-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - US Lawmakers at Loggerheads on Debt Ceiling

Executive Summary:

- Curve steepens further as debt ceiling talks remain at an impasse

- Powell under attack, Warren strengthens opposition to renomination

- Lagarde sees structural barriers to recovery

US 2yr10yr yield spread tops 125bps, hitting new multi-month highs

NORTH AMERICA

MNI BRIEF: Sen. Warren Strongly Opposes Powell Renomination

U.S. Senator Elizabeth Warren has on Tuesday strongly opposed Fed Chair Jerome Powell's renomination, saying he has weakened financial regulations during his tenure. "Your record gives me gave concern," she said during a hearing. "Over and over, you have acted to make our banking system less safe and that makes you a dangerous man to head up the Fed. And it's why I will oppose your renomination."

MNI: Banks Face Tougher Rules Under Biden's Next Fed Vice-Chair

U.S. banks could face higher capital requirements and tougher stress tests while nonbanks may see regulation tightened under the incoming vice chair for supervision at the Federal Reserve, former top Fed officials, regulatory and industry experts told MNI.

MNI BRIEF: Canada Housing Agency Ups Mkt Vulnerability to High

Canada's federal housing agency raised its assessment of the market's vulnerability to high from moderate in a report Tuesday, as Montreal joined Toronto as being under major pressure. Canada Mortgage and Housing Corp.'s report now shows high risks in six of 14 cities it tracks. "Home price acceleration, alongside continued overvaluation, as home prices further detach from fundamental factors, such as labour income, has created a high degree of vulnerability in Canada's housing market," the report said.

Bloomberg: Democrats Debate Debt Limit Plan After Yellen's Oct. 18 Deadline

Democratic leaders are discussing how to increase the federal debt ceiling after a warning by Treasury Secretary Janet Yellen that her department will effectively run out of cash around Oct. 18 unless Congress suspends or increases the limit.

EUROPE

MNI BRIEF: Recovery Pointing in Opposite Directions - Lagarde

Monetary policy must continue to be expansionary and patient if Europe's economy is to safely exit the coronavirus pandemic safely and set itself on the path to sustainable 2% inflation, ECB president Christine Lagarde said Tuesday. Structural changes, along with the atypical nature of the recovery can produce opposing effects on growth and inflation, Lagarde said, some of them temporary, others less clearly so. Looking beyond the pandemic, she continued, the ECB expects inflation to only slowly converge towards 2%.

MNI BRIEF: Riksbank's Ingves-Room To Hike If Inflation Sticky

Riksbank Governor Stefan Ingves said it had ample scope to tighten if inflation proved persistent, though the Riksbank's central view is that its rise will be transitory. With the policy rate at zero "we have plenty of space on the upside if we are completely wrong (on inflation)," Ingves said at a European Economics and Financial Centre, University of London event.

MNI INTERVIEW: Commodity Currencies Hit By Climate Risk

Commodity-linked currencies from Mexico to Australia have begun to tend to depreciate when perceptions of climate change risk rise, and their exchange rates are becoming less linked to the prices of their main exports, a shift that may continue as nations move to curb global warming, Norges Bank economist Vegard Larsen told MNI. There is a significant statistical relationship between depreciations of commodity currencies and increased news coverage of how climate change may disrupt the energy industry and beyond, Larsen said in an interview. Currencies like the Canadian dollar and South Africa's rand are also showing less of a connection between commodity prices and their exchange rates, he said.

ASIA

MNI BRIEF: China Can Maintain 5-6% Growth: PBOC Governor

China's potential economic growth rate is still seen in the 5-6% range, with conditions to implement normal monetary policies, wrote Yi Gang, governor of the People's Bank of China in an article published by a PBOC-run magazine Journal of Financial Research. The country will extend the time for normal monetary policy as long as possible, and there is no need to implement asset purchase operations at this time, Yi added. In the article, Yi also noted that the yield curve can also maintain a normal, upward shape.

MNI: Race To Lead Japan's LDP To Impact Future BOJ

One of four candidates for the Liberal Democratic Party presidential election will emerge on Wednesday with all onboard with large-scale fiscal spending to support an economy facing downside risks caused by a prolonged coronavirus pandemic and general support for current monetary policies.

MNI STATE OF PLAY: Bank Of Thailand Looks To Economy Re-Open

The Bank of Thailand is expected to hold interest rates at a record low 0.50% on Wednesday despite earlier pressure from some board members for a cut to bolster the pandemic-hit economy.

DATA

MNI: US CONF BOARD CONSUMER CONFIDENCE 109.3 IN SEP V AUG 115.2

US TSYS SUMMARY: Curve Steepens Further, 2y10y Highest Since June

- Another session of bear steepening continued to work in favour of longer-end yields, boosting 10y, 20y, 30y yields to their highest levels in at least three months. The steepening bias put 2y10y spreads above 125bps for the first time since June, as the normalization message put through by last week's Fed continues to filter into prices.

