-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: SLOOS Credit Standards Tighten

- MNI BRIEF: Fed Survey Shows Lending Standards Tightened In Q1

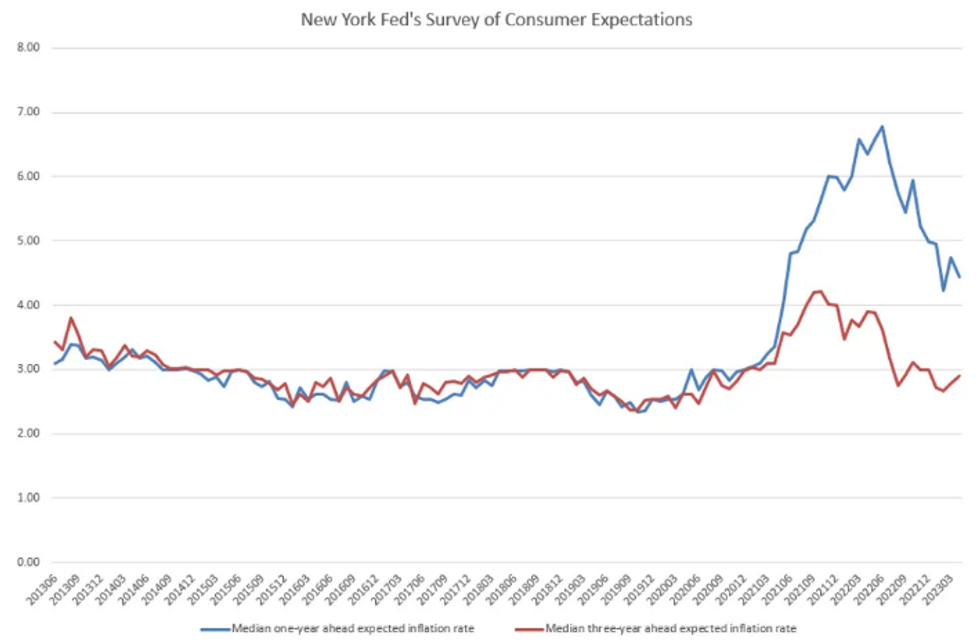

- MNI BRIEF: NY Fed Consumer Inflation Expectations

US

FED: Banks reported a further tightening of lending standards in commercial and industrial loans, small business credit as well as commercial real estate in the first quarter, according to the Fed's latest Senior Loan Officer Survey released Monday, likely reflecting the fallout from U.S. regional banking turmoil that led to a number of bank failures.

- "Banks reported expecting to tighten standards across all loan categories" in 2023, the Fed report said. "Banks most frequently cited an expected deterioration in the credit quality of their loan portfolios and in customers' collateral values, a reduction in risk tolerance, and concerns about bank funding costs, bank liquidity position, and deposit outflows as reasons for expecting to tighten lending standards over the rest of 2023."

- A similar trend was seen in loans to consumers. "Standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit cards."

Tsys Off Lows, Heavy Issuance Weighed; SLOOS Lending Tightened

Just off late session lows, Tsys under deal-tied hedging pressure from heavier than expected corporate bond issuance today ($6B Merck 6pt and $2.25B Apple 5pt lead Monday's $20B+ issuance) on a mainly quiet session with London out for King Charles Coronation celebration.

- Treasury futures traded lows following the release of the latest quarterly NY Fed Sr Loan Officer Survey (SLOOS) showed lending standards tightened across all sectors.

- Not a big surprise, banks reported a further tightening of lending standards in commercial and industrial loans, small business credit as well as commercial real estate in the first quarter, according to the Fed's latest Senior Loan Officer Survey released Monday, likely reflecting the fallout from U.S. regional banking turmoil that led to a number of bank failures.

- President Biden and House speaker McCarthy are expected to discuss the debt limit on Tuesday, while data focus is on CPI read for April on Wednesday and PPI on Thursday.

OVERNIGHT DATA

- Median inflation expectations increased a tenth at the three- and five-year-ahead horizons to 2.9% and 2.6%. Median home price growth expectations increased by 0.7ppts to 2.5% in April, the highest reading since July of last year, and year-ahead expected gas prices changes increased 0.5ppts, the Survey of Consumer Expectations released Monday showed.

