-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk Appetite Improves, Banks Climbing

EXECUTIVE SUMMARY

Tsys Weaker, Little New From Fed Chairman Powell Citing Forecasts

- Treasury futures hold modestly weaker in late trade, near the middle of a relatively narrow session range after mirroring moves in German Bunds in the first half. Not much coverage and little market reaction to Fed Chairman Powell meeting with the Republican Study Committee for lunch, expecting one more hike this year citing Fed forecasts.

- Meanwhile, futures traded weaker after the $35B 7Y note auction (91282CGS4) tailed 1.1bp: 3.626% high yield vs. 3.615% WI; 2.39x bid-to-cover vs. 2.49x last month. Treasury and corporate bond-tied hedging contributed to the range while yield curves see-sawed off steeper levels to marginally flatter: 2s10s -.379 at -52.280 vs. -47.063 high.

- From a technical perspective 10Y futures prices remain below last Friday’s high of 117-01+. Price action on Mar 24 is a potential reversal signal - a shooting star candle pattern. It suggests scope for further weakness towards the 20-day EMA, at 114-05. The average represents a key support ahead of 113-26, the Mar 22 low. Key resistance and the bull trigger has been defined at 117-01+.

- Items in focus for Thursday: Weekly Claims, GDP and Personal Consumption at 0830ET. Afternoon Fed Speakers: Richmond Fed Barkin and Boston Fed Collins will answer questions at separate events at 1445ET, MN Fed Kashkari will speak at a town hall event, moderated Q&A at 1300ET.

CANADA

BOC: Bank of Canada Deputy Governor Toni Gravelle said government bond purchases deployed during the Covid pandemic could wrap up around the end of next year or the first half of 2025 while the ample reserves policy may keep up to an extra CAD60 billion of settlement balances in the system.

- Ample reserves could also be as little as CAD20 billion depending on market conditions, or equal to 1% to 2% of Canada's GDP, Gravelle said, less than the Federal Reserve's longer-run level of reserves estimated at 10% to 13% of U.S. gross domestic product. The Bank of Canada will start buying assets again once the proper level of settlement balances is reached, he said.

- "Quantitative tightening is happening, but it will take time to run its course," Gravelle said. His speech also said the central bank is prepared to step in with liquidity if the collapse of SVB and Credit Suisse roil markets, but didn't directly say how that could affect its balance sheet plans. For more see MNI Policy main wire at 1232ET..

EUROPE

SPAIN: The Spanish government sees little chance that the European Union’s already-delayed reform of its fiscal rules will be agreed during its June-December presidency of the bloc, officials told MNI, increasing the chances that the existing Stability and Growth Pact will come back into force next year and put pressure on budgets throughout the EU.

- The current Swedish presidency, which looks set to fail in its drive to push through reform of the rules in the Stability and Growth Pact, has missed a perfect opportunity for an agreement, given Sweden’s status as a northern country but one not so insistent on fiscal discipline as the rest of the so-called “frugal” group, Spanish officials said.

- As of June, given Spain’s clear interest in obtaining favorable treatment for its own fiscal situation, any excessive effort directed at passing the reform during its presidency would be perceived as putting its national interest ahead of that of the bloc as a whole, the officials said.

US Pending Home Sales Surprisingly Hold Onto January Jump

- Pending home sales were stronger than expected in February, rising 0.8% M/M (cons -3%) with no payback after jumping 8.1% M/M in Jan.

- Its leading nature helps support the surprise strength in US existing home sales after they surged 14.5% in Feb, in further evidence of what looked like a bottoming in housing market activity in the months just prior to regional banking woes.

- Latest weekly bank credit data, which only capture the early days of the fallout with the week to Wed Mar 15, didn't show a material tightening in gross loan books and instead saw an increase across various loan categories including residential real estate.

MARKETS SNAPSHOT

Key late session market levels:

