-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Eurozone Inflation Insight – November 2024

MNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

MNI ASIA OPEN: US Jobs Surge, Avg Hourly Earnings Soft

- MNI BRIEF: September US Jobs Surge Unexpectedly; U-Rate 3.8%

- MNI INTERVIEW: Fed Done Hiking, Will Cut As Soon As Q1-Tilley

- MNI: Canada Sept Job Gains Beat Forecast And Wages Climb 5%

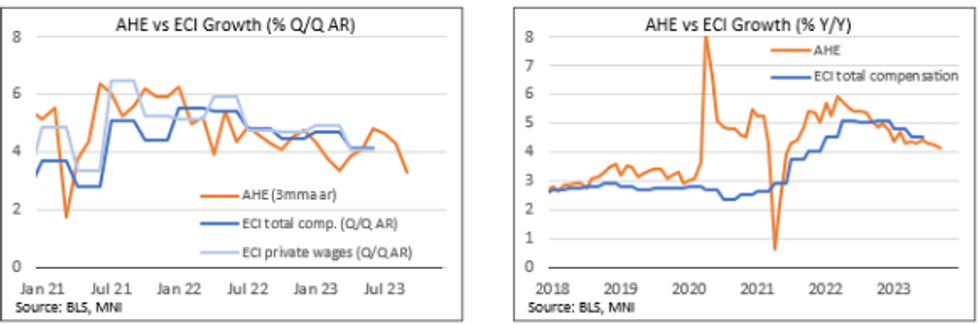

- MNI US DATA: Softer AHE Spells Further Declines for the Employment Cost Index

US

US DATA: U.S. employers added 336,000 new jobs in September, nearly double Wall Street expectations, while hiring in August and July were revised substantially higher by another 119,000. The unemployment rate was steady at 3.8%.

- The stronger than expected data should keep a final quarter-point hike on the table for the FOMC, which meets next Oct. 31-Nov. 1. The dollar strengthened and the 10-year Treasury yield shot back to 4.8%, while U.S. stock futures fell. (See: MNI INTERVIEW: Fed's Fujita Sees Signs of Jobs Soft Landing)

- Job gains were led by leisure and hospitality (96,000), government (73,000) and health care (41,000). Employment in food services and drinking places has returned to its pre-pandemic February 2020 level, the BLS noted. The household survey showed less strength, with the number of employed people rising just 86,000 in September and no change in the participation rate.

- Average hourly earnings growth continued to slow to 0.207% for the month, down from 0.237% in August, and the yearly pace of 4.15% was the lowest since June 2021.

FED: The Federal Reserve is likely done raising interest rates and will need to reduce them sooner than policymakers indicated in their September forecasts – perhaps as early as the first quarter as growth proves weaker than expected, former Philadelphia Fed economic advisor Luke Tilley told MNI.

- “They don’t need to hike rates anymore. Inflation is slowing incredibly quickly,” Tilley said in an interview. (See MNI POLICY: Softer Trend Inflation Boosts Case For Fed Pause)

- He said Fed estimates for core PCE to end the year at 3.7% are too high because they would require the monthly gain to accelerate back to a 0.3% pace, adding that recent worries about growth picking up speed again are based on backward-looking data. As disinflation proves more persistent, the Fed will need to adjust course, said Tilley, now chief economist at Wilmington Trust. For more see MNI Policy main wire at 0808ET.

CANADA

CANADA DATA: Canada's job creation came in much faster than the market expected in September and wage gains continued to run around a 5% pace the central bank has said is too hot, though the job gain partly reflects volatility in accounting for contract education workers during back-to-school season.

- Employment rose by 63,800 to top all forecasts in a survey with a consensus increase of 15,000. The unemployment rate remained 5.5% for a third month, better than the forecast it would climb to 5.6%. The strength of the job gain was muted by a 71,800 increase in the labor force, reflecting continued record immigration, and Statistics Canada reiterated in Friday's report from Ottawa that it now takes about 50,000 jobs a month to keep the job market in place, about double the requirement in the recent past.

- The job gain revives views of the economy's resiliency through the Bank of Canada's 10 interest-rate increases and the prospect of inflation becoming entrenched, something officials have said would require another painful series of rate hikes. Unemployment is still somewhat close to the record low of 4.9% set last year. Worker demands for big pay hikes were underlined by a recent offer to Ford's autoworkers for a 15% raise over three years and revived talk of a contract with 1970s-style cost of living allowances. For more see MNI Policy main wire at 0831ET.

US TSYS Markets Roundup: FI Well Off Post-Jobs Data Lows, EQ Near Highs

- Still weaker after the bell, Tsy futures clung to a narrow range since midday after bouncing off post-data lows with stocks, ignoring prospect of tighter policy following this morning's strong Sep job gains (+336k vs. +170k est).

- Further slowing in average hourly earnings and the softening in trend growth for non-supervisory roles makes a further pullback in the Employment Cost Index for the coming quarters.