- Lack of a clear path for an extension of the US debt ceiling further unsettled investors, with Republicans and Democrats still at loggerheads on the most viable path to avoid a looming government shutdown.

- The US Treasury completed this week's bond issuance schedule with a 7yr sale. The deep concession built into the auction supported demand, with the sale resulting in only a relatively small tail.

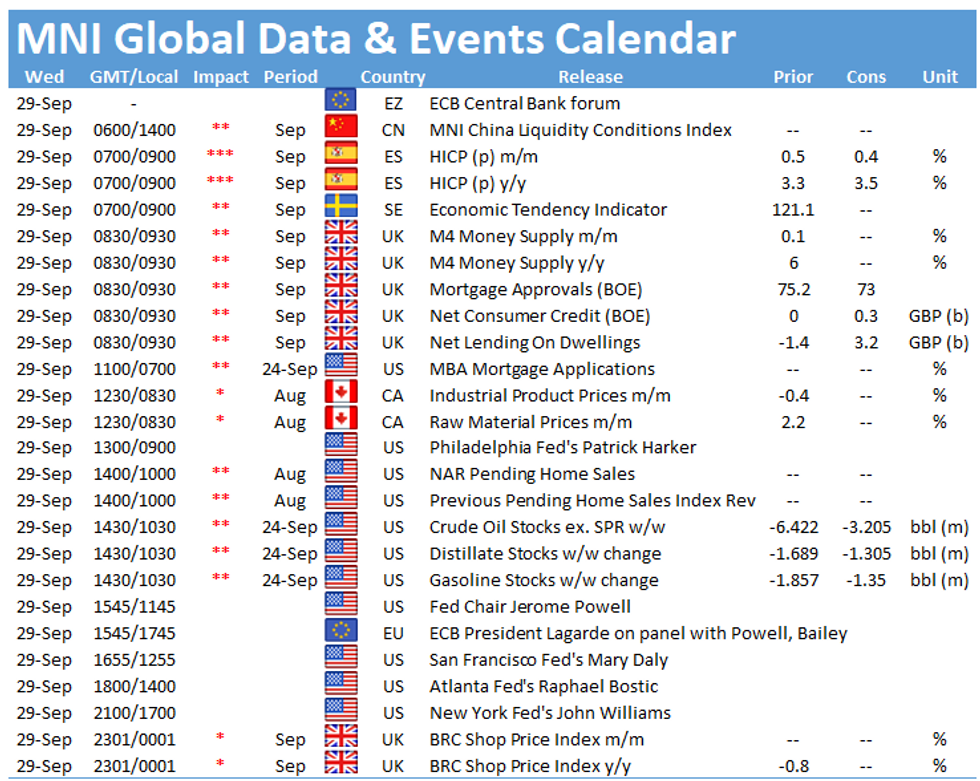

- Focus Wednesday turns to pending home sales numbers as well as comments from Fed's Bullard, Harker Daly and Bostic. Fed Chair Powell appears at the ECB forum for central banking, speaking alongside Lagarde, Bailey and Kuroda.

Levels Update:

- The Dec 21 T-Note future is down 9+ ticks at 131-16. The 2-Yr yield is up 2.3bps at 0.301%, 5-Yr yield up 3.3bps at 1.018%, 10-Yr yield up 4.3bps at 1.5305% while the 30-Yr yield is up 7.2bps at 2.0668%.

FOREX: Rising Yields/Falling Equity Indices Buoy Greenback, GBP Plummets

- Pound Sterling came under significant selling pressure on Tuesday as market concerns surged over the fuel crisis sweeping the UK potentially leading to a sharp slowdown in growth.

- GBP rose over 1% against both the Euro and the Dollar and in the process has cleared a host of key supports. The triangle base at 1.3637 in cable, drawn from the Jul 20 low has been breached and this has led to a move below 1.3602, the Aug 20 low. While 1.3520 support has held for now, the focus is on weakness towards 1.3462 next, 50.0% of the Sep '20 - Jan bull phase.

- Rising US yields and pressure on equity indices kept broad dollar indices in favour, rising just shy of 0.5%. Three straight days of gains has prompted the DXY to rise to the best levels since November 2020. Key resistance at 93.73, Aug 20 high has been breached and a sustained break of this hurdle would confirm a resumption of the underlying uptrend and target 94.30 Nov 4, 2020 high.

- Elsewhere, antipodean FX were clear underperformers, retreating well over half a percent. Evidence of the broad dollar theme developing was most notably signalled by JPY and CHF also losing ground against the greenback, matching CAD losses of around 0.4%.

- Risk dynamics also weighed on EM FX with the JPM emerging market currency index falling 0.65%. Noteworthy moves were seen in USDMXN (+1.20%) and USDZAR (+1.07%).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.