-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Rate Cut Chances Firm Despite Hawkish Fed Speak

- MNI: Hopes Rise In Dash For EU Fiscal Rule Deal By Year End

- MNI: Fed's Bowman Still Sees Need To Raise Rates Further

- MNI: Fed's Logan Looking For Restrictive Conditions

US TSYS Fed Gov Bowman Remains Hawkish, Tsy Curves Bull Flatten

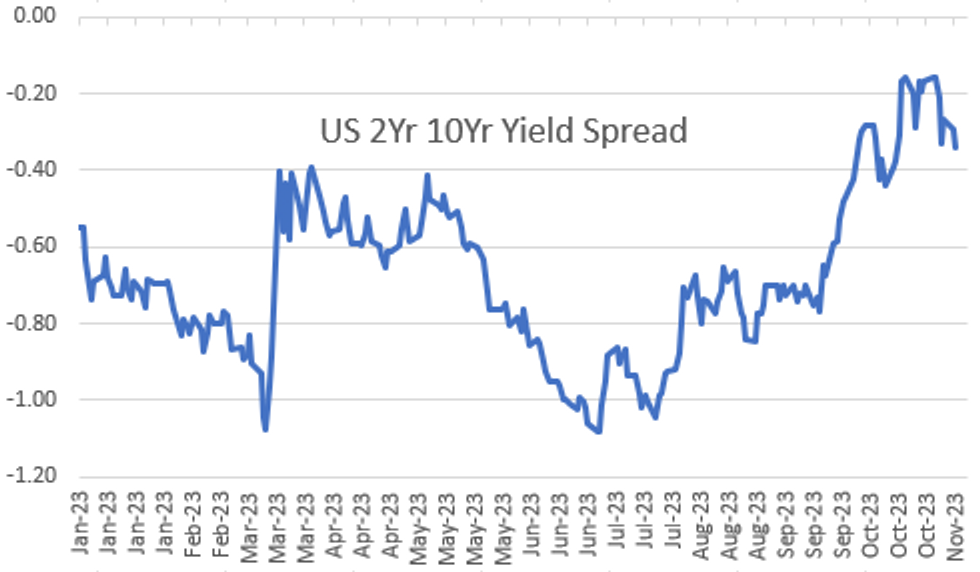

- Tsy futures are drifting near late session highs after the bell, curves flatter with the short end underperforming (2Y10Y -4.508 at -34.067). Light on data, markets showed muted reaction to multiple Fed speakers on the day.

- Fed Gov. Bowman (voter) maintained her hawkish stance in prepared remarks at the 2023 Ohio Bankers League (full here).

- Bowman supported the FOMC’s decision last week to hold rates unchanged but continues to expect that the Fed will need to hike further “to bring inflation down to our 2 percent target in a timely way”.

- On inflation: "Some components of core services inflation have picked up, and I see a continued risk that core services inflation remains stubbornly persistent. In my view, there is also a risk that higher energy prices could reverse some of the progress made to bring overall inflation down."

- Despite this afternoon's hawkish Fed speak, projected rate cut chance into early 2024 gains some ground: December holds at 2.4bp at 5.347%, January 2024 cumulative 3.9bp at 5.368%, while March 2024 pricing in -28.1% chance of a rate cut (-27.6 this morning) with cumulative at -3.1bp at 5.292%, May 2024 cumulative -15bp at 5.174%. Fed terminal at 5.365% in Feb'24.

- Meanwhile, Treasury futures holding narrow range near session highs after $48B 3Y note auction (91282CJK8) largely as expected 4.701% high yield vs. 4.702% WI; 2.67x bid-to-cover vs. 2.56x prior month.

US

FED: Hopes have risen for a deal by the end of the year on reforming the European Union’s fiscal rules after significant concessions to Germany and other so-called “frugal” countries in a proposal presented by Spain, holder of the bloc’s rotating presidency, officials close to the talks told MNI.

- Under the “Landing Zone” proposal submitted to negotiations between EU financial officials on Monday ahead of this Thursday’s meeting of finance ministers, states would guarantee a “common safety margin” below the 3% of GDP fiscal deficit threshold in the long term. The size of the margin, which would be applicable to all states regardless of debt level, has yet to be determined and it could be between one or even three percentage points of output, officials said.

