-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Sec Yellen Assures Deposits Safe

EXECUTIVE SUMMARY

US TSYS: Yellen 2.0 Shakes Markets Up

- Treasury futures surged higher across the board in late trade, partially tied to the sell-off in sock indexes lead by banks while a safe haven tone accelerated even as Tsy Secretary Yellen attempted to softens her comments on deposit insurance yesterday, pledging additional actions "if warranted".

- Front month bonds initially surged to 132-01 high. reversed to 131-14 briefly before see-sawing back to 132-08 high

- SPX Emini futures had fallen to 3954.5 low are back near 3975 at the moment.

- Wednesday's testimony from Tsy Sec Yellen weighed on stocks after stating the Tsy is "not considering broad increase in deposit insurance", at odds with Chairman Powell's comment supportive of regional banks.

- Prepared text earlier than expected: Yellen to say "We have used important tools to act quickly to prevent contagion. And they are tools we could use again," she said in prepared testimony to Congress. "The strong actions we have taken ensure that Americans’ deposits are safe. Certainly, we would be prepared to take additional actions if warranted."

- Yield curves continue to climb off deeper inverted levels: 2s10s marking -38.116 high as short end rates outperform 2Y futures mark 103-30.25 high, yield 3.7535% low. In line, implied rate cuts by year end accelerate with Dec'23 cumulative -86.6 at 3.946%, Fed Terminal slips to 4.89% in May.

US

TSYS: Treasury Secretary Janet Yellen plans to tell lawmakers Thursday Americans' deposits are safe and officials would be prepared to protect smaller banks if necessary.

- Yellen to say "We have used important tools to act quickly to prevent contagion. And they are tools we could use again," she said in prepared testimony to Congress. "The strong actions we have taken ensure that Americans’ deposits are safe. Certainly, we would be prepared to take additional actions if warranted."

- In a separate hearing Wednesday Yellen said she has not considered or discussed "blanket insurance" to banking deposits without approval by Congress. Some banking groups have urged the Biden administration and the FDIC to temporarily guarantee all U.S. bank deposits.

UK

BOE: The Bank of England Monetary Policy Committee voted seven-to-two for a 25 basis point rate hike at its March meeting following an upside surprise to inflation in the February data.

- The MPC anticipated that inflation would fall markedly in the second quarter and more than it had previously expected with services inflation set to remain broadly unchanged but the majority took the view that stronger-than-expected near-term growth and the upside inflation shock justified tightening.

- "Headline CPI inflation had surprised significantly on the upside and the near-term path of GDP was likely to be somewhat stronger than expected," the minutes stated with the majority placing some weight on the idea that the stronger domestic and global demand reflected something more than the decline in energy prices. For more see MNI Policy main wire at 0801ET.

EUROPE

ECB: Eurozone financial conditions are tightening following the collapse of Silicon Valley Bank and the forced takeover of Credit Suisse by UBS, a former member of the European Central Bank’s executive board told MNI, adding that the ECB still has work to do to tame inflation but that the peak in rates is now likely to be lower.

- Recent banking turmoil will intensify what “was already being observed” as lenders become more cautious about making loans, Jose Manuel Gonzalez-Paramo, who sat on the executive board from 2004 and 2012, said in an interview.

- While tighter financial conditions have a similar effect to an increase in interest rates, he considered it too soon to quantify this equivalence, which will vary day-by-day depending on market conditions.

- “If you ask five different experts you will get five different answers, because there are many ways to calculate that number,” said Gonzalez-Paramo, admitting that it would allow a lower peak in rates than previously expected. For more see MNI Policy main wire at 1214ET.

OVERNIGHT DATA

- US JOBLESS CLAIMS -1K TO 191K IN MAR 18 WK

- US PREV JOBLESS CLAIMS REVISED TO 192K IN MAR 11 WK

- US CONTINUING CLAIMS +0.014M to 1.694M IN MAR 11 WK

- US Q4 CURRENT ACCOUNT GAP -$206.8B

- US Q3 CURRENT ACCOUNT REVISED TO -$219B

- US FEB NEW HOME SALES +1.1% TO 0.640M SAAR

- US JAN NEW HOME SALES REVISED TO 0.633M SAAR

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 114.96 points (0.36%) at 32138.7

