-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Off Lows, Shorts Unwound Ahead Month End

EXECUTIVE SUMMARY

US

FED: Boston Fed President Susan Collins said Thursday an additional 25 basis point hike would reasonably balance risks to bring inflation down, while recent banking developments will likely tighten lending standards and additionally help to reduce price pressures.

- "Inflation remains too high, and recent indicators reinforce my view that there is more work to do, to bring inflation down to the 2% target associated with price stability," she said according to prepared remarks.

- Last week's SEP shows the median FOMC official sees a fed funds funds rate range of 5% to 5.25% and this reasonably balances "the risk of monetary policy not being restrictive enough to bring inflation down, and the risk that activity slows by more than needed to address elevated price pressures," she said.

- The Boston Fed chief expects holding interest rates there through the end of the year. "Of course, I’ll be carefully watching a range of indicators including data on inflation, spending, labor markets, and financial conditions." For more see MNI Policy main wire at 1245ET.

FED: The Federal Reserve must remain vigilant to the possibility that inflation worries have become so widespread in the economy that the recent banking turmoil and its drag on economic activity might not be enough to tamp down price pressures, Richmond Fed President Thomas Barkin said Thursday.

- “It is possible that tightening credit conditions, along with the lagged effect of our rate moves, will bring inflation down relatively quickly. But I still see three reasons why it could take time for inflation to return to target,” Barkin said in prepared remarks to the Virginia Council of CEOs.

- It will take time to figure out whether the recent turbulence in the banking sector, including the failure of a few regional banks, will lead to a broader tightening of credit conditions that would be disinflationary, he added.

- “Even resilient banks can impact the broader economy if, to minimize their liquidity risk and protect capital, they choose to tighten access to credit. Research shows that such a pullback would limit consumer spending and curtail business investment. But it is too early to know whether that will happen now, or not,” Barkin said. For more see MNI Policy main wire at 1243ET.

- It should include liquidity requirements and enhanced liquidity stress testing, annual supervisory capital stress tests, comprehensive resolution plans, a reduction in transition periods to growing banks that are projected to exceed the USD100 billion threshold, and expanding long-term debt requirements to a broader range of banks. Each of the reforms can be accomplished under existing law, according to a White House fact sheet.

- Market reaction is limited following yesterday's WaPo article. The KBW banking index is little changed at -1.6% on the day, the regional banking index drifting off session lows but still -1.9%.

US: Several reports this week have suggested that House Republicans may be preparing to step away from their most ambitious goals from debt ceiling negotiations - balancing the federal budget in 10 years and freezing spending at pre-pandemic levels, without significantly cutting Social Security, Medicare or military funding.

- Bloomberg writes: “The GOP’s attempt to extract promises of fiscal belt-tightening is straight out of their 2011 political playbook, which yielded a 10-year, $2.1 trillion accord.

US TSYS: Implied Cuts Cooling Ahead Month End

- Treasury futures are see-sawing around mostly higher levels after the bell, paring short hedges while front end rates hold weaker as implied rate cuts in the second half of the year continue to soften (Fed funds implied hike for Dec'23 44.8 cumulative at 4.364%).

- Modest volumes on the day on inside ranges across the board, TYM3 under 1M contracts at the moment, as accounts take a breather to consider risk profiles going into Friday's month end.

- Treasury futures mirroring weaker Bunds early in the session after German Prelim March harmonized CPI comes out higher than estimated (1.1% MoM vs. +0.8% est). A delayed sell-off followed slightly higher than expected weekly claims (+198k vs. +195k est) while second revision of Q4 GDP +2.6% vs. +2.7% est (Consumption +1.0%; Deflator +3.9%; PCE Core +4.4%)

