-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Harker Urges Cautious Policy Approach

MNI ASIA MARKETS ANALYSIS: Rate Slide Falters Ahead Dec NFP

MNI ASIA OPEN: Short Term Inflation Expectations Rise

EXECUTIVE SUMMARY

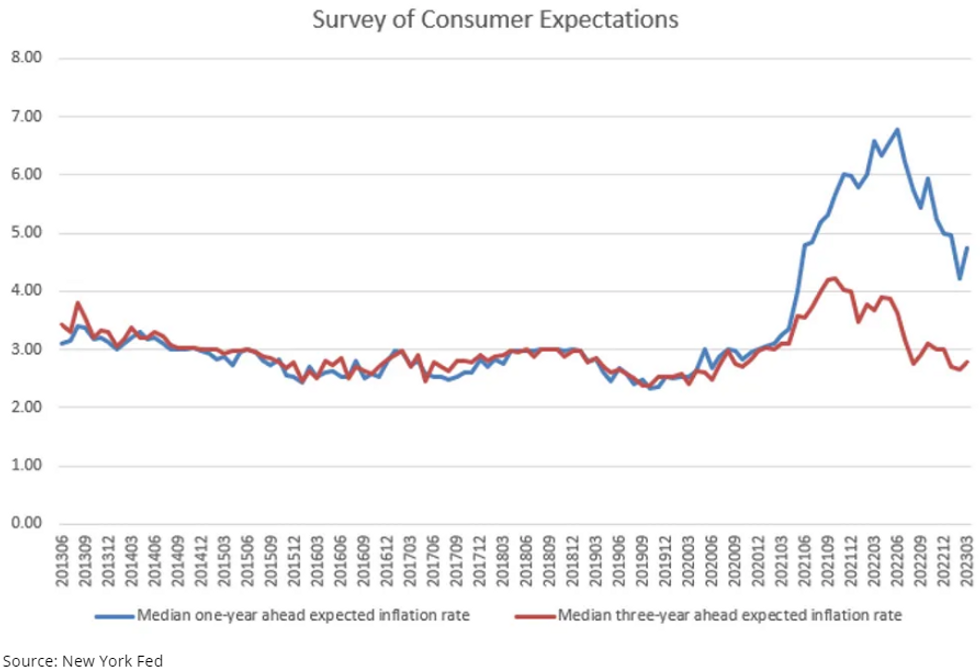

MNI BRIEF: Price Views Increase For 1st Time Since Oct- NY Fed

U.S. consumers' short-term inflation expectations rose for the first time since October according to a New York Fed Survey, with the share of households reporting it's harder to obtain credit than a year ago reaching a series high.

U.S. consumers' short-term inflation expectations rose for the first time since October according to a New York Fed Survey, with the share of households reporting it's harder to obtain credit than a year ago reaching a series high.- Median inflation expectations for the year ahead increased 0.5ppt to 4.7%, while at the three-year-ahead horizon expectations increased 0.1ppt to 2.8%, the New York Fed said. However, the median expectation at the five-year-ahead horizon decreased 0.1ppt to 2.5%. Expectations about home price growth climbed 0.4ppt to 1.8%, but remained below pre-pandemic levels.

- Median household spending growth expectations increased to 5.7% in March from 5.6% in February, the first increase in the series since October 2022. (See: MNI INTERVIEW: Fed Not Done Hiking Despite Bank Pain-Cecchetti)

CANADA

BOC: Bank of Canada policymakers on Wednesday will likely affirm they are holding interest rates unless inflation bubbles up again, widening rhetorical gaps with U.S. and European officials talking about hikes and investors seeing cuts in the months ahead.

- Governor Tiff Macklem appears set to keep language about the drag of eight prior rate hikes pulling back a strong economy, and another increase only being justified by a run of evidence inflation is getting stuck well above target. All 22 economists surveyed by MNI see the rate unchanged at 4.5% for a second meeting in the decision due at 10am EST, followed an hour later by a press conference.

