-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

MNI ASIA OPEN: US December CPI Stickier Than Expectations

- MNI BRIEF: Fed’s Barkin On March Rate Cut-Let’s See The Data

- MNI Cleveland Fed Mester: March Probably Too Early For Rate Cut

- MNI INTERVIEW: Aggressive Wage Bargaining To Extend BOC Hold

- MNI BRIEF: ECB Could Cut 50bps If Supported By Data - Vujcic

- MNI ECB: European Parliament To Seek To Dilute Fiscal Rules

- MNI US: Still Stubborn Service Inflation But Market Reluctant To Stray Too Far From March Cut

- MNI CPI Core Services Ex-Housing - Dec'23

US TSYS 10Y Yield Back Below 4% Ahead PPI

- Treasury futures near late session highs but still shy of this morning's initial knee-jerk bid following more-or-less in-line CPI inflation data: CPI MoM (0.3% vs. 0.2% est), YoY (3.4% vs. 3.2% est); Ex Food and Energy MoM (0.3% vs. 0.3% est), YoY (3.9% vs. 3.8% est).

- Tsys climbed off midmorning lows in a positive reaction to Croatian National Bank governor Boris Vujcic comment at a MNI Connect webcast that the ECB should cut interest rate in 25bps increments, although 50bps moves should not be excluded if warranted by incoming data.

- Tsys ignored Cleveland Fed Mester comment that March is probably too early for a rate cut, focusing on dovish comments from Richmond Fed Barkin: needs convincing evidence inflation is stabilizing, but is open to cutting "once inflation on track to 2%".

- FI market bounce seems rather tepid, however, as markets await tomorrow morning's PPI data before committing. MN Fed President Kashkari speaks about economic conditions tomorrow as well (1000ET).

- Modest post-auction support as short sets reversed ($21B 30Y auction reopen (912810TV0) stops through for the second consecutive time: 4.229% high yield vs. 4.231% WI; 2.37x bid-to-cover vs. 2.43x in the prior month (2.38x 5-auction average.

- Curves near two-month highs: 2s10s taps -27.670, last seen November 7. Meanwhile, 10Y yield slipped below 4% late to 3.9847 (-.0436). Initial technical resistance for Mar'24 10Y futures up above at 112-19 (High Jan 4); support holds at 111-06+ (Low Jan 05).

NEWS

Richmond Fed Barkin (MNI): December CPI Came In About As Expected, Won’t Prejudge March Rate Cut

It’s too soon for Federal Reserve officials to consider whether it will be appropriate to start cutting interest rates in March as financial markets are currently anticipating, saying he needs to see how economic data play out in coming months, Richmond Fed President Thomas Barkin told reporters Thursday.

FED Mester (MNI): March Probably Too Early For Rate Cut

Cleveland Fed's Mester ('24 voter retiring in June) says CPI hasn't really changed her view: the job isn't done yet and we need to finish the job. Highlights from her Bloomberg TV appearance: Will assess conditions as they come in and really evaluate the risks around both parts of the mandate. We don't want to see inflation progress stall out but this report doesn't suggest that's happening, it just suggests we've got more work to do and we're committed to do it.

BOC INTERVIEW (MNI): Aggressive Wage Bargaining To Extend BOC Hold

The Bank of Canada faces too many inflation obstacles to cut interest rates anytime soon with inflation now migrating to big wage demands, former top Statistics Canada economist Philip Cross told MNI. “Rates are going to have to be higher for longer than the market had been assuming, because inflation is showing signs of being entrenched,” said Cross, a researcher at the Macdonald-Laurier Institute who had managed StatsCan's current economic analysis branch.

ECB BRIEF (MNI): ECB Could Cut 50bps If Supported By Data - Vujcic

The ECB should cut interest rate in 25bps increments, Croatian National Bank governor Boris Vujcic told on an an ongoing MNI Connect webstream, although 50bps moves should not be excluded if warranted by incoming data. Vujcic repeated his view that rate cuts are unlikely before the summer, though earlier moves cannot be ruled out as the ECB pursues a meeting-by-meeting policy approach.

ECB BRIEF (MNI): Real Wage Rises Supporting Growth, Recovery- Vujcic

Wage growth of around 3.6% this year, following last year's 5.7% increase, means Croatia's economic above-average growth is likely to continue, Boris Vujcic tells an ongoing MNI Connect webstream. The Eurozone's newest member saw GDP growth of around 3% last year, with personal consumption expected to expand at "significant pace" in 2024 and 2025, he said.

