-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI ASIA OPEN: Rate Rally on Soft PMIs Ahead Friday Eco-Summit

- MNI MNI 2023 Jackson Hole Preview

- MNI MBA Purchase Applications Lowest Since 1995 As Higher Tsy Yields Weigh

- MNI US DATA: New Home Sales Beat Expectations With Significant Regional Volatility

- MNI US DATA: Preliminary Payrolls Benchmark Revision Lower Than Some Expected

- MNI INTERVIEW: ECB QT To Fuel Doubts Over "Whatever It Takes"

- MNI US PMIs: Higher Input Price Inflation But Not Passed Onto Selling Price Inflation

US

US: Federal Reserve Chairman Powell’s task in his Jackson Hole keynote speech is to reaffirm the recent turn to a meeting-by-meeting, data-dependent approach to policy while emphasizing that the Fed intends to keep rates in restrictive territory for a lengthy period of time.

- In this regard it is likely to sound like a bookend to his brief 2022 speech in which he invoked the lessons of the 1970s and 80s to say “we must keep at it until the job is done”, with Powell laying out the “higher for longer” rate landscape for the year ahead.

- Most analysts expect Powell to deliver a hawkish-on-balance message, and combined with the recent jump in market rates, the bar is set reasonably high for a hawkish reaction.

- MNI's Preview of Jackson Hole includes what we know so far is scheduled for the event, sell-side analysis, and a run-down of recent Fed communications.

EUROPE

ECB: Investors are likely to question the determination of the European Central Bank to deploy its Transmission Protection Instrument to tame any blowouts in bond spreads if high-debt states come under market pressure at the same time as it is reducing its balance sheet via quantitative tightening, Scope Ratings’ senior director of sovereign ratings Dennis Shen told MNI.

- Fiscal discipline will become still more essential if the central bank is perceived to be constrained by its tightening stance, Shen, noting that European Union budgetary rules will start to tighten next year as the escape clause from the Stability and Growth Pact is deactivated.

- “If they ever were to use the TPI – obviously they hope not to – but within that confine, where they are tightening monetary policy, but at the same time intervening to correct augmented yield spreads, I would suspect there will be limitations to the efficacy of the programme,” he said in an interview. For more see MNI Policy main wire at 0838ET.

US TSYS Services PMI Slowdown Spurs Treasury Rally

- Tail-wind for European rates triggered overnight after weaker than expected European Services PMI carried over to US markets. Cautious short covers reported with many leaning short in anticipation of hawkish messaging from CBs at Jackson Hole eco-summit that starts Thu' evening.

- Treasury futures extend the early rally after S&P PMIs comes out lower than estimated: S&P Global US Manufacturing PMI (47.0 vs 49.0 est), Services (51.0, 52.2 est), Composite (50.4, 51.5 est).

- Rates continued to grind higher after Preliminary Payrolls Benchmark Revision came out lower than some expected. The preliminary estimate of the payrolls benchmark revision based on the latest QCEW suggests the level of payrolls could be revised lower by -306k in the twelve month period up to March 2023.

- Heavy Treasury futures volumes reported, partially tied to post-data squaring and to a surge in quarterly futures from Sep'23 to Dec'23 (Dec'23 takes lead quarterly position Thursday, August 31).

- Today's long end led rally weighed on curves: 3M10Y -14.644 at -127.504, 2Y10Y -4.213 at -76.825. Contributing to the move: several large flatteners Blocked/crossed on the day: 2Y/10Y, 5Y/10Y and 5Y/30Y Ultra.

- Short end support did, however, temper rate hike projections through yr end: Sep 20 FOMC is 11% w/ implied rate change of +2.7bp to 5.356%. November cumulative of +10.1bp at 5.43, December cumulative of 7.9bp at 5.408%. Fed terminal holding has climbed to 5.42% in Nov'23.