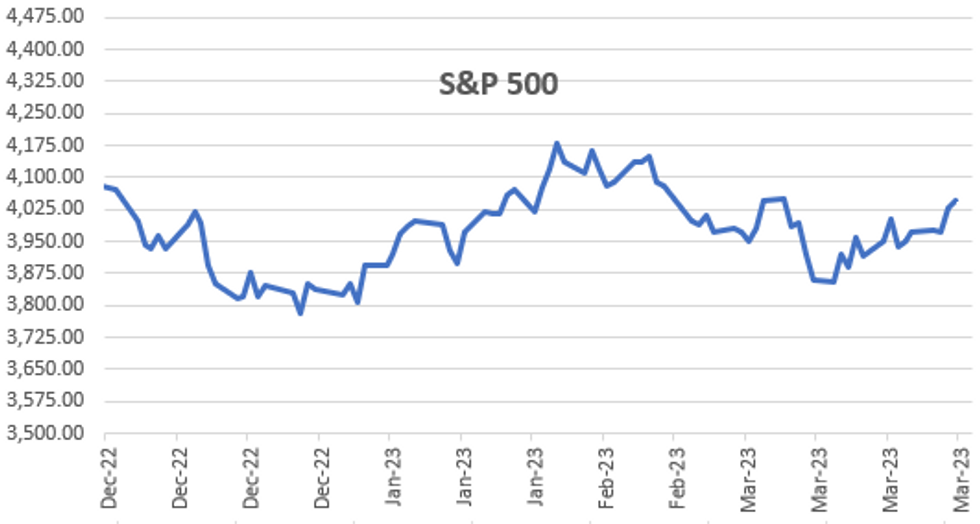

- Additional early pressure from stocks taking another leg higher (SPX Eminis +20.0 at 4077.50) amid reports of safe haven unwinds, chatter over reallocation from rates to stocks into month-end.

- Focus turns to Friday's PCE, PMI and UofM Sentiment, Fed speakers: Williams, Cook and Waller later in the evening.

OVERNIGHT DATA

- US JOBLESS CLAIMS +7K TO 198K IN MAR 25 WK

- US PREV JOBLESS CLAIMS REVISED TO 191K IN MAR 18 WK

- US CONTINUING CLAIMS +0.004M to 1.689M IN MAR 18 WK

- US Q4 GDP +2.6%

- US Q4 PCE PRICE INDEX +3.7%, PREV +3.7%;

- US CORE PCE +4.4% (CONSENSUS +4.3%), PREV +4.3%

- Real GDP revised down again in the third Q4 release, now seen at 2.57% annualized (2.68 prior).

- It was led by another downward revision for personal consumption to 1.03% (1.37 2nd release, 2.09 1st), although initial monthly data suggest a solid bounce into Q1 (with Feb PCE eyed tomorrow). Indeed, the latest Atlanta Fed GDPNow tracks at 3.2% for Q1 GDP.

- The relative drag from consumption was partly offset by upward revised non-residential investment. On the price side, core PCE saw a modest upward revision back in Q4, up from ~4.35 to 4.41% annualized.

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 100.39 points (0.31%) at 32709.6

- S&P E-Mini Future up 17.5 points (0.43%) at 4057.5

- Nasdaq up 71.3 points (0.6%) at 11932.44

- US 10-Yr yield is down 1.3 bps at 3.5507%

- US Jun 10-Yr futures are up 1.5/32 at 114-18.5

- EURUSD up 0.0061 (0.56%) at 1.0843

- USDJPY down 0.42 (-0.32%) at 132.77

- WTI Crude Oil (front-month) up $1.33 (1.82%) at $72.93

- Gold is up $16.5 (0.84%) at $1963.19

- EuroStoxx 50 up 54.15 points (1.28%) at 4231.27

- FTSE 100 up 56.16 points (0.74%) at 7564.27

- German DAX up 193.62 points (1.26%) at 15328.78

- French CAC 40 up 76.38 points (1.06%) at 7186.99

US TREASURY FUTURES CLOSE

- 3M10Y -5.674, -127.127 (L: -132.912 / H: -121.169)

- 2Y10Y -1.119, -55.236 (L: -58.354 / H: -49.958)

- 2Y30Y -0.949, -35.59 (L: -40.207 / H: -29.152)

- 5Y30Y +0.395, 8.07 (L: 4.217 / H: 9.87)

- Current futures levels:

- Jun 2-Yr futures down 2.125/32 at 103-4.875 (L: 103-01.125 / H: 103-09.625)

