-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: YCC Options On Table For BoJ

- YCC Options On Table For BoJ Amid Market Pressure - MNI

- Yellen to meet Chinese official in bid to ease tensions

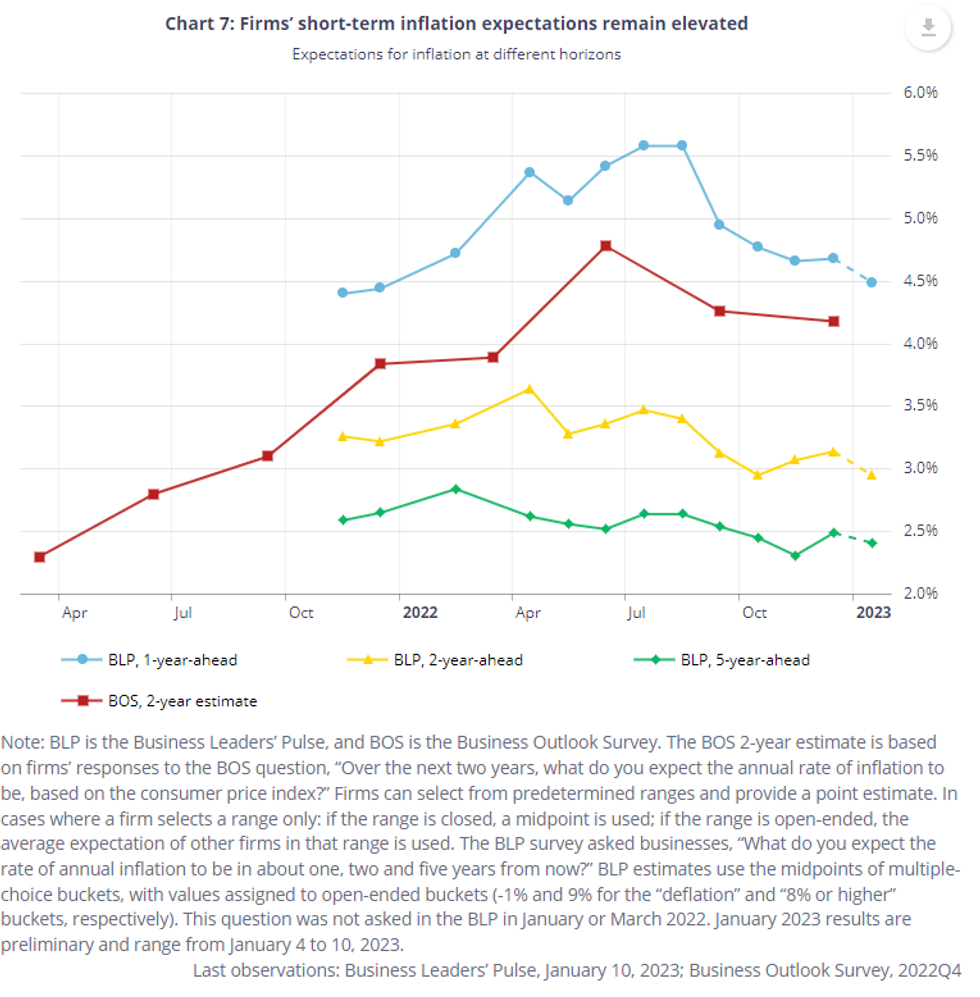

- BoC surveys show record inflation expectations in some measures but dovish reaction in fixed income markets

- We Need New Attempt As EU-US FTA More Urgently - German Fin Min

NEWS

North America

CANADA (MNI): BOC Surveys Show Record Inflation Expectations

Canadian firms and households expect record inflation according to central bank surveys published Monday, firming up the case for Governor Tiff Macklem to hike interest rates by at least another quarter point next week.

