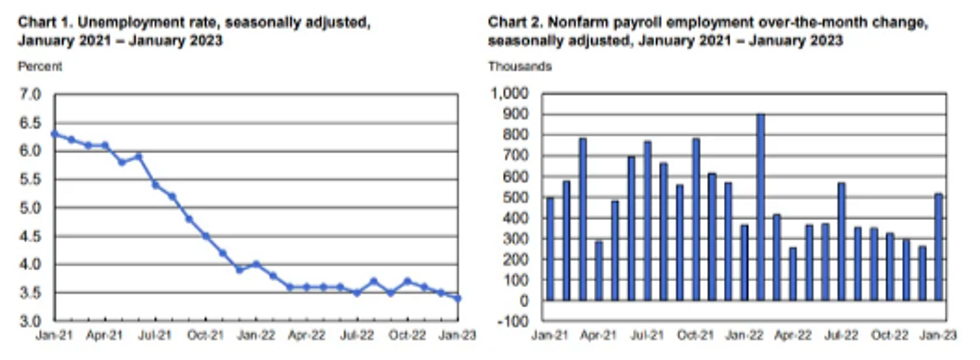

U.S. employers added 517,000 jobs in January, double the pace in December and easily surpassing analyst expectations for a below-200,000 reading, as the unemployment rate sank a tenth to 3.4%, the lowest since 1969, the Bureau of Labor Statistics reported Friday. November and December payrolls figures were also revised 71,000 higher.

- The data will likely keep the Federal Reserve on its hiking path. Average hourly earnings growth slowed a tenth to 0.3% in January or 4.4% over the year, in line with expectations and down from 4.9% in December, but the average workweek rose 0.3 hour to 34.7 hours.

- Hiring in January was above the 401,000 average monthly gain in 2022 and was led by leisure and hospitality (128,000), professional and business services (82,000) and health care (58,000). Workforce participation was little changed at 62.4%.

US

FED: High frequency U.S. pay data collected by Homebase shows "promising" signs of slowing through the first month of the year and suggests wage growth could cool to pre-Covid levels by early next year, Federal Reserve Bank of St. Louis economist Max Dvorkin told MNI Friday.

- Tracking the same worker over time using the Homebase payroll software, Dvorkin found the median wage increase in January declined to 3.8% from around 4.4% in 2022. There's no comparable figure for earlier periods due to data limitations. However, a trimmed mean of wage changes over a four-week period also show the typical seasonal spike in wage growth is 1 to 2 percentage points lower this January compared to last year, Dvorkin said.

- "If you worry about inflation and where it’s going, these are very promising figures," he said. "Since the second quarter of 2022, wages increases have been slowing, and if this continue we’ll be able to see something that resembles the kinds of increases seen before the pandemic early next year or late this year." For more, see MNI Policy main wire at 1357ET.

US: U.S. consumers are expecting the economy to slip into recession this year, though labor market strength suggests the downturn may not be deep or long-lasting, Conference Board chief economist Dana Peterson told MNI.

- Peterson said a drop in the Conference’s Board’s Expectations Index to below 80 for January “usually signals that consumers expect a recession within the next six to 12 months.” While recent high-profile layoffs have been concentrated in industries like technology, finance and retail, consumers might be nervous about their own futures despite ongoing signs of broad labor market strength.

- “People may be becoming more concerned about their own employment prospects and the state of their incomes in the future, should they become one of those people who are let go,” she said. The economy boasted another surprising surge in job growth in January, with more than half a million new positions created. For more, see MNI Policy main wire at 1131ET.

UK

BOE: Data dependence is back: The MNI Markets team had expected a 50bp hike at the February 2023 MPC meeting, and had thought that there was better risk-reward to position for a dovish outcome.

- The BOE did indeed drop “forceful” and the new guidance is much more conditional on the data.

- We think that the market pricing of one final 25bp hike in March, as well as the new analyst consensus expecting the same, looks appropriate.

- We have read through over 20 analyst reviews and note that there has been a large swing towards a consensus of one final 25bp hike in March to a 4.25% terminal rate.

US TSYS: FED Remains in Play Post-NFP/ISM Data

Off lows, Tsy futures remain broadly weaker after this morning's surge in job gains for January of +517k, 2.75x larger than the mean estimate of 188k (and well over 320k high estimate survey of 77 economists by Bbg). Tsy 30YY at 3.6288% +.0840, yield curves extend inversion: 2s10s -6.590 at -78.151%).

- Unemployment rate sank a tenth to 3.4%, the lowest since 1969, the Bureau of Labor Statistics reported Friday. November and December payrolls figures were also revised 71,000 higher.