- Perceptions and expectations of credit conditions were mixed. Labor market expectations deteriorated with unemployment expectations and perceived job loss risk increasing and job finding expectations decreasing.

- US MARCH WHOLESALE INVENTORIES WERE UNCHANGED; EST. 0.1%

- US MARCH WHOLESALE SALES FALL 2.1% M/M; EST. +0.4%

- US SAW $173B BUDGET SURPLUS IN APRIL-CBO

- APRIL SURPLUS $135B LESS THAN AMOUNT RECORDED LAST YEAR-CBO

- FEDERAL BUDGET DEFICIT $928B IN FIRST SEVEN MONTHS OF FY23-CBO

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 42.78 points (-0.13%) at 33631.41

- S&P E-Mini Future up 4.75 points (0.11%) at 4155

- Nasdaq up 22.6 points (0.2%) at 12258.62

- US 10-Yr yield is up 7.6 bps at 3.5129%

- US Jun 10-Yr futures are down 16/32 at 115-7

- EURUSD down 0.0012 (-0.11%) at 1.1007

- USDJPY up 0.33 (0.24%) at 135.13

- WTI Crude Oil (front-month) up $1.76 (2.47%) at $73.11

- Gold is up $5.39 (0.27%) at $2022.19

- EuroStoxx 50 up 8.22 points (0.19%) at 4348.65

- German DAX down 8.19 points (-0.05%) at 15952.83

- French CAC 40 up 7.98 points (0.11%) at 7440.91

TREASURY FUTURES CLOSE

- 3M10Y +7.853, -172.244 (L: -185.434 / H: -171.447)

- 2Y10Y -1.155, -49.265 (L: -51.113 / H: -45.919)

- 2Y30Y -0.973, -17.842 (L: -19.744 / H: -13.291)

- 5Y30Y -0.706, 33.26 (L: 31.421 / H: 36.298)

- Current futures levels:

- Jun 2-Yr futures down 5.5/32 at 103-5.75 (L: 103-05.25 / H: 103-11.625)

- Jun 5-Yr futures down 12.25/32 at 109-29.5 (L: 109-29 / H: 110-11.25)

- Jun 10-Yr futures down 16.5/32 at 115-6.5 (L: 115-05.5 / H: 115-27.5)

- Jun 30-Yr futures down 1-01/32 at 129-30 (L: 129-28 / H: 131-13)

- Jun Ultra futures down 1-16/32 at 138-9 (L: 138-04 / H: 140-10)

US 10YR FUTURE TECHS: (M3) Pullback Considered Corrective

- RES 4: 118-00 Round number resistance

- RES 3: 117-29+ High Aug 26 2022 (cont)

- RES 2: 117-01+ High Mar 24 and bull trigger

- RES 1: 116-12/117-00 High May 5 / 4

- PRICE: 115-18 @ 11:00 BST May 8

- SUP 1: 115-13+ Low May 5

- SUP 2: 115-09 20-day EMA

- SUP 3: 114-25+ 50-day EMA

- SUP 4: 114-10 Low May 1

Treasury futures traded lower Friday and are trading closer to recent lows. The trend outlook remains bullish and the recent pullback is considered corrective. Attention is on key resistance at 117-01+, the Mar 24 high and bull trigger. A break of this hurdle would strengthen current trend conditions. Initial firm support is at 115-09, the 20-day EMA. Key support is far-off at 113-30+, the Apr 19 low.

SOFR FUTURES CLOSE

- Jun 23 -0.035 at 94.925

- Sep 23 -0.070 at 95.240

- Dec 23 -0.095 at 95.670

- Mar 24 -0.10 at 96.195

- Red Pack (Jun 24-Mar 25) -0.09 to -0.065

- Green Pack (Jun 25-Mar 26) -0.06 to -0.05

- Blue Pack (Jun 26-Mar 27) -0.05 to -0.04

- Gold Pack (Jun 27-Mar 28) -0.045 to -0.04

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00469 to 5.05495 (+.03156 total last wk)

- 3M +0.03345 to 5.07218 (-.04259 total last wk)

- 6M +0.06484 to 5.01035 (-.13406 total last wk)

- 12M +0.09853 to 4.65213 (-.25548 total last wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $112B

- Daily Overnight Bank Funding Rate: 5.06% volume: $278B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.517T

- Broad General Collateral Rate (BGCR): 5.03%, $569B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $558B

