-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, February 5

MNI BRIEF: China Spring Festival Trips Up 5.9% Y/Y

MNI BCB Preview - September 2021: Dial Up The Hawkishness

Executive Summary

- The Copom are widely expected to continue their tightening cycle with a 100 basis point hike, bringing the Selic rate to 6.25%.

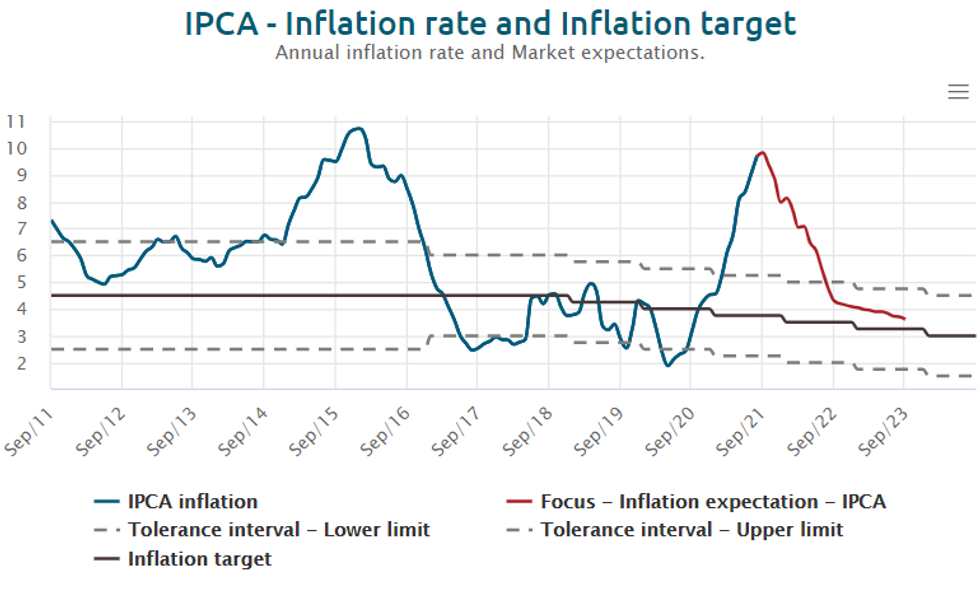

- Annual IPCA headline inflation rose to 9.68% in August, representing the highest level since early 2016, has prompted some analysts to forecast even larger hikes.

- Notable commentary between meetings from Governor Campos Neto has somewhat calmed market pricing/volatility before the decision.

- However, the persistence of inflationary pressures and the continued upward pressure on inflation expectations may warrant more substantial tightening, or at least a hardening of the language/forward guidance in order to anchor expectations.

Click to view the full preview: MNI Brazil Central Bank Preview - September 2021.pdf

Relentless Inflation Acceleration

- Annual IPCA headline inflation rose to 9.68% in August, above the expected 9.5%, representing the highest level since early 2016. The persistence of the upward inflation surprises has been echoed in the consistent adjustments to expectations, indicated within the most recent BCB focus surveys.

- Economists now see 2021 year-end inflation at 8.35%. This is up from 8.00% previously and most notably has increased from 6.79% since the August BCB meeting. 2022 expectations have also edged higher to 4.10% from 3.81% since the last time the Copom met, evidence of a further contamination of medium-term expectations.

- Combined with these adjustments to expected prices, economists also revised their Selic rate forecasts higher. They now see the key rate reaching 8.25% (up from 7% at time of prior meeting) by year-end 2021 and 8.5% by year-end 2022.

Markets

- Market turbulence has been particularly prevalent given the ongoing political and fiscal challenges. DI swap-rates have risen roughly 100bps in the front-end of the curve and around 150bps in the belly and longer tenors since the August meeting and USDBRL has risen roughly 3%. Morgan Stanley highlight that "a hawkish BCB has been the most important anchor for the currency" and that any marginal dovish interpretation at this juncture may provide significant downside risks for BRL.

- Markets may also be looking for hints on the central bank's potential view of the terminal rate. So far policy makers have only indicated they see the Selic ending the cycle above the neutral level, but have yet to elaborate on quite how far above.

Source: Brazil Central Bank

Source: Brazil Central Bank

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.