-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Rates Strong Ahead Heavy Wednesday Schedule

EXECUTIVE SUMMARY

US TSYS: Ylds Lower, Curves Bull Fatten Ahead Wed's Nov FOMC Minutes

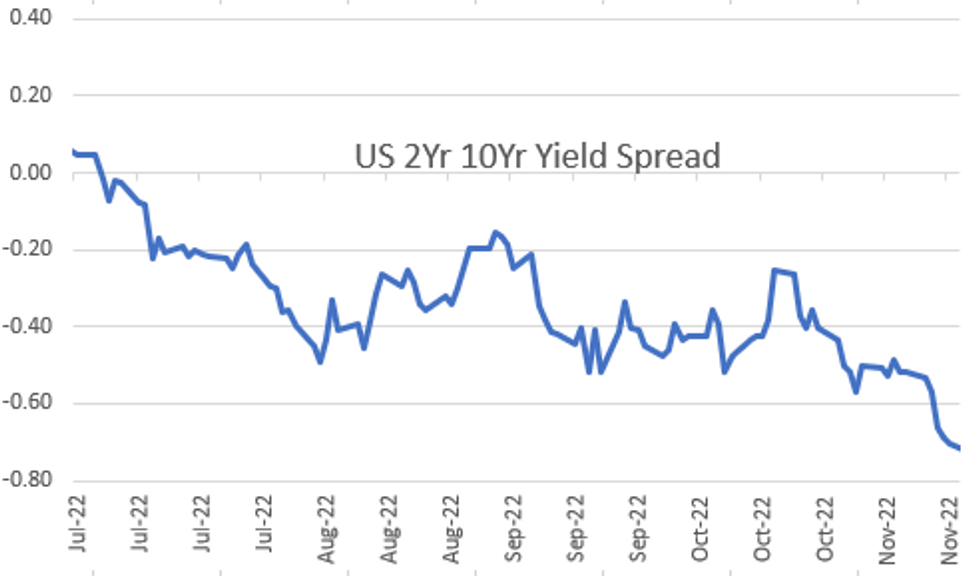

Tsys stronger, near late session highs after the bell, yield curves bull-flattening to new all-time lows (2s10s -76.451), 30YY slip to 3.8153% low.

- KC Fed President Esther George Tuesday said the large savings buffer Americans possess is likely to require higher interest rates to keep a lid on consumer spending.

- "High savings is likely to provide momentum to consumption and require higher interest rates," she said in remarks at a conference held by the Central Bank of Chile, estimating Americans continue to hold on to USD2.3 trillion in excess savings relative to pre-pandemic levels.

- Heavy overall volumes, TYZ2 appr 3M - tied to Dec/Mar rolling ahead Wed, Nov 30 first notice (Mar24 takes lead), over 1.9M TYZ/TYH spds trade after the close makes appr 1.1M not roll-tied, average volumes.

- Tsys pare gains after $35B 7Y note auction (91282CFY2) tail: 3.890% high yield vs. 3.862% WI; 2.33x bid-to-cover vs. 2.43x last month.

- Reminder: Weekly jobless claim rolled to Wednesday due to Thursday's Thanksgiving Holiday mkt close (followed by early noon close Fri, Globex at 1215ET, NYSE and Nasdaq at 1300ET). Note on Tsy bill auctions: competitive closing time for 4- and 8W bills earlier than the usual 1130ET to 1000ET, followed by 17W bill auction at 1130ET.

US

FED: Kansas City Fed President Esther George Tuesday said the large savings buffer Americans possess is likely to require higher interest rates to keep a lid on consumer spending.

- "High savings is likely to provide momentum to consumption and require higher interest rates," she said in remarks at a conference held by the Central Bank of Chile, estimating Americans continue to hold on to USD2.3 trillion in excess savings relative to pre-pandemic levels. "This excess saving and the distribution of those savings is going to be a key factor I think shaping the outlook for output for inflation and certainly for interest rates."

- George, in remarks that focused on the distributional consequences of monetary policy, also said US house prices remain 25% above their pre-pandemic trend and while largely an issue of supply one can argue it is in part due to the magnitude and duration of quantitative easing.

CANADA

BOC: The Bank of Canada remains far from reaching its inflation goal and interest-rate hikes are just starting to show results cooling economic growth and price gains, Senior Deputy Governor Carolyn Rogers said Tuesday.

- "We have a long way to go to get inflation back to target, but there are some early signs that monetary policy is working," Rogers told a student group. "Unfortunately, this adjustment is not without some pain."

