-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CHINA LIQUIDITY INDEX: Liquidity Ample; Aided By Policy

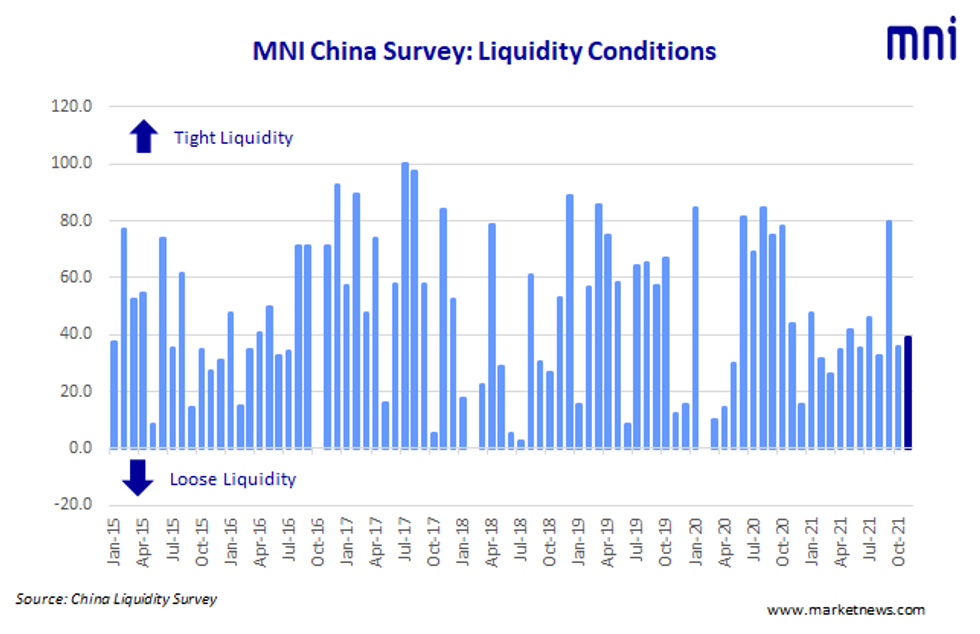

MNI Nov China Liquidity Conditions Index 38.9 Vs 35.7 Oct

Liquidity conditions across China's interbank market were little changed through November, as efforts by the People's Bank of China to 'stabilize' the markets soothed any concerns for traders, the latest MNI Liquidity Conditions Index shows.

The Liquidity Condition Index rose to 38.9 in November from previous 35.7, with 85.2% of the traders reporting similar or improved conditions.

The higher the index reading, the tighter liquidity appears to survey participants.

"Liquidity was and will be well managed by the central bank via its monetary tools," a trader with a state-owned bank based in Shanghai told MNI.

The People's Bank of China conducted CNY1 trillion MLFs in November to hedge the equivalent maturity, overall draining a net CNY790 billion from the interbank market as of Nov 23, MNI calculated.

EXPORTS RESILIENT

The Economy Condition Index bounced to 14.8 in November from last 7.1, despite few signs of the economy picking up steam

"Retail sales, benefiting from the (National Day) holiday effect, bounced back for a second month. However, investments fell to the year's low, weighed by high PPI and tighter financing," a Shandong based trader said.

"We noticed resilient exports in recent months, probably helped by a recovery in manufacturing orders from other countries in Asia coming out of the Covid pandemic," a trader based in Jiangsu told MNI.

CONSISTENT POLICY

The PBOC Policy Bias Index stood at 40.7 in November, down from 44.6 in October, with 81.5% of the participants saying current policy will be implemented.

"The huge injection of CNY1 trillion MLF, together with the launch of the green credit facilities, will help avoid markets expecting a loosening in policy through reserve cuts," a senior trader with top bank in Beijing told MNI.

The Guidance Clarity Index was 53.7 in November, after 57.1 last month, with 92.6% of the traders receiving clear signals or messages from the central bank.

RATES DOWN

The 7-Day Repo Rate Index edged down to 74.1 from 82.1 reading, with 14.8% of the participants – 7.7% more than last month – predicting ample liquidity will weigh on rates.

The 7-day weighted average interbank repo rate for depository institutions (DR007) closed at 2.1573% Tuesday.

The 10-year CGB Yield Index was 75.9 in November, slightly lower than the previous 76.8 reading, with 63.0% of respondents seeing yields continuing to rise.

The MNI survey collected the opinions of 27 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions. Interviews were conducted Nov 8 – Nov 19.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.