-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Soft PMI, Consumer Confidence Up Ahead FOMC

- MNI: Yield Spike Cuts Chance Of Fed Dec Hike, Q1 Still In Play

- MNI US DATA: House Prices Continue Robust Run

- MNI INTERVIEW: Some Positives In Cloudy UK Labour Data

- MNI INSIGHT: BOE Labour Market Stock Take Not Ready Until Feb

- MNI BOJ Delivers Dovish YCC Tweak

- MNI Chicago Business Barometer™ - Steady at 44.0 in October

US

FED: Sharply higher U.S. bond yields lower the chances the Federal Reserve will need to deliver a previously-projected final quarter-point hike for the fed funds rate this year, former Fed officials told MNI, though sustained above-trend growth could still prod the Fed to tighten next year.

- The 10-year Treasury yield rose above 4% in August and touched 5% this month, its highest since 2007, as the economy grew well above trend in the third quarter and traders came around to the Fed's higher-for-longer message. Analysts have compared the bond yield surge to as many as three rate hikes and Fed officials suggested tighter financial conditions could substitute for additional tightening.

- "If financial conditions are more or less what we see today by December, I think it’s plausible that the committee will skip the hike," said former Atlanta Fed President Dennis Lockhart. Twelve FOMC members penciled in a 25 basis point hike by the end of this year in the September Summary of Economic Projections, "but there’s nothing automatic about the final increase in 2023, and as things look today, it’s better than an even chance they could skip it." For more see MNI Policy main wire at 1340ET.

US TSYS Markets Roundup: No Scary Month End, Focus on Wed FOMC

US TSYS: Tsy futures are drifting in steady to narrowly mixed territory late Tuesday, 10Y and 10Y Ultras closest to steady after the bell, curves flatter but off late morning lows: 3M10Y -3.522 at -60.432 vs. -68.652 low, 2Y10Y -3.147 at -19.336 vs. -22.521 low.

- Main focus on Wednesday afternoon's FOMC annc, most likely leaving rates unchanged for the 2nd consecutive meeting. Economic activity data has been strong and inflation progress has arguably stalled since the September meeting, the Committee will maintain a cautious approach as it assesses the impact of tighter financial conditions and the lagged effects of past tightening.

- Additional focus tomorrow on ADP (0815ET), the final Tsy Refunding announcement (0830ET) and JOLTS Job Openings (1000ET).

- Precursor to Wed's FOMC policy annc, soft China PMI early overnight helped prime Tsys as they broke higher after the BOJ left policy unchanged at -0.1%, left upper limit of YCC framework at 1%. Meanwhile, soft Eurozone CPI and GDP growth helping Tsys extend highs heading into the NY open.

US TSYS/SUPPLY: Borrowing Ests $1.6T In Line, Sets Stage For Tsy Upsizing -- Treasury's marketable borrowing estimates for the Oct-Dec 2023 (Q4) and Jan-Mar 2024 (Q1) quarters came in roughly in line with expectations.

- The 2Q total of $1.592T ($776B Q4, $816B Q1) was in line with MNI's and analysts' estimates, though there had been some lingering concerns about an upside surprise potentially stemming from more pessimistic fiscal expectations or higher-than-expected cash balance targets.

- The Q4 total was downwardly revised $76B from August's refunding process: that's more or less in line as expected reflecting the timing of tax receipts landing in the quarter (financing requirements dropped $80B total), with the end-Sep TGA cash balance target unchanged at $750B.

- The Q1 figure was fairly straightforward as well, with the TGA cash balance seen level at $750B, and the $548B estimated financing need in line with expectations.

UK

BOE: While unadjusted UK Labour Force Survey data have been revealed to be unreliable, some of its components still provide useful policy signals, including measures of growing levels of economic inactivity which have caught the attention of the Bank of England, economics professor and Office for National Statistics research associate Donald Houston told MNI.

- Inactivity in the UK work force, particularly due to ill-health, appears to be stabilising at high levels after surging in the wake of the Covid pandemic, Houston said in an interview. The data is likely to figure in deliberations ahead of this week’s decision by the BOE as it weighs whether to further raise interest rates, despite the ONS’s recent admission that the survey from which it comes has become less representative.

- “The portion of people aged 16 to 64, who have a work limiting health condition, rose from just over 16% to just over 18% between 2019 and 2022 … Over a three-year period that is a massive impact,” Houston said, adding that this upwards trend together with overall economic inactivity appears to have stabilised. “You would expect, you would hope, that it will start to come down again as NHS waiting times come down, as the prevalence of long COVID comes down. But these could be quite slow processes over years.” (See MNI INTERVIEW: UK's Inactive Population Steadies At High Level) For more see MNI Policy main wire at 1049ET.