- Treasury futures still shy of the pre-data levels: TYZ3 currently at 106-27.5 (-14.5) vs. 107-10 high, well off initial technical resistance at 107-14 (Oct 3 high) followed by firm resistance at 108-12, the 20-day EMA.

- Heavy volumes recorded after the bell, TYZ3 >2.1M, curves well off this morning's highs: 3M10Y +5.424 at -73.751 vs. -63.477 high, 2Y10Y +.679 at -29.925 vs. -24.882 high (least inverted since October 2022).

- Cross asset summary: Greenback reversed post data highs - making session lows (DXY -.275 at 106.057 vs. 106.974 high), Gold higher (+10.25 at 1830.55), crude making modest gain (WTI +0.58 at 82.89). Stocks near late session highs: S&P E-Mini futures are up 54.75 points (1.28%) at 4345.25, Nasdaq up 204.4 points (1.5%) at 13423.76, DJIA up 336.95 points (1.02%) at 33455.87.

- Looking ahead to next week: September PPI and FOMC minutes on Wednesday, CPI Thursday.

OVERNIGHT DATA

- US SEP NONFARM PAYROLLS +336K

PRIVATE +263K, GOVT +73K - PRIVATE +263K, GOVT +73K

- US PRIOR MONTHS PAYROLLS REVISED: AUG +227K; JUL +236K

- US BLS: NET REVISIONS FOR AUG, JULY +119K

- US SEP UNEMPLOYMENT RATE 3.8%

- US SEP AVERAGE HOURLY EARNINGS +0.2% Vs AUG +0.2%; +4.2% YOY

- US SEP AVERAGE WEEKLY HOURS 34.4 HRS

- US DATA: AHE Unrounded - Sep'23:

- Total AHE:M/M (SA): 0.207% in Sep from 0.237% in Aug

- Y/Y (SA): 4.15% in Sep from 4.255% in Aug

- AHE Non-Supervisory:

- M/M (SA): 0.207% in Sep from 0.207% in Aug

- Y/Y (SA): 4.345% in Sep from 4.505% in Aug

- CANADIAN SEPT JOBS +63.8K VS FORECAST +15K, PRIOR +39.9K

- SEPT JOBLESS RATE +5.5% VS FORECAST +5.6%, PRIOR +5.5%.

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA up 387.79 points (1.17%) at 33507.01

- S&P E-Mini Future up 62.25 points (1.45%) at 4353.25

- Nasdaq up 235.8 points (1.8%) at 13455.26

- US 10-Yr yield is up 6.1 bps at 4.7799%

- US Dec 10-Yr futures are down 14.5/32 at 106-27.5

- EURUSD up 0.0043 (0.41%) at 1.0594

- USDJPY up 0.82 (0.55%) at 149.33

- WTI Crude Oil (front-month) up $0.68 (0.83%) at $82.99

- Gold is up $11.63 (0.64%) at $1831.96

European bourses closing levels:

- EuroStoxx 50 up 44.62 points (1.09%) at 4144.43

- FTSE 100 up 43.04 points (0.58%) at 7494.58

- German DAX up 159.55 points (1.06%) at 15229.77

- French CAC 40 up 61.9 points (0.88%) at 7060.15

US TREASURY FUTURES

- 3M10Y +5.424, -73.751 (L: -80.999 / H: -63.477)

- 2Y10Y +0.891, -29.715 (L: -33.922 / H: -24.882)

- 2Y30Y -0.58, -13.723 (L: -19.668 / H: -7.512)

- 5Y30Y -0.916, 19.395 (L: 15.126 / H: 22.407)

- Current futures levels:

- Dec 2-Yr futures down 3.375/32 at 101-9.125 (L: 101-04.875 / H: 101-12.875)

- Dec 5-Yr futures down 8.75/32 at 104-25.5 (L: 104-12.25 / H: 105-02)

- Dec 10-Yr futures down 14.5/32 at 106-27.5 (L: 106-06.5 / H: 107-10)

- Dec 30-Yr futures down 28/32 at 110-17 (L: 108-29 / H: 111-14)

- Dec Ultra futures down 1-01/32 at 114-9 (L: 112-05 / H: 115-11)

US 10Y TREASURY FUTURE TECHS (Z3) Strong Negative Close

- RES 4: 109-24+ 50-day EMA

- RES 3: 108-26+ High Sep 22

- RES 2: 108-12 20-day EMA

- RES 1: 107-14 High Oct 3

- PRICE: 106-27.5 @ 1215 ET Oct 6

- SUP 1: 106-03+/00 Low Sep 4 / Round number support

- SUP 2: 105-17 2.0% lower 10-dma envelope

- SUP 3: 105-14+ 3.0% Lower Bollinger Band

- SUP 4: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

A bear trend in Treasuries remains intact, with the pressure going through on the back of the NFP release making for a strong negative close. This week’s fresh cycle lows confirm a resumption of the downtrend and maintain the price sequence of lower lows and lower highs. Support at 107-07, the Sep 28 low, has been cleared signalling scope for the 106-00 handle next. Initial firm resistance is seen at 108-12, the 20-day EMA.