ECB (MNI): European Parliament To Seek To Dilute Fiscal Rules

Members of the European Parliament are likely to push for dilution of the tough cuts in budget deficits outlined in proposed new fiscal rules for the bloc in upcoming “Trialogue” negotiations between the legislature, member states and the European Commission, parliamentarians and a senior EU official told MNI.

US President Biden (MNI): Inflation Is Down While Growth And Jobs Remain Strong

US President Joe Biden has issued a statement on today's CPI print, touting a "two-thirds" decrease in inflation from its peak, and warning that "extreme Republicans" have "no plan to lower costs for families."

US (MNI): Schumer Expected To Start Process On CR To Avert Govt Shutdown Today

Senate Majority Leader Chuck Schumer (D-NY) is expected to today tee up a legislative vehicle as a placeholder for a Continuing Resolution to avoid a partial government shutdown on January 20. The process usually takes around a week, with a cloture vote in the Senate likely to come Tuesday.

US-CHINA (MNI): Commerce Ministers Hold Call, China Warns On US Chip Sanctions

The Chinese Ministry of Commerce has issued comments following a call between Commerce Minister Wang Wentao and his US counterpart Gina Raimondo earlier today.

SECURITY (MNI): FT-Maersk CEO: US & Allies Must Do What They Need To Do On Houthi Attacks

FT reportingcomments from CEO of shipping giant AP Møller-Maersk Vincent Clerc, claiming that the disruption to global shipping caused by Houthi rebels firing on vessels in and around the Red Sea could last for a significant period of time.

OVERNIGHT DATA

US DEC CPI 0.3%, CORE 0.3%; CPI Y/Y 3.4%, CORE Y/Y 3.9%

US DEC ENERGY PRICES 0.4%

US DEC OWNERS' EQUIVALENT RENT PRICES 0.5%

US DATA: CPI Unrounded - Dec'23

Unrounded % M/M (SA): Headline 0.303%; Core: 0.309% (from 0.285%)

Unrounded % Y/Y (NSA): Headline 3.352%; Core: 3.93% (from 4.007%)

Core services excl OER & primary rents: 0.40% M/M after 0.44%. Latest 3mth av of 0.35%

Core services excl all shelter: 0.45% M/M after 0.47%. Latest 3mth av of 0.43%

US DATA (MNI): Still Stubborn Service Inflation But Market Reluctant To Stray Too Far From March Cut

- Core CPI came in slightly stronger than expected in December at 0.31% M/M (cons 0.3 but skewed lower).

- There weren’t any particularly large drivers for the surprise compared to recent months, although used cars led with a further 0.5% increase despite continued wholesale price declines.

- Heavily weighted rent measures showed no sign of further moderation and the supercore CPI was solid at 0.40% M/M (limited analyst estimates were closer to 0.35%) for minimal progress from the 0.44% in November.

- Trend growth rates are clearly stubborn: core CPI increased 3.3% annualized over the past three months (a trend notably near unchanged for the past three months as well) and has registered 3.2% over the past six months, whilst supercore CPI has been running at 4.3% and 4.6% annualized over the past three and six months.

- The report offers a worrying stalling in the moderation in CPI data although core PCE has been running lower than core CPI in recent months, and we suspect it should have continued to do so in December barring any PPI surprises tomorrow.

US JOBLESS CLAIMS -1K TO 202K IN JAN 06 WK

US PREV JOBLESS CLAIMS REVISED TO 203K IN DEC 30 WK

US CONTINUING CLAIMS -0.034M to 1.834M IN DEC 30 WK

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 5.99 points (0.02%) at 37700.8

- S&P E-Mini Future down 7.5 points (-0.16%) at 4813

- Nasdaq down 3.2 points (0%) at 14965.73

- US 10-Yr yield is down 4.4 bps at 3.9847%

- US Mar 10-Yr futures are up 12.5/32 at 112-8.5

- EURUSD down 0.0011 (-0.1%) at 1.0962

- USDJPY down 0.33 (-0.23%) at 145.43

- WTI Crude Oil (front-month) up $0.85 (1.19%) at $72.22

- Gold is up $2.44 (0.12%) at $2026.79

- European bourses closing levels:

- EuroStoxx 50 down 26.7 points (-0.6%) at 4442.28

- FTSE 100 down 75.17 points (-0.98%) at 7576.59

- German DAX down 142.78 points (-0.86%) at 16547.03

- French CAC 40 down 38.46 points (-0.52%) at 7387.62

US TREASURY FUTURES CLOSE

- 3M10Y -3.762, -140.291 (L: -142.772 / H: -132.922)