- S&P E-Mini Future up 14.25 points (0.36%) at 3983

- Nasdaq up 128.3 points (1.1%) at 11795.1

- US 10-Yr yield is down 5 bps at 3.3837%

- US Jun 10-Yr futures are up 33/32 at 116-4

- EURUSD down 0.0017 (-0.16%) at 1.084

- USDJPY down 0.8 (-0.61%) at 130.64

- Gold is up $25.48 (1.29%) at $1995.68

- EuroStoxx 50 up 11.44 points (0.27%) at 4207.14

- FTSE 100 down 67.24 points (-0.89%) at 7499.6

- German DAX down 5.8 points (-0.04%) at 15210.39

- French CAC 40 up 8.13 points (0.11%) at 7139.25

US TREASURY FUTURES CLOSE

- 3M10Y -0.047, -131.368 (L: -134.84 / H: -120.197)

- 2Y10Y +10.354, -40.326 (L: -51.632 / H: -38.166)

- 2Y30Y +16.988, -12.149 (L: -31.301 / H: -9.17)

- 5Y30Y +13.389, 27.237 (L: 11.513 / H: 28.786)

- Current futures levels:

- Jun 2-Yr futures up 12.5/32 at 103-28.5 (L: 103-13.625 / H: 103-30.25)

- Jun 5-Yr futures up 27/32 at 110-18 (L: 109-22.5 / H: 110-20.25)

- Jun 10-Yr futures up 1-01.5/32 at 116-04.5 (L: 115-01 / H: 116-08)

- Jun 30-Yr futures up 1-02/32 at 132-01 (L: 130-14 / H: 132-08)

- Jun Ultra futures up 25/32 at 142-02 (L: 140-03 / H: 142-12)

US 10YR FUTURES TECHS: Key Near-Term Support Stays Intact

- RES 4: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 3: 117-00 61.8% of the Aug - Oct 2022 bear leg (cont)

- RES 2: 116-28+ High Jan 19 and key resistance

- RES 1: 115-27/116-24 High Mar 23 / 20

- PRICE: 115-24+ @ 16:30 GMT Mar 23

- SUP 1: 113-26 Low Mar 22

- SUP 2: 113-15 50-day EMA

- SUP 3: 113-08+ Low Mar 15

- SUP 4: 112-26 61.8% retracement of the Mar 2 - 20 rally

Treasury futures touched a low of 113-26 on Wednesday, before rebounding. The move higher leaves a firm support at the 50-day EMA intact - at 113-15. A break of this average is required to signal a stronger reversal. This would open 112-26, a Fibonacci retracement. For bulls, a continuation higher higher would refocus attention on the key resistance zone between 116-24, Monday’s high and 116-28+, the Jan 19 high. This zone is a bull trigger.

EURODOLLAR FUTURES CLOSE

- Jun 23 +0.095 at 94.955

- Sep 23 +0.280 at 95.525

- Dec 23 +0.30 at 95.870

- Mar 24 +0.280 at 96.265

- Red Pack (Jun 24-Mar 25) +0.180 to +0.235

- Green Pack (Jun 25-Mar 26) +0.175 to +0.185

- Blue Pack (Jun 26-Mar 27) +0.130 to +0.175

- Gold Pack (Jun 27-Mar 28) +0.110 to +0.135

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.24857 to 4.90714% (+0.24628/wk)

- 1M +0.04829 to 4.84529% (+0.01929/wk)

- 3M +0.05371 to 5.13371% (+0.13528/wk)*/**

- 6M +0.02757 to 5.14271% (+0.09042/wk)

- 12M -0.07423 to 5.10686% (+0.7272/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $92B

- Daily Overnight Bank Funding Rate: 4.57% volume: $281B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.203T

- Broad General Collateral Rate (BGCR): 4.52%, $512B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $499B

- (rate, volume levels reflect prior session)

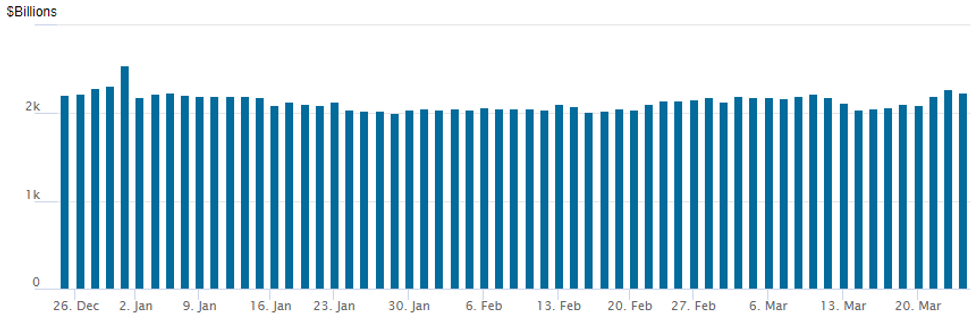

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,233.956B w/ 99 counterparties vs. the prior session's new high for 2023 of $2,.279.608B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $1.2B Prologis Wraps Up Day's $13.65B Total Corporate Issuance

Prologis' $1.2B 2pt launch wraps up the day's issuance, total of $13.65B total on the day, the lion's share of which is United Health's $6.5B 4pt.

