-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

MNI ASIA OPEN: Policy Pivot Not an End to Hikes

EXECUTIVE SUMMARY

US

FED: Federal Reserve Governor Chris Waller Friday said he favors another downshift at the next meeting ending February 1 to a 25bp rate hike but anticipates continued tightening going forward.

- Last week's moderation in CPI growth was "very welcome news" that indicates that broader inflationary pressure across the economy is easing, he said in a speech. "I currently favor a 25-basis point increase at the FOMC’s next meeting at the end of this month," he said. "Beyond that, we still have a considerable way to go toward our 2 percent inflation goal, and I expect to support continued tightening of monetary policy."

- The Fed is widely expected to lower the size of its rate hikes further at its Feb. 1 decision. (See: MNI: Fed Rates Likely Headed Above 5% Despite Cooling CPI). For more see MNI Policy main wire at 1301ET.

- “If this loosening of conditions makes things looser in the sense that growth takes off, employment doesn’t loosen and inflation starts to take off again then, yeah, we’re going to have to do a lot more,” he said during a Q&A after a speech at the Council on Foreign Relations. Waller has backed a 25bp hike at the next FOMC meeting.

- “The market has a very optimistic view that inflation is just going to melt away. We have a different view. It’s going to be a slower, harder slog to get inflation down and thus we have to keep rates higher for longer and not cut them before the end of the year.” (See MNI INTERVIEW: Fed Rates To Peak Well Above 5%, No Cuts In 2023).

- Research from Olivier Blanchard and co-authors had indicated a jump in the jobless rate would likely result from a drop in vacancies due to the historical relationship between the two indicators. Mongey's findings suggest otherwise.

- “Vacancies have been coming down steadily over the past eight few months” despite a 3.5% jobless rate matching 50-year lows, he said in a FedSpeak podcast interview. For more see MNI Policy main wire at 1423ET.

FED: The Federal Reserve's expanded toolkit over the years to include forward guidance and balance sheet policy means there's a shorter lag in policy transmitting to inflation, Kansas City Fed senior economist Taeyoung Doh told MNI, adding he expects a continuing deceleration in inflation.

- "The peak impact on inflation is actually likely to happen right now in the first half of this year," he said, noting a significant jump in a proxy measure of the fed funds rate in the first half of last year and estimating a one-year time lag. Still, it is likely less than half of the Fed's overall tightening has flowed into inflation so far, Doh said in an interview.

- Recent research from Doh and San Francisco Fed coauthor Andrew T. Foerster suggests there may have been an acceleration in the maximum effect on inflation following the Fed's broader use of balance sheet and forward-guidance tools in 2009, reducing the time between policy moves and their peak impact from three years to as little as 12 months. For more see MNI Policy main wire at 0901ET.

US TSYS: Risk Buoyed Ahead Fed Blackout

Tsys weaker across the board but off midday lows after the bell, 30YY +.0943 at 3.6555% vs. 3.6646% high, yield curves bear steepening (2s10s +4.530 at -69.177. Decent volumes (TYH3 >1.2M) on a relatively subdued session w/ the Federal Reserve heading into policy blackout at midnight (through Feb 2).

- Sole data point underscored move: Existing home sales fell by less than expected in December, -1.5% M/M (cons -3.4%) after -7.9% M/M, faring better than the latest slide in pending home sales. It left an 18% decline on the year for the sharpest annual decline since 2008.

- While Bonds dragging short end rates lower, market expectation for 25bp hike at next FOMC on Feb 1 stable: Fed funds implied hike for Feb'23 25.8bp, Mar'23 cumulative steady 45.1bp to 4.783%, May'23 steady at 55.6bp to 4.888%, terminal dips slightly to 4.890% in Jun'23.

- No concerted headline driver, Bond weakness more tied to concerted commentary from various central bank officials (not just Fed) on improved global outlook in past couple weeks lending to intermediate-long end pressure on those growth prospects.

- Risk buoyed by dovish comments from Fed Gov Waller, favoring another downshift at the next meeting ending February 1 to a 25bp rate hike but anticipates continued tightening going forward.