CANADA (MNI): Canada Minister Briefed 45% Cost Jump Risks Housing Goal

Canadian Finance Minister Chrystia Freeland was warned by the department's top official last summer that surging construction costs could hamper a signature goal of easing a housing shortage, a pressure taking on more significance as the government seeks record immigration this year, a document obtained by MNI shows.

CANADA (BBG): Bank of Canada Names Nicolas Vincent as Deputy Governor

Economics professor Nicolas Vincent will join the Bank of Canada’s governing council as a deputy governor, according to an announcement Monday. Vincent fills the vacancy left by Tim Lane’s departure in September 2022.

Asia

JAPAN (MNI): YCC Options On Table Amid Market Pressure

The Bank of Japan’s meeting this week could consider options including promising more unlimited purchases of bonds or reducing the maturity of its yield curve control framework as markets continue to probe its commitment to ultra-easy monetary policy, MNI understands.

CHINA-US (AFP): Yellen to meet Chinese official in bid to ease tensions

US Treasury Secretary Janet Yellen will meet with a top Chinese official on Wednesday to discuss the global economy and seek to deepen communications between their countries, a Treasury official said Monday. Yellen's meeting with Chinese Vice Premier Liu He, to take place in Zurich, will be their first in-person encounter following three virtual meetings, the official said.

Global

COMMODITIES (BBG): Aluminum Climbs to Seven-Month High as Goldman Flags Upside

Aluminum hit its highest since June as Goldman Sachs Group Inc. raised its forecasts for the widely used metal on stronger demand in Europe and China. The metal, used in everything from beverage cans to car bodies, will probably average $3,125 a ton this year in London, analysts including Nicholas Snowdon said in a note on Sunday. That’s up nearly 20% from both current levels and the bank’s previous forecast.

COMMODITIES (BBG): European Gas Slumps to 16-Month Low on Strong Supply Outlook

Natural gas prices in Europe dropped to the lowest level since September 2021 as the supply outlook got a boost with full stockpiles in China forcing buyers to send LNG cargoes to the continent. Benchmark futures fell as much as 15% on Monday, taking the decline so far this year to 27%. Chinese importers are trying to divert February and March shipments to Europe amid weak prices at home and high inventories. That’s easing concerns that the reopening of China’s economy will boost demand and pull cargoes away from the west.

Europe

UK (MNI): Public Purse Risk From Insurance Reform -BOE Bailey

Bank of England Governor Andrew Bailey and his colleague Sam Woods, Deputy Governor for Prudential Regulation, warned parliamentarians that changes to the insurance regulatory regime posed a risk to the public finances.

EU-UK (MNI): Joint Statement Brief, But Still A Signal Of Cooperation On NI Protocol

The UK gov't and EU have released a joint statement following a videoconference today between UK Foreign Sec James Cleverly, Northern Ireland Sec Chris Heaton-Harris and EU Commission VP Maros Sefcovic. The statement was brief and relatively vague, but nevertheless marks a positive step towards some form of resolution to the long-running issues surrounding the Northern Ireland protocol.

EU-US (MNI): German Fin Min-We Need New Attempt As EU-US FTA More Urgently

German Finance Minister Christian Lindner has penned an op-ed for German outlet Die Welt laying our his views for supporting the German and EU economies amid calling for a resurgence in globalisation. On EU-US relations and trade the minister states that "...after the American Inflation Reduction Act, we need anew attempt at a trade agreement with the USA all the more urgently", and talks up 'level playing fields' between allies.

UK/UKRAINE (MNI): Britain Calls On Germany To Unlock Supply Of Battle Tanks To Ukraine

British Defence Minister Ben Wallace has told the UK parliament today that Germany must act to unlock the supply of battle tanks to Ukraine.

ECB (BBG): ECB’s De Cos Says ‘Significant’ Rate Hikes to Continue

European Central Bank Governing Council member Pablo Hernandez de Cos said big increases in borrowing costs will continue as officials look to further bring down euro-zone inflation. “The Governing Council has indicated that it will be necessary to continue raising interest rates significantly in the coming meetings, at a sustained pace, until reaching levels that allow us to ensure that inflation will return to the target,” de Cos said Monday in a speech.

