-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 2025 Rate Cut Projections Abate

MNI BRIEF: Canada Says Has Leverage Against Trump Tariffs

MNI BRIEF: Fed Must Keep Higher Rate Through Next Year- IMF

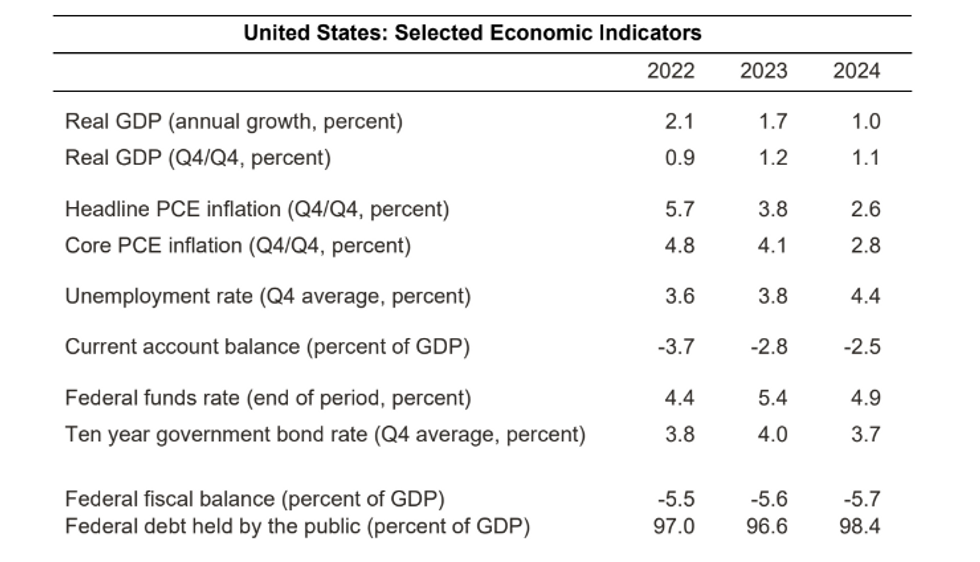

The Federal Reserve needs to raise its policy rate another 25 basis points to a range of 5.25%-5.5% and hold it there until late next year to deal with stubborn inflation, the IMF's annual review of the U.S. economy published Friday said.

"Rates will need to be somewhat higher for longer," IMF Managing Director Kristalina Georgieva said at a press conference after publishing an annual review of the U.S. economy. "Bringing inflation back to the 2% target will require an extended period of tight monetary policy."

Job data hasn't shown the loosening needed to slow inflation and a higher share of long-term debt has blunted tighter monetary policy so far, the IMF said. "This creates a material risk that the Federal Reserve will have to raise the policy rate by significantly more than is currently expected to return inflation to 2 percent," the IMF report said. (See: MNI INTERVIEW: Companies' Contribution To US Inflation Falling)

The IMF chief urged lawmakers to end the debt limit crisis that creates "a self-inflicted injury" to the world economy. The fund's report also said that "the last few years have seen U.S. fixed income markets prove to be insufficiently resilient under stress" and after the SVB collapse "prudential requirements should be made more stringent for mid-sized banks, subjecting them to similar requirements as larger banks."

Source: IMF

Source: IMF

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.