-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Yields Grind Higher

US TSYS: Rates Hold Lower, Narrow Band

Early Tuesday risk sentiment after China said it will end quarantine requirements for inbound travelers in early January, gradually evaporated as Tsys continued to drift lower on very light volumes by the close (TYH3<585k), while equities reversed early gains, Dow shares outperformed mildly weaker SPX and Nasdaq shares ahead the FI close. Trade volumes will hopefully improve Wednesday as London returns from extended Christmas holiday.

- Carry-over weakness w/ US$ index lowest levels in six months, extended losses from last week when data showed that US core PCE prices, the central bank’s preferred inflation gauge, fell to a four-month low of 4.7% YoY in Nov.

- Little react after $42B 2Y note auction (91282CGD7) stops through: 4.373% high yield vs. 4.390% WI; 2.71x bid-to-cover vs. 2.64x prior. Indirect take-up climbs to 62.22% vs. 56.98% last month, direct take-up 18.71% vs. 20.62%. primary dealer take-up 19.07% vs. 22.39%.

- Focus turns to Wed's data: Richmond Fed Mfg Index (-9, -10) and Pending Home Sales MoM (-4.6%, -1.2%); YoY (-36.7%, --) at 1000ET

- US Tsy auctions: $22B 2Y FRN Note auction re-open (91282CFS5) at 1130ET, $43B 5Y Note auction (91282 CGC9) at 1300ET

OVERNIGHT DATA

- US NOV. RETAIL INVENTORIES RISE 0.1% M/M; EST. -0.1%

- US ADVANCE WHOLESALE INVENTORIES ROSE 1.0 % IN NOV

- US NOV. ADV GOODS TRADE DEFICIT $83.3B; EST. -$96.7B

- S&P CoreLogic CS 20-City MoM SA (-0.5%); YoY (9.2%)

- Dallas Fed Manufacturing Index is -18.8 for December

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 31.5 points (0.09%) at 33236.02

