-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Lowers Borrow Ests, Risk-On Ahead FOMC

- MNI Fed Preview - Jan 2024: Dropping The Tightening Pretense

- MNI US FED: Fed Review To Rebalance Inflation Targeting-Ex Officials

- MNI INTERVIEW: Taylor Rule Supports March Cut -Ex-Fed's Tracy

- OVERNIGHT DATA: US Treasury Borrow Estimate Lowered

- MNI Regional Fed Manufacturing Surveys Clash With PMIs In January

US

Fed Preview - Jan 2024 (MNI): Dropping The Tightening Pretense

The Federal Reserve will hold rates steady for the 5th time in 6 meetings in January, further cementing expectations that the hiking cycle is over and that the next move will be a cut.

US FED (MNI): Fed Review To Rebalance Inflation Targeting-Ex Officials

The Federal Reserve’s framework review that begins later this year is likely to yield modest but significant changes to the existing average-inflation targeting regime, putting more emphasis on the need to respond to inflation when it is too high as well as when it is too low, nearly a dozen former Fed officials and senior staffers told MNI in a series of interviews.

INTERVIEW (MNI): Taylor Rule Supports March Cut -Ex-Fed's Tracy

Monetary rules of thumb suggest the Federal Reserve would be well-placed to begin lowering interest rates in March, especially with global economic weakness and geopolitical conflicts keeping economic activity and inflation in check, former senior adviser to the president at the Dallas Fed Joseph Tracy told MNI.

NEWS

INTERVIEW (MNI): Last Thing BOC Wants Is Cut And U-Turn- Stillo

The Bank of Canada will resist cutting rates until mid-year even as a mild recession takes hold in case sustained inflationary pressures in areas such as housing force another change of course, an ex-forecasting manager for the country's largest province told MNI's FedSpeak podcast.

HUNGARY (MNI): Opp. Calls For Emergency Parl't Session To Approve Sweden NATO Bid

Hungary's opposition parties have submitted a motion calling for the National Assembly to be reconvened for an emergency session on 5 February in order to ratify Sweden's NATO accession.

SECURITY (MNI): WH Kirby: President Biden Will Determine Response To Jordan Attack

White House National Security Council Spokesperson John Kirby has told reporters that the US, "does not seek another war, we do not seek to escalate, but we will absolutely do what is required to protect ourselves, to continue that [anti-ISIS] mission, and to respond appropriately to these attacks."

SECURITY (MNI): Meeting In Cairo On Three-Phase Ceasefire Agreement In "Coming Days"

Axios’ Barak Ravid reports that a meeting will be held in Cairo, Egypt in the “coming days,” to discuss an emerging “three-phase” ceasefire agreement between Israel and Hamas. During the first stage, Israeli hostages and Palestinian prisoners will be released in return for a six-week pause in fighting.

ISRAEL (MNI): NBC News-Israel Agrees On Hostage Deal, Could Pave Way To Ceasefire

NBC News reporting that Israel has agreed to a framework on a hostage deal that could set the stage for a phased ceasefire if Hamas also signs up.

MIDEAST (MNI): Killing Of US Personnel Raises Prospect Of Direct Response Against Iran

The killing of three US service personnel, and the injuring of at least 34 others, in a strike on a remote military outpost in Jordan on 28 Jan could see a notable escalation in US military actions in the Middle East in response to the attack.

US TSYS FI Extends Rally on Lower Tsy Borrow Ests.

- Tsy futures as well as stocks extending session highs (contract highs on latter) after the Treasury cut Jan-March borrow est's from $816B to $760B, and estimates April-June at $202bn. The refunding announcement is scheduled for Wednesday at 0830ET.

- Mar'24 10Y futures (TYH4 tapped 111-23 high, +22) continues to see-saw near the top end of range since January 18. Initial technical resistance at 112-01+ (High Jan 17). 10Y yield slipped to 4.0568% low.

- Focus remains on gradually lower inflation and timing of first FOMC rate cut since March 2020 in the lead up to this Wednesday's policy announcement. No action expected from the Fed Wednesday, but dealer estimates of when and by how much is varied (GS: 25bp cut in March, 5 total cuts in 2024 to 4.25%; DB 3.75% by year end, UBS 2.75% year end; flipside: Santander est's 50bp by year end to 5%).

- Cross asset summary: stocks near recent highs (SPX eminis 4953.25 vs. Fri's 4956.0 contract high), Crude weaker (WTI -1001 at 77.01), gold firmer (+13.32 at 2031.84.

OVERNIGHT DATA: US Treasury Borrow Estimate Lowered

- Treasury cuts Jan-March borrowing estimates from $816bn to $760bn, and estimates April-June at $202bn.

- The combination is clearly lower than the estimates we noted ahead of the release, summing to $962bn over the two quarters vs $1118bn for JPM/SocGen or $1269bn for DB.