- While BOE Governor Andrew Bailey said at the August press conference that the review would be ready by November, this week’s meeting will now have to base its considerations on the flawed Labour Force Survey, with the stock take’s questions over a possible rise in the unemployment level compatible with stable inflation or a fall in potential growth still unanswered. (See MNI INTERVIEW: Some Positives In Cloudy UK Labour Data)

- The BOE’s Monetary Policy Committee is widely expected to leave its policy rate on hold at 5.25% on Thursday, but the decision will be close with the state of the UK’s supply side a key concern for both hawkish and dovish members as they deliberate over whether to tighten further. For more see MNI Policy main wire at 1049ET.

JAPAN

BOJ: The BoJ policy meeting has largely come out in line with market expectations. None of the major policy parameters were shifted, with the policy rate kept at -0.10%, the 10yr yield target at 0%, both maintained Most of the focus was on the language tweak around YCC, with the 1% upper bound referred to as a reference point. This suggests we may yields move beyond this level, but the BoJ will still step in to curb excessive moves.

- The BoJ has also decided to scrap its daily fixed rate bond buying operations. It indicated this could result in 'large side effects". The central bank stated it may increase JGB bond purchases nimbly and it will continue with large scale bond buying operations.

- The forward guidance wasn't changed, whilst the central bank also stands ready to ease again if needed.

- On the inflation forecasts the current fiscal year forecast was raised to 2.8% from 2.5%, but importantly by 2025 inflation is still expected to back under the 2% target (1.7% versus the 1.6% prior forecast).

- All in all the market is seeing this as a dovish YCC tweak. USD/JPY has rallied in response. We got to highs of 150.10, but now sit a little lower, last near 149.95/00.

OVERNIGHT DATA

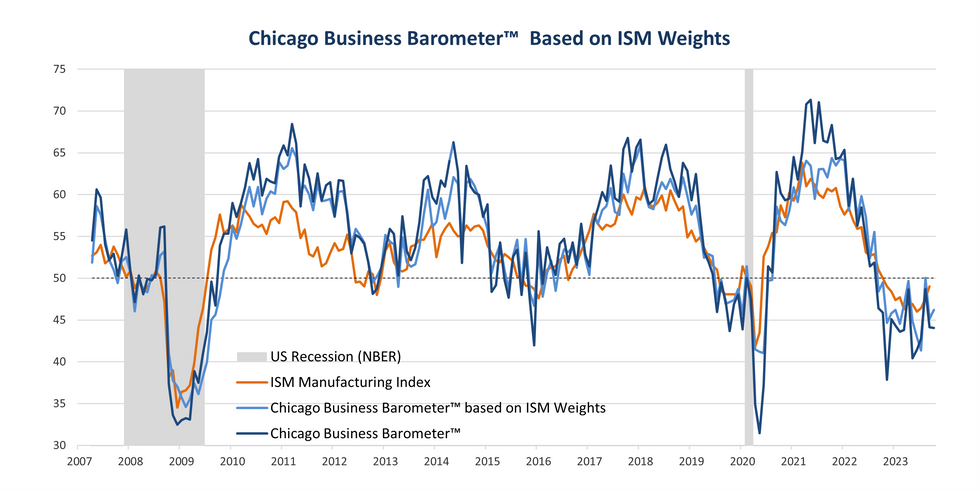

US DATA: The Chicago Business Barometer™, produced with MNI fell -0.1 points to 44.0 from 44.1 in September. It remains below the 48.7 level seen in August but broadly in line with the 2023 average of 44.2. For more see MNI Policy main wire at 0951ET.

US DATA: Conference Board consumer sentiment softened by less than expected in October, to 102.6 (cons 100.5) after an upward revised 104.3 (initial 103.0).

- Within the survey, the labor differential ticked up to 26.3 but from a downward revised 25.5 (initial 27.3).

- It doesn’t materially change the latest trend, having averaged 26 in the latest three months for a fall below the 33 averaged through 2019 but still relatively elevated on a historical basis - see chart.

- The limited change on the latest month suggests little bias for the unemployment rate at Friday’s payrolls report, after the prior large step down to the 26 level came along with a step higher in the u/e rate to 3.8% where it has since stayed (cons shows an unchanged 3.8% for Friday).

US DATA: FHFA and S&P CoreLogic house prices again came in stronger than expected, this time for August.

- FHFA prices increased 0.6% M/M (cons 0.5) after 0.8%, and having now increased every month since Aug’22 are up 5.6% Y/Y.

- S&P CoreLogic 20-city prices meanwhile increased a seasonally adjusted 1.01% M/M (cons 0.8) albeit after a downward revised 0.78% M/M (initial 0.87). This series has seen six months of increases now to leave prices up 2.2% Y/Y.

- The latest moves mean FHFA prices are 5% above the previous peak seen in Jun’22 whilst S&P Core Logic 20-city prices have just surpassed their prior peak. They stand 46% and 42% higher than Feb’20 pre-pandemic levels respectively.