DATA

Canada

* BOC BUSINESS OUTLOOK SURVEY OVERALL INDICATOR +0.07

* FUTURE SALES GROWTH BALANCE OF OPINION -24

* FIRMS SEEING +3% CPI IS RECORD 84% FROM PRIOR 77%

* CANADA DEC. EXISTING HOME SALES RISE 1.3% M/M - bbg

* CANADIAN NOV MANUFACTURING SALES -0.0% MOM

* CANADA NOV FACTORY INVENTORIES -0.5%; INVENTORY-SALES RATIO 1.68

CANADA DATA: Dovish FI Reaction To BOS/CSCE Surveys

- GoCs see a dovish reaction to the BOS/CSCE surveys, with 2YY rallying a further 4bps for now down almost 10bps on the day with the belly also rallying 7bps. USDCAD meanwhile largely looks through the report with the US out.

- Overall confidence in the Business Outlook Survey fell further in Q4, at +0.1 touching new lows since 3Q20 albeit still close to average levels through 2019.

- Most firms expect a mild recession in Canada this year, with increases in the share of those worried about demand and credit availability along with reduced supply chain concerns.

- Inflation expectations were somewhat mixed. A record 84% of firms expected inflation to average above 3% over the next two years having dipped 1pp to 77% back in Q3. However, actual expectations eased to an average 4.18% (from 4.26) over two years and the additional more timely Business Leaders’ Pulse saw 2-year ahead inflation at 2.95% (from 3.14) and 5-year ahead at 2.41% (from 2.49).

- Further, average year-ahead expected wage increases cooled another 0.2pps to 4.7% Y/Y having potentially peaked at 5.8% in Q2.

US TSYS: Consolidating Friday's Cheapening, Awaiting Wednesday Deluge

- TYH3 trades 4 ticks lower at 114-20+ with the entirety of the move coming through European hours before an unsurprisingly muted US session with the US out for Martin Luther King Day (~200k volumes). It extends Friday’s decline but keeps well within Thursday’s CPI-induced ranges.

- The technical trend needle continues to point north, with resistance at 115-15+ (Jan 13 high) whilst to the downside sits 113-26+ (20-day EMA).

- Tomorrow’s session provides a steady first day back for the US (although China data overnight of importance), with data limited to the Empire manufacturing index, as usual providing the first regional steer for January. Followed by Fedspeak late on with NY Fed’s Williams giving welcoming remarks at 1500ET.

- The week then kickstarts in earnest on Wed, following the BoJ with a deluge of US data including retail sales, PPI inflation, industrial production, inventories, NAHB homebuilder sentiment and the Fed Beige Book along with four separate Fed speakers.

EU BONDS: EGBs-GILTS CASH CLOSE: Early Weakness Fades Ahead Of UK Data

The UK curve bear flattened while Germany's twist steepened Monday, amid limited trading ranges in Bund and Gilt yields in a US holiday-thinned session.

- Core FI sold off early in the session on no particular catalyst, potentially in a continuation of the profit-taking and position squaring seen late last week. Yields then fell steadily for most of the session.

- BTP spreads narrowed from early wides, with 10Y closing flat to Bunds.

- BoE's Bailey told Parliament of risks of inflation not dropping as fast as expected due to supply side factors (China reopening, UK labour force constraints), though his comments had little discernable market impact.

- Likewise, little immediate reaction to ECB's/Finland's Rehn calling for "significant" hikes at the upcoming ECB meetings.

- UK data takes centre stage with jobs data early Tuesday, and CPI Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.7bps at 2.566%, 5-Yr is down 1.2bps at 2.19%, 10-Yr is up 0.7bps at 2.175%, and 30-Yr is up 1.3bps at 2.147%.