SOFR FUTURES CLOSE

- Dec 23 -0.035 at 94.535

- Mar 24 -0.060 at 94.630

- Jun 24 -0.070 at 94.830

- Sep 24 -0.065 at 95.095

- Red Pack (Dec 24-Sep 25) -0.06 to -0.06

- Green Pack (Dec 25-Sep 26) -0.065 to -0.06

- Blue Pack (Dec 26-Sep 27) -0.06 to -0.055

- Gold Pack (Dec 27-Sep 28) -0.06 to -0.055

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00509 to 5.34107 (+0.02208/wk)

- 3M +0.00054 to 5.40674 (+0.01124/wk)

- 6M -0.00817 to 5.45446 (-0.01281/wk)

- 12M -0.03319 to 5.39656 (-0.06970/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $102B

- Daily Overnight Bank Funding Rate: 5.32% volume: $253B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.520T

- Broad General Collateral Rate (BGCR): 5.30%, $573B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $564B

- (rate, volume levels reflect prior session)

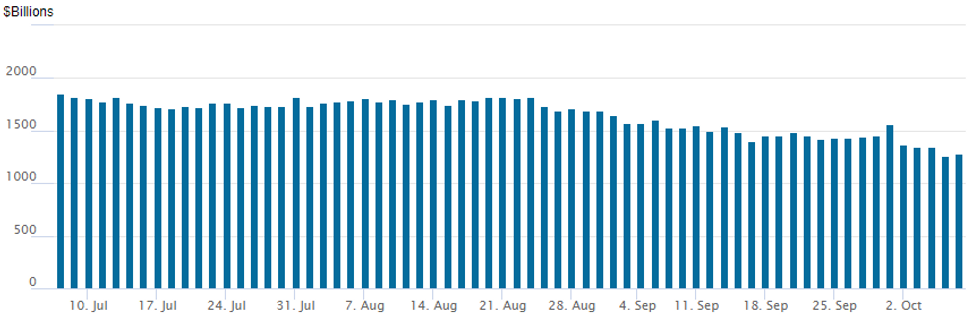

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation usage bounces to $1,283.461B w/95 counterparties vs. $1,265.132B - the lowest since mid-September 2021 in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE Issuers Sidelined Ahead Jobs Data

No new corporate issuance expected Friday, focus on September jobs report.

- Date $MM Issuer (Priced *, Launch #)

- $5.06B Priced Thursday, $14.75 total for the week

- 10/05 $1.25B *Fox Corp 10Y +190

- 10/05 $1.25B *MuniFin +3Y SOFR+38

- 10/05 $1B *FFCB 2Y +10 (issued $1B 3Y +15 on Aug 9)

- 10/05 $900M *Atmos Energy $400M 10Y +120, $500M 30Y +133

- 10/05 $660M *Uzbekistan 5Y 8.125%

FOREX NFP-Triggered USD Rally Proves Short-Lived

- The September NFP report comfortably topped expectations, with the US adding 336k jobs over the month, helping prompt a surge in the US dollar and a re-steepening of the US yield curve. The very long-end of the sovereign yield curve spiked to put 30y yields back above 5.00% and trigger a broad greenback rally.

- This USD strength was short-lived, however, with yields undergoing a full reversal off highs, undermining the USD Index and cementing the fourth consecutive negative close for the greenback. The reversal came as the focus turned to softer-than-expected average hourly earnings, which spell further downside pressure on the Employment Cost Index and less pressure on the Federal Reserve to hike rates further beyond the end of 2023.

- The NFP report boosted short-end pricing marginally, with OIS-implied pricing for the November 1st FOMC decision rising to 7.5bps, still well short of a 50% chance for a 25bps hike.

- JPY was the poorest performer, hampered by the risk-rally that accompanied a rollover in US yields. High beta currencies, most notably the SEK, which has outperformed NOK through the week on the back of a weaker oil prices, with the cross in close proximity to the June 23 low at 0.9834 as the next clear downside level.

- Focus for the coming week turns to the US CPI release, the last look at inflation before the November 1st FOMC meeting. Expectations for the September print are for a small softening in annual headline rates to 4.1% Y/Y for core and 3.6% Y/Y for the headline, while monthly prints for core and headline are both expected at 0.3% M/M.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/10/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 09/10/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 09/10/2023 | 0800/1000 |  | EU | ECB's de Guindos Speaks at Conference | |

| 09/10/2023 | 0900/0500 | * |  | US | Business Inventories |

| 09/10/2023 | 1315/0915 |  | US | Fed's Michael Barr | |

| 09/10/2023 | 1500/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 09/10/2023 | 1730/1330 |  | US | Fed Vice Chair Philip Jefferson | |

| 09/10/2023 | 2000/2100 |  | UK | BoE's Mann speaks at NABE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.