- Supply of existing homes on the market is slowly increasing but the market remains far tighter compared to more ‘normal’ pre-pandemic years, helping keep upward pressure on prices.

- US REDBOOK: OCT STORE SALES +4.7% V YR AGO MO

- US REDBOOK: STORE SALES +5.3% WK ENDED OCT 28 V YR AGO WK

US DATA: The overall ECI increased 1.07% annualized in Q3 for a ‘low’ beat of 1.0 consensus, after an unrevised 1.02% in Q2.

- Wages & salaries show a more notable acceleration on the quarter though, up from 0.9% to 1.20% annualized for technically the fastest since 2Q22.

- Perhaps dampening the impact of this strength in wages & salaries is the fact that it looks driven by the public sector.

- The private sector ECI printed 1.01% in Q3 for almost exactly the same pace as 1.02% in Q2, whilst private sector wages & salaries printed 1.06% after 1.00%.

- Private sector wage pressures are better described as stabilizing at a still strong rate rather than re-accelerating.

- CANADA FLASH Q3 GDP -0.1% ANNUALIZED

- CANADIAN AUG GDP 0% VS +0.1% EXPECTED, PRIOR 0%

- CANADA FLASH SEPT GROSS DOMESTIC PRODUCT 0%

- CANADA Q3 FLASH GDP 0% QUARTER OVER QUARTER

- CANADA AUG GROSS DOMESTIC PRODUCT +0.0% MOM

- CANADA AUG GOODS INDUSTRY GDP -0.2%, SERVICES +0.1%

- CANADA REVISED JUL GROSS DOMESTIC PRODUCT +0.0% MOM

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 108.42 points (0.33%) at 33037.85

- S&P E-Mini Future up 25 points (0.6%) at 4211.25

- Nasdaq up 51.6 points (0.4%) at 12841.06

- US 10-Yr yield is down 0.8 bps at 4.8859%

- US Dec 10-Yr futures are down 3.5/32 at 106-3.5

- EURUSD down 0.0032 (-0.3%) at 1.0583

- USDJPY up 2.44 (1.64%) at 151.54

- WTI Crude Oil (front-month) down $1.1 (-1.34%) at $81.20

- Gold is down $11.15 (-0.56%) at $1984.94

- European bourses closing levels:

- EuroStoxx 50 up 32.8 points (0.81%) at 4061.12

- FTSE 100 down 5.67 points (-0.08%) at 7321.72

- German DAX up 93.8 points (0.64%) at 14810.34

- French CAC 40 up 60.58 points (0.89%) at 6885.65

US TREASURY FUTURES CLOSE

- 3M10Y -3.078, -59.988 (L: -68.652 / H: -57.311)

- 2Y10Y -2.076, -18.265 (L: -22.521 / H: -14.926)

- 2Y30Y -2.494, -3.259 (L: -8.209 / H: 1.106)

- 5Y30Y -1.063, 21.259 (L: 18.227 / H: 23.909)

- Current futures levels:

- Dec 2-Yr futures down 2/32 at 101-6.875 (L: 101-06.125 / H: 101-10.375)

- Dec 5-Yr futures down 3/32 at 104-14.75 (L: 104-13.75 / H: 104-24.75)

- Dec 10-Yr futures down 4/32 at 106-3 (L: 106-02 / H: 106-21)

- Dec 30-Yr futures steady at at 109-9 (L: 108-29 / H: 110-12)

- Dec Ultra futures down 2/32 at 112-9 (L: 111-29 / H: 113-27)

US 10Y FUTURE TECHS: (Z3) Trend Structure Remains Bearish

- RES 4: 109-20 High Sep 19

- RES 3: 108-06+/16 50-day EMA / High Oct 12 and key resistance

- RES 2: 107-22+ High Oct 16

- RES 1: 106-25+ 20-day EMA

- PRICE: 106-05.5 @ 1430 ET Oct 31

- SUP 1: 105-10+ Low Oct 19 and the bear trigger

- SUP 2: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 103-31+ 2.0% 10-dma envelope

- SUP 4: 103-20+ Low Jun’07

Treasuries are consolidating. The trend condition is unchanged and the direction remains down. The recent breach of 106-03+, the Oct 4 low, confirmed a resumption of the downtrend and maintains the price sequence of lower lows and lower highs. The focus is on 104-26, a Fibonacci projection. Key short-term trend resistance is at 108-16, the Oct 12 high. Initial firm resistance is at 106-25+, the 20-day EMA.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 -0.010 at 94.560