- Canada held rates at the highest since 2007 last month and Macklem said he's likely done with inflation expected to slow to 3% by midyear and to the 2% target in 2024. Inflation moderated to 5.2% in February from 6.8% three months earlier and officials have said Canada can plot its own course on rates because local price gains are about the lowest across major economies. For more see MNI Policy main wire at 0907ET.

JAPAN

BOJ: New Bank of Japan Governor Kazuo Ueda on Monday brushed aside any suggestion of anything more than tweaks to yield curve control as he maintains easy policy settings and bids to achieve the 2% inflation target within his five-year term.

- While the BOJ will carefully monitor economic conditions, Ueda said it was appropriate to maintain rates at negative levels and that the impact on financial institutions is limited.

- “Powerful easy policy is mainly based on the negative interest rate policy. While the negative rate policy has a depressing impact on banks’ profits, financial intermediation is working smoothly,” Ueda said, downplaying the impact of recent financial volatility overseas though he added that any concern over banks’ interest rate exposure will not impede the implementation of monetary policy. For more see MNI Policy main wire at 1020ET.

US Tsys: Yields Inch Higher Ahead Wed's CPI, FOMC Minutes

- Treasury yield climbed higher in the first half of Monday's trade, holding a narrow range through the rest of the session on generally quiet second half. Yield curves reverse early steepening, 2s10s currently -.277 at -59.294 vs. -55.765 high.

- Fed funds implied hike for May'23 at 18.4bp, Jun'23 18.8bp cumulative at 5.014%. Projected rate cuts later in the year also holding near Fri's levels with just under two 25bp cuts priced in for December: -44.1 cumulative at 4.396.

- Trade volumes were light (TYM3<720k) with much of Europe still out for an extended Easter holiday, while markets showed little reaction to FEB. WHOLESALE SALES +0.4% M/M; EST. +0.6%, INVENTORIES +0.1%; EST. 0.2% data.

- Market depth/trade volumes will likely improve tomorrow with London bank on-line, but many will be close to the sidelines ahead Wednesday's CPI (0.2% MoM est vs. 0.4% prior; 5.1% YoY est vs. 6.0% prior) and FOMC minutes for the March meeting.

- NatWest economists suspect weaker energy prices "should weigh on the headline CPI; we expect the earlier drop in energy prices should lead to about a 5% decline in gasoline component, while increases in food prices (0.3%) and the core CPI (0.434%) should not be too different than last month (0.452%)."

OVERNIGHT DATA

- US FEB. WHOLESALE SALES RISE 0.4% M/M; EST. +0.6%

- US FEB. WHOLESALE INVENTORIES RISE 0.1%; EST. 0.2%

- US FEDERAL GOVERNMENT SAW $376B DEFICIT IN MARCH - CBO

- CBO: US DEFICIT STANDS AT $1.1T IN FIRST SIX MONTHS OF FY23

MARKETS SNAPSHOT

- DJIA up 53.17 points (0.16%) at 33539.5

- S&P E-Mini Future down 1.25 points (-0.03%) at 4131

- Nasdaq down 16.1 points (-0.1%) at 12072.05

- US 10-Yr yield is up 2.4 bps at 3.4149%

- US Jun 10-Yr futures are down 9/32 at 115-16.5

- EURUSD down 0.0047 (-0.43%) at 1.0858

- USDJPY up 1.42 (1.07%) at 133.59

- WTI Crude Oil (front-month) down $0.92 (-1.14%) at $79.78

- Gold is down $17.34 (-0.86%) at $1990.56

US TREASURY FUTURES CLOSE

- 3M10Y -0.867, -157.822 (L: -166.761 / H: -153.368)

- 2Y10Y -0.256, -59.273 (L: -61.411 / H: -55.765)

- 2Y30Y -0.697, -38.2 (L: -41.743 / H: -33.644)

