-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY0.5 Bln via OMO Monday

MNI ASIA OPEN: Tsy Borrow Cost Selling Meets Month-End Buying

EXECUTIVE SUMMARY

US TSYS: Late Session Volatility: What Sell-Off?

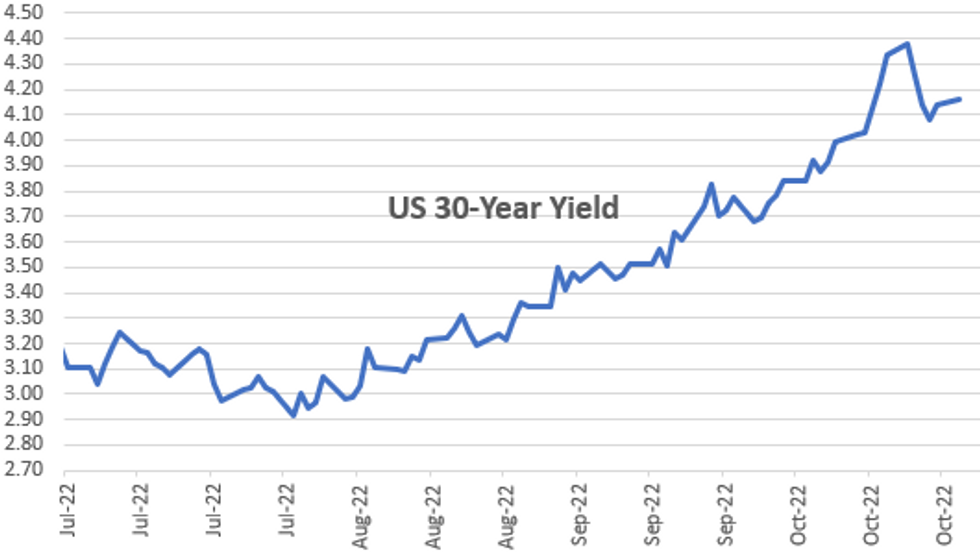

Tsy futures gapped higher (30YY 4.1436%) in the last few minutes -- likely month-end buying hitting an air pocket after Tsys gapped lower following the Tsy dept annc raising Q4 borrowing by $150B.

- Bonds had gapped lower right on the bell (30YY climbs to 4.2274% high), yield curves off lows after the US Tsy announced its current estimates of privately-held net marketable borrowing for the October – December 2022 and January – March 2023 quarters.

- During the October – December 2022 quarter, Treasury expects to borrow $550 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $700 billion. The borrowing estimate is $150 billion higher than announced in August 2022, primarily due to changes to projections of fiscal activity, greater than projected discount on marketable securities, and lower non-marketable financing. Tsy Quarterly Refunding release Wed morning at 0830ET.

- Tue's ISMs likely to draw same muted reaction ahead Wed's FOMC policy announcement with 75bp expected, as much focus on year end guidance as current annc: step-down to a 50bp hike at the following meeting looks like the path of least resistance for now – the question is, how strongly does the FOMC seek to express that view. Employment data: ADP private jobs data early Wed (0815ET) followed by October read for NFP this Fri at 0830ET.

US

US TSY: MNI: The U.S. Treasury Department on Monday announced it expects to borrow USD550 billion in privately-held net marketable debt in the fourth quarter, USD150 billion more than previously announced in August.

- Treasury is assuming a cash balance of USD700 billion at the end of December. For the first quarter next year, Treasury plans to borrow USD578 billion, assuming an end-of-March cash balance of USD500 billion. The Treasury's next quarterly refunding will be released at 8:30 a.m. November 2.

- The estimates assume enactment of a debt limit suspension or increase and if Congress does not act to address the debt limit the Treasury's cash balance may be lower than assumed. During the third quarter, Treasury borrowed USD457 billion.

FED: Rising interest rates will put parts of the global financial system under severe strain, posing a serious dilemma for the European Central Bank and the Federal Reserve as they try to contain inflation, one of Germany’s foremost economists told MNI.

- Financial stability risks could emerge “very quickly” for both the ECB and the Fed, putting them “in a similar situation as the Bank of England was: namely, having to choose between fighting inflation and safeguarding financial stability,” said Moritz Schularick, macroeconomics professor at Sciences Po and the University of Bonn, and this year’s Leibniz Prize winner. Central bank independence is also likely to come under pressure as government financing costs rise, he noted.

- “There's an effective upper bound on interest rates, a financial stability upper bound,” Schularick said shortly before ECB policymakers made their second consecutive 75bps rate hike last Thursday, putting the deposit rate on course for 2% in December. For more see MNI Policy main wire at 0701ET.

