-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weaker But Off Lows Ahead Jackson Hole Summit

- MNI INTERVIEW: Fed’s Harker Says Probably Time To Stop Hiking

- MNI INTERVIEW2:Fed’s Harker-Soft Landing In Sight, Jobs Weaker

- MNI INTERVIEW: Fed's Harker Sees Rates On Hold Thru Year-End

- MNI BRIEF: Fed's Collins Expects Rates High For Longer

- MNI US DATA: Durable Goods Revisions Amplify An Otherwise Small Miss

- MNI US DATA: Lower Than Expected Claims, Helped By Ohio Stepping Lower

US Tsys: Weaker But Off Lows Ahead Jackson Hole Eco-Summit

- US Rates are trading weaker after the bell, trading sideways near lows since midday. Early session saw fast two-way trade as Treasury futures extended lows after briefly bouncing post data: weekly claims lower than expected at 230k vs. 240k, Durable Goods Orders -5.2% vs. -4.0% est (4.6% prior), ex-transportation gains 0.5% vs 0.2% est.

- After establishing lows (TYU3 109-17), dovish comments from Philly Fed Harker this morning ahead if Fri's Jackson Hole eco-summit spurred a round of short covering across the board,

- Rates and equities reacted positively (if delayed) to Philly Fed Harker telling MNI he is inclined to support holding interest rates at their current level at least through the end of the year and possibly longer.

- Rates came back under pressure while stocks continue to trade weaker after Boston Fed Collins urged keeping rates higher for longer. "I don't think it's helpful to say a preset path, we may need additional increments, and we may be very near a place where we can hold for a substantial amount of time," Collins said.

- While there may be additional sideline comments from central bank officials this evening (eco-summit agenda to be released at 2000ET tonight), main focus is on Chairman Powell's speech at 1005ET.

US

FED: The Federal Reserve is bringing inflation gradually back down to target, and it’s probably time for officials to consider leaving interest rates on hold until at least early next year, Philadelphia Fed President Patrick Harker told MNI Thursday.

- “We can hold steady for a while because we are clearly in a restrictive stance in my view. We can sit here for a while, let monetary policy continue to do its work,” he said in an interview on the sidelines of the Kansas City Fed’s annual Jackson Hole Symposium. “Inflation is not where we want it to be, but it is moving in the right direction.”

- He said it’s too early to start discussing rate cuts, but the time will come when the economy is ready for them. “At some point we’re clearly going to adjust rates lower. I just don’t see that happening until at least the beginning of next year, maybe even after that,” he said. For more see MNI Policy main wire at 1208ET.

FED: The Federal Reserve appears on track to pull off a gradual decline in inflation without a major spike in unemployment – the vaunted soft landing – as signs mount that the job market is cooling but not grinding to a halt, Philadelphia Fed President Patrick Harker told MNI.

- “Right now our forecast is we’ll see unemployment tick up to 4-ish%, back to its natural rate, with a continued deceleration of inflation,” he said in an interview on the sidelines of this year’s Kansas City Fed Symposium. Unemployment has recently hovered near historic lows around 3.5%

- “There’s clearly been a softening in the labor market. It is easier for firms to find people to work. And people aren’t leaving at the same rate they were.” Harker said his contacts with businesses and community leaders around the Philly Fed’s district suggests firms’ pricing power is weakening as well, though growth remains fairly robust. For more see MNI Policy main wire at 1253ET.

FED: Federal Reserve Bank of Philadelphia President Patrick Harker told MNI Thursday he is inclined to support holding interest rates at their current level at least through the end of the year and possibly longer.

- "At this point I think it's prudent to pause again and let what we've done work," Harker said in an exclusive interview in Jackson Hole. "We can hold steady for a while because we're clearly in a restrictive stance." He envisions rates staying at 5.25%-5.5% "at least through the end of this year" and doesn't see cuts until "at least the beginning of next year and maybe even after that."

FED: The Federal Reserve is "extremely likely" to hold for a substantial amount of time at its peak rate, Boston Fed President Susan Collins said Thursday, and she's still open to additional increases.