- S&P E-Mini Future down 16.75 points (-0.43%) at 3853

- Nasdaq down 138.2 points (-1.3%) at 10359.58

- US 10-Yr yield is up 11.1 bps at 3.8581%

- US Mar 10-Yr futures are down 24/32 at 112-10.5

- EURUSD up 0.0004 (0.04%) at 1.0641

- USDJPY up 0.62 (0.47%) at 133.49

- WTI Crude Oil (front-month) up $0.04 (0.05%) at $79.61

- Gold is up $14.75 (0.82%) at $1812.93

- EuroStoxx 50 up 15.88 points (0.42%) at 3832.89

- German DAX up 54.17 points (0.39%) at 13995.1

- French CAC 40 up 45.76 points (0.7%) at 6550.66

US TSY FUTURES CLOSE

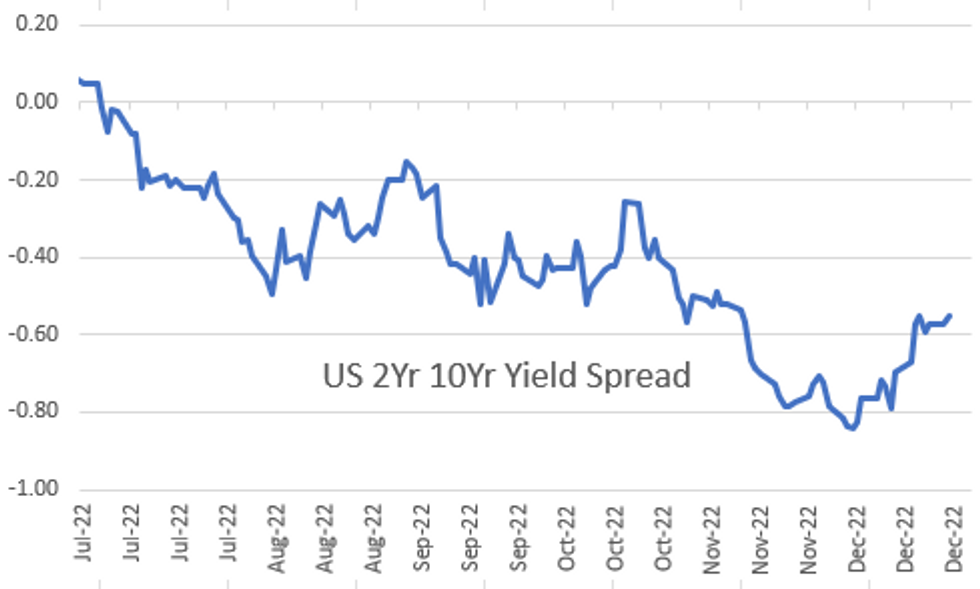

- 3M10Y +10.959, -47.32 (L: -65.18 / H: -45.51)

- 2Y10Y +2.369, -55.449 (L: -60.967 / H: -54.734)

- 2Y30Y +3.091, -47.096 (L: -54.304 / H: -45.486)

- 5Y30Y +1.429, -2.091 (L: -7.28 / H: -0.157)

- Current futures levels:

- Mar 2-Yr futures down 6.375/32 at 102-19.875 (L: 102-18.5 / H: 102-26.625)

- Mar 5-Yr futures down 14.25/32 at 107-31.75 (L: 107-30.5 / H: 108-16.25)

- Mar 10-Yr futures down 24/32 at 112-10.5 (L: 112-10 / H: 113-06.5)

- Mar 30-Yr futures down 1-26/32 at 125-11 (L: 125-09 / H: 127-15)

- Mar Ultra futures down 2-20/32 at 134-15 (L: 134-11 / H: 137-21)

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.045 at 94.90

- Jun 23 -0.080 at 94.830

- Sep 23 -0.095 at 94.950

- Dec 23 -0.105 at 95.245

- Red Pack (Mar 24-Dec 24) -0.105 to -0.095

- Green Pack (Mar 25-Dec 25) -0.10 to -0.095

- Blue Pack (Mar 26-Dec 26) -0.085 to -0.08

- Gold Pack (Mar 27-Dec 27) -0.09 to -0.085

SHORT TERM RATES

US DOLLAR LIBOR: No new settlements, below as of Friday, December 16. Benchmark resumes Wednesday, December 27.

- O/N +0.00171 to 4.31671% (-0.00029/wk)

- 1M -0.00185 to 4.38686% (+0.03400/wk)

- 3M +0.00257 to 4.72643% (-0.01943/wk)*/**

- 6M +0.00457 to 5.15314% (-0.03372/wk)

- 12M +0.02800 to 5.44386% (-0.03500/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $107B

- Daily Overnight Bank Funding Rate: 4.32% volume: $270B

- Secured Overnight Financing Rate (SOFR): 4.30%, $991B

- Broad General Collateral Rate (BGCR): 4.26%, $364B

- Tri-Party General Collateral Rate (TGCR): 4.26%, $352B

- (rate, volume levels reflect prior session)

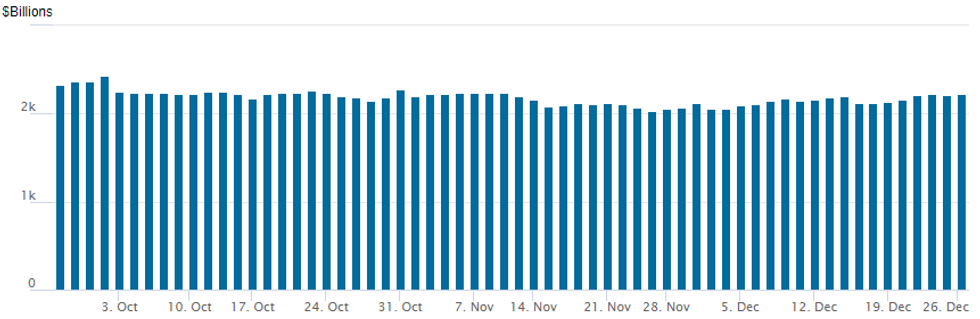

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,221.259B w/ 100 counterparties vs. $2,216.348B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/12/2022 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/12/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/12/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/12/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 27/12/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.