UK

BOE: The Bank of England is widely expected to announce a 75-basis-point rate increase on Thursday after its November meeting, with a fiscal squeeze and Bank projections that market pricing has overblown the amount of tightening required in this cycle reducing the chances of a larger hike.

- Another fragmented Monetary Policy Committee vote looks likely, following the three-way split over September’s 50 bps hike, though with more of a bias towards smaller rather than larger increases.

- On the hawkish side, independent member Cathy Mann has advocated front-loading hikes. The UK labour market remains tight, and fellow MPC member Jonathan Haskel, who has highlighted the hit to labour supply from extensive long-term sickness, is unlikely to shift his views after backing 75 bps in September. For more see MNI Policy main wire at 1254ET.

BOE: There is a strong case to move for the Bank of England to move from its current full reserve remuneration to a tiered regime, which would deliver a hefty fiscal gain with no loss of monetary policy efficacy, former senior BOE official David Aikman told MNI.

- The drum beat for a shift to a tiered-reserve regime is intensifying with former Deputy Governor Paul Tucker recently published a paper advocating it and as pressure on the public finances pushes the Treasury to find ways to lower debt interest costs.

- The Bank has not made any public commentary on the case for reserve tiering but Aikman, who now heads Kings Business School, said “I would be very surprised if there hadn’t been a dialogue between the Bank and the Treasury on this.” For more see MNI Policy main wire at 0849ET.

OVERNIGHT DATA

- MNI CHICAGO BUSINESS BAROMETER OCT 45.2 VS 45.7 SEP

- MNI CHICAGO: OCT PRICES PAID 74.8 VS 74.1 SEP

- MNI CHICAGO: OCT EMPLOYMENT 45.6 VS 40.2 SEP

- MNI CHICAGO: OCT PRODUCTION 45.1 VS 44.5 SEP

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 128.85 points (-0.39%) at 32737.81

- S&P E-Mini Future down 27.25 points (-0.7%) at 3882

- Nasdaq down 114.3 points (-1%) at 10980.37

- US 10-Yr yield is up 3.8 bps at 4.0499%

- US Dec 10Y are down 9.5/32 at 110-22.5

- EURUSD down 0.0083 (-0.83%) at 0.9881

- USDJPY up 1.09 (0.74%) at 148.71

- WTI Crude Oil (front-month) down $1.71 (-1.95%) at $86.05

- Gold is down $11.83 (-0.72%) at $1632.03

- EuroStoxx 50 up 4.52 points (0.13%) at 3617.54

- FTSE 100 up 46.86 points (0.66%) at 7094.53

- German DAX up 10.41 points (0.08%) at 13253.74

- French CAC 40 down 6.28 points (-0.1%) at 6266.77

US TSY FUTURES CLOSE

- 3M10Y +4.274, -3.497 (L: -11.359 / H: 2.336)

- 2Y10Y -3.476, -44.493 (L: -45.946 / H: -40.734)

- 2Y30Y -5.647, -33.848 (L: -35.878 / H: -28.624)

- 5Y30Y -3.91, -8.279 (L: -10.957 / H: -4.103)

- Current futures levels:

- Dec 2Y down 4.5/32 at 102-6.375 (L: 102-04.875 / H: 102-10.5)

- Dec 5Y down 7.5/32 at 106-20.5 (L: 106-14.5 / H: 106-27.5)

- Dec 10Y down 10/32 at 110-22 (L: 110-12 / H: 110-30.5)

- Dec 30Y down 7/32 at 121-1 (L: 120-03 / H: 121-08)

- Dec Ultra 30Y down 21/32 at 128-22 (L: 127-04 / H: 129-10)

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.055 at 94.880

- Mar 23 -0.10 at 94.730

- Jun 23 -0.115 at 94.780

- Sep 23 -0.10 at 94.995

- Red Pack (Dec 23-Sep 24) -0.095 to -0.06

- Green Pack (Dec 24-Sep 25) -0.045 to -0.025

- Blue Pack (Dec 25-Sep 26) -0.025 to -0.02

- Gold Pack (Dec 26-Sep 27) -0.025 to -0.015

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00072 to 3.06314% (-0.01786 total last wk)

- 1M +0.03715 to 3.80486% (+0.18214 total last wk)

- 3M +0.02072 to 4.46029% (+0.08114 total last wk) * / **

- 6M -0.01500 to 4.91586% (+0.05586 total last wk)