- "We may be near, it could even be at a place where we would hold, but certainly additional increments are possible, and we need to look holistically and be really patient right now, and not to try to get ahead of what the data will tell us as it unfolds," she said in an interview with Yahoo Finance in Jackson Hole.

- "I don't think it's helpful to say a preset path, we may need additional increments, and we may be very near a place where we can hold for a substantial amount of time," Collins said.

OVERNIGHT DATA

- US JOBLESS CLAIMS -10K TO 230K IN AUG 19 WK

- US PREV JOBLESS CLAIMS REVISED TO 240K IN AUG 12 WK

- US CONTINUING CLAIMS -0.009M to 1.702M IN AUG 12 WK

Initial jobless claims were lower than expected in the week to Aug 19 at 230k (cons 240k) after a fractionally upward revised 240k (initial 239k).

- The four-week average still ticked higher to 237k (+2k), off its recent low of 228k on Jul 28 but still below the recent peak of 257k from Jun 23.

- Looking at the NSA data by state, a new player has entered the weekly distortion game, with Hawaii jumping from 1.7k to 5.4k in the week.

- Ohio meanwhile leads the move lower, with a 5.9k decline after its recent unusually high levels compared to other states. For comparison, total NSA claims fell -15.4k to 198k.

- US JUL DURABLE NEW ORDERS -5.2%; EX-TRANSPORTATION +0.5%

- US JUN DURABLE GDS NEW ORDERS REV TO +4.4%

- US JUL NONDEF CAP GDS ORDERS EX-AIR +0.1% V JUN -0.4%

Core durable goods data were weaker than expected in the preliminary July print, especially when factoring in downward revisions.

- Orders increased +0.1% M/M (cons 0.1) but after a downward revised -0.4% M/M (initial 0.1) in June.

- Shipments surprisingly fell -0.2% M/M (cons -0.1%) after a downward revised -0.1% M/M (initial 0.1).

- The orders trend is now seen unchanged at ~1.8% annualized, but it had been tracking at 2.4% annualized as of the initial June data. Either way, it continues to exhibit resilience to the heavy contraction implied by the ISM manufacturing survey, as has been the case for some months now.

- The report takes off some of the gloss from the 0.5% rebound in manufacturing production in July after the -0.5% of June.

- US AUG. KANSAS CITY FED MANUFACTURING INDEX 0.0; EST. -10

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 250.32 points (-0.73%) at 34232.27

- S&P E-Mini Future down 42.25 points (-0.95%) at 4406.75

- Nasdaq down 188.3 points (-1.4%) at 13539.03

- US 10-Yr yield is up 3.8 bps at 4.2293%

- US Sep 10-Yr futures are down 9.5/32 at 109-19.5

- EURUSD down 0.0055 (-0.51%) at 1.0808

- USDJPY up 1.02 (0.7%) at 145.86

- Gold is up $1.67 (0.09%) at $1917.21

- EuroStoxx 50 down 34.45 points (-0.81%) at 4232.22

- FTSE 100 up 13.1 points (0.18%) at 7333.63

- German DAX down 106.92 points (-0.68%) at 15621.49

- French CAC 40 down 32.16 points (-0.44%) at 7214.46

US TREASURY FUTURES CLOSE

- 3M10Y +3.76, -124.071 (L: -134.6 / H: -123.48)

- 2Y10Y -0.172, -78.304 (L: -80.402 / H: -75.952)

- 2Y30Y -1.241, -71.786 (L: -74.339 / H: -68.079)

- 5Y30Y -0.399, -10.559 (L: -13.143 / H: -8.326)

- Current futures levels:

- Sep 2-Yr futures down 4.125/32 at 101-8.125 (L: 101-07.25 / H: 101-11.375)

- Sep 5-Yr futures down 6.75/32 at 105-25.25 (L: 105-23.25 / H: 106-00.5)

- Sep 10-Yr futures down 9.5/32 at 109-19.5 (L: 109-17 / H: 109-31.5)