OVERNIGHT DATA

- US NAR DEC EXISTING HOME SALES -1.5% TO 4.02M SAAR

- NAR: DEC EXISTING HOME SALES PACE WEAKEST SINCE NOV 2010

- NAR: MEDIAN SALE PRICE GAIN SMALLEST SINCE MAY 2020

- Existing home sales fell by less than expected in December, -1.5% M/M (cons -3.4%) after -7.9% M/M, faring better than the latest slide in pending home sales, leaving 18% decline on the year for the sharpest annual decline since 2008.

- A heavy drop in inventories saw relative supply buck the recent trend and decline from 3.3 to 2.9 months. It remains off lows from last winter of 1.6-1.7 months but the market is still tighter than the 3.9 months averaged through 2019, in turn an order of magnitude tighter than the 6.5 months in 2006 and almost 9 months in 2007.

- NAR's Yan: "However, expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year. Markets in roughly half of the country are likely to offer potential buyers discounted prices compared to last year."

- CANADA NOV RETAIL -0.1% VS FORECAST -0.5%, OCT +1.3%

- RETAIL EX-AUTOS -0.6% VS FORECAST -0.7%, PRIOR +1.6%

- CANADA JOBLESS BENEFIT RECIPIENTS REACH LOWEST SINCE 1997

- CANADIAN DECEMBER FLASH ESTIMATE RETAIL SALES +0.5%

- CANADIAN NOVEMBER RETAIL SALES VOLUMES -0.4%

- CANADIAN YEAR OVER YEAR RETAIL SALES +5.2%

- This was the lowest number of EI beneficiaries on record since comparable data became available in 1997, outside of the summer of 2020 when the Canadian Emergency Response Benefit was in place."

MARKETS SNAPSHOT

Key late session market levels:

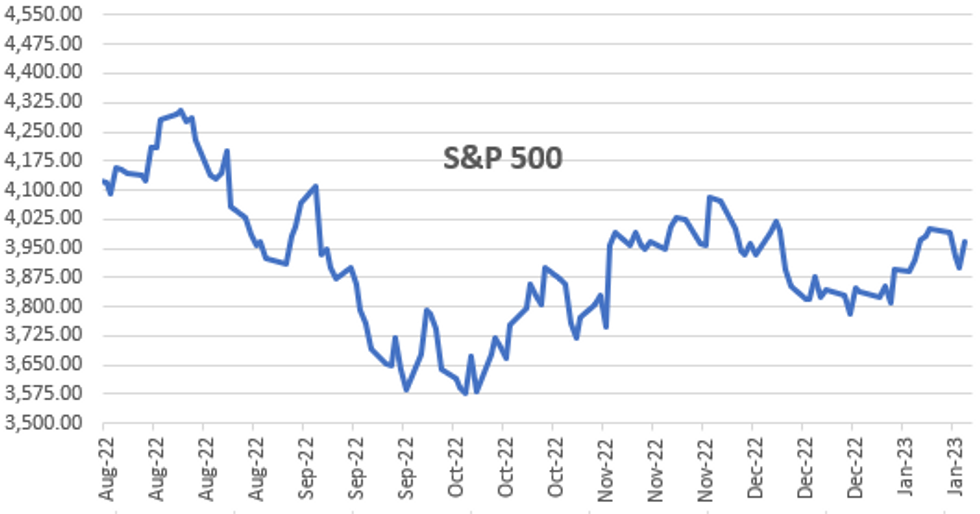

- DJIA up 299.78 points (0.91%) at 33341.69

- S&P E-Mini Future up 70.25 points (1.79%) at 3985.25

- Nasdaq up 281.9 points (2.6%) at 11133.17

- US 10-Yr yield is up 8.5 bps at 3.4769%

- US Mar 10-Yr futures are down 17.5/32 at 115-3

- EURUSD up 0.0025 (0.23%) at 1.0858

- USDJPY up 1.09 (0.85%) at 129.52

- WTI Crude Oil (front-month) up $0.98 (1.22%) at $81.31

- Gold is down $2.53 (-0.13%) at $1929.68

- EuroStoxx 50 up 25.62 points (0.63%) at 4119.9

- FTSE 100 up 23.3 points (0.3%) at 7770.59

- German DAX up 113.2 points (0.76%) at 15033.56

- French CAC 40 up 44.12 points (0.63%) at 6995.99

US TSY FUTURES CLOSE

- 3M10Y +7.945, -119.278 (L: -133.034 / H: -117.808)

