-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

MNI BRIEF: Japan Oct Real Wages Unchanged Y/Y

MNI ASIA OPEN: SF Fed Daly Expects Further Eco Slowdown

EXECUTIVE SUMMARY

US

FED: SF Fed's Daly ('24 voter) tells the WSJ that her views are very consistent with the SEP from the Dec meeting.

- Unsurprisingly, therefore, the overall stance is consistent with the minutes wanting to avoid an easing in financial conditions: "Something above" 5% is "absolutely likely" for the peak rate and it will be challenging to find the peak rate to pause at but the Fed shouldn't declare victory based on one month of data as doing so early and stopping could worsen the economy.

- Right now, she sees a case can be made for either a 25bp or 50bp hike in Feb but also that hiking in more gradual steps lets the Fed react more nimbly.

- Relatively hawkish on inflation: core services ex housing inflation has shown no sense of coming down, sees more persistence in aspects of inflation with it being tough to get down.

- Moderately more optimistic on labor market: wages coming down is consistent with labor market slowing and gives hope that service inflation is slowing, labor supply and demand are coming better into balance.

- The mixed nature of the report has meant differing takeaways from the fifteen sellside analysts reviewed in our report. Instrumental for guiding the market to a 25bp or 50bp hike for Feb 1 will be Powell speaking tomorrow (Jan 10) before CPI on Thursday (Jan 12), with a potential last minute steer from the ECI on Jan 31.

UK

BOE: Bank of England Chief Economist Huw Pill warned that the conditions are in place in the UK, because of its already tight labor market and declining labor supply, for elevated inflation to become more enduring. Pill's comments, in a speech at the Money Market Association of New York University, suggest that he believes further monetary tightening may well be required.

- Pill raised the possibility that the natural jobless rate, the rate compatible with stable inflation, may have risen, which would entail that even rising unemployment may not initially be enough to curb inflation and that the Bank's Monetary Policy Committee is looking again at its assumption on the labour market link to inflation.

- He warned that reduced supply may not immediately feed through to lower demand as the growing number of early retirees could spend excess savings built up during the Covid pandemic. The Monetary Policy Committees meets next in February with market expectations a fine call between a 25 and 50 basis point hike.

US TSYS: Tsys Extend Past Friday Highs

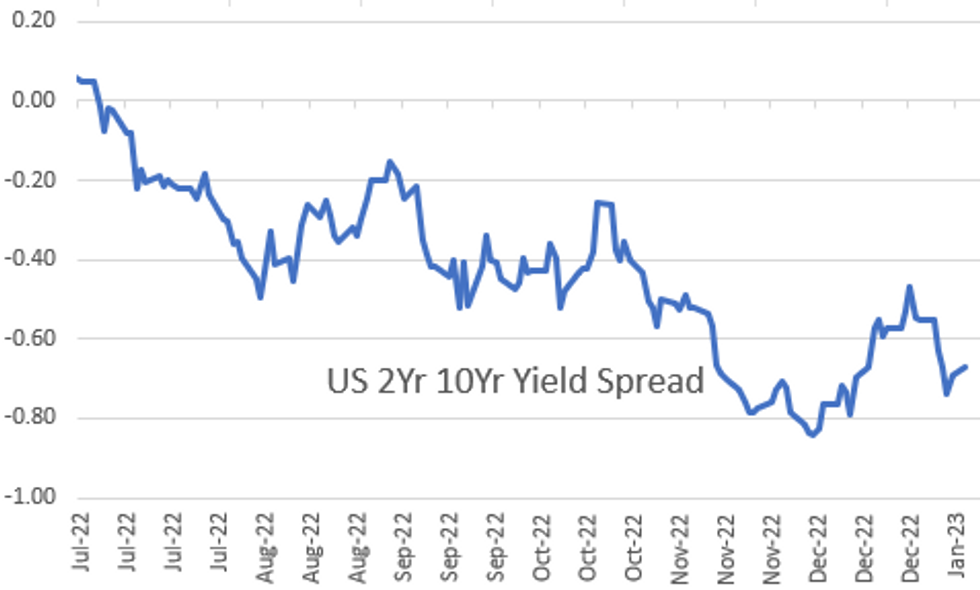

Tsys futures near top end of session range after extending highs past to early Friday/post-NFP highs. Current 30YY -.0399 at 3.6475%; yield curves off steeper levels (2s10s +2.280 at -67.880 vs. -65.820 high).