- The new proposal also contains a provision for public debt ratios above the 60% of GDP limit to fall by a minimum amount during adjustment periods, again with the numerical quantification of that yet to be set. For more see MNI Policy main wire at 0908ET.

FED: Federal Reserve Governor Michelle Bowman favors raising the fed funds rate again to bring inflation back to 2%, citing continued risk that core services inflation remains "stubbornly persistent" and higher energy prices reverse some past progress on inflation, she said Tuesday.

- "While I continue to expect that we will need to increase the federal funds rate further to bring inflation down to our 2% target in a timely way, I supported the FOMC’s decision last week to hold the target range for the federal funds rate at the current level as we continue to assess incoming information and its implications for the outlook," she said in remarks prepared for an Ohio Bankers League event in Columbus, Ohio.

- "Some components of core services inflation have picked up, and I see a continued risk that core services inflation remains stubbornly persistent. In my view, there is also a risk that higher energy prices could reverse some of the progress made to bring overall inflation down," she said.

FED: Dallas Federal Reserve President Lorie Logan said Tuesday the core question for policy makers is whether financial conditions are sufficiently restrictive to return inflation to 2% in a timely and sustainable way.

- Logan acknowledged inflation has been coming down but said it remains "too high" and the labor market generally remains too tight, although there has been some important cooling in recent months. "Since the most recent FOMC meeting, we have seen some retracement in the 10-year yield and financial conditions," she said.

- "I'll be watching to see whether that that continues and what that means for the implications of policy. So importantly I'm going to be looking at the data and I'm going to be looking at financial conditions as we get closer to the following meeting."

OVERNIGHHT DATA

US SEPT. TRADE DEFICIT $61.5B; EST. -$59.8B prior revised to -$58.7B from -58.3B

- US SEP CONSUMER CREDIT +$9.1B

- US SEP REVOLVING CREDIT +$3.1B

- US SEP NONREVOLVING CREDIT +$5.9B

- CANADIAN SEP TRADE BALANCE CAD +2.0 BILLION

- CANADA SEP EXPORTS CAD 67.0 BLN, IMPORTS CAD 65.0 BLN

- CANADA REVISED AUG MERCHANDISE TRADE BALANCE CAD +0.9 BLN

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 48.29 points (0.14%) at 34143.75

- S&P E-Mini Future up 11.75 points (0.27%) at 4395.75

- Nasdaq up 132 points (1%) at 13650.93

- US 10-Yr yield is down 6.8 bps at 4.5748%

- US Dec 10-Yr futures are up 15.5/32 at 108-2.5

- EURUSD down 0.0024 (-0.22%) at 1.0694

- USDJPY up 0.36 (0.24%) at 150.43

- WTI Crude Oil (front-month) down $3.5 (-4.33%) at $77.33

- Gold is down $10.32 (-0.52%) at $1967.83

- European bourses closing levels:

- EuroStoxx 50 down 5.27 points (-0.13%) at 4153.37

- FTSE 100 down 7.72 points (-0.1%) at 7410.04

- German DAX up 16.67 points (0.11%) at 15152.64

- French CAC 40 down 27.5 points (-0.39%) at 6986.23

US TREASURY FUTURES CLOSE

- 3M10Y -7.314, -85.622 (L: -89.971 / H: -79.195)

- 2Y10Y -4.511, -34.07 (L: -35.525 / H: -27.646)

- 2Y30Y -4.513, -17.533 (L: -20.17 / H: -10.531)

- 5Y30Y -1.543, 20.187 (L: 17.591 / H: 23.317)

- Current futures levels:

- Dec 2-Yr futures up 1.625/32 at 101-16 (L: 101-13.5 / H: 101-17.625)

- Dec 5-Yr futures up 8.75/32 at 105-17.5 (L: 105-09.75 / H: 105-21.5)

- Dec 10-Yr futures up 16.5/32 at 108-3.5 (L: 107-19.5 / H: 108-09.5)

- Dec 30-Yr futures up 1-13/32 at 113-28 (L: 112-15 / H: 114-11)

- Dec Ultra futures up 1-24/32 at 117-21 (L: 115-28 / H: 118-10)