- Meanwhile, ISM services was far stronger than expected in January at 55.2 (cons 50.5), back at the 55.5 in Nov via December's 49.2. The largest increase since Jun'20 followed the largest downward surprise since 2008.

- Short end rates gapped lower as markets reverted back to more (possibly larger) rate hikes ahead - but moderated somewhat in the second half. Fed funds implied hike for Mar'23 at 22.5bp (vs. 23.3bp post-ISM), May'23 cumulative 37.5bp to 4.957%, Jun'23 41.5bp to 4.997%, terminal climbs to 4.980% in Jun'23.

- Goldman Sachs' chief economist Jan Hatzius tweeted “this morning’s report provides strong evidence of continued economic expansion in January. We continue to expect two more 25bp fed funds rate hikes in March and May, and we continue to expect no rate cuts in 2023."

OVERNIGHT DATA

- US JAN. UNEMPLOYMENT RATE FALLS TO 3.4% VS 3.5%

- US JAN. AVERAGE HOURLY EARNINGS RISE 0.3% M/M; EST. +0.3%

- US PRIOR MONTHS PAYROLLS REVISED: DEC +260K; NOV +290K

- US DATA: AHE Unrounded - Jan'23:

- M/M (SA): 0.304% in Jan from 0.396% in Dec

- Y/Y (SA): 4.426% in Jan from 4.939% in Dec

- AHE Non-Supervisory Unrounded:

- M/M (SA): 0.248% in Jan from 0.356% in Dec

- Y/Y (SA): 5.134% in Jan from 5.423% in Dec

- US ISM JAN SERVICES COMPOSITE INDEX 55.2

- US ISM JAN SERVICES BUSINESS INDEX 60.4

- US ISM JAN SERVICES PRICES 67.8

- US ISM JAN SERVICES EMPLOYMENT INDEX 50

- US ISM JAN SERVICES NEW ORDERS 60.4

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 188.29 points (-0.55%) at 33828.43

- S&P E-Mini Future down 49.25 points (-1.18%) at 4136.25

- Nasdaq down 209.9 points (-1.7%) at 11974.89

- US 10-Yr yield is up 14.3 bps at 3.5357%

- US Mar 10-Yr futures are down 38/32 at 114-11.5

- EURUSD down 0.0109 (-1%) at 1.0802

- USDJPY up 2.44 (1.9%) at 131.07

- WTI Crude Oil (front-month) down $2.72 (-3.58%) at $73.27

- Gold is down $47.5 (-2.48%) at $1865.80

- EuroStoxx 50 up 16.86 points (0.4%) at 4257.98

- FTSE 100 up 81.64 points (1.04%) at 7901.8

- German DAX down 32.76 points (-0.21%) at 15476.43

- French CAC 40 up 67.67 points (0.94%) at 7233.94

US TSY FUTURES CLOSE

- 3M10Y +10.556, -114.467 (L: -129.237 / H: -110.947)

- 2Y10Y -5.943, -77.504 (L: -78.476 / H: -69.701)

- 2Y30Y -11.782, -68.14 (L: -69.011 / H: -54.675)

- 5Y30Y -9.72, -4.209 (L: -4.822 / H: 8.622)

- Current futures levels:

- Mar 2-Yr futures down 12.625/32 at 102-21.125 (L: 102-20.5 / H: 103-02.125)

- Mar 5-Yr futures down 27.75/32 at 109-2.75 (L: 109-01.5 / H: 110-00.5)

- Mar 10-Yr futures down 1-04.5/32 at 114-13 (L: 114-08 / H: 115-22.5)

- Mar 30-Yr futures down 1-25/32 at 130-00 (L: 129-19 / H: 132-09)

- Mar Ultra futures down 2-02/32 at 142-22 (L: 141-29 / H: 145-20)

US 10YR FUTURE TECHS: (H3) Strong Reversal Lower

- RES 4: 117-00 61.8% retracement of the Aug - Oct bear leg (cont)

- RES 3: 116-28 0.618 proj of the Dec 30 - Jan 19 - 30 price swing

- RES 2: 116-11+ 0.50 proj of the Dec 30 - Jan 19 - 30 price swing

- RES 1: 116-00/116-08 High Feb 2 / High Jan 19 and the bull trigger

- PRICE: 114-15 @ 16:06 GMT Feb 3

- SUP 1: 114-08 Low Feb 3

- SUP 2: 114-05+ Low Jan 30 and a key short-term support

- SUP 3: 114-04+ 50-day EMA

- SUP 4: 113-17+ 61.8% retracement of the Dec 30 - Jan 19 bull leg

A sharp pullback in Treasury futures Friday reversed Wednesday’s gains. Attention turns to the key support that has been defined at 114-05+, the Jan 30 low. A break of this level is required to reinstate a bearish theme. This would also likely result in a break of the 50-day EMA, at 114-04+. On the upside, the bull trigger is at 116-08, the Jan 19 high. A move above 116-08, would confirm a resumption of the uptrend that started Oct 21 2022.