OVERNIGHT DATA

- US MBA: REFIS -3% SA; PURCH INDEX -5% SA THRU AUG 18 WK

- US MBA: UNADJ PURCHASE INDEX -30% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 7.31% VS 7.16% PREV

- US MBA: MARKET COMPOSITE -4.2% SA THRU AUG 18 WK

MBA composite mortgage applications fell -4.2% last week (refis -3%, purchases -5%).

- It came as the 30Y mortgage rate increase 15bps to 7.31% for the highest since 2000, after the 7.16% the prior week tied with October’s high for the highest since 2001. The rate shouldn’t have come as too much of a surprise as mortgage rates maintained the ~300bp spread to 10Y Treasury yields.

- As noted in recent weeks, purchase applications have been pushing lower towards February’s cycle lows and the latest -5% drop pushed them through it for the lowest since 1995.

MNI US PMIs: The manufacturing PMI fell to 47.0 (cons 49.0) in Aug prelim after 49.0, only lowest since June. The services PMI fell to 51.0 (cons 52.2) after 52.3 for its weakest since February. The composite PMI fell to 50.4 (cons 51.5) after 52.0.

- The press release on composite activity: "Subdued client demand drove the slowdown across the economy, as total new orders declined for the first time in six months. Contractions in new orders were seen at manufacturers and service providers alike."

- "Meanwhile, cost pressures regained some momentum as the rate of input price inflation quickened on the back of greater fuel, wage and raw material costs. Efforts to remain competitive and drive sales stifled the pace of selling price inflation, however, which softened from that seen in July."

- US JUL NEW HOME SALES +4.4% TO 0.714M SAAR

- US JUN NEW HOME SALES REVISED TO 0.684M SAAR

US New Home Sales: Stronger than expected in July at 714k (cons 704k), with a 4.4% increase (cons 1.0%) after a marginally downward revised -2.8% in June (initial -2.5%).

- A wild breakdown by major region makes it hard to get a sense of the underlying trend, ranging from +47% for the relatively small midwest to -6% for the south, by far the largest.

- New home sales are back at pre-pandemic levels continues to contrast heavily with existing home sales continuing to decline at more than 20% below pre-pandemic levels. It comes with continued high supply of new builds, with new homes as a share of all homes on the market continuing to sit at very high relative levels.

US DATA: Preliminary Payrolls Benchmark Revision Lower Than Some Expected. The preliminary estimate of the payrolls benchmark revision based on the latest QCEW suggests the level of payrolls could be revised lower by -306k in the twelve month period up to March 2023.

- This is smaller than a few estimates closer to -500k seen beforehand, and is a relatively small figure considering the just over 4mln jobs added over that period in the latest iteration of the data.

- It gives a ballpark estimate for the finalized benchmark revision for payrolls growth to come with the Jan’24 report released in February.

- CANADA JUNE RETAILS +0.1% VS FORECAST +0.5%, PRIOR +0.1%

- CANADA JULY FLASH RETAIL SALES +0.4%

- CANADA RETAIL EX-AUTOS -0.8% VS FORECAST +0.3%, PRIOR -0.3%

- CANADA RETAIL EX-AUTOS & GAS -0.9% VS PRIOR -0.1%

- CANADIAN JUNE RETAIL SALES VOLUMES -0.2%

- CANADA Q2 RETAILS 0% VS Q1 +0.6%, Q2 VOLUMES -0.8%

- CANADIAN YOY RETAIL SALES -0.6%

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 154.15 points (0.45%) at 34445.36

- S&P E-Mini Future up 48.5 points (1.1%) at 4448.5

- Nasdaq up 234.5 points (1.7%) at 13741.71

- US 10-Yr yield is down 12.8 bps at 4.1958%

- US Sep 10-Yr futures are up 26/32 at 109-28

- EURUSD up 0.0015 (0.14%) at 1.0862

- USDJPY down 1 (-0.69%) at 144.88

- Gold is up $19.72 (1.04%) at $1917.11

- EuroStoxx 50 up 6.3 points (0.15%) at 4266.67

- FTSE 100 up 49.77 points (0.68%) at 7320.53

- German DAX up 22.79 points (0.15%) at 15728.41

- French CAC 40 up 5.74 points (0.08%) at 7246.62

US TREASURY FUTURES CLOSE

- 3M10Y -14.317, -127.177 (L: -127.766 / H: -114.699)