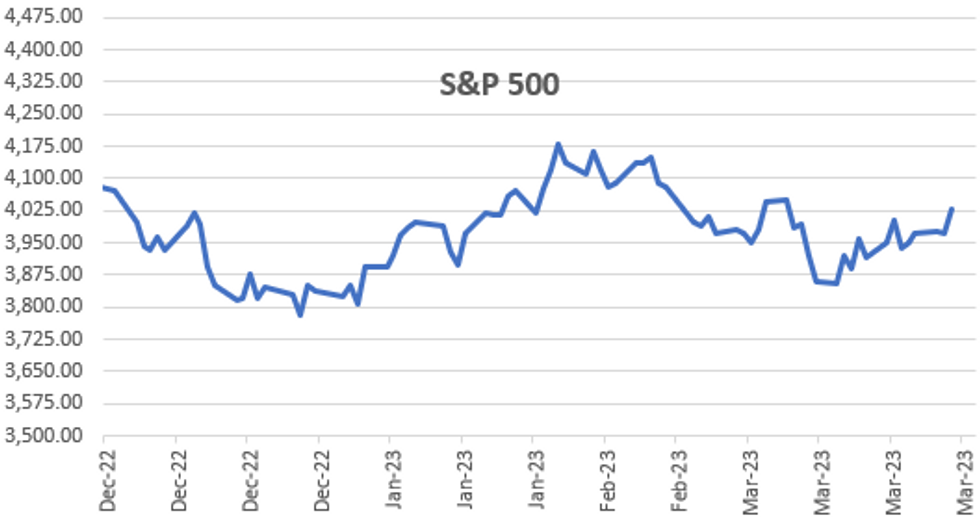

- DJIA up 304.24 points (0.94%) at 32699.43

- S&P E-Mini Future up 54.5 points (1.36%) at 4056.5

- Nasdaq up 211.7 points (1.8%) at 11927.63

- US 10-Yr yield is down 0.4 bps at 3.5658%

- US Jun 10-Yr futures are down 3.5/32 at 114-17

- EURUSD down 0.0002 (-0.02%) at 1.0843

- USDJPY up 1.81 (1.38%) at 132.7

- WTI Crude Oil (front-month) down $0.2 (-0.27%) at $72.98

- Gold is down $9.9 (-0.5%) at $1963.63

- EuroStoxx 50 up 63.06 points (1.51%) at 4231.27

- FTSE 100 up 80.02 points (1.07%) at 7564.27

- German DAX up 186.76 points (1.23%) at 15328.78

- French CAC 40 up 98.65 points (1.39%) at 7186.99

US TREASURY FUTURES CLOSE

- 3M10Y -4.659, -122.491 (L: -126.405 / H: -115.717)

- 2Y10Y +0.05, -51.851 (L: -54.612 / H: -47.063)

- 2Y30Y +0.948, -30.888 (L: -35.283 / H: -25.004)

- 5Y30Y +1.042, 10.232 (L: 6.576 / H: 14.04)

- Current futures levels:

- Jun 2-Yr futures down 1.5/32 at 103-6.875 (L: 103-02.875 / H: 103-11.75)

- Jun 5-Yr futures down 2.5/32 at 109-7.75 (L: 109-00.5 / H: 109-17)

- Jun 10-Yr futures down 3.5/32 at 114-17 (L: 114-07 / H: 114-28)

- Jun 30-Yr futures down 5/32 at 129-25 (L: 129-06 / H: 130-07)

- Jun Ultra futures up 1/32 at 139-5 (L: 138-08 / H: 139-24)

US 10YT FUTURE TECHS: Bear Threat Remains Present

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 2: 116-06+/117-01+ High Mar 27 / High Mar 24 and bull trigger

- RES 1: 115-07+ High Mar 28

- PRICE: 114-17 @ 1445 ET Mar 29

- SUP 1: 114-07 Low Mar 29

- SUP 2: 114-05/113-26 20-day EMA / Low Mar 22

- SUP 3: 113-24 50-day EMA

- SUP 4: 113-08+ Low Mar 15

Treasury futures traded flat through Wednesday trade, having recouped losses off a 114-07 low. Nonetheless, prices remain below last Friday’s high of 117-01+. Price action on Mar 24 is a potential reversal signal - a shooting star candle pattern. It suggests scope for further weakness towards the 20-day EMA, at 114-05. The average represents a key support ahead of 113-26, the Mar 22 low. Key resistance and the bull trigger has been defined at 117-01+.

EURODOLLAR FUTURES CLOSE

- Jun 23 +0.005 at 94.830

- Sep 23 -0.060 at 95.165

- Dec 23 -0.060 at 95.445

- Mar 24 -0.065 at 95.810

- Red Pack (Jun 24-Mar 25) -0.05 to -0.025

- Green Pack (Jun 25-Mar 26) -0.015 to +0.010

- Blue Pack (Jun 26-Mar 27) +0.010 to +0.015

- Gold Pack (Jun 27-Mar 28) +0.010 to +0.015

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 to 4.81157% (+0.00271/wk)

- 1M -0.01842 to 4.84029% (+0.00972/wk)

- 3M -0.00372 to 5.15914% (+0.05771/wk)*/**

- 6M -0.03714 to 5.20957% (+0.22,228/wk)

- 12M -0.02728 to 5.16043% (+0.32457/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.16286% on 3/28/23

- Daily Effective Fed Funds Rate: 4.83% volume: $98B

- Daily Overnight Bank Funding Rate: 4.82% volume: $268B

- Secured Overnight Financing Rate (SOFR): 4.84%, $1.345T

- Broad General Collateral Rate (BGCR): 4.80%, $515B

- Tri-Party General Collateral Rate (TGCR): 4.80%, $504B

- (rate, volume levels reflect prior session)