- 2Y10Y +4.423, -28.966 (L: -36.944 / H: -27.968)

- 2Y30Y +6.966, -8.794 (L: -20.19 / H: -7.525)

- 5Y30Y +5.018, 27.956 (L: 21.09 / H: 28.928)

- Current futures levels:

- Mar 2-Yr futures up 5.875/32 at 102-27.875 (L: 102-20.25 / H: 102-29)

- Mar 5-Yr futures up 10.75/32 at 108-13.75 (L: 107-30 / H: 108-17)

- Mar 10-Yr futures up 12.5/32 at 112-8.5 (L: 111-19.5 / H: 112-16)

- Mar 30-Yr futures up 15/32 at 122-20 (L: 121-15 / H: 123-15)

- Mar Ultra futures up 7/32 at 129-22 (L: 128-12 / H: 130-29)

US 10Y FUTURE TECHS: (H4) Recent Pullback Considered Corrective

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 112-19 High Jan 4

- PRICE: 112-08+ @ 1515 ET Jan 11

- SUP 1: 111-06+ Low Jan 05

- SUP 2: 110-29+ 50-day EMA

- SUP 3: 110-16 Low Dec 13

- SUP 4: 109-31+ Low Dec 11 and a key short-term support

Treasuries are consolidating but remain in a short-term bearish corrective cycle. The print below the 20-day EMA suggests scope for a continuation lower near-term. The next key pivot support is 110-29+, the 50-day EMA. Moving average studies continue to suggest the medium-term trend direction is up. A recovery would refocus attention on the bull trigger at 113-12, the Dec 27 high. Clearance of this resumes the uptrend.

SOFR FUTURES CLOSE

- Mar 24 +0.030 at 94.960

- Jun 24 +0.080 at 95.435

- Sep 24 +0.115 at 95.860

- Dec 24 +0.130 at 96.210

- Red Pack (Mar 25-Dec 25) +0.095 to +0.130

- Green Pack (Mar 26-Dec 26) +0.075 to +0.085

- Blue Pack (Mar 27-Dec 27) +0.055 to +0.065

- Gold Pack (Mar 28-Dec 28) +0.030 to +0.045

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00103 to 5.33316 (-0.00608/wk)

- 3M -0.01247 to 5.31399 (-0.01527/wk)

- 6M -0.02909 to 5.15565 (-0.03719/wk)

- 12M -0.04015 to 4.80295 (-0.05155/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.660T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $677B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $665B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $91B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $247B

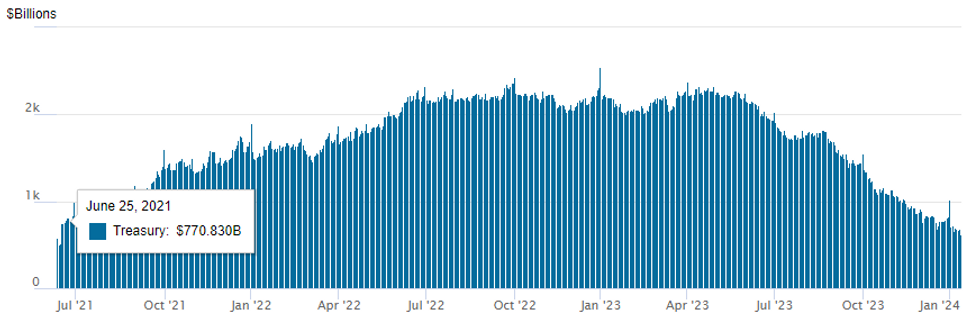

FED REVERSE REPO OPERATION: New Lows

NY Federal Reserve/MNI

- RRP usage inches falls to $626.370B vs. $679.961B Wednesday, today's usage marks the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties slips to 76 from 79 on Wednesday, compares to Tuesday's 72 -- the lowest since January 5, 2022.

PIPELINE $5B SocGen 5Pt Debt Issuance Launched

- Date $MM Issuer (Priced *, Launch #)

- 1/11 $5B #Societe Generale $1.15B 4NC3 +150, $350M 4NC3 SOFR, $1B 6NC5 +165, $1.25B 11NC10 +210, $1.25B 31NC30 +295

- 1/11 $1.2B #Niagara Mohawk Power $500M 10Y +130, $700M 30Y +145

- Expected Friday:

- 1/12 $750M DirecTV 6NC2

EGBs-GILTS CASH CLOSE: BTPs Outperform As Vujcic Opines On 50bp Cuts

Periphery spreads tightened for a 4rd consecutive session Thursday, with core EGBs/Gilts trading mixed as US inflation developments weighed.