- While bounce coincided with similar move in German Bunds into the London close, support in line w/ NY Fed SURVEY OF CONSUMER EXPECTATIONS that shows decline in short term inflation and household spending exp.

- "Median one-year-ahead inflation expectations declined to 5.0 percent, its lowest reading since July 2021, according to the December Survey of Consumer Expectations. Medium-term expectations remained at 3.0 percent, while the five-year-ahead measure increased to 2.4 percent. Household spending expectations fell sharply to 5.9 percent from 6.9 percent in November, while income growth expectations rose to a new series high of 4.6 percent."

- Short end maintaining bid as terminal rate slips to 4.93% in Jun'23-Jul'23. Fed funds implied hike for Feb'23 -.8 to 30.9bp, Mar'23 cumulative -1.0 to 50.1bp to 4.833%, May'23 -1.0 to 59.5bp to 4.927%.

- Fed speak coming up (main focus on Chairman Powell Tue):

- Atl Fed Bostic moderated discussion (no text, Q&A) at 1230ET,

- SF Fed Daly WSJ interview, live event at 1230ET

- Fed Chair Powell on central Bank independence, Riksbank event at 0900ET

OVERNIGHT DATA

US NOV. CONSUMER CREDIT RISES $27.962B M/M; EST. +$25.000FED: SURVEY OF CONSUMER EXPECTATIONS

- Short-Term Inflation Expectations Decline, Household Spending Expectations Fall Sharply

- Median one-year-ahead inflation expectations declined to 5.0 percent, its lowest reading since July 2021, according to the December Survey of Consumer Expectations.

- Medium-term expectations remained at 3.0 percent, while the five-year-ahead measure increased to 2.4 percent. Household spending expectations fell sharply to 5.9 percent from 6.9 percent in November, while income growth expectations rose to a new series high of 4.6 percent.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 104.91 points (-0.31%) at 33561.19

- S&P E-Mini Future up 5.75 points (0.15%) at 3925.25

- Nasdaq up 98.4 points (0.9%) at 10678.13

- US 10-Yr yield is down 2.8 bps at 3.5302%

- US Mar 10-Yr futures are up 10/32 at 114-17

- EURUSD up 0.0103 (0.97%) at 1.0746

- USDJPY down 0.35 (-0.27%) at 131.73

- WTI Crude Oil (front-month) up $0.95 (1.29%) at $74.73

- Gold is up $6.24 (0.33%) at $1871.46

- EuroStoxx 50 up 50.79 points (1.26%) at 4068.62

- FTSE 100 up 25.45 points (0.33%) at 7724.94

- German DAX up 182.81 points (1.25%) at 14792.83

- French CAC 40 up 46.41 points (0.68%) at 6907.36

US TSY FUTURES CLOSE

- 3M10Y -1.238, -108.701 (L: -113.214 / H: -102.019)

- 2Y10Y +2.415, -67.745 (L: -70.241 / H: -65.82)

- 2Y30Y +2.424, -54.613 (L: -56.78 / H: -51.896)

- 5Y30Y +0.794, -0.609 (L: -1.17 / H: 2.347)

- Current futures levels:

- Mar 2-Yr futures up 3.75/32 at 102-30.625 (L: 102-24.75 / H: 102-31.625)

- Mar 5-Yr futures up 6.5/32 at 109-7.25 (L: 108-28.5 / H: 109-11.75)

- Mar 10-Yr futures up 10/32 at 114-17 (L: 114-00 / H: 114-23.5)

- Mar 30-Yr futures up 15/32 at 129-22 (L: 128-16 / H: 130-01)

- Mar Ultra futures up 25/32 at 140-27 (L: 138-28 / H: 141-11)