- 2Y10Y -3.624, -76.236 (L: -76.935 / H: -71.606)

- 2Y30Y -2.808, -67.786 (L: -68.603 / H: -61.76)

- 5Y30Y +0.344, -8.582 (L: -10.473 / H: -4.097)

- Current futures levels:

- Sep 2-Yr futures up 5/32 at 101-11.625 (L: 101-05.875 / H: 101-13)

- Sep 5-Yr futures up 14.25/32 at 105-31 (L: 105-14.75 / H: 106-02.25)

- Sep 10-Yr futures up 26/32 at 109-28 (L: 109-00.5 / H: 109-31.5)

- Sep 30-Yr futures up 1-27/32 at 120-6 (L: 118-12 / H: 120-11)

- Sep Ultra futures up 2-20/32 at 126-8 (L: 123-24 / H: 126-12)

US 10Y FUTURE TECHS (U3) Trend Condition Remains Bearish

- RES 4: 111-29 High Aug 10

- RES 3: 111-18+ 50-day EMA

- RES 2: 110-29 High Aug 11

- RES 1: 109-28+/110-12 High Aug 18 / 20-day EMA

- PRICE: 109-14+ @ 11:28 BST Aug 23

- SUP 1: 108-28/26+ Yesterday’s low / Low Oct 21 2022 (cont)

- SUP 2: 108-12 1.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 107-22 2.0% 10-dma envelope

- SUP 4: 107.17 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

The trend direction in Treasuries remains down and the contract traded to a fresh cycle low yesterday. The move down confirms a resumption of the trend and maintains the bearish price sequence of lower lows and lower highs. Last week’s breach of support at 109.24, the Aug 4 low, also confirmed a continuation of the trend. The focus is on 108.12, a Fibonacci projection. Firm resistance is 110-12, the 20-day EMA. Gains are considered corrective.

SOFR FUTURES CLOSE

- Sep 23 +0.010 at 94.588

- Dec 23 +0.030 at 94.595

- Mar 24 +0.060 at 94.790

- Jun 24 +0.090 at 95.095

- Red Pack (Sep 24-Jun 25) +0.110 to +0.120

- Green Pack (Sep 25-Jun 26) +0.125 to +0.130

- Blue Pack (Sep 26-Jun 27) +0.140 to +0.140

- Gold Pack (Sep 27-Jun 28) +0.150 to +0.160

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00035 to 5.31495 (+.00068/wk)

- 3M +0.00798 to 5.39105 (+0.00788/wk)

- 6M +0.01079 to 5.45769 (+0.01315/wk)

- 12M +0.02318 to 5.41133 (+0.02795/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $101B

- Daily Overnight Bank Funding Rate: 5.31% volume: $273B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.307T

- Broad General Collateral Rate (BGCR): 5.27%, $550B

- Tri-Party General Collateral Rate (TGCR): 5.27%, $543B

- (rate, volume levels reflect prior session)

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

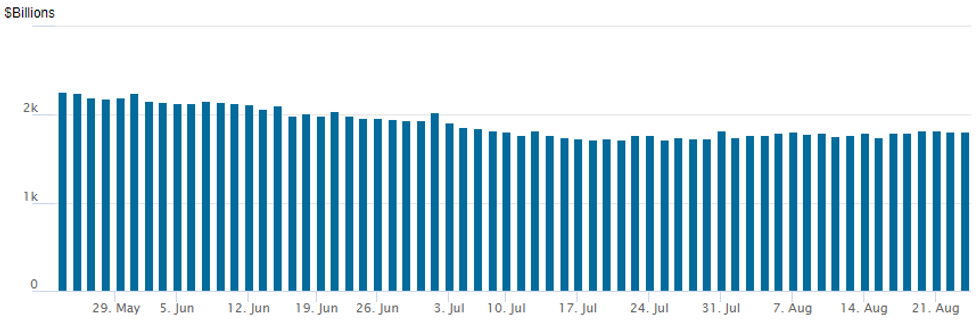

Repo operation inches up to $1,816.533B w/96 counterparties, compared to $1,812.294B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

