-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Unexpected Risk Appetite After CPI Rise

EXECUTIVE SUMMARY

FED: September CPI report reflects an environment in which high inflation has become entrenched, and there's no reason to think that will go away quickly.

- Atlanta Fed economist Brent Meyer says it will likely be months if not a year before the impact of tighter monetary policy is felt on consumer inflation.

- Businesses surveyed by the Atlanta and Richmond Fed banks anticipate unusually high cost pressures for at least another year.

- Core CPI jumped 0.576% from a month earlier, just an edge higher than the 0.567% increase recorded in August and two-tenths higher than market expectations. It was up 6.6% from a year earlier, the highest since 1982. Core services inflation accelerated to 0.8% from 0.6% in August, while core goods inflation was close to flat. The large owners' equivalent rent category hit a cycle high of 0.8% even as some analysts looked for a slight moderation.

US TSYS: Unexpected Risk Appetite Return After Jump in CPI

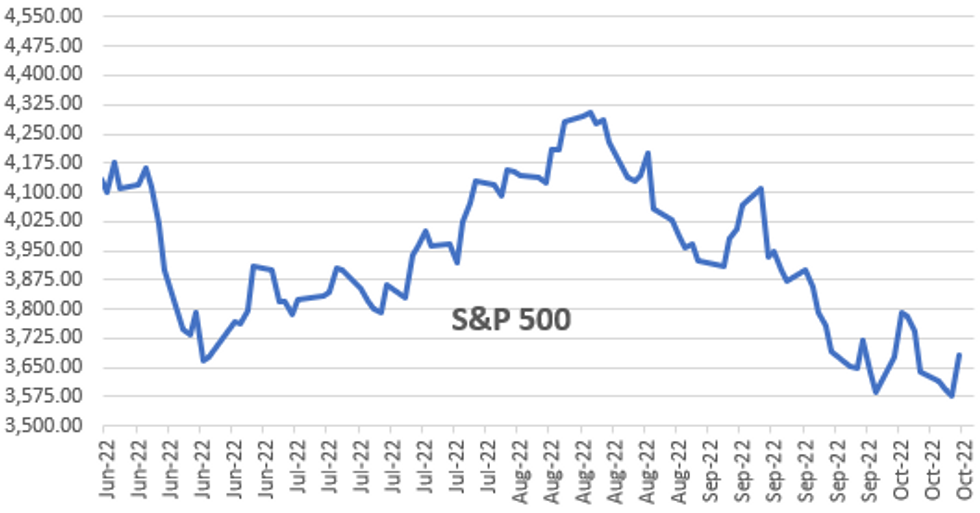

Volatile day for rates and equity markets, Tsys weaker again after bonds actually traded higher in late trade -- an unexpected rally in both rates AND equities (SPX tapped 3697.25 high vs. 3503.25 post-data low) after this morning's bounce in CPI inflation measure.- Largely ignoring weekly claims (+9K to 228K; continuing claims +0.003M to 1.368M) Tsys gapped lower following jump in CPI (8.2%, core 6.6%), yield curve bear flattening as prospect of 75bp hike in Nov a lock weighed heavily on the front end.

- Contributing to the rally that coincided w/BOE buy-op, large 10Y Block buy: +14,278 TYZ2 110-21, large buy through 110-16.5 post-time offer at 0957:35ET, 110-24 last (--23.5); appr DV01 $940k.

- Otherwise there did not appear to be any specific headline driver for the surge in risk appetite after the morning data - but more a confluence of acceptable triggers for risk takers: chatter from some traders that CPI seen as peak inflation.

- Another desk pointed out the NY Fed Underlying Inflation Gauge (UIG) was not as stark as the CPI: The UIG "full data set" measure for September is currently estimated at 4.4%, a 0.1 percentage point decrease from the current estimate of the previous month. The "prices-only" measure for September is currently estimated at 6.0%, unchanged from the current estimate for the previous month.

US: Sticky Services Drive Significant US CPI Beat

- Headline CPI bounced from 0.1% to 0.4% M/M (cons 0.2%) and core surprisingly nudged up from 0.57% to 0.58% M/M (cons 0.4%). The latter saw core CPI inflation extend to fresh cycle highs of 6.6% Y/Y, surpassing March’s 6.5%, with various regional Fed measures showing the same upward trajectory.

- The beat on core CPI was all about services (0.79% M/M from 0.58 which looks like the highest since the early 1980s whilst core goods barely registered with 0.02% from 0.46%.

- Familiar categories led this surprising core service strength, most notably OER (0.81% M/M from 0.71) and rent of primary residence (0.84% M/M from 0.74) hit new cycle highs vs some analysts looking for very slight moderation.