- 2Y10Y +3.739, -69.968 (L: -75.293 / H: -69.134)

- 2Y30Y +4.169, -52.769 (L: -58.691 / H: -52.243)

- 5Y30Y +1.25, 8.919 (L: 4.66 / H: 8.995)

- Current futures levels:

- Mar 2-Yr futures down 3.375/32 at 103-0.375 (L: 102-30.625 / H: 103-03.5)

- Mar 5-Yr futures down 10.5/32 at 109-22.25 (L: 109-17 / H: 110-01)

- Mar 10-Yr futures down 17.5/32 at 115-03 (L: 114-27.5 / H: 115-21)

- Mar 30-Yr futures down 1-06/32 at 130-18 (L: 130-03 / H: 131-27)

- Mar Ultra futures down 2-00/32 at 142-01 (L: 141-20 / H: 144-07)

US 10YR FUTURE TECHS: (H3) Bull Cycle Still In Play

- RES 4: 117-17+ 1.00 proj of the Nov 3 - Dec 13 - Dec 30 price swing

- RES 3: 117-00 High Sep 8 2022

- RES 2: 116-30 2.0% 10-dma env

- RES 1: 116-08 High Jan 19

- PRICE: 114-30 @ 1200ET Jan 20

- SUP 1: 114-16 Low Jan 18

- SUP 2: 114-09+ Low Jan 17 and a key support

- SUP 3: 114-03+ 20-day EMA

- SUP 4: 113-26+ Low Jan 10

Treasury futures traded higher Thursday to maintain the positive price sequence of higher highs and higher lows and note that moving average studies are highlighting a bullish backdrop. On the continuation chart, the 200-dma has been pierced. A clear break would reinforce current conditions. The focus is on 116-30, the upper band of a MA envelope. Key support to watch is 114-09+, Jan 17 low. The latest pullback is considered corrective.

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.005 at 94.970

- Jun 23 -0.020 at 94.90

- Sep 23 -0.030 at 95.025

- Dec 23 -0.045 at 95.395

- Red Pack (Mar 24-Dec 24) -0.095 to -0.075

- Green Pack (Mar 25-Dec 25) -0.095 to -0.085

- Blue Pack (Mar 26-Dec 26) -0.105 to -0.10

- Gold Pack (Mar 27-Dec 27) -0.105 to -0.095

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00429 to 4.30514% (-0.000857/wk)

- 1M +0.00471 to 4.51314% (+0.05871/wk)

- 3M +0.00028 to 4.81557% (+0.02314/wk)*/**

- 6M +0.02114 to 5.10200% (+0.00086/wk)

- 12M +0.04258 to 5.34729% (-0.00971/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $100B

- Daily Overnight Bank Funding Rate: 4.32% volume: $273B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.231T

- Broad General Collateral Rate (BGCR): 4.27%, $453B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $433B

- (rate, volume levels reflect prior session)

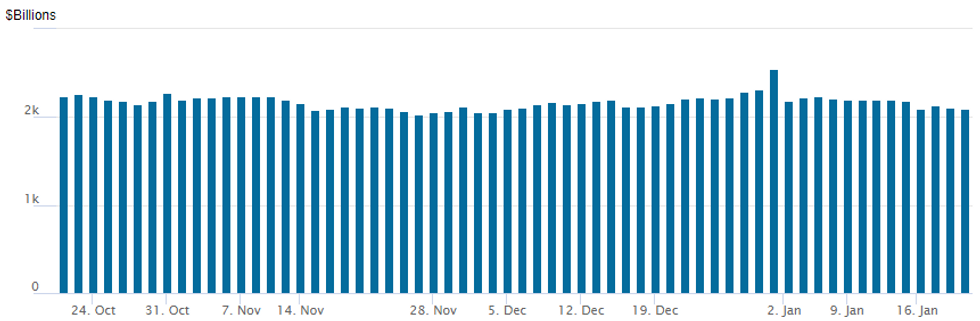

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,090.523B w/ 98 counterparties vs. prior session's $2.110.145B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: Largest High-Grade Corporate Debt Issuance Since Mar'22