- Sep 30-Yr futures down 12/32 at 119-27 (L: 119-24 / H: 120-23)

- Sep Ultra futures down 14/32 at 125-26 (L: 125-19 / H: 126-29)

Sep/Dec Quarterly Futures Roll Update: Surge in Tsy quarterly futures roll volume from Sep'23 to Dec'23 today, 2s-10s over 1M each. Most at/over 25% complete before Dec'23 futures takes lead quarterly position, next Thursday morning. Current markets:

- TUU/TUZ 1,070,500 from -14.12 to -13.25, -13.62 last, 20% complete

- FVU/FVZ 1,362,000 from -16.5 to -15.75, -16.25 last, appr 28% complete

- TYU/TYZ 1,279,800 from -15.0 to -14.0, -14.75 last, appr 26% complete

- UXYU/UXYZ 400,300 from -19.0 to -18.0, -18.75 last, appr 24% complete

- USU/USZ 379,800 from -6.75 to -4.75, -6.75 last, appr 31% complete

- WNU/WNZ 547,800 from -120.5 to -118.5, -120.0 last, appr 35% complete

- Reminder, September futures won't expire until next month: 10s, 30s and Ultras on September 20, September 29 for 2s and 5s.

US 10Y FUTURE TECHS: (U3) Corrective Bounce Holds… For Now

- RES 4: 111-29 High Aug 10

- RES 3: 111-16 50-day EMA

- RES 2: 110-29 High Aug 11

- RES 1: 110-11 20-day EMA

- PRICE: 109-20+ @ 1520 ET Aug 24

- SUP 1: 108-28/26+ Low Aug 22 / Low Oct 21 2022 (cont)

- SUP 2: 108-12 1.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 107-22 2.0% 10-dma envelope

- SUP 4: 107.17 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

The trend direction in Treasuries remains down and Wednesday’s strong rally is considered corrective for now. The recent break of 109.24, the Aug 4 low, confirmed a continuation of the downtrend. Note too that moving average studies are in a bear-mode position, highlighting current market sentiment. The focus is on 108.12, a Fibonacci projection. Firm resistance is 110-09, the 20-day EMA. Gains are considered corrective.

SOFR FUTURES CLOSE

- Sep 23 -0.023 at 94.565

- Dec 23 -0.045 at 94.550

- Mar 24 -0.080 at 94.715

- Jun 24 -0.10 at 950

- Red Pack (Sep 24-Jun 25) -0.10 to -0.03

- Green Pack (Sep 25-Jun 26) -0.025 to -0.025

- Blue Pack (Sep 26-Jun 27) -0.025 to -0.02

- Gold Pack (Sep 27-Jun 28) -0.02 to -0.015

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00529 to 5.32024 (+.00597/wk)

- 3M -0.00315 to 5.38790 (+0.00473/wk)

- 6M -0.01268 to 5.44501 (+0.00047/wk)

- 12M -0.03594 to 5.37539 (-0.00799/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.32% volume: $265B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.270T

- Broad General Collateral Rate (BGCR): 5.27%, $542B

- Tri-Party General Collateral Rate (TGCR): 5.27%, $536B

- (rate, volume levels reflect prior session)

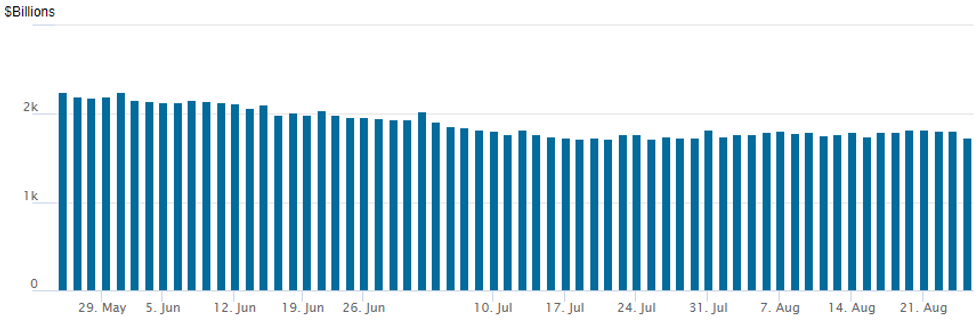

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation falls to $1,731.623B w/96 counterparties, compared to $1,816.533B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

EGBs-GILTS CASH CLOSE: UK Bull Flattening, BTPs Underperform

The German curve twist steepened while the UK's bull flattened Thursday.