- Medical care services, a key component for non-shelter services with a weight close to tenants' rent, also accelerated to new cycle highs at 0.99% M/M (from 0.77) for 8.7% annualized on a 3month rolling basis.

- If there was a silver lining it was that goods inflation is cooling from improving global supply chains and USD strength, plus the fact that CPI rent measures are expected to catch up with a softer housing market in months ahead.

- However, yet another month of inflation not just failing to moderate more meaningfully but actually accelerating will be of renewed concern for the FOMC. More thoughts on potential rate implications here.

OVERNIGHT DATA

- US: Core Services Drives Inflation Beat

- The beat on core CPI was all about Services: +0.786% M/M (up from +0.580% last month) which looks like the highest since the early 80s. Core goods barely registered, +0.019% M/M (vs 0.459% prior).

- US DATA: CPI Unrounded - Sep'22

- Unrounded % M/M (SA): Headline 0.386%; Core: 0.576% (from 0.567%).

- Unrounded % Y/Y (NSA): Headline 8.202%; Core: 6.631% (from 6.322%).

- US SEP CPI 0.4%, CORE 0.6%; CPI Y/Y 8.2%, CORE Y/Y 6.6%

- US SEP ENERGY PRICES -2.1%

- US SEP OWNERS' EQUIVALENT RENT PRICES 0.8%

- US JOBLESS CLAIMS +9K TO 228K IN OCT 08 WK

- US PREV JOBLESS CLAIMS REVISED TO 219K IN OCT 01 WK

- US CONTINUING CLAIMS +0.003M to 1.368M IN OCT 01 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 892.82 points (3.06%) at 30105.28

- S&P E-Mini Future up 98 points (2.73%) at 3687

- Nasdaq up 237.2 points (2.3%) at 10654.59

- US 10-Yr yield is up 5.8 bps at 3.9537%

- US Dec 10Y are down 16/32 at 110-31.5

- EURUSD up 0.0081 (0.83%) at 0.9785

- USDJPY up 0.28 (0.19%) at 147.18

- WTI Crude Oil (front-month) up $1.83 (2.1%) at $89.12

- Gold is down $7.22 (-0.43%) at $1666.08

- EuroStoxx 50 up 30.87 points (0.93%) at 3362.4

- FTSE 100 up 24.12 points (0.35%) at 6850.27

- German DAX up 183.32 points (1.51%) at 12355.58

- French CAC 40 up 60.72 points (1.04%) at 5879.19

US TSY FUTURES CLOSE

- 3M10Y -2.471, 23.959 (L: 18.423 / H: 36.167)

- 2Y10Y -10.649, -50.348 (L: -51.453 / H: -38.397)

- 2Y30Y -10.591, -52.468 (L: -56.656 / H: -40.96)

- 5Y30Y -3.523, -28.198 (L: -35.05 / H: -20.785)

- Current futures levels:

- Dec 2Y down 10.875/32 at 102-7.25 (L: 102-02.5 / H: 102-20.125)

- Dec 5Y down 16.25/32 at 106-21.25 (L: 106-03.25 / H: 107-13.25)

- Dec 10Y down 16/32 at 110-31.5 (L: 110-02 / H: 111-28.5)

- Dec 30Y down 22/32 at 124-15 (L: 122-28 / H: 125-28)

- Dec Ultra 30Y down 1-11/32 at 132-27 (L: 131-06 / H: 135-03)

US 10Y FUTURE TECHS: (Z2) Vulnerable Despite Today’s Bounce

- RES 4: 115-13+ Low Sep 7

- RES 3: 114-31+ 38.2% retracement of the Aug 2 - Sep 28 bear leg

- RES 2: 112-25+/113-30 20-day EMA / High Oct 4 and the bull trigger

- RES 1: 111-28+ High Oct 12

- PRICE: 111-03 @ 19:31 BST Oct 13

- SUP 1: 110-00 Psychological Support

- SUP 2: 109-23+ Low Nov 30 2007 (cont)

- SUP 3: 108.23 3.0% 10-dma envelope

- SUP 4: 108-20 1.00 projection of the Oct 4 - 11 - 13 price swing

Treasuries broke out of this week’s consolidative range today, resulting in a break of support at 110-19, the Sep 28 low and bear trigger. Despite the bounce off the day low, the break confirms a resumption of the downtrend and maintains the trend sequence of lower and lower highs. The focus is on the psychological 110.00 handle where a break would further reinforce bearish conditions. Initial key resistance is at 112-25+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.165 at 94.945