- Global yields jumped led by Treasuries after US December inflation readings came in slightly higher than expected.

- But subsequent to US CPI, an MNI event with Croatia's/ECB's Vujcic saw a dovish turn in market pricing when he said that half-point rate cuts should not be ruled out if justified by incoming data.

- On the day, the German curve twist steepened marginally, with the short end benefiting from a pullback in ECB hike pricing expectations cued by the Vujcic comments. The UK curve leaned bear steeper.

- Periphery spreads maintained their narrowing made at the open, after a brief tick higher on US CPI. BTP/Bund closed below 160bp, at the same level as the Dec 22 close (157.1bp).

- ECB's Lagarde speaks after the cash close; Friday's early highlight is UK GDP/activity data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.3bps at 2.626%, 5-Yr is down 1.7bps at 2.153%, 10-Yr is down 1.0bps at 2.236%, and 30-Yr is up 0.8bps at 2.426%.

- UK: The 2-Yr yield is up 2bps at 4.255%, 5-Yr is up 0.2bps at 3.757%, 10-Yr is up 2.3bps at 3.842%, and 30-Yr is up 2.5bps at 4.44%.

- Italian BTP spread down 2.6bps at 157.1bps / Spanish down 2.1bps at 91.8bps

FOREX Initial Greenback Spike Faded as Treasuries Yields Reverse Lower

- Stubbornly above-estimate inflation data from the US prompted a quick spike for the greenback on Thursday, with early declines for the USD index quickly erased. However, topside momentum was kept in check as US yields began to reverse lower across the remainder of the US session and the DXY has been edging back towards unchanged levels as we approach the APAC crossover.

- USDJPY reached as high as 146.41 in the aftermath of the CPI release, extending the 2024 recovery. However, with two-year treasury yields touching a year-to-date low in recent trade, USDJPY is edging lower in sympathy. Pre-data lows of 145.14 will act as the immediate target, however, it is worth noting a key short-term support has been defined much lower at 143.42, the Jan 9 low.

- The likes of AUD (-0.30%) and CHF (-0.27%) are marginal underperformers on Thursday, with equities weakness largely responsible for the Aussie leg.

- GBP retaining its position as the outperformer in 2024 against the dollar, rising 0.10% on the session and narrowing the gap with session highs around 127.75. With the trend outlook remaining bullish, attention is on resistance at 1.2827, the Dec 28 high and bull trigger. Clearance of this level <Cell 27, 0>would confirm a resumption of the uptrend and open 1.2881, a Fibonacci retracement point. Initial firm support lies at 1.2611, Jan 2 low.

- China CPI/PPI figures will be released on Friday as well as trade balance data for December. Attention then turns to UK growth figures and US December PPI data.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/01/2024 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 12/01/2024 | 0130/0930 | *** |  | CN | Producer Price Index |

| 12/01/2024 | 0130/0930 | *** |  | CN | CPI |

| 12/01/2024 | 0500/1400 |  | JP | Economy Watchers Survey | |

| 12/01/2024 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 12/01/2024 | 0700/0700 | ** |  | UK | Index of Services |

| 12/01/2024 | 0700/0700 | *** |  | UK | Index of Production |

| 12/01/2024 | 0700/0700 | ** |  | UK | Trade Balance |

| 12/01/2024 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 12/01/2024 | 0745/0845 | *** |  | FR | HICP (f) |

| 12/01/2024 | 0745/0845 | ** |  | FR | Consumer Spending |

| 12/01/2024 | 0800/0900 | *** |  | ES | HICP (f) |

| 12/01/2024 | 1230/1330 |  | EU | ECB's Lane Speech + Q&A at REBUILD Annual Conference | |

| 12/01/2024 | - | *** |  | CN | Trade |

| 12/01/2024 | - | *** |  | CN | Money Supply |

| 12/01/2024 | - | *** |  | CN | New Loans |

| 12/01/2024 | - | *** |  | CN | Social Financing |

| 12/01/2024 | 1330/0830 | *** |  | US | PPI |

| 12/01/2024 | 1500/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/01/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2024 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2024 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.