- Jun 5-Yr futures up 1.25/32 at 109-9 (L: 108-31.75 / H: 109-13)

- Jun 10-Yr futures up 1.5/32 at 114-18.5 (L: 114-07 / H: 114-23.5)

- Jun 30-Yr futures up 10/32 at 130-4 (L: 129-13 / H: 130-11)

- Jun Ultra futures up 17/32 at 139-23 (L: 138-29 / H: 140-06)

US 10YR FUTURE TECHS: Remains Vulnerable

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 2: 116-06+/117-01+ High Mar 27 / High Mar 24 and bull trigger

- RES 1: 115-07+ High Mar 28

- PRICE: 114-15 @ 1400ET Mar 30

- SUP 1: 114-06 20-day EMA

- SUP 2: 113-26 Low Mar 22

- SUP 3: 113-24 50-day EMA

- SUP 4: 113-08+ Low Mar 15

Treasury futures are trading closer to this week’s lows and just ahead of support at the 20-day EMA, which intersects at 114-06. The bearish candle pattern on Mar 24 - a shooting star - remains in play and suggests scope for a continuation lower. Note Monday’s pattern is a bearish engulfing candle - reinforcing a short-term bearish threat. A break of the 20-day EMA would open 113-26, the Mar 22 low. Initial resistance is at 115-07+, the Mar 28 high.

EURODOLLAR FUTURES CLOSE

- Jun 23 -0.045 at 94.785

- Sep 23 -0.045 at 95.135

- Dec 23 -0.040 at 95.415

- Mar 24 -0.035 at 95.785

- Red Pack (Jun 24-Mar 25) -0.035 to +0.010

- Green Pack (Jun 25-Mar 26) +0.020 to +0.045

- Blue Pack (Jun 26-Mar 27) +0.045 to +0.050

- Gold Pack (Jun 27-Mar 28) +0.020 to +0.045

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00014 to 4.81143% (+0.00257/wk)

- 1M +0.00728 to 4.84757% (+0.01700/wk)

- 3M +0.01743 to 5.17657% (+0.07514/wk)*/**

- 6M +0.06272 to 5.27229% (+0.28500/wk)

- 12M +0.07114 to 5.23157% (+0.39571/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.17657% on 3/30/23

- Daily Effective Fed Funds Rate: 4.83% volume: $97B

- Daily Overnight Bank Funding Rate: 4.82% volume: $247B

- Secured Overnight Financing Rate (SOFR): 4.83%, $1.287T

- Broad General Collateral Rate (BGCR): 4.79%, $506B

- Tri-Party General Collateral Rate (TGCR): 4.79%, $494B

- (rate, volume levels reflect prior session)

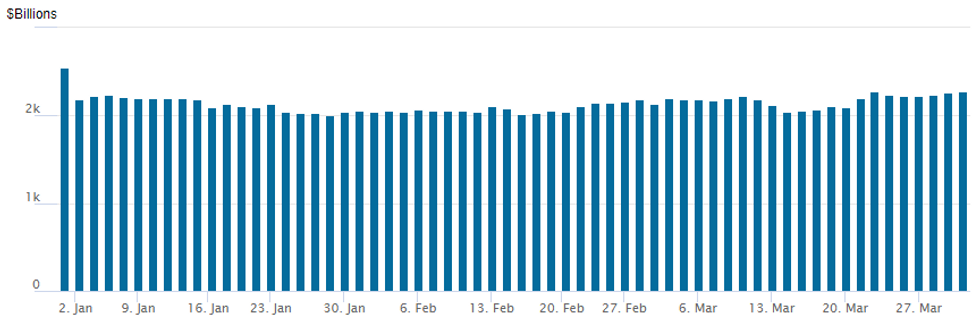

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,271.531B (second highest for 2023 after $2,279.608B on March 22) w/ 102 counterparties, compares to yesterday's $2,264.862B. Record high of $2,553.716B from December 30, 2022 remains intact.