- Mar 24 -0.030 at 94.625

- Jun 24 -0.045 at 94.830

- Sep 24 -0.050 at 95.090

- Red Pack (Dec 24-Sep 25) -0.045 to -0.03

- Green Pack (Dec 25-Sep 26) -0.02 to -0.015

- Blue Pack (Dec 26-Sep 27) -0.015 to -0.01

- Gold Pack (Dec 27-Sep 28) steady

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00049 to 5.31959 (-0.00453/wk)

- 3M +0.00563 to 5.38275 (-0.00046/wk)

- 6M +0.00824 to 5.44273 (+0.00210/wk)

- 12M +0.00819 to 5.36741 (-0.00554/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $97B

- Daily Overnight Bank Funding Rate: 5.32% volume: $245B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.470T

- Broad General Collateral Rate (BGCR): 5.30%, $566B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $552B

- (rate, volume levels reflect prior session)

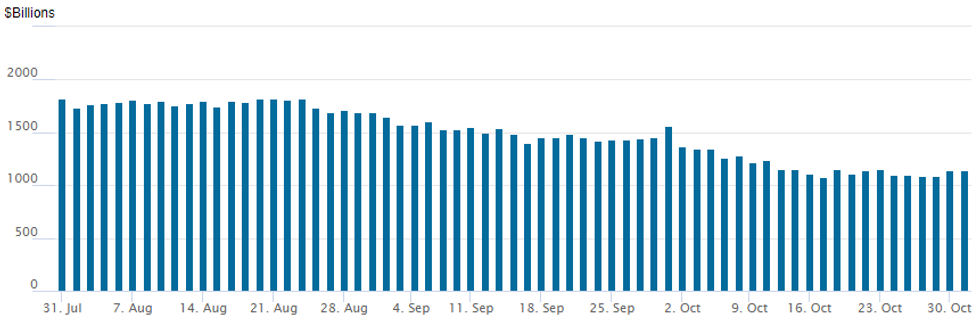

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage slips to $1,137.697B w/100 counterparties vs. $1,138.035B in the prior session. Latest usage compares to $1,082.399B on October 17- the lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $1.9B StanChart 3Pt Guidance

- Date $MM Issuer (Priced *, Launch #)

- 10/31 $1.9B StanChart $750M 4.25NC3.25 +185, $400M 4.25NC3.25 SOFR+203, $750M 6.25NC5.25 +220

- 10/31 $500M #Camden Property 3Y +95

FOREX USDJPY Nears 2022 Highs As No Intervention Confirmed

- With late reports on Monday suggesting the Bank of Japan could raise its cap on yields at the October policy meeting, markets were underwhelmed as the BOJ only relaxed the upper limit of its range for the 10-year bond yield. While citing economic uncertainty, the bank indicated that it does not want to see a surge in interest rates.

- There has been sharp weakness for the Japanese Yen as a result and confirmation that there was no intervention earlier in October appeared to give USDJPY bulls the green light. As such, the pair has risen from overnight lows of 149.03 to reach as high as 151.71, just 24 pips shy of the 2022 highs and up a significant 1.6%.

- Obviously given the two separate episodes of MOF intervention last year, markets will be eagerly monitoring any step up in verbal rhetoric or indeed any action from Japanese officials.

- Above 151.95, we have 152.20 and 153.52 as the next resistance points, both Fibonacci projections.

- The price action resulted in the USD index turning early declines into firm gains, with the index rising just over 0.5% on the session. Greenback strength was underpinned by a higher-than-expected employment cost index for Q3 and October consumer confidence in the US beating also beating expectations.

- Elsewhere, EURUSD rose substantially in the lead up to Eurozone inflation data that matched Germany’s releases in coming in below expectations. This along with the firmer greenback led EURUSD all the way back to 1.0558 after printing a 1.0675 high during early European trade.

- Bolstered equity benchmarks did little to enthuse the likes of GBP, AUD, NZD and CAD, all taking their cues from the surging dollar. CHF is also one of the poorest performers on the day with USDCHF rising 0.8% and extending the recovery from last week's lows.

- New Zealand unemployment data headlines the APAC docket on Wednesday before US ADP, ISM Manufacturing and JOLTS data crosses in the US session. Focus then turns to the FOMC decision where Chair Powell’s press conference and the Statement will attempt to underpin market hike pricing which is broadly aligned with the Fed’s previously signalled path.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/11/2023 | 0030/1130 | * |  | AU | Building Approvals |

| 01/11/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/11/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/11/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/11/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/11/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/11/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 01/11/2023 | 1230/0830 | ** |  | US | Treasury Quarterly Refunding |

| 01/11/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/11/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/11/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/11/2023 | 1400/1000 | *** |  | US | JOLTS jobs opening level |

| 01/11/2023 | 1400/1000 | *** |  | US | JOLTS quits Rate |

| 01/11/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/11/2023 | 1800/1400 | *** |  | US | FOMC Statement |

| 01/11/2023 | 2015/1615 |  | CA | BOC Governor testifies at Senate hearing |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.