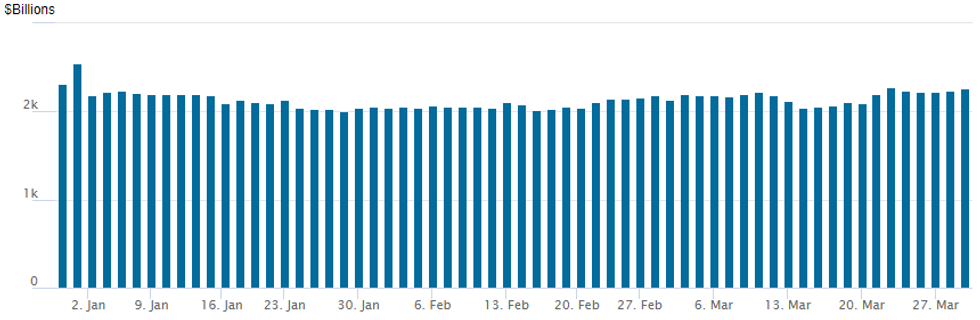

FED Reverse Repo Operation: Second Highest For 2023

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,264.862B (second highest for 2023 after $2,279.608B on March 22) w/ 104 counterparties, compares to yesterday's $2,231.749B. Record high of $2,553.716B from December 30, 2022 remains intact.

PIPELINE: $500M Archer-Daniels-Midland 10Y Priced

$4.25B To price Wednesday- Date $MM Issuer (Priced *, Launch #)

- 03/29 $1B #Al-Rajhi Bank 5Y +110

- 03/29 $900M #New York Life $600M 3Y +85, $300M 3Y SOFR+93

- 03/29 $750M #Allstate 10Y +170

- 03/29 $600M #Aviation Capital Group 5Y +275

- 03/29 $500M *Archer-Daniels-Midland 10Y +105

- 03/29 $500M Nederlandse Financierings-Maatschappij 2Y +27a

EGBs-GILTS CASH CLOSE: Bear Flattening Continues In Germany

The German curve bear flattened for the third consecutive session, with the UK's twist flattening Wednesday.

- 2Y German yields were the underperformer again, punctuated by a close on the session highs. 10Y UK and German yields peaked in early afternoon, with notable macro / cross-asset drivers few and far between.

- Periphery EGB spreads tightened as Greece held a successful 5Y GGB syndication and risk assets (notably equities) rallied throughout the session.

- Terminal ECB and BoE hike pricing rose very slightly on the day(2-3bp).

- ECB's Lane says under the bank's baseline scenario more hikes will be needed; Kazimir said hikes should continue, "maybe at a slower pace".

- The BoE FPC's minutes noted tighter credit conditions but resilient banks.

- BoE's Mann and ECB's Schnabel speak after the cash close.

- Data was again a sideshow (French consumer confidence was in line, UK lending/money supply data was on the strong-side), with attention firmly on Thursday's CPI releases.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.2bps at 2.654%, 5-Yr is up 4.8bps at 2.328%, 10-Yr is up 3.9bps at 2.329%, and 30-Yr is up 3.5bps at 2.408%.

- UK: The 2-Yr yield is up 4.8bps at 3.412%, 5-Yr is up 3.1bps at 3.316%, 10-Yr is up 1.6bps at 3.472%, and 30-Yr is down 3bps at 3.831%.

- Italian BTP spread down 2.7bps at 182.1bps / Spanish down 2.1bps at 101.6bps

FOREX: Greenback Trades On Surer Footing, USDJPY Leads The Charge

- The USD index (+0.30%) looks set to snap its losing streak this week with few new headlines/drivers providing a more stable backdrop and prompting some moderate relief for the greenback.

- The dollars ascent has been led by weakness in the Japanese Yen which sees USDJPY trade roughly 200 pips off the overnight lows, hovering just below the day’s peak of 132.76 as we approach the end of Wednesday trade.

- While there has been an element of the JPY playing some catch up with rising US Yields over previous sessions, the firmer price action for major equity indices on Wednesday has provided a much more benign environment from which USDJPY has rallied.

- Despite the overall trend conditions remaining bearish for USDJPY, the pair is in close proximity of two resistance levels. Firm resistance is seen at the 20-day EMA, at 132.82 and 133.00, the March 22 high, where a break is required to ease the bearish technical pressure.

- Core rates may take their cues from Eurozone CPI prints tomorrow, China PMIs & US Core PCE price index data both on Friday.

- On the domestic docket, March Tokyo core CPI will be published Friday, along with unemployment, industrial production and retail sales figures for February.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/03/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 30/03/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/03/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/03/2023 | 0800/1000 | *** |  | DE | Hesse CPI |

| 30/03/2023 | 0900/1100 | ** |  | IT | PPI |

| 30/03/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/03/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/03/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 30/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/03/2023 | 1230/0830 | *** |  | US | GDP |

| 30/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/03/2023 | 1645/1245 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2023 | 1645/1245 |  | US | Boston Fed's Susan Collins | |

| 30/03/2023 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 30/03/2023 | 1945/1545 |  | US | Treasury Secretary Janet Yellen |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.