- Mar 23 -0.230 at 94.855

- Jun 23 -0.235 at 94.905

- Sep 23 -0.220 at 95.055

- Red Pack (Dec 23-Sep 24) -0.195 to -0.095

- Green Pack (Dec 24-Sep 25) -0.065 to -0.005

- Blue Pack (Dec 25-Sep 26) steadysteady0 to +0.010

- Gold Pack (Dec 26-Sep 27) +0.010 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00286 to 3.06171% (-0.01486/wk)

- 1M +0.07343 to 3.41214% (+0.09857/wk)

- 3M +0.06828 to 4.07914% (+0.17357/wk) * / **

- 6M +0.04857 to 4.53857% (+0.15386/wk)

- 12M +0.03829 to 5.10600% (+0.10971/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.07914% on 10/13/22

- Daily Effective Fed Funds Rate: 3.08% volume: $110B

- Daily Overnight Bank Funding Rate: 3.07% volume: $287B

- Secured Overnight Financing Rate (SOFR): 3.04%, $972B

- Broad General Collateral Rate (BGCR): 3.00%, $390B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $371B

- (rate, volume levels reflect prior session)

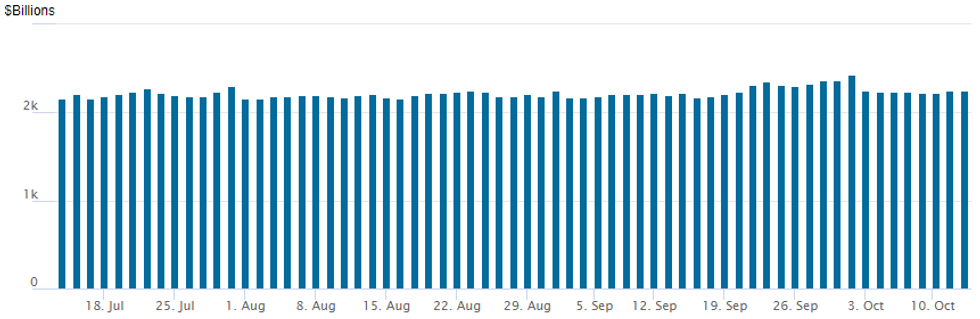

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,244.102B w/ 102 counterparties vs. $2,247.206B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EGBs-GILTS CASH CLOSE: UK Politics Drive Rally (In Spite Of US CPI)

In another session of large moves, the biggest driver Wednesday was UK politics, eclipsing the impact of another above-expected US CPI print.

- Gilt yields fell to session lows around midday on multiple reports the UK Gov't was set to "U-turn" on its fiscal package (30Y down 72bp from the Weds high at one point). Bunds followed along.

- But EGBs/Gilts sold off sharply (Bunds underperforming Gilts) after US Sept CPI data came in hot.

- Core FI recovered slightly after a large uptake in the BoE inflation-linked Gilt purchase op (the nominal long-dated op saw lighter takeup, no reac).

- Yields finished closer to session lows than highs with flattening in both the German and UK curves. Bonds didn't share in a large rally in global equities / dollar weakness toward the end of the cash session, which had little obvious catalyst.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 8.8bps at 1.915%, 5-Yr is up 2.5bps at 2.076%, 10-Yr is down 3.3bps at 2.281%, and 30-Yr is down 6.2bps at 2.294%.

- UK: The 2-Yr yield is down 21.3bps at 3.804%, 5-Yr is down 22.9bps at 4.244%, 10-Yr is down 23.7bps at 4.199%, and 30-Yr is down 27bps at 4.548%.

- Italian BTP spread down 3.1bps at 239.2bps / Greek down 7bps at 260.2bps

FOREX: Dollar Slips Further With Surging Equities and Sliding Real Yields

- BBDXY is pushed to fresh session lows on a combination of surging equities, with the two moving in inverted lockstep since US CPI.

- US real yields are adding downward pressure to the dollar again after having less impact earlier in the session, with the 10Y stepping back closer to where it was before CPI at 1.57% (-2.3bps on the day) in a significant reversal from highs of 1.74% forty five minutes after the data.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/10/2022 | 0130/0930 | *** |  | CN | CPI |

| 14/10/2022 | 0130/0930 | *** |  | CN | Producer Price Index |

| 14/10/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 14/10/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 14/10/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 14/10/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 14/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 14/10/2022 | - | *** |  | CN | Trade |

| 14/10/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/10/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/10/2022 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/10/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/10/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/10/2022 | 1400/1000 |  | US | Kansas City Fed's Esther George | |

| 14/10/2022 | 1430/1030 |  | US | Fed Governor Lisa Cook | |

| 14/10/2022 | 1615/1215 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.