- (rate, volume levels reflect prior session)

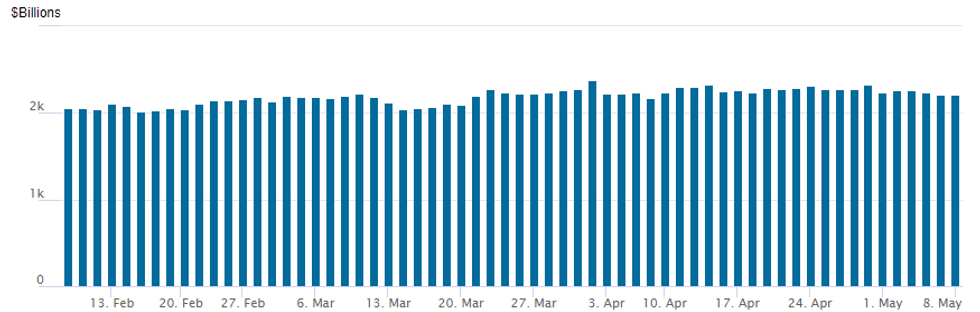

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

NY Fed reverse repo usage slips back to $2,217.601B w/ 104 counterparties, compares to prior $2,207.415B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $5.25B Apple 5Pt Launched

Just waiting on T-Mobile 3pt issuance to launch- Date $MM Issuer (Priced *, Launch #)

- 05/08 $6B #Merck 6Pt: $500M 5Y +57, $750M 7Y +82, $1.5B 10Y +100, $750M 21Y +102, $1.5B 30Y +120, $1B 40Y +135.

- 05/08 $5.25B #Apple 5pt: $1B 3NC1 +70, $1.5B 5Y +55, $500M 7Y +70, $1B 10Y +80, $1.25B 30Y +108.

- 05/08 $1B Ball Corp 6NC3 6%a

- 05/08 $1B #Oncor Electric Delivery $600M 5Y +85, $400M tap 20Y +145

- 05/08 $1B #Schlumberger Investment $500M 5Y +105, $500M 10Y +135

- 05/08 $1.8B #Eversource Energy $450M 3Y +105, $550M 5Y +130, $800M 10Y +162.5

- 05/08 $1.25B #Caterpillar Financial 3Y +65 (drops 3Y SOFR leg)

- 05/08 $Benchmark T-Mobile 5Y +135, 10Y +173, 30Y +195

- 05/08 $850M #Bell Telephone of Canada 10Y +160

- 05/08 $800M #DTE Energy 5Y +140

- 05/08 $700M #Baltimore Gas WNG 30Y+158

EGB CASH CLOSE: Reversing moves seen in equities

- EGBs have generally reversed moves in equities seen today with little liquidity in the trading session given the public holiday in the UK.

- Indeed, moves in 10-year Bunds have been more measured than those seen in 10-year USTs today with the former up 2.6bp versus the 5.3bp move seen in 10-year USTs at the time of writing. The limited moves seen in Bunds versus USTs may be partly due to the disappointing German industrial production print seen this morning.

- There has also been a different move in curves with German 2s10s flattening (in contrast to the modest steepening seen in US 2s10s).

- Spreads have widened a little today for both semi-core and peripherals with 10-year BTP-Bund spreads over 2bp wider on the day at writing.

- Bund futures are down -0.34 today at 135.57 with 10y Bund yields up 2.8bp at 2.317% and Schatz yields up 4.4bp at 2.607%.

- BTP futures are down -0.45 today at 114.42 with 10y yields up 4.9bp at 4.238% and 2y yields up 3.8bp at 3.295%.

- OAT futures are down -0.35 today at 129.78 with 10y yields up 3.1bp at 2.905% and 2y yields up 3.7bp at 2.778%.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/05/2023 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/05/2023 | 0130/1130 | *** |  | AU | Retail trade quarterly |

| 09/05/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 09/05/2023 | 0800/1000 |  | EU | ECB Lane in Policy Panel at IMF event | |

| 09/05/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/05/2023 | 1230/0830 |  | US | Fed Governor Philip Jefferson | |

| 09/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/05/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/05/2023 | 1605/1205 |  | US | New York Fed's John Williams | |

| 09/05/2023 | 1700/1900 |  | EU | ECB Schnabel Lecture at Hessischer Kreis e.V. | |

| 09/05/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.