US 10Y FUTURE TECHS: (Z3) Bull Cycle Still In Play

- RES 4: 110-07+ High Sep 14

- RES 3: 110-00 Round number resistance

- RES 2: 109-20 High Sep 19

- RES 1: 108-25+ High Sep 25

- PRICE: 107-31+ @ 11:31 GMT Nov 7

- SUP 1: 107-01 20-day EMA

- SUP 2: 105-27+/105-10+ Low Nov 1 / Low Oct 19 and bear trigger

- SUP 3: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 104-19+ 2.0% 10-dma envelope

Treasuries maintain a firmer short-term tone and the contract is holding on to the bulk of its recent gains. Last week’s gains resulted in the break of the 50-day EMA, at 108-01, and delivered a print above 108-16, the Oct 12 high and a key resistance. A clear break of this 108-16 hurdle would strengthen a bullish case and signal scope for a climb towards 109-20, the Sep 19 high. Initial support lies at 107-01, the 20-day EMA.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 steady00 at 94.615

- Mar 24 +0.005 at 94.740

- Jun 24 +0.020 at 94.995

- Sep 24 +0.035 at 95.295

- Red Pack (Dec 24-Sep 25) +0.050 to +0.075

- Green Pack (Dec 25-Sep 26) +0.075 to +0.085

- Blue Pack (Dec 26-Sep 27) +0.090 to +0.105

- Gold Pack (Dec 27-Sep 28) +0.110 to +0.115

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00147 to 5.32197 (+0.00021/wk)

- 3M -0.00239 to 5.36567 (-0.01450/Wk)

- 6M -0.00497 to 5.39322 (-0.03267/wk)

- 12M -0.00116 to 5.26162 (-0.06428/Wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $101B

- Daily Overnight Bank Funding Rate: 5.32% volume: $251B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.559T

- Broad General Collateral Rate (BGCR): 5.30%, $583B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $570B

- (rate, volume levels reflect prior session)

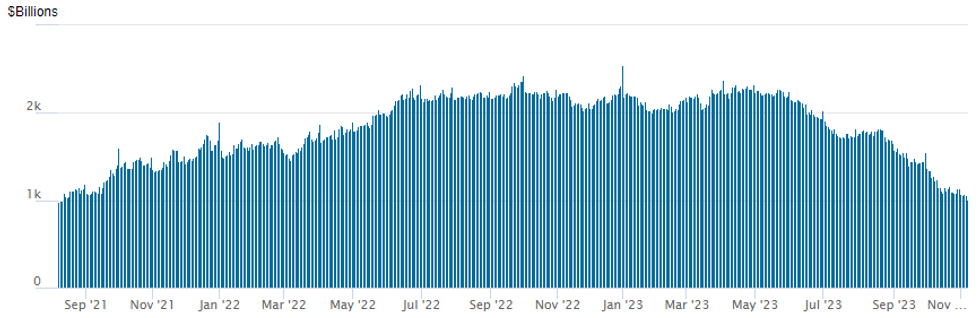

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage falls to new two-year low of $1,008.685B w/97 counterparties vs. $1,062.787B in the prior session. Today's usage compares to prior two year low of $1,054,986B from Nov 2.

PIPELINE: $2.25B VW 3Pt Launched

Ameriprise, World Bank and Rep of Turkiye still expected to launch

- Date $MM Issuer (Priced *, Launch #)

- 11/07 $2.25B #VW Group $750M 3Y +135, $700M 5Y +170, $800M 7Y +190

- 11/07 $2B #Charter Communication WNG $1.1B 3Y +150, $900M 10Y +210

- 11/07 $2B #Indonesia $1B 5Y 5.4%, $1B 10Y 5.6% Sukuk

- 11/07 $2B *Provence of British Columbia 5Y SOFR+55

- 11/07 $1.25B #SocGen PerpNC5.5 10%

- 11/07 $1B *Denmark 2Y +9

- 11/07 $750M #BBVA 11NC10 +330

- 11/07 $500M #Ares Management 5Y +187

- 11/07 $Benchmark Ameriprise Financial 5Y +140a

- 11/07 $Benchmark World Bank (IBRD) 10Y +56

- 11/07 $Benchmark Rep of Turkiye 5Y Sukuk 8.625%a

EGBs-GILTS CASH CLOSE: Long End Impresses As Oil Sinks

European core FI rallied sharply Tuesday in a bull flattening move, with strong outperformance at the long end.