- DB for instance was closer with the Jan-Mar estimate with $797bn but then expected $472bn for Apr-Jun.

- JPM and SocGen both looked for circa $260bn for Apr-Jun.

- Treasury assumes a lower end-quarter cash balance than the above analysts, at $750bn for end-of-June vs $775bn penciled in by JPM and $800bn by DB. SOMA redemptions of $197bn meanwhile were exactly as DB forecast.

US: Regional Fed Manufacturing Surveys Clash With PMIs In January. The Dallas Fed manufacturing index saw a large miss in January, falling to -27.4 (cons -11.0) after a downward revised -10.4 (initial -9.3).

- The 17pt slide followed a 9.5pt increase, leaving it close to recent lows of -29.1 in May at levels prior to pandemic lows not seen since Jan’16 and 2008-09.

- It sees a full round of misses for regional Fed manufacturing indices in January following the Empire State (-43.7 vs cons -5.0), Philly Fed (-10.6 vs cons -6.5), Richmond Fed (-15 vs cons -8) and Kansas City (-9 vs cons -3).

- Weighed heavily by the ever-volatile Empire index slumping to -43.7, the average of the five surveys is -21.1 for the lowest since 2009 outside of Mar-May’20 pandemic months.

- The regional Fed measures are firmly in contrast to the flash US PMI which increased from 47.9 to 50.3 in January for its highest since Oct’22. Wednesday’s MNI Chicago PMI could help lend weight to which development looks more likely ahead of Thursday’s ISM manufacturing release.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 199.52 points (0.52%) at 38311.87

- S&P E-Mini Future up 36 points (0.73%) at 4952.25

- Nasdaq up 169.9 points (1.1%) at 15625.54

- US 10-Yr yield is down 6 bps at 4.0778%

- US Mar 10-Yr futures are up 18.5/32 at 111-19.5

- EURUSD down 0.002 (-0.18%) at 1.0833

- USDJPY down 0.76 (-0.51%) at 147.39

- WTI Crude Oil (front-month) down $0.98 (-1.26%) at $77.02

- Gold is up $13.54 (0.67%) at $2032.14

- European bourses closing levels:

- EuroStoxx 50 up 3.89 points (0.08%) at 4639.36

- FTSE 100 down 2.35 points (-0.03%) at 7632.74

- German DAX down 19.68 points (-0.12%) at 16941.71

- French CAC 40 up 6.67 points (0.09%) at 7640.81

US TREASURY FUTURES CLOSE

- 3M10Y -5.616, -128.581 (L: -130.683 / H: -124.364)

- 2Y10Y -2.038, -23.401 (L: -25.503 / H: -20.758)

- 2Y30Y -0.75, 1.029 (L: -1.374 / H: 2.965)

- 5Y30Y +1.075, 34.12 (L: 32.272 / H: 34.911)

- Current futures levels:

- Mar 2-Yr futures up 3.375/32 at 102-21.75 (L: 102-19.25 / H: 102-22.25)

- Mar 5-Yr futures up 10.5/32 at 107-31.25 (L: 107-23.5 / H: 108-01.5)

- Mar 10-Yr futures up 18/32 at 111-19 (L: 111-05 / H: 111-23)

- Mar 30-Yr futures up 1-05/32 at 120-23 (L: 119-23 / H: 121-01)

- Mar Ultra futures up 1-18/32 at 127-01 (L: 125-21 / H: 127-14)

US 10Y FUTURE TECHS: (H4) Gains Considered Corrective

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 112-01+ High Jan 17

- PRICE: 111-20 @ 1520 ET Jan 29

- SUP 1: 110-26 Low Jan 19

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11 and a key short-term support

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

The trend needle in Treasuries continues to point south and short-term gains are considered corrective for now. Sights are on 110-26, the Jan 19 low. A break of this level would confirm a resumption of the current bear cycle and highlight a clear break of the 50-day EMA, at 111-03+. This would set the scene for a move towards 110-16, the Dec 13 low. Firm resistance is 112-26+, the Jan 12 high. Initial resistance is at 111-18, the 20-day EMA.