- "We don’t want this transition to be more difficult than it has to be," she said, "but higher interest rates in the short term will bring inflation down in the long term. Canadians are looking for ways to protect themselves from rising prices, and we are working to protect them from entrenched inflation."

EUROPE

SWEDEN: The Riksbank is widely expected to hike by 75-basis-points on Thursday after its November meeting, following its 100bps increase in September, but hefty declines in property prices and the Swedish central bank's own research showing high household sensitivity to interest rates suggest it will signal the end of the tightening cycle is near.

- After delaying the start of its tightening campaign compared to its peers, the Riksbank has moved aggressively, with all five Executive Board members voting to increase the policy rate to 1.75% in September, when its forecast showed the policy rate peaking at a little over 2.5% in Q3 2023. While market pricing indicates that this anticipated cycle high is likely to be increased this time round, the increment is unlikely to be large.

- The board's strategy of front-loading hikes to reinforce its commitment to getting inflation back to target is clear but so are downside risks.

OVERNIGHT DATA

US NOV. RICHMOND FED FACTORY INDEX -9; EST. -8

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 381.55 points (1.13%) at 34080.94

- S&P E-Mini Future up 46.5 points (1.17%) at 4004.5

- Nasdaq up 116.6 points (1.1%) at 11141.09

- US 10-Yr yield is down 6.5 bps at 3.7615%

- US Dec 10Y are up 9/32 at 112-19

- EURUSD up 0.0054 (0.53%) at 1.0296

- USDJPY down 0.9 (-0.63%) at 141.24

- Gold is down $0.33 (-0.02%) at $1737.69

- EuroStoxx 50 up 20.62 points (0.53%) at 3929.9

- FTSE 100 up 75.99 points (1.03%) at 7452.84

- German DAX up 42.42 points (0.3%) at 14422.35

- French CAC 40 up 23.08 points (0.35%) at 6657.53

US TSY FUTURES CLOSE

- 3M10Y -10.902, -51.122 (L: -55.436 / H: -42.547)

- 2Y10Y -2.483, -75.687 (L: -76.451 / H: -69.041)

- 2Y30Y -2.184, -68.658 (L: -70.243 / H: -60.833)

- 5Y30Y +1.621, -11.28 (L: -12.671 / H: -5.637)

- Current futures levels:

- Dec 2Y down 0.125/32 at 102-3.125 (L: 102-02.25 / H: 102-05.375)

- Dec 5Y up 4/32 at 107-22 (L: 107-15.25 / H: 107-24)

- Dec 10Y up 9/32 at 112-19 (L: 112-06.5 / H: 112-22.5)

- Dec 30Y up 1-04/32 at 126-19 (L: 125-10 / H: 126-27)

- Dec Ultra 30Y up 1-20/32 at 135-04 (L: 133-12 / H: 135-16)

US 10Y FUTURE TECHS: (Z2) Trend Needle Points North

- RES 4: 115-14+ 50.0% retracement of the Aug 2 - Oct 21 downleg

- RES 3: 114-17 High Sep 20

- RES 2: 113-30 High Oct 4 and a key resistance

- RES 1: 113-11 High Nov 16

- PRICE: 112-20@ 1415ET Nov 22

- SUP 1: 111-22/110-12+ 20-day EMA / Low Nov 10

- SUP 2: 109+10+ Low Nov 04

- SUP 3: 108-26+ Low Oct 21 and the bear trigger

- SUP 4: 108-06+ Low Oct 2007 (cont)

The short-term trend condition in Treasury futures remains bullish and the contract is holding on to the bulk of its recent gains. This month's bullish price action has resulted in a break of 112-13+, the 50-day EMA. A continuation higher would strengthen bullish conditions and open 113-30, Oct 4 high and a key resistance. On the downside, initial firm support is at 111-22, the 20-day EMA. A break of this average would signal scope for a deeper retracement.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.018 at 95.025

- Mar 23 -0.005 at 94.725

- Jun 23 +0.005 at 94.685

- Sep 23 -0.005 at 94.845

- Red Pack (Dec 23-Sep 24) +0.025 to +0.135

- Green Pack (Dec 24-Sep 25) +0.080 to +0.135

- Blue Pack (Dec 25-Sep 26) +0.060 to +0.070

- Gold Pack (Dec 26-Sep 27) +0.075 to +0.085

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00700 to 3.81843% (+0.00629/wk)

- 1M +0.03714 to 4.01614% (+0.05943/wk)

- 3M +0.00685 to 4.69871% (+0.03385/wk) * / **

- 6M -0.00943 to 5.16214% (+0.01943/wk)

- 12M +0.01300 to 5.57886% (+0.06943/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.69871% on 11/22/22