- There were few macro catalysts evident in the session, with a weak German industrial production figure already telegraphed by Monday's factory orders data.

- But Bunds and Gilts were boosted by a 3+% drop in oil prices, and overnight central bank developments including BoE chief economist Pill making remarks about possible mid-2024 rate cuts, and a dovishly-perceived RBA hike.

- While UK instruments outperformed overall, 30Y German yields fell by the most in 3 months.

- Portugal underperformed on the EGB periphery following the surprise resignation of Prime Minister Costa amid a corruption probe into his office and gov't ministries.

- ECB's Nagel speaks after the cash close, with tomorrow's docket including Bund supply, German final CPI, Italian and Eurozone retail sales, the ECB's consumer expectations survey, and an appearance by BOE Gov Bailey.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.9bps at 2.984%, 5-Yr is down 5bps at 2.577%, 10-Yr is down 8.1bps at 2.658%, and 30-Yr is down 11.2bps at 2.894%.

- UK: The 2-Yr yield is down 8.9bps at 4.632%, 5-Yr is down 8.5bps at 4.244%, 10-Yr is down 10.7bps at 4.27%, and 30-Yr is down 11.5bps at 4.737%.

- Italian BTP spread down 1.3bps at 189.2bps / Portuguese up 2.5bps at 73.4bps

FOREX AUD Slumps Following Dovish Hike From RBA, Greenback Inches Higher

- The greenback looks set to be one of the strongest performers in G10 on Tuesday, helping the USD Index (+0.20) post a second consecutive session of gains to partially reverse Friday's sharp pull lower. The USD Index remains below the 50-dma resistance at 105.727, which provides the first upside level.

- AUD (-0.90%) remains the poorest performer after the RBA's 25bps rate hike (as expected) was accompanied by a switch to data-dependency, moderating the tightening message from the bank. AUD/USD erased Friday's rally in response, with 0.6394 marking the next support (50-dma).

- Meanwhile, NOK/SEK (-1.08%) has plumbed new multi-month lows, with the March 21 low of 0.9725 the next downside level to watch. Moves coincide with a further weakening in the oil price, as Brent and WTI crude futures both post multi-week lows on Tuesday, down over 4% amid fresh demand concerns.

- In sympathy with the greenback edging higher, EURUSD slipped back below 1.0700 throughout the session and briefly printed at 1.0664 before stabilising. The move lower failed tor each the pre-NFP levels around 1.0655 and further weakness would focus on the next support zone of 1.0638 and 1.0632 - a 38.2% Fib and the 50-dma respectively.

- A lack of tier-one data releases on Wednesday keeps the focus on central bank speakers. BOE Governor Bailey is due to speak at the Central Bank of Ireland Financial System Conference before Fed Chair Powell is due to deliver opening remarks at the Division of Research and Statistics Centennial Conference.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/11/2023 | 0001/0001 | ** |  | UK | KPMG/REC Jobs Report |

| 08/11/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 08/11/2023 | 0745/0845 | * |  | FR | Foreign Trade |

| 08/11/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 08/11/2023 | 0900/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 08/11/2023 | 0930/0930 |  | UK | BOE's Bailey address at CB of Ireland | |

| 08/11/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 08/11/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 08/11/2023 | 1015/0515 |  | US | Fed Governor Lisa Cook | |

| 08/11/2023 | 1045/1145 |  | EU | ECB's Lane Keynote speech in Latvia | |

| 08/11/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/11/2023 | 1330/0830 | * |  | CA | Building Permits |

| 08/11/2023 | 1415/0915 |  | US | Fed Chair Jerome Powell | |

| 08/11/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 08/11/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 08/11/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 08/11/2023 | 1830/1330 |  | CA | BOC minutes from last rate meeting | |

| 08/11/2023 | 1840/1340 |  | US | New York Fed's John Williams | |

| 08/11/2023 | 1900/1400 |  | US | Fed Vice Chair Michael Barr | |

| 08/11/2023 | 2145/1645 |  | US | Fed Vice Chair Philip Jefferson |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.