$4B Asian Development Bank 5Y SOFR Launched

- Date $MM Issuer (Priced *, Launch #)

- 08/23 $4B #Asian Development Bank (ADB) 5Y SOFR+35

- 08/23 $Benchmark Kommunalbanken Norway 5Y SOFR+44

- 08/23 $Benchmark Pacific Life 3Y +100a

EGBs-GILTS CASH CLOSE: Bellies Outperform As PMIs Sink Rate Hike Pricing

The bellies of the German and UK curves outperformed in a significant overall rally Wednesday as soft August PMIs signalled recessionary conditions and called into question how much further the ECB and BoE would raise rates.

- Gilts outperformed overall but it was Eurozone PMI data that provided the initial shock. A sharp contraction in German services activity highlighted a poor Eurozone reading (30-month low 48.3 v 50.5 expected), then the UK report piled on with the lowest Services PMI since January 2021 (48.7).

- Whether the ECB hikes next is now at best a 50/50 proposition per market pricing, while a full 25bp hike has been removed from the BoE's hike path in the past few sessions. More cuts past the peak are now expected as well (by 9bp for each of the central banks).

- Hedging around the pricing of the Finnish and EFSF syndications may have provided a little bit of downside impetus in early afternoon trade, but supply was no match for macro as today's driving force.

- Periphery EGB spreads closed mixed, with Italy and Spain outperforming (0.7bp tighter to 10Y Bunds) and Greece underperforming.

- Thursday's data includes French sentiment and UK CBI distributive trades, but attention will turn quickly to US data (incl jobless claims) and the start of the Jackson Hole symposium.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 11.3bps at 2.974%, 5-Yr is down 13.5bps at 2.519%, 10-Yr is down 12.8bps at 2.517%, and 30-Yr is down 9.5bps at 2.63%.

- UK: The 2-Yr yield is down 17.3bps at 4.973%, 5-Yr is down 19.3bps at 4.49%, 10-Yr is down 17.7bps at 4.468%, and 30-Yr is down 13.9bps at 4.696%.

- Italian BTP spread down 0.7bps at 165.2bps / Greek bond up 2.9bps at 132.6bps

FOREX Greenback Swiftly Reverses Lower Following Weak US Data

- Early demand for the greenback dissipated during US hours, with the reversal lower for the USD index extending following the weaker than expected US Flash PMI data for August. The substantial move lower for US yields prompted the Yen to outperform and the associated rally for equities left the likes of AUD, NZD and emerging market currencies leading the charge.

- The consistent grind higher for treasury futures underpinned the relentless bid for the Japanese Yen on Wednesday. USDJPY printed as high as 145.90 overnight before eventually sliding back below the 145 mark on the disappointing US PMI data and pushing to session lows of 144.54 in late US trade. Initial firm support lies at 144.17, the 20-day EMA.

- Interestingly, the JPY had also been strengthening during Europe, led by a solid move lower for EURJPY and GBPJPY following similar weakness in the PMI data across Europe.

- The broad USD weakness throughout US hours led the likes of EURUSD and GBPUSD back to unchanged levels, but the noticeable outperformers were both AUD and NZD, as lower yields enhanced the optimism for global risk sentiment. AUDUSD price action today has narrowed the gap with firm resistance seen at 0.6522, the 20-day EMA.

- US durable goods and jobless claims are Thursday’s data highlights, however, obvious focus will be on the Jackson Hole Symposium. Chair Powell’s task in his Jackson Hole keynote speech is to reaffirm the recent turn to a meeting-by-meeting, data-dependent approach to policy while emphasizing that the Fed intends to keep rates in restrictive territory for a lengthy period of time.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/08/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/08/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 24/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 24/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/08/2023 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/08/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 24/08/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 24/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/08/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.