US 10YR FUTURE TECHS: (H3) Building On Recent Gains

- RES 4: 115-11+ High Dec13 and bull trigger

- RES 3: 115-05 2.0% 10-dma envelope

- RES 2: 114-17 76.4% retracement of the Dec 13 - 30 bear leg

- RES 1: 114-12 High Jan 9

- PRICE: 114-08 @ 15:14 GMT Jan 9

- SUP 1: 113-09+ 50-day EMA

- SUP 2: 112-18+/111-28 ow Jan 5 / Low Dec 30

- SUP 3: 111-27+ 61.8% retracement of the Nov 3 - Dec 13 rally

- SUP 4: 111-01 76.4% retracement of the Nov 3 - Dec 13 rally

Treasury futures traded sharply higher Friday. The contract has cleared resistance at the late December highs as well as the 100-dma to strengthen the short-term bullish condition. The focus is on 114-17, a Fibonacci retracement point. On the downside, initial support lies at 113-09+, the 50-day EMA. A move below this level would expose support at 112-18+, Jan 5 low and the bear trigger at 111-28, the Dec 30 low.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.020 at 94.935

- Jun 23 +0.035 at 94.880

- Sep 23 +0.050 at 95.030

- Dec 23 +0.060 at 95.395

- Red Pack (Mar 24-Dec 24) +0.050 to +0.080

- Green Pack (Mar 25-Dec 25) +0.025 to +0.035

- Blue Pack (Mar 26-Dec 26) +0.035 to +0.040

- Gold Pack (Mar 27-Dec 27) +0.035 to +0.035

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00114 to 4.31129% (-0.00457 total last wk)

- 1M +0.00272 to 4.40429% (+0.01000 total last wk)

- 3M -0.02729 to 4.78257% (+0.04257 total last wk)*/**

- 6M -0.05600 to 5.14100% (+0.05814 total last wk)

- 12M -0.09700 to 5.46186% (+0.07672 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.81171% on 1/5/23

- Daily Effective Fed Funds Rate: 4.33% volume: $114B

- Daily Overnight Bank Funding Rate: 4.32% volume: $290B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.118T

- Broad General Collateral Rate (BGCR): 4.27%, $424B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $391B

- (rate, volume levels reflect prior session)

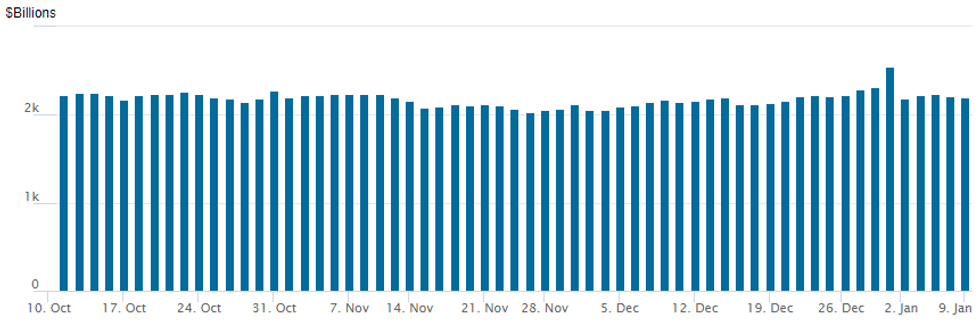

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,199.121B w/ 103 counterparties vs. prior session's $2.242.486B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $4.7B Regal Rexnard 4Pt Issuance Leads

- Date $MM Issuer (Priced *, Launch #)

- 01/09 $4.7B #Regal Rexnord $1.1B 3Y +215, $1.25B 5Y +240, $1.1B 7Y +270, $1.25B 10Y +290

- 01/09 $3B #Toyota Motor Credit $1.2B 2Y +63, $300M 2Y SOFR+56, $1B 5Y +98, $500M 10Y +118

- 01/09 $3B #Philippines $500M 5.5Y +105, $1.25B 10.5Y +145, $1.25B 25Y 5.5%

- 01/09 $2B *POSCO Holdings $700M 3Y +190, $1B 5Y +220, $300M 10Y +250

- 01/09 $2B #Dell International $1B 5Y +160, $1B 10Y +225

- 01/09 $1.75B #BNP Paribas 6NC5 +145

- 01/09 $1.1B #Realty Income $500M 3NC1 +125, $600M 7Y +145

- 01/09 $1.1B #WEC Energy $650M 3Y +85, $450M 5Y +112.5

- 01/09 $1B #Crown Castle 5Y +137.5

- 01/09 $Benchmark RBC 3Y +115a, 3Y SOFR, 5Y +145a, 10Y +175a

- 01/09 $Benchmark National Bank of Canada 2Y +130, 2Y SOFR

- 01/09 $Benchmark Mongolia bond issuance investor calls

- 01/09 $Benchmark CaixaBank investor calls

- 01/09 $Benchmark KBC investor calls

- Expected Tuesday:

- 01/10 $Benchmark Israel 10Y

- 01/10 $Benchmark AIIB 5Y SOFR+65a

- 01/10 $Benchmark KFW 5Y SOFR+42a

EGBs-GILTS CASH CLOSE: Slightly Weaker With Supply Eyed

Bunds and Gilts weakened modestly Monday in a risk-on session for equities in which periphery EGBs outperformed.

