-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CHINA LIQUIDITY INDEX: Conditions Tight Into Quarter-End

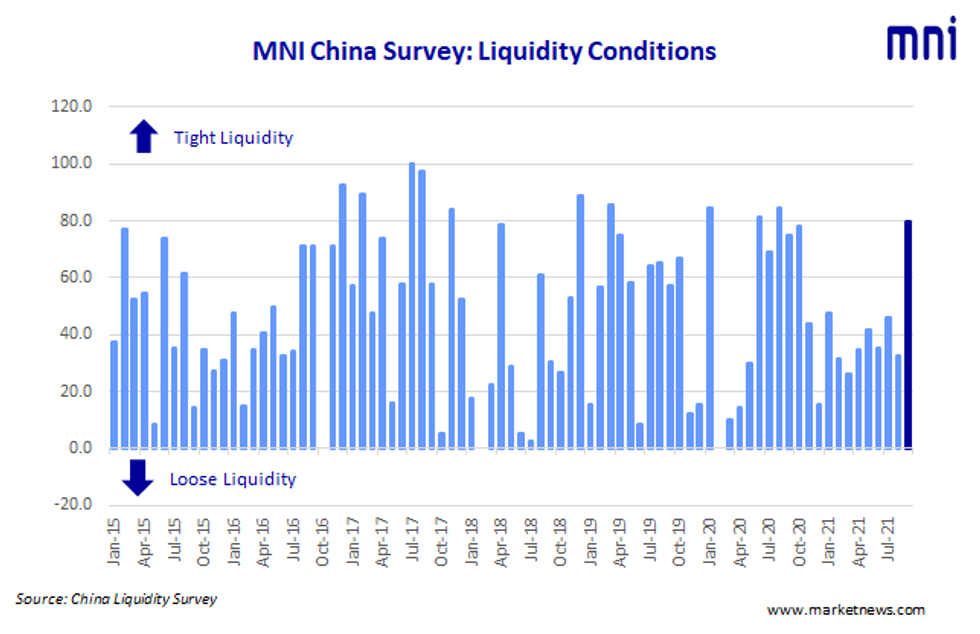

MNI Sep China Liquidity Conditions Index 79.6 Vs 32.7 Aug

China's interbank market saw tighter liquidity conditions into the quarter-end, although the latest round of injections from the People's Bank of China just about managed to keep conditions balanced, according to the latest MNI Liquidity Conditions Index, but concerns over the economy and financial risks exposed by the recent Evergrande default linger.

The Liquidity Condition Index jumped to 79.6 in September from August's 32.7 , with nearly 60% of respondents reporting tighter condition towards quarter end. The reading, close to the levels seen last September, marked a fourth consecutive monthly rise from June.

The higher the index reading, the tighter liquidity appears to survey participants.

"Liquidity is tighter (than last month) even with the big injection from the central bank," a trader with a large sized commercial bank based in Shanghai told MNI, highlighting how difficult short-term borrowing was between banks.

Another trader noted the strong demand for overnight and 7-day repos over the quarter-end, but said the PBOC's injections helped ease conditions.

.The People's Bank of China conducted CNY600 billion MLF in September to hedge the equivalent maturity and injected a net CNY335 billion into the interbank market as of Sep 27 to iron the increasing cash demands before 7-day National Day holiday, MNI calculated.

DEPRESSED ECONOMY

The Economy Condition Index fell to 5.6 in September, just below the 5.8 seen in August and the lowest level since the 0.0 recorded in February 2020 at the height of the pandemic in China.

One trader with a State-owned bank in Fujian said the economy was now sitting below expected kevels, with another saying growth dynamics were undoubtedly under pressure as exports were slowing and the services sector was pressured by fresh Covid-19 outbreaks.

The PBOC Policy Bias Index sat at 42.6 in September, up from 40.4 in August, with 85.2% of the participants believing the central bank's policy stance would be maintained, with recent official guidance seen as clear and steady.

The Beijing-based trader said the markets seemed clear that it was unlikely there would be any policy easing, although the PBOC had plenty of options still open to it.

The Guidance Clarity Index was at 57.4 in September, up from the 55.8 reading in August, with a Shanghai-based fund manager saying "both aim and the operation (of the PBOC) are clear enough to understand."

SHORT-TERM RATES UP

The 7-Day Repo Rate Index surged to 79.6 from 57.7 reading, with 70.4% of the participants seeing rates edge higher towards the end of quarter, especially before the 7-day Golden Week holiday.

The 7-day weighted average interbank repo rate for depository institutions (DR007) closed at 2.1889% Tuesday.

The 10-year CGB Yield Index stood at 35.2 in September, up from 30.8 previously, with nearly half of the traders (44.4%) seeing yields lower over the next three months while another 40.7% participants saying the yield would fluctuate in a tight range.

MNI collected the opinions of 27 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions. Interviews were conducted Sep 13 – Sep 24.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.