PIPELINE: $750M Western Midstream 10Y Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/30 $750M #Western Midstream 10Y +262.5

- 03/30 $500M Nederlandse Financierings-Maatschappij 2Y SOFR+24

- $3.75B Priced Wednesday

- 03/29 $1B *Al-Rajhi Bank 5Y +110

- 03/29 $900M *New York Life $600M 3Y +85, $300M 3Y SOFR+93

- 03/29 $750M *Allstate 10Y +170

- 03/29 $600M *Aviation Capital Group 5Y +275

- 03/29 $500M *Archer-Daniels-Midland 10Y +105

EGBs-GILTS CASH CLOSE: German Inflation Seen Keeping Pressure On ECB

Thursday's Euro area inflation data had been highly anticipated as a potential market-mover - and it delivered, with Bunds underperforming after trading in a wide range.

- Bunds soared on a lower-than-expected Spanish CPI print in early trade, only to reverse all gains after German state-level CPI pointed to a higher-than-expected national print.

- The latter released in early afternoon topped expectations with core looking stubbornly high, triggering the next leg of the selloff.

- Gilts outperformed on the day, with modest weakness mostly in the belly of the UK curve, contrasting with yet more bear flattening in Germany.

- For a short time, there were no ECB cuts priced in 2023, with the peak coming in December. Overall peak pricing rose over 12bp on the day (an end-year ECB depo rate of around 3.61% is now seen).

- ECB's Kazaks told MNI that more rate increases will be needed in the baseline scenario. He speaks Friday morning, with colleagues Visco, Lagarde and Vujcic later in the day.

- Friday's week/month/quarter-end session also brings more upper-tier data: Dutch/French/Italian/Eurozone CPI and UK GDP are the highlights.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.5bps at 2.749%, 5-Yr is up 7.8bps at 2.406%, 10-Yr is up 4.5bps at 2.374%, and 30-Yr is up 1.3bps at 2.421%.

- UK: The 2-Yr yield is up 4.3bps at 3.455%, 5-Yr is up 5bps at 3.366%, 10-Yr is up 4.6bps at 3.518%, and 30-Yr is up 1.8bps at 3.849%.

- Italian BTP spread up 4bps at 186.1bps / Spanish up 1.6bps at 103.2bps

FOREX: Greenback Weakness Resumes, German CPI Bolsters Euro

- The greenback was once again on the back foot throughout Thursday’s trading session. The USD index has declined 0.45% approaching the APAC crossover and is gravitating towards last weeks lows of 101.92. Broad greenback weakness has been aided by a firmer Euro which has been underpinned by stronger-than-expected German CPI data and an associated adjustment in ECB terminal pricing.

- EURUSD came within 4 pips of key short-term resistance at 1.0930, the Mar 23 high. A break of this level would reinstate the recent bull theme and signal scope for a climb towards 1.1033, the Feb 2 high.

- Sterling was also one of the day’s best performers. GBPUSD has recently cleared a number of resistance points, strengthening a short-term bullish condition. Sights are on resistance at 1.2401, the Feb 2 high and 1.2448, the Jan 23 high.

- For USDJPY, after multiple tests towards the 133.00 handle throughout the trading session, the pair fell around 60 pips during US hours, narrowing in on the overnight lows of 132.21. Broad USD weakness has had little impact on the pair up until this point with the firmer risk backdrop in general underpinning cross/JPY strength.

- Overall, the trend direction in USDJPY remains down and this week’s gains are considered corrective. The 20-day EMA has been tested. Firmer resistance is seen at 133.00, the March 22 high, and the 50-day EMA that intersects at 133.38. A clear break of this EMA would highlight a stronger reversal.

- Overnight, China PMIs will kick off Friday’s busy docket. Eurozone CPI Flash Estimate, US Core PCE price index and the MNI Chicago Business Barometer, will be in focus ahead of the weekend close.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/03/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/03/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 31/03/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 31/03/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/03/2023 | 0630/0830 | ** |  | CH | retail sales |

| 31/03/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/03/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/03/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/03/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/03/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/03/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 31/03/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/03/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 31/03/2023 | 1500/1700 |  | EU | ECB Lagarde Q&A with Students | |

| 31/03/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/03/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2023 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 31/03/2023 | 1900/1500 |  | US | New York Fed's John Williams | |

| 31/03/2023 | 2145/1745 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.