- BoE Chief Economist Pill's speech - the most anticipated event of the session - was initially taken hawkishly by markets with short-end yields ticking up a couple of basis points, but while February BoE hike pricing remained firm, it softened further down the strip.

- The German curve bear flattened, with the UK's steepening and the 5Y segment outperforming with today's short-dated APF sale seeing high bid-cover.

- BTPs outperformed, with 10Y spreads closing below 200bp for the first time this year.

- Tuesday's docket is highlighted by central bank speakers (including Bailey, Schnabel, and Powell) and huge supply with auctions from Austria, Germany, Netherlands, UK, and syndications from Belgium, Italy, Latvia.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.2bps at 2.613%, 5-Yr is up 1.5bps at 2.266%, 10-Yr is up 1.8bps at 2.228%, and 30-Yr is up 2.4bps at 2.179%.

- UK: The 2-Yr yield is up 0.8bps at 3.446%, 5-Yr is down 0.4bps at 3.446%, 10-Yr is up 5.5bps at 3.527%, and 30-Yr is up 7.4bps at 3.945%.

- Italian BTP spread down 5.8bps at 195.7bps / Spanish down 1.3bps at 104.5bps

FOREX: Greenback Maintains Downward Bias Ahead of Critical Week

- The USD index is trading with a 0.82% decline on Monday, continuing the weaker price action seen post US employment and ISM data on Friday. Greenback weakness comes ahead of a critical week, with both the US CPI release as well as the beginning of the US earnings season to come.

- Among the majors, the single currency is outperforming with EURUSD, extending its recovery to print fresh seven-month highs above 1.0750.

- The Japanese Yen showed relative underperformance in European trade and was the sole currency falling against the USD. However, USDJPY’s bounce to 132.66 was short-lived before fresh selling emerged and the pair finds itself gravitating towards the overnight 131.30 lows approaching the APAC crossover.

- Tech levels of note remain somewhat unchanged, with 133.73 marking the 20-day EMA. The key support and trigger for a resumption of the downtrend is 129.52, Jan 3 low. Initial key short-term resistance has been defined at 134.77.

- Despite major equity indices reversing a significant portion of their gains throughout US trade, the likes of AUD, NZD and GBP have remained buoyant, gaining a tailwind from the renewed optimistic sentiment. AUD/USD has now traded close to 4% above last week's lows, keeping momentum tilted in favour of the bulls for now. Prices now hold within range of the $0.69 handle, which marks a sizeable expiry for Wednesday's NY cut, with A$1.6bln notional set to roll off.

- Central bank governors on the speaker slate on Tuesday with Fed’s Powell, BOC’s Macklem and the BOJs Kuroda all participating in a panel discussion titled "Central bank independence and new risks: climate" at the Riksbank’s International Symposium on Central Bank Independence, in Stockholm.

- The data focus is primarily on US CPI, scheduled on Thursday.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/01/2023 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 10/01/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/01/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 10/01/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 10/01/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 10/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/01/2023 | 1010/0510 |  | CA | Governor Macklem at Riksbank Conference | |

| 10/01/2023 | 1010/1010 |  | UK | BOE Governor Bailey at Riksbank conference | |

| 10/01/2023 | 1010/1110 |  | EU | ECB's Isabel Schnabel at Riksbank conference | |

| 10/01/2023 | 1010/1910 |  | JP | BOJ Governor Haruhiko Kuroda at Riksbank conference | |

| 10/01/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/01/2023 | 1400/0900 |  | US | Fed Chair Jerome Powell at Riksbank conference | |

| 10/01/2023 | 1400/1500 |  | DE | Buba Vice President Claudia Busch as Riksbank conference | |

| 10/01/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 10/01/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 10/01/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.