- Date $MM Issuer (Priced *, Launch #)

- 03/23 $6.5B #United Health $1.25B +5Y +88, $1.5B 10Y +118, $2B 30Y +143, $1.75B 40Y +158

- 03/23 $2B #Medtronic $1B 5Y +87.5, $1B 10Y +115

- 03/23 $1.5B #Nutrien $750M 5Y +150, $750M 30Y +215

- 03/23 $1.2B #Prologis $750M 10Y +140, $450M 30Y +160

- 03/23 $900M #Public Service E&G $500M 10Y +122, $400M 30Y +142

- 03/23 $800M #Marriott Int 6Y +170

- 03/23 $750M #AIG (American International Group) 10Y +210

EGBs-GILTS CASH CLOSE: Bull Steepening As Hike Pricing Fades

EGBs and Gilts saw strong bull steepening Thursday as Wednesday's dovish Fed decision pulled down European central bank hike pricing.

- The BoE delivered a modest hawkish surprise with its 25bp hike on a 7-2 vote today. But the initial jump in terminal rate pricing of about 6bp faded over the course of the session with the focus on BoE's expectation for inflation to fade.

- Peak Bank Rate pricing dropped 16bp on the day, including 4bp compared with just before the BoE decision (just another 30bp of hikes are seen).

- ECB hike pricing faded along the same lines (terminal -10bp vs pre-Fed), with various hawks (including Muller) sounding half-hearted about future raises.

- Norges Bank and the SNB hiked by 25bp and 50bp respectively as expected.

- Periphery spreads edged wider with risk assets flat on the session.

- Little let-up ahead with UK retail sales data first thing Friday morning, followed by flash March PMI figures across Europe.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 18.1bps at 2.526%, 5-Yr is down 17.4bps at 2.198%, 10-Yr is down 13.3bps at 2.195%, and 30-Yr is down 7.2bps at 2.251%.

- UK: The 2-Yr yield is down 19.9bps at 3.295%, 5-Yr is down 15.9bps at 3.215%, 10-Yr is down 9.1bps at 3.36%, and 30-Yr is down 5.3bps at 3.833%.

- Italian BTP spread up 2.9bps at 187.1bps / Greek up 6.5bps at 195.2bps

FOREX: Late Safe Haven Demand As Equities Falter

- The greenback spent much of Thursday consolidating the post-FOMC decline. However, a late bout of weakness across equity markets, led by the decline in regional bank indices, spurred some solid demand for safe havens which benefitted both the greenback and the Japanese Yen.

- The likes of EURJPY and AUDJPY extended their losses to around 1% in the late session and despite a brief bout of turbulence over Yellen bank deposit headlines, USDJPY also printed fresh session lows below 130.40 approaching the APAC crossover.

- Fresh short-term trend lows for the pair maintains the current bearish price sequence of lower lows and lower highs and now exposes a move to 129.75, the 76.4% retracement of the Jan 16 - Mar 8 rally.

- EURUSD was unable to consolidate gains around the 1.09 handle and fell sharply towards the close. However, the pair maintains a firmer short-term tone overall. A clear breach of the Fibonacci hurdle at 1.0911 is required to strengthen bullish conditions and open 1.1000 and a key resistance at 1.1033, the Feb 2 high and a bull trigger. Initial firm support is seen at 1.0760, the Mar 15 high and a recent breakout point.

- UK retail sales on Friday before Eurozone data comes thick and fast throughout the morning, with French flash manufacturing and services PMI’s kicking off a raft of Eurozone data points. Capping off the week, durable goods and PMIs highlight the US docket.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/03/2023 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 24/03/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/03/2023 | 0700/0800 | ** |  | SE | PPI |

| 24/03/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 24/03/2023 | 0730/0730 |  | UK | DMO to Publish Apr-Jun Gilt Op Calendar | |

| 24/03/2023 | 0800/0900 | ** |  | ES | PPI |

| 24/03/2023 | 0800/0900 | *** |  | ES | GDP (f) |

| 24/03/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/03/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/03/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/03/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/03/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/03/2023 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/03/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 24/03/2023 | 1500/1500 |  | UK | BOE Mann Panellist at Global Independence Center Conference Ukraine | |

| 24/03/2023 | 1630/1630 |  | UK | BOE Announces Q2 Active Gilt Sales Schedule |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.