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.075 at 94.975

- Jun 23 -0.160 at 94.815

- Sep 23 -0.220 at 94.850

- Dec 23 -0.265 at 95.175

- Red Pack (Mar 24-Dec 24) -0.27 to -0.23

- Green Pack (Mar 25-Dec 25) -0.21 to -0.19

- Blue Pack (Mar 26-Dec 26) -0.18 to -0.15

- Gold Pack (Mar 27-Dec 27) -0.14 to -0.115

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00614 to 4.55271% (+0.24800/wk)

- 1M -0.00814 to 4.57186% (-0.00701/wk)

- 3M +0.02800 to 4.83414% (+0.00885/wk)*/**

- 6M -0.00243 to 5.05743% (-0.04486/wk)

- 12M -0.02872 to 5.25114% (-0.06500/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.83414% on 2/2/23

- Daily Effective Fed Funds Rate: 4.58% volume: $99B

- Daily Overnight Bank Funding Rate: 4.57% volume: $282B

- Secured Overnight Financing Rate (SOFR): 4.56%, $1.290T

- Broad General Collateral Rate (BGCR): 4.52%, $489B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $468B

- (rate, volume levels reflect prior session)

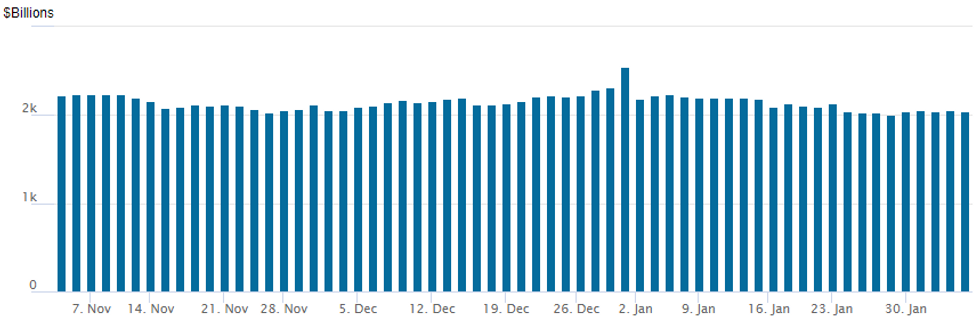

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,041.217B w/ 103 counterparties vs. prior session's $2,050.063B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $5.25B Oracle 4Pt Lead Thu's Corporate Bond Issuance

$10.45B Priced Thursday, $11.15B total first two days of February- Date $MM Issuer (Priced *, Launch #)

- 02/02 $5.25B *Oracle $750M each 5Y +110 & 7Y +130, $1.5B 10Y +155, $2.25B 30Y +203

- 02/02 $1.6B *MPLX $1.1B 10Y +170, $500M 30Y +212.5

- 02/02 $1.5B *PNC Financial PerpNC7 6.25%

- 02/02 $1.1B *National Rural Utilities $600M 3Y +70, $200M tap 5Y +95, $300M tap 10Y +123

- 02/02 $1B *Alexandria Real Estate $500M 12Y +137.5, $500M 30Y +160

- Muted Wednesday supply

- 02/01 $700M *Dominican Rep 8Y 7.0%

FOREX: USD Index Trades To Three-Week High On Above-Estimate US Data

- A combination of a punchy non-farms payroll print and above expectation ISM services in the US have sparked renewed demand for the greenback on Friday, with the USD index climbing to three-week highs and showing no signs of retreating approaching the close.

- Antipodeans are leading declines in G10FX amid a sharp reversal lower for crude futures. Both AUD and NZD have slipped over 2%, with Japanese Yen weakness following closely behind.

- The impressive near-300 pip bounce for USDJPY now places the focus for bulls on clearance of 131.58 which would be a positive development and signal a short-term reversal.

- For AUDUSD, short-term support at 0.6984, the Jan 31 low, has been broken which brings an important technical area into play around 0.6872, the low on Jan 19 and the 50-day exponential moving average.

- Higher US yields have particularly impacted several emerging market currencies. The most notable laggard is the South African rand, however LatAm FX has also been heavily bearing the brunt of the turn in sentiment. USDMXN, after making a new four-year low on Thursday, has no bounced the best part of 2.5% with 18.50 firmly capping the peso strength in 2023.

- No tier-one data releases on Monday, however, Tuesday will bring the RBA rate decision and later that day, Fed Chair Powell is due to participate in a moderated discussion at the Economic Club of Washington.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 06/02/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/02/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/02/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/02/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/02/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 06/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.