- After a strong open, Bunds and Gilts pulled back gradually for the next several hours.

- Yields hit session highs in mid-afternoon before fading alongside US Treasuries after MNI's interview with Philadelphia Fed Pres Harker who provided the first (dovish) comments from Jackson Hole.

- BTPs underperformed the European space, with Italian banking sector uncertainty rekindled as BBG reported that the government is set to is eyeing a borrower-friendly measure on bad loans.

- Looking ahead, the Jackson Hole agenda is released overnight, with Friday's focus being German IFO and speeches by Fed's Powell and ECB's Lagarde. We also get a BTP Short-Term auction.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.1bps at 2.963%, 5-Yr is unchanged at 2.519%, 10-Yr is up 0.2bps at 2.519%, and 30-Yr is down 0.5bps at 2.625%.

- UK: The 2-Yr yield is down 1.3bps at 4.96%, 5-Yr is down 1.5bps at 4.475%, 10-Yr is down 4bps at 4.428%, and 30-Yr is down 5.1bps at 4.645%.

- Italian BTP spread up 0.6bps at 165.8bps / Spanish up 0.1bps at 102.6bps

PIPELINE Japan Finance Org 3Y SOFR on Tap

- Date $MM Issuer (Priced *, Launch #)

- 08/24 $750M #Japan Finance Org for Municipalities (JFM) 3Y SOFR+62

- $5.85B Priced Wednesday, $13.3B/wk

- 08/23 $4B *Asian Development Bank (ADB) 5Y SOFR+35

- 08/23 $1.25B *Kommunalbanken Norway 5Y SOFR+44

- 08/23 $600M *Pacific Life 3Y +88

FOREX USD Index Recovers Towards Trend Highs, Turkish Lira Surges

- Despite yesterday’s sell-off following the weaker than expected US data, the greenback regained its poise on Thursday and the USD index is narrowing back in on trend highs around 104.00 as we approach the APAC crossover.

- Weaker equity benchmarks and slightly higher US yields have underpinned the renewed optimism for the greenback, with the more risk sensitive currencies in G10 most heavily impacted. AUD, NZD and GBP have all declined around 0.9% on Thursday as markets now await any signals from Chair Powell on Friday regarding the path for US monetary policy.

- For cable, the pair has pierced initial support at 1.2621, the Aug 14 low and the short-term bear trigger. Further weakness places the key focus on 1.2591, the Jun 29 low and an important support. A break below here would confirm a resumption of the downtrend.

- Elsewhere, USDJPY had a substantial bounce from the 144.60 overnight lows to trade just below 146 and EURUSD was slowly grinding south throughout the session, hovering around 10 pips above the 1.0800 mark.

- In emerging markets, a bumper rate hike of 750bps from the CBRT has placed the Turkish Lira as the best performing currency. USDTRY is down an impressive 5.8% after the central bank ramped up their tightening to establish the disinflation course as soon as possible and to anchor inflation expectations.

- Tokyo Core CPI data is due overnight before German IFO data for August. Aside from final UMich sentiment data and inflation expectations, all focus will be on the Jackson Hole symposium and associated central bank speakers.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/08/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 25/08/2023 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/08/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 25/08/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/08/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/08/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index Direction |

| 25/08/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/08/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 25/08/2023 | 1405/1005 |  | US | Fed Chair Powell on economic outlook | |

| 25/08/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/08/2023 | 1900/2100 |  | EU | ECB's Lagarde speaks at Jackson Hole | |

| 26/08/2023 | 1625/1725 |  | UK | BoE's Broadbent speaks in Jackson Hole |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.