- 12M +0.07929 to 5.44829% (-0.10657 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.46029% on 10/31/22

- Daily Effective Fed Funds Rate: 3.08% volume: $107B

- Daily Overnight Bank Funding Rate: 3.07% volume: $300B

- Secured Overnight Financing Rate (SOFR): 3.05%, $951B

- Broad General Collateral Rate (BGCR): 3.00%, $397B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $384B

- (rate, volume levels reflect prior session)

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,275.459B w/ 112 counterparties vs. $2,183.290B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $1.5B Blackstone Holdings, $1B American Electric Power Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/31 $1.5B #Blackstone Holdings $600M 5Y +170, $900M +10Y +215

- 10/31 $1B #American Electric Power $500M 5Y +155, $500M 10Y +195

- 10/31 $500M #Church & Dwight WNG 10Y +158

- 10/31 $Benchmark American Express 5Y +185a

- 10/31 $Benchmark Comcast 3Y +85a, 5Y +115a, 10Y +155a

- 11/?? Chatter: $4B Credit Suisse issuance

EGBs-GILTS CASH CLOSE: BoE Week Starts With UK Short End Underperformance

Stronger-than-expected Eurozone flash inflation sparked a further round of EGB weakness, though Schatz managed to outperform their UK counterparts amid a short-end pre-BoE Gilt selloff.

- EGB weakness continued as last week's dovish ECB narrative is reassessed (particularly in light of the above-expected 10.7% Y/Y rise in EZ CPI, alongside stonger-than-expected Q3 GDP prints).

- Bunds have nearly retraced the entire post-ECB rally, with bear steepening seen today.

- But the UK curve bear flattened as terminal UK rate pricing edged higher with an eye on Thursday's BoE decision, and amid hawkish repricing of central banks elsewhere (including the Fed whose decision is Wednesday).

- Peripheries underperformed, with BTP spreads widening nearly 9bp.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is down 0.3bps at 1.936%, 5-Yr is up 0.8bps at 2.005%, 10-Yr is up 3.9bps at 2.142%, and 30-Yr is up 5.7bps at 2.135%.

- UK: The 2-Yr yield is up 7.2bps at 3.333%, 5-Yr is up 4.9bps at 3.631%, 10-Yr is up 3.8bps at 3.516%, and 30-Yr is up 4.6bps at 3.608%.

- Italian BTP spread up 8.6bps at 215.8bps / Spanish up 3.4bps at 108.3bps

FOREX: Greenback Makes Solid Gains Into Month-End, GBP Poorest On The Board

- The USD traded on the front foot for the entirety of Monday’s trading session with the USD index grinding 0.75% higher to start the week. This comes as markets gear towards positioning for the upcoming Fed rate decision on Wednesday.

- GBP was the poorest performer in G10, falling against all others and further unwinding some of the recent outperformance to put GBP/USD (-1.30%) comfortably back below the 1.15 mark.

- Weakness for the Chinese Yuan persisted throughout the day, with the latest wave of pressure following overnight source reports from Bloomberg, that the US has raised the idea of export control regimes for China with their European partners - mimicking the patterns and techniques used with Russia.

- Furthermore, weaker Purchasing Managers' Index, sliding to 49.2 (contractionary zone) in October from 50.1 in September underpinned the strength seen for USDCNH. The non-manufacturing PMI also dropped by 1.9 points to 48.7, falling below 50 for the first time since May.

- Greenback gains were fairly broad based with both the Euro and Japanese Yen falling victim. USDJPY continues its recovery from the post-intervention 145.11 lows to trade just shy of the 149 handle. In similar vein, EURUSD traded consistently lower despite above expectation Eurozone CPI prints and is now back below 0.99. On the technical front, markets will be watching key support at 0.9839, the former bear channel resistance.

- Overnight we have the RBA decision/statement. While inflation showed no signs of slowing in Q3, recent RBA commentary gives many reasons why it is likely to stick to 25bp in November rather than return to a 50bp move. In the US, we have ISM Manufacturing PMI as well as Jolts data before Wednesday’s FOMC decision.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/11/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/11/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/11/2022 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 01/11/2022 | 0800/0900 |  | CH | SECO Consumer Confidence | |

| 01/11/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/11/2022 | - |  | DK | Danish General Election | |

| 01/11/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/11/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/11/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/11/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/11/2022 | 1400/1000 | * |  | US | Construction Spending |

| 01/11/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 01/11/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 01/11/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 01/11/2022 | 2230/1830 |  | CA | BOC Governor Macklem at Senate bank committee |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.