SOFR FUTURES CLOSE

- Mar 24 +0.010 at 94.875

- Jun 24 +0.015 at 95.295

- Sep 24 +0.025 at 95.710

- Dec 24 +0.045 at 96.070

- Red Pack (Mar 25-Dec 25) +0.070 to +0.090

- Green Pack (Mar 26-Dec 26) +0.090 to +0.095

- Blue Pack (Mar 27-Dec 27) +0.095 to +0.095

- Gold Pack (Mar 28-Dec 28) +0.095 to +0.10

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00387 to 5.33260 (+0.00053 total last wk)

- 3M -0.00477 to 5.31266 (+0.00225 total last wk)

- 6M -0.00471 to 5.15269 (-0.00193 total last wk)

- 12M +0.00005 to 4.79903 (+0.00049 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.712T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $676B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $668B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $100B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $270B

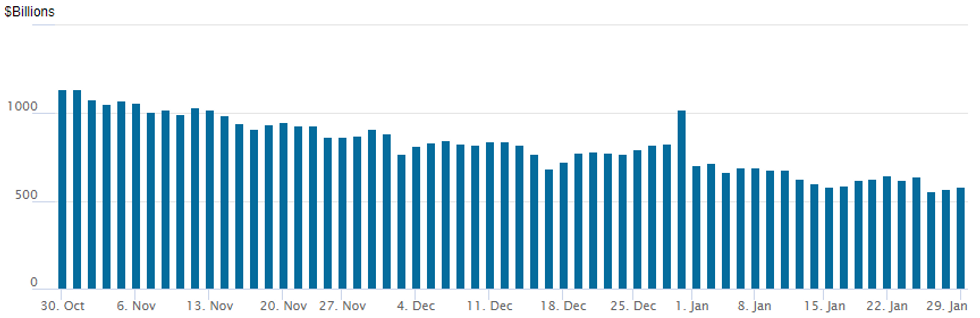

US FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

- RRP usage climbs to $581,410B vs. $570.828B last Friday. Compares to cycle low of $557.687B on Thursday, January 25, lowest level since mid-June 2021.

- Meanwhile, the number of counterparties climbs to 81 vs. 77 on Friday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $5.5B IBM 7Pt, $4.4B NextEra 5Pt Launched

- Date $MM Issuer (Priced *, Launch #

- 1/29 $5.5B #IBM: $600M 2Y +45, $500M 3Y +55, $500M 5Y +65, $500M 7Y +75, $1B 10Y +85, $1B 20Y +85, $1.4B 30Y +100

- 1/29 $4.4B #Nextera $1B 2Y +65, $600M 2Y SOFR+76, $900M 5Y +95, $1.1B 10Y +120, $800M 30Y +125

- 1/29 $2.5B #Northrop Grumman $500M 5Y +65, $850M 10Y +85, $1.15B 30Y 90

- 1/29 $2.25B #Kinder Morgan $1.25B 5Y +105, $1B 10Y +135

- 1/29 $2B #Capital One $1B 6NC5 +170, $1B 11NC10 +195

- 1/29 $1B *Hyundai Capital $500M 3Y +110, $500M 5Y +120

- 1/29 $800M Nationstar Mortgage 8NC3 7.375%a

- 1/29 $750M *Blue Owl Credit 7Y +290

- 1/29 $600M #Golub Capital +5Y +225

- 1/29 $500M *Northern Natural Gas 30Y +127

FOREX Greenback Pares Gains Post Treasury Announcement, USDJPY Drops 40 Pips

- Upward pressure for both equities and treasuries in the aftermath of the Treasury’s quarterly refunding announcement sees the USD index paring its prior advance on the session.

- This has been most notable in the decline for USDJPY to fresh session lows at 147.26 in recent trade. Outperformance evident in the likes of Aussie and Kiwi sees further downward pressure on EURAUD and EURNZD, with the latter extending declines to 1.00% on the session.

- Australian retail sales data is due overnight before Spanish CPI and other European GDP figures. In the US, JOLTS data and consumer confidence will cross before Wednesday’s Fed Decision & presser.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/01/2024 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/01/2024 | 0030/1130 | ** |  | AU | Retail Trade |

| 30/01/2024 | 0630/0730 | ** |  | FR | Consumer Spending |

| 30/01/2024 | 0630/0730 | *** |  | FR | GDP (p) |

| 30/01/2024 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/01/2024 | 0800/0900 | *** |  | ES | GDP (p) |

| 30/01/2024 | 0800/0900 | ** |  | CH | KOF Economic Barometer |

| 30/01/2024 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/01/2024 | 0900/1000 | *** |  | IT | GDP (p) |

| 30/01/2024 | 0900/1000 | ** |  | IT | PPI |

| 30/01/2024 | 0900/1000 |  | EU | ECB's Lane on 'a year with the euro in Croatia' | |

| 30/01/2024 | 0900/1000 | *** |  | DE | GDP (p) |

| 30/01/2024 | 0930/0930 | ** |  | UK | BOE M4 |

| 30/01/2024 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/01/2024 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 30/01/2024 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 30/01/2024 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 30/01/2024 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/01/2024 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/01/2024 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/01/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 30/01/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 30/01/2024 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/01/2024 | 1500/1000 | ** |  | US | housing vacancies |

| 30/01/2024 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 30/01/2024 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 30/01/2024 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 30/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 31/01/2024 | 2350/0850 | * |  | JP | Retail sales (p) |

| 31/01/2024 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.