- Daily Effective Fed Funds Rate: 3.83% volume: $94B

- Daily Overnight Bank Funding Rate: 3.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.015T

- Broad General Collateral Rate (BGCR): 3.76%, $404B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $395B

- (rate, volume levels reflect prior session)

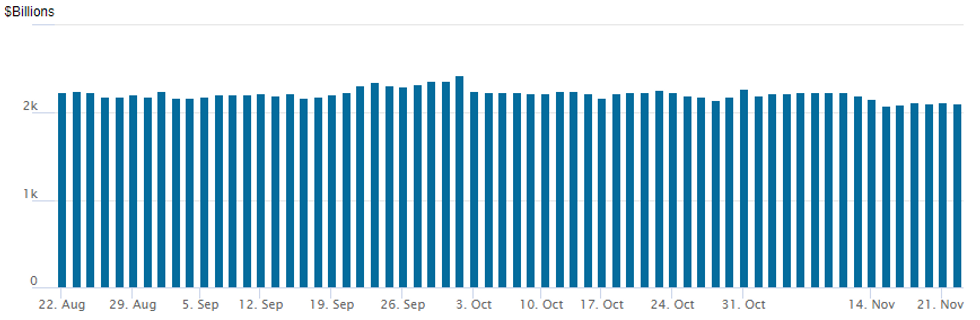

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,103.932B w/ 92 counterparties vs. $2,125.426B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $1.75B Swedish Export Credit Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/22 $1.75B #Swedish Export Credit (SEC) 2025 SOFR+51

EGBs-GILTS CASH CLOSE: Constructive Pre-PMI Session

Bunds and Gilts advanced modestly Tuesday for the 2nd consecutive session in light trade.

- Bank of Lithuania Pres Simkus told MNI that the ECB "definitely need a 50bps hike" at the December meeting, but asked "do we need 75bps?", calling it premature to make that judgment.

- Eurozone Nov consumer confidence was weak but slightly beat expectations.

- GGBs outperformed - while it wasn't a market-mover, they were underpinned by the EU's finding that Greece has done enough to qualify for the final disbursement of debt relief.

- Attention turns to flash PMI data Wednesday morning.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.9bps at 2.11%, 5-Yr is down 1bps at 1.963%, 10-Yr is down 1.6bps at 1.978%, and 30-Yr is down 2.1bps at 1.89%.

- UK: The 2-Yr yield is down 4.6bps at 3.142%, 5-Yr is down 5.3bps at 3.221%, 10-Yr is down 4.9bps at 3.137%, and 30-Yr is up 0.9bps at 3.316%.

- Italian BTP spread down 1.1bps at 193.5bps / Greek down 1.5bps at 226bps

FOREX: USD Continues To Weaken Approaching APAC Crossover

- The greenback spent the majority of Tuesday’s session reversing Monday’s advance, weakening steadily amid a more positive risk backdrop as both equity and commodity indices posted solid gains.

- The USD index has risen 0.65% and resides just 30 pips below Friday’s close with the World Cup and the Thanksgiving holiday likely capping the momentum for any sizable adjustments in currency markets.

- Broad greenback weakness was led by USD/CNH backtracking in early European / late Asia-Pac hours, putting the pair back below the 50-dma, narrowing the gap towards 7.1031, the 50% retracement for the Nov 14 - Nov 21 upleg.

- The Norwegian Krone is the strongest in G10 amid supportive price action in crude futures following the strong bounce late Monday. Additionally, NZD is on the front foot, with markets again posturing ahead of the RBNZ decision on Wednesday where the bank is expected to raise rates by a further 75bps to 4.25%.

- 0.6206 and 0.6251 represent the nearest levels of note on the topside for NZDUSD, with the latter representing the three-month high for the pair.

- As well as the RBNZ decision, flash Eurozone PMIs will be in the spotlight before US durable goods, new home sales and UMich sentiment data. The FOMC minutes caps off the Wednesday docket. Sell-side analysts mostly see risks to the minutes as leaning hawkish, at the very least cementing expectations for an upgrade to the median 2023 dot in December's next SEP vs September's editions.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 23/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/11/2022 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/11/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 23/11/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/11/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/11/2022 | 1500/1000 | *** |  | US | New Home Sales |

| 23/11/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 23/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/11/2022 | 1700/1200 | ** |  | US | Natural Gas Stocks |

| 23/11/2022 | 1900/1400 |  | US | FOMC minutes | |

| 23/11/2022 | 1900/1900 |  | UK | BOE Pill Speech at Beesley Lecture Series | |

| 23/11/2022 | 2130/1630 |  | CA | Governor Macklem testifies at House finance committee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.