$9.05B Priced Thursday, $28.4B total for week and $187.075B total for January so far, compares to last January total of $203.26B and highest amount since Mar'22.- Date $MM Issuer (Priced *, Launch #)

- 01/19 $2.75B *PNC Financial 4NC3 +125a, 11NC10 +190a

- 01/19 $1.75B *Serbia +5Y +330a, 10Y +385a

- 01/19 $1.5B *CAF +3Y SOFR+125

- 01/19 $1.25B *BFCM (Credit Mutuel) 3Y +118, dropped 3Y SOFR leg

- 01/19 $1B *Council of Europe Dev Bank (CoE) WNG 5Y SOFR+41a

- 01/19 $800M *Israel Discount Bank 5Y +190a

EGBs-GILTS CASH CLOSE: Bunds Underperform As ECB Hikes Re-Priced

Bund yields on Friday rose the most of any session this month, continuing their underperformance of Gilts as European curves bear steepened.

- Weakness across the German curve came as ECB's Lagarde pledged to "stay the course of resilience" on monetary policy, with 2023 hike pricing completing a full reversal of the dovish move earlier this week (143bp, where they entered the week, vs a low of 126bp on Tues).

- UK long-end yields rose sharply too, though short end weakness was relatively more contained, with very weak Dec retail sales data out early this morning.

- With ECB tightening expectations ratcheting higher, BTPs underperformed overall with spreads vs Bunds widening more than 10bp, closing the week above 180bp having tested the 170bp handle.

- Attention early next week will be on flash Jan PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.9bps at 2.577%, 5-Yr is up 8.6bps at 2.21%, 10-Yr is up 11.2bps at 2.177%, and 30-Yr is up 14.3bps at 2.141%.

- UK: The 2-Yr yield is up 3.6bps at 3.49%, 5-Yr is up 5.9bps at 3.296%, 10-Yr is up 10.3bps at 3.378%, and 30-Yr is up 10.9bps at 3.721%.

- Italian BTP spread up 10.6bps at 181.6bps / Spanish up 3.1bps at 95.8bps

FOREX: USDJPY Posts Impressive 225-Pip Range, Antipodean FX Rallies With Equities

- The USD index remains close to unchanged on Friday with very little newsflow or data driving specific momentum across G10 currency markets. An initial surge for USDJPY contributed towards broad greenback strength in early US trade, however the late rally for major equity indices prompted broad USD weakness and saw the DXY trade from highs of 102.50 all the way back to 102 approaching the week’s close.

- USDJPY boasted an impressive recovery off the overnight 128.36 lows to trade as high as 130.61. Despite the lack of news trigger, the BOJ were very active again in yield curve control overnight, upping their purchase operations toward shorter maturities and appearing largely unfazed by the rip higher in core CPI overnight, which rose to a 41 year high.

- As the dust settled on the move, equities traded with a very positive tone, with most major indices extending above Thursday’s highs and eating into the sizeable weekly declines.

- Perky risk sentiment bolstered the likes of AUD and NZD with the latter rising 1.2% and erasing the entirety of the post Ardern resignation announcement losses from the prior day. NZDJPY is posting a 2.1% advance on Friday.

- The Euro was much more subdued and a moderate dip down to the 1.0800 mark found solid support back to the highs of the day ~1.0860. Topside focus remains on 1.0913, a Fibonacci projection amid a number of sell-side analysts upgrading their EURUSD forecasts over the past fortnight.

- Worth noting that not only do the Fed enter their blackout period before the Feb 01 meeting, China will also be out all next week for Lunar New Year. Highlights on the docket next week include the Bank of Canada decision as well as the first reading of Q4 US GDP.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/01/2023 | 1430/1530 |  | EU | ECB Panetta Intro at ECON Hearing | |

| 23/01/2023 | 1500/1000 | ** |  | US | leading indicators |

| 23/01/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/01/2023 | 1745/1845 |  | EU | ECB Lagarde Speech at Deutsche Boerse | |

| 24/01/2023 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.