-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Banxico Review - August 2021: Split Views

Banxico Review - August 2021

Executive Summary:

- Banxico's governing board decided to hike the overnight rate by 25bps to 4.5%, in line with market consensus.

- As in June, the decision to hike was split with three members voting for the hike and two voting for a hold at 4.25%. The dissenters were Deputy Governors Esquivel and Borja, in line with the previous meeting.

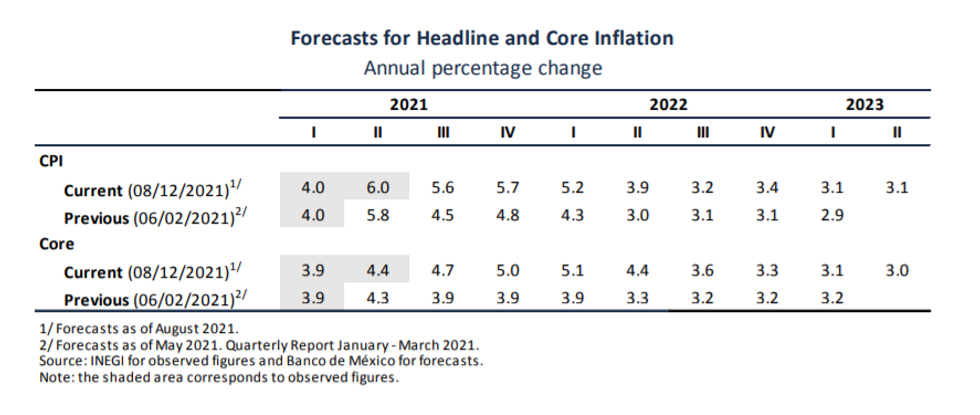

- With the new monetary policy communication in effect, Banxico provided their revised projections for both headline and core inflation for the following eight quarters. Notable upward adjustments were made to Q4'21 forecasts, being revised to 5.7% for headline and 5% for the core reading.

- Despite the new forecasts and the hike, markets have interpreted the statement as marginally dovish, prompting some pressure on the Mexican peso and a relief rally in local rates.

- Analyst views on the meeting are mixed with some institutions interpreting the statement as not so hawkish and others believing the inflation forecasts cement an ongoing tightening cycle.

Click to view the full review: MNI Banxico Review - August 2021.pdf

Key Takeaways:

- Banxico made notable adjustments to short-term headline and core inflation projections. Additionally, the estimated time of convergence to their target was pushed back from Q3 2022 to Q1 2023 (full table below).

- While the adjustment to expectations might appear to cement the need for additional tightening, the fact that two deputy governors still voted for a hold is significant.

- The governing board repeated the shocks that have increased inflation are still expected to be transitory.

- In a fairly neutral statement, very similar to the one published in June, Banxico reiterated their cautious stance, emphasising they will remain in data-dependence mode going forward, while continuing to indicate risks to the new projections are still tilted to the upside.

- As such, the following Bi-weekly CPI prints retain the utmost importance for signals of further policy action at the upcoming meetings.

- Additionally, as we edge closer to Governor Díaz de León's departure, analysts will likely begin to assess an increase in the likelihood of a pause as President AMLO will have four of his nominees once Herrera takes the helm.

- Markets saw a relief rally in local rates in the immediate aftermath. The TIIE curve bull steepened as front-end swap rates had been pricing in the risk of a more hawkish split/message. 1-yr TIIE swap rates had been about 5bps higher leading into the decision and finished the trading session roughly 8bps lower.

- USDMXN had an initial upward adjustment from around 19.87 to 19.92 on the release. Some further dollar strength overnight kept the pair supported, slowly edging back towards the 20.00, however, recent narrow ranges appear unlikely to be meaningfully tested.

Source: Banxico

Source: Banxico

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.