- UK: The 2-Yr yield is up 2.7bps at 3.516%, 5-Yr is up 0.7bps at 3.312%, 10-Yr is up 1.8bps at 3.384%, and 30-Yr is up 0.3bps at 3.727%.

- Italian BTP spread unchanged at 184.3bps / Spanish down 0.9bps at 98.9bps

EU OPTIONS: Mostly Downside In Bobl, Bunds

Monday's Europe rates/bond options flow included:

- OEH3 117.25/116.25 ps bought for 32 in 4k, vs OEG3 117.25 put sold at 32.5 in 2k

- OEG3 119 calls sold at 9 in 8k

- RXG3 136/135 put spread bought for 16 in 5k

- RXG3 136.50/136.00 put spread bought for 13 in 3k

- RXG3 137/136 put spread vs 139/140 call spread sold at 1 in 1.5k (sold cs)

- SFIH3 96.00/96.10 call spread (v 9575.5) bought for 1.25 in 4k

- SFIH3 95.75/95.60/95.45 put fly sold at 2.5 in 3k

- SFIH3 95.50/95.60/95.70/95.80 call condor sold at 2.5 in 5k

FOREX: Greenback Recovers Well After Printing Fresh 7-Month Lows

- Despite the greenback trading to fresh trend lows in early trade on Monday, the USD index has recovered well to trade in positive territory for the session. The US market closure for MLK Day prompted further stabilisation for the USD after last week’s slump, although ranges for major currencies remained subdued throughout typical US trading hours.

- The key laggards on Monday are the Chinese Yuan and the Japanese Yen, both depreciating around half a percent. For USDJPY in particular, the pair has made a substantial recovery after printing 127.23 during APAC hours and now resides back above the 128.50 mark.

- The overnight selloff extended USDJPY’s downswing briefly to over 4% from last week’s highs before the US CPI data. The JPY will remain in focus this week with speculation that the Bank of Japan could potentially make further policy tweaks at its January meeting, scheduled on Wednesday.

- Moving average studies remain in a bear mode condition and a bearish price sequence highlights a clear downtrend. Furthermore, the 50- and 200-dmas have crossed, highlighting a potential bearish death cross. The focus is on 126.81, a Fibonacci projection. The first resistance is at 129.52, the Jan 3 low and a recent breakout point.

- Little to report across the rest of G10 FX and the immediate focus shifts to Chinese growth data which kicks off the docket during Tuesday’s APAC session. UK employment figures will then cross before US traders return and Canadian CPI will be published.

COMMODITIES: Goldman Bullish But Crude Oil Fades On Demand Concerns

- Crude oil fades through a light US session with MLK Day on ongoing concern for global oil demand.

- Goldman’s Currie however says “you cannot come up with a more bullish concoction for commodities” and that global oil use may rise by 2mbpd this year if international travel resumes. It follows last week making the case for $105/bbl Brent by 4Q23.

- WTI is -1.3% at $78.85, pulling back from an intraday high of $80.22 that sets initial resistance after which sits the bull trigger at $85.59 (Jan 3 high). The latest declines in WTI and Brent don’t yet trouble support levels.

- Brent is -1.3% at $84.18, pulling back from an intraday high of $85.59 that sets initial resistance after which sits the key $87.00 (Jan 3 high).

- Gold is -0.2% at $1915.57, pulling back from an earlier high of $1929.03 that moves closer to testing resistance at $1934.4 (Apr 25, 2022 high).

- Buoyed by the GS commodity outlook, aluminium has touched a seven-month high with a 1.8% rise to $2595 with Goldman targeting an average $3125/ton this year.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/01/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 17/01/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 17/01/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 17/01/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 17/01/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 17/01/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 17/01/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 17/01/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 17/01/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 17/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/01/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 17/01/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 17/01/2023 | 1330/0830 | *** |  | CA | CPI |

| 17/01/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/01/2023 | 2000/1500 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.