- 5Y30Y -0.347, 10.537 (L: 6.601 / H: 12.949)

- Current futures levels:

- Jun 2-Yr futures down 2/32 at 103-10.5 (L: 103-09.125 / H: 103-15.875)

- Jun 5-Yr futures down 5/32 at 109-30 (L: 109-27 / H: 110-07.5)

- Jun 10-Yr futures down 8.5/32 at 115-17 (L: 115-12 / H: 115-31.5)

- Jun 30-Yr futures down 17/32 at 132-18 (L: 132-06 / H: 133-19)

- Jun Ultra futures down 25/32 at 142-20 (L: 142-09 / H: 144-05)

EURODOLLAR FUTURES CLOSE

- Jun 23 -0.035 at 94.690

- Sep 23 -0.045 at 95.045

- Dec 23 -0.035 at 95.415

- Mar 24 -0.035 at 95.880

- Red Pack (Jun 24-Mar 25) -0.04 to -0.035

- Green Pack (Jun 25-Mar 26) -0.05 to -0.045

- Blue Pack (Jun 26-Mar 27) -0.04 to -0.04

- Gold Pack (Jun 27-Mar 28) -0.055 to -0.04

SHORT TERM RATES

US DOLLAR LIBOR: No settlements Monday due to ongoing London bank holiday, resume Tuesday. For reference, the levels below are from Thursday, April 6:

- O/N +0.00042 to 4.80971% (+0.00885 total last wk)

- 1M +0.01015 to 4.90029% (+0.04258 total last wk)

- 3M -0.01314 to 5.19786% (+0.00515 total last wk)*/**

- 6M -0.05471 to 5.23743% (-0.07557 total last wk)

- 12M -0.07386 to 5.12571% (-0.17958 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.22257% on 4/3/23

- Daily Effective Fed Funds Rate: 4.83% volume: $100B

- Daily Overnight Bank Funding Rate: 4.83% volume: $123B

- Secured Overnight Financing Rate (SOFR): 4.81%, $1.431T

- Broad General Collateral Rate (BGCR): 4.79%, $538B

- Tri-Party General Collateral Rate (TGCR): 4.79%, $523B

- (rate, volume levels reflect prior session)

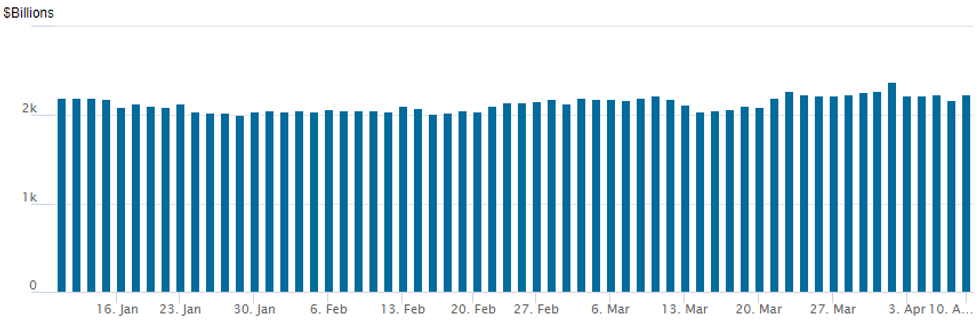

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,239.655B w/ 115 counterparties, compares to prior $2,173.663B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

PIPELINE: $1B Take-Two Software Priced

- Date $MM Issuer (Priced *, Launch #)

- 04/10 $1B *Take-Two Software WNG 3Y +125, 5Y +145

- 04/10 $500M Macquarie AirFinance 5NC2 8.75%a

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2023 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 11/04/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 11/04/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 11/04/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank Spring Meetings | |

| 11/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/04/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 11/04/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/04/2023 | 1730/1330 |  | US | Chicago Fed's Austan Goolsbee | |